Antigua and Barbuda offers a wealth of business opportunities for foreign investors and companies looking to expand in the region. With its stable political climate, investor-friendly policies, and strategic location, Antigua and Barbuda has become a hub for various industries, including tourism, offshore banking, technology, and renewable energy. Learn more about how to hire a PEO in Antigua and Barbuda.

Using a Professional Employer Organization (PEO) in Antigua and Barbuda helps simplify the complexities of international expansion. It also ensures a solid foundation for your company’s growth and success in this tropical paradise.

In this piece, we will highlight the benefits of a PEO in Antigua and Barbuda and how to hire talent in this island paradise.

See also: Company formation Antigua and Barbuda

What is a PEO in Antigua and Barbuda?

A Professional Employer Organization (PEO) is a helpful partner for businesses. It handles all the tricky HR tasks, from hiring to handling taxes and benefits. In Antigua and Barbuda, a PEO takes care of these important but time-consuming jobs so businesses can concentrate on growing without worrying about staying compliant and the extensive paperwork.

This is especially useful if a company wants to hire local workers but doesn’t want to go through the hassle of setting up a legal entity in the country.

Benefits of Using a PEO in Antigua and Barbuda

Partnering with a PEO in Antigua and Barbuda enables companies to quickly enter the local market, ensuring that business operations start promptly. Hiring local staff through a PEO offers several advantages, including:

- Focus on core business

- Cost-effective approach

- Efficient hiring process

- Time savings

- Local expertise and compliance

- Fast setup

Focus on core business

By delegating HR responsibilities to a PEO in Antigua and Barbuda, your company can focus on its main tasks and managing employees directly. This concentration enables a stronger emphasis on business expansion and development.

Cost-effective approach

Hiring a PEO saves money by cutting down recruitment and administrative costs. This is especially beneficial if you want to hire local staff but haven’t fully set up your company in Antigua and Barbuda.

Efficient hiring process

A PEO helps in finding the right employees by sourcing and selecting suitable candidates tailored to your company’s needs. This saves time and effort in finding the perfect staff.

Time savings

Outsourcing payroll and other HR tasks to a PEO means you don’t have to deal with time-consuming paperwork. This allows you to use your time and resources more efficiently for strategic business activities.

Local expertise

A Professional Employer Organization in Antigua and Barbuda ensures a company adheres to all local employment laws and regulations. Their local expertise guarantees that an organization’s employment relationships meet legal requirements, reducing the risk of fines or legal issues.

Fast setup

A PEO service in Antigua and Barbuda should already be recognized as a legal entity, so using it will allow you quick access to the market. There is no need for a lengthy entity establishment.

Hiring Employees in Antigua and Barbuda with a PEO

A reliable PEO in Antigua and Barbuda can handle the complexities of different employment contracts in the country. The essential employment regulations managed by a PEO in Antigua and Barbuda comprise:

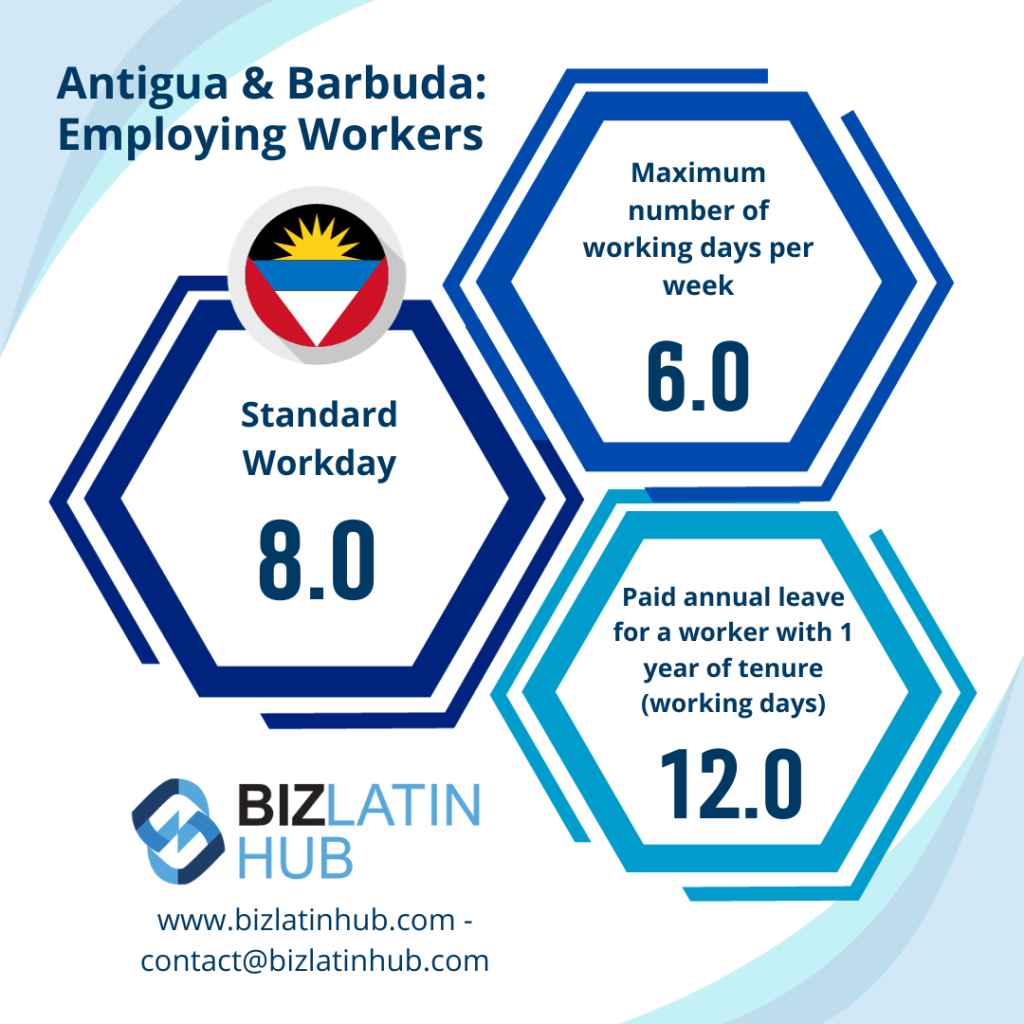

Working Hours: The standard workweek spans 48 hours, but most people work 40 hours, with overtime compensated at one and a half times the regular rate.

Holidays: Antigua and Barbuda observe 10 national holidays, and employees are entitled to 12 days of annual leave after completing 150 days in a job.

Bonuses: It is customary for employees to receive a Christmas bonus.

Sick Leave: Employees are entitled to 12 days of sick leave per year.

Maternity/Paternity Pay: By law, there is a maximum paid 13-week maternity leave period.

Tax: Antigua and Barbuda do not levy income tax on individuals.

Value Added Tax (VAT): Taxable activities for purposes of the Antigua and Barbuda sales tax are sales of goods or supplies of services within Antigua and Barbuda and the import of goods.

The standard rate is 15%, with a reduced rate of 12.5% applying to hotels. Certain goods and services may be zero-rated or exempt

Social Security: Effective 1st January 2021, the contribution rate increased to 14% of insurable earnings for private-sector workers; of which the employee pays 6% and the employer pays 8%.

Contracts: Written contracts must be provided to employees and submitted to the government.

Termination of Contracts: Upon contract termination, employers must settle any outstanding salary and proportional bonuses. If termination lacks just cause, severance pay might be offered.

Biz Latin Hub Can Help You With a PEO in Antigua and Barbuda

At Biz Latin Hub, we offer an extensive range of market entry and back-office solutions in Latin America and the Caribbean.

We have expertise in being a PEO in Antigua and Barbuda, legal services, accounting and taxation, company incorporation, and visa processing.

Our presence extends across major cities in the region, bolstered by robust partnerships in numerous other markets. This extensive network equips us with a wealth of resources ideally tailored to facilitate cross-border initiatives and market entry strategies in diverse countries.

Contact us today to learn more about our services and how we can help you achieve your business goals in Latin America and the Caribbean.

If this article on PEO in Antigua and Barbuda was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.