Located in the eastern Caribbean Sea, Saint Lucia is a tropical paradise renowned for its breathtaking landscapes and colorful cultural tapestry. Its rich history and culture are shaped by French and British influences. The island is very welcoming to foreign investors seeking to do business, especially with a PEO in Saint Lucia. Read on to learn more about how a PEO in Saint Lucia can help you in your business endeavors and how to recruit in this beautiful country, and learn why it’s so common to see more investors interested in company formation in Saint Lucia.

Key Takeaways On PEO in Saint Lucia

| Is it legal to hire through a PEO in Saint Lucia? | Yes, hiring in Saint Lucia through a PEO is legal. It ensures compliance with labor laws, handles payroll and taxes, and simplifies employment without needing a local entity. |

| What are the benefits of hiring through a PEO in Saint Lucia? | Hiring through an PEO in Saint Lucia offers quick market entry without a local entity, ensures compliance with complex labor laws, manages payroll and taxes, reduces legal risks, and allows you to focus on core business operations effortlessly. |

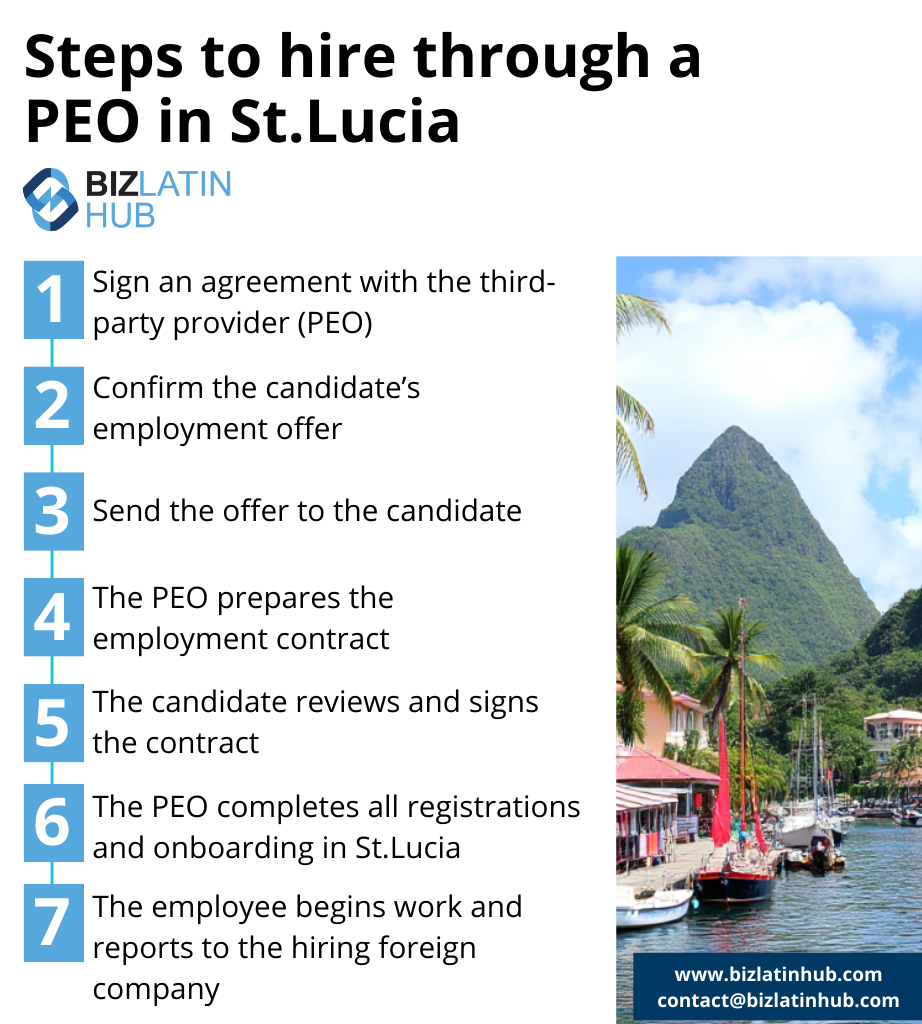

| Steps to hire through a PEO in Saint Lucia | Assess the Need to Hire in Saint Lucia Source Local Talent Choose a PEO Approve the Offer Letter Onboard the Employee via the PEO |

| Why employ Saint Lucian workers? | Employing workers through a PEO in Saint Lucia streamlines market entry by managing HR, payroll, and legal compliance, allowing you to hire local talent quickly and focus on business growth without establishing a local entity. |

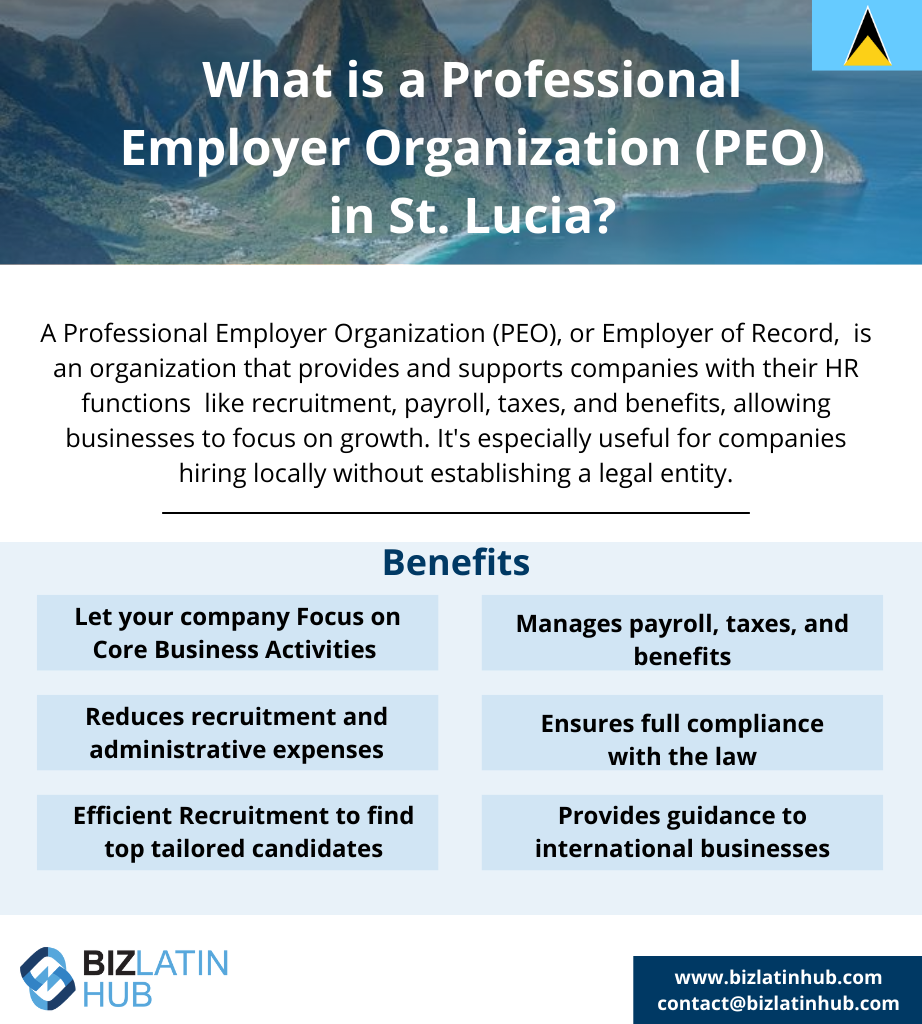

Understanding the Role of PEOs

A PEO is an external entity that takes on various HR responsibilities for client businesses. These responsibilities can range from payroll and employee benefits management to ensuring compliance with employment laws. PEOs work closely with businesses to provide tailored solutions that meet specific needs, allowing companies to focus on their core operations with confidence and peace of mind.

Some of the key functions of a PEO are:

- Payroll and benefits administration: Managing employee payroll, tax withholdings, and benefits packages, including health insurance, retirement plans, and other employee benefits.

- Human resources management: Handling HR functions such as employee onboarding, training, and development, as well as compliance with employment regulations.

- Risk management: Assisting with risk and compliance management, including workers’ compensation, safety training, and regulatory compliance to mitigate legal risks.

- Employee administration: Managing various administrative tasks related to employees, such as record-keeping, employee handbooks, and regulatory reporting.

- Legal compliance: Ensuring adherence to labor laws, regulations, and employment standards, helping businesses avoid legal pitfalls and penalties.

- Tax compliance: Handling tax-related responsibilities, including payroll taxes, ensuring accurate and timely tax filings, and staying compliant with local tax regulations.

- Providing access to benefits: Offering small and medium-sized businesses the opportunity to provide competitive employee benefits that they might not be able to access on their own.

Why work with a PEO in Saint Lucia?

The main benefit of working with a PEO in Saint Lucia is that it allows you and your business to focus resources on what matters: the services you provide. A PEO takes a huge weight off your shoulders, as a good PEO is already familiar with local regulations, top talent, and the best strategies to get the best out of your money, and time.

Why spend time learning the intricacies of the laws and regulations of the country you’re planning to expand into when there are already plenty of experts who can act as a guide for you? Working in Saint Lucia can be a breeze if you work with a PEO.

Here are four reasons why you should work with a PEO in Saint Lucia:

- Cost-Effective: Using a PEO can be more cost-effective than setting up a legal entity, which might be expensive to establish and maintain.

- Compliance: PEOs have a deep understanding of the labor rules and regulations in Saint Lucia, ensuring that your global workforce satisfies all local tax, social security, and immigration requirements. This can help mitigate risks of employee misclassification and/or non-compliance.

- Flexibility: PEOs allow businesses to employ local sales representatives to explore the local market, employ qualified IT personnel for projects of any complexity or duration, and test the market for viability. If the market is found unfeasible, businesses can easily withdraw without losing much compared to what could be lost after establishing an entity.

- Supportive Environment: A supportive work environment is crucial for job satisfaction. PEOs can provide this support, making it easier for employees to take on tasks and feel more confident about offering their viewpoints or ideas.

PEO vs. EOR in Saint Lucia – What’s the Difference?

When expanding into Saint Lucia, businesses often choose between a Professional Employer Organization (PEO) or an Employer of Record (EOR) to hire and manage employees.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations. EOR services are legal in Saint Lucia and are frequently used by foreign companies to test the market before establishing a permanent presence.

Note that PEO and EOR are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms.

Important Tip: While an EOR provides a quick-entry solution, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in Saint Lucia. Biz Latin Hub offers both PEO and EOR solutions, helping businesses navigate regulations, establish entities, and ensure full HR compliance. Whether you need a fast market entry or a stable long-term presence, we can guide you through the process.

A PEO in Saint Lucia Can Boost Your Business

Saint Lucia has become a great hub for companies looking to enter new markets. Its lifestyle, culture, and business opportunities are too attractive to pass on. In today’s competitive business environment, the partnership between businesses and Professional Employer Organizations has become increasingly vital.

For businesses in Saint Lucia, the advantages of collaborating with a PEO are numerous. They range from streamlined HR processes and enhanced employee management to robust legal compliance. A reliable PEO, can empower businesses to focus on strategic growth and development, secure in the knowledge that their HR functions are in capable hands.

If you’re seeking expert assistance with HR management and legal compliance in Saint Lucia, consider partnering with a trusted Professional Employer Organization to ensure your business is as good and as profitable as it can be.

It’s also important to note that while the benefits of working with a PEO in Saint Lucia are generalized, it’s also vital for you to take a look at the business you have, and your needs when deciding whether to work with a PEO.

Common FAQs when hiring through an Employer of Record (EOR) in Saint Lucia

Based on our experience these are the common questions and doubts of our clients.

You can hire an employee in Saint Lucia by establishing your legal entity within the country and then utilizing this entity to recruit staff. Alternatively, you can opt for an Employer of Record (EOR), a third-party organization that facilitates the employment of individuals in Saint Lucia by serving as the legal employer. This approach eliminates the necessity of having a local legal entity to hire employees.

A standard employment contract in Saint Lucia must be drafted in English and should encompass the following details:

Identification and address of the employer and employee

Date and location of agreement

Description of assigned tasks

Salary details and potential additional benefits

Payment frequency

Contract duration and any probationary period

Specified working hours

Applicable supplementary benefits (if any)

The obligatory employment benefits in Saint Lucia consist of:

Provision of necessary work tools and equipment

Payment of social security contributions, including health and pension plans

Statutory benefits such as severance pay and interest on severance pay

Entitlement to paid leave, including vacation and weekly rest

Disability benefits for work-related or general disabilities

Transport allowance (if provided by the employer)

Overtime compensation and additional wage supplements (if applicable)

The total cost incurred by an employer for hiring an employee varies depending on the salary structure. Saint Lucia operates under two salary structures: the standard salary and the comprehensive salary. The standard employer cost for mandatory employment benefits ranges from 40% to 55%, whereas the comprehensive salary imposes an additional 20% to 35% on the gross salary.

Please refer to our payroll calculator to know more about this.

Biz Latin Hub can help you with a PEO in Saint Lucia

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross-border operations.

As well as knowledge about PEO in Saint Lucia, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent or otherwise doing business in Latin America and the Caribbean.If this article on PEO in Saint Lucia was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.