Belize provides foreign investors and business owners with unique advantages seldom found elsewhere. Being a tax-friendly destination with robust privacy laws, it’s no surprise that company formation in Belize is swiftly gaining popularity among international investors. Partnering with a Professional Employer Organization (PEO) in Belize streamlines the challenges of global expansion. This strategic approach establishes a strong base for your company to thrive in the Central American country. This guide explains the function of a PEO and how it serves as a strategic solution for businesses looking to hire in Belize efficiently and compliantly.

Key Takeaways: Using a PEO in Belize

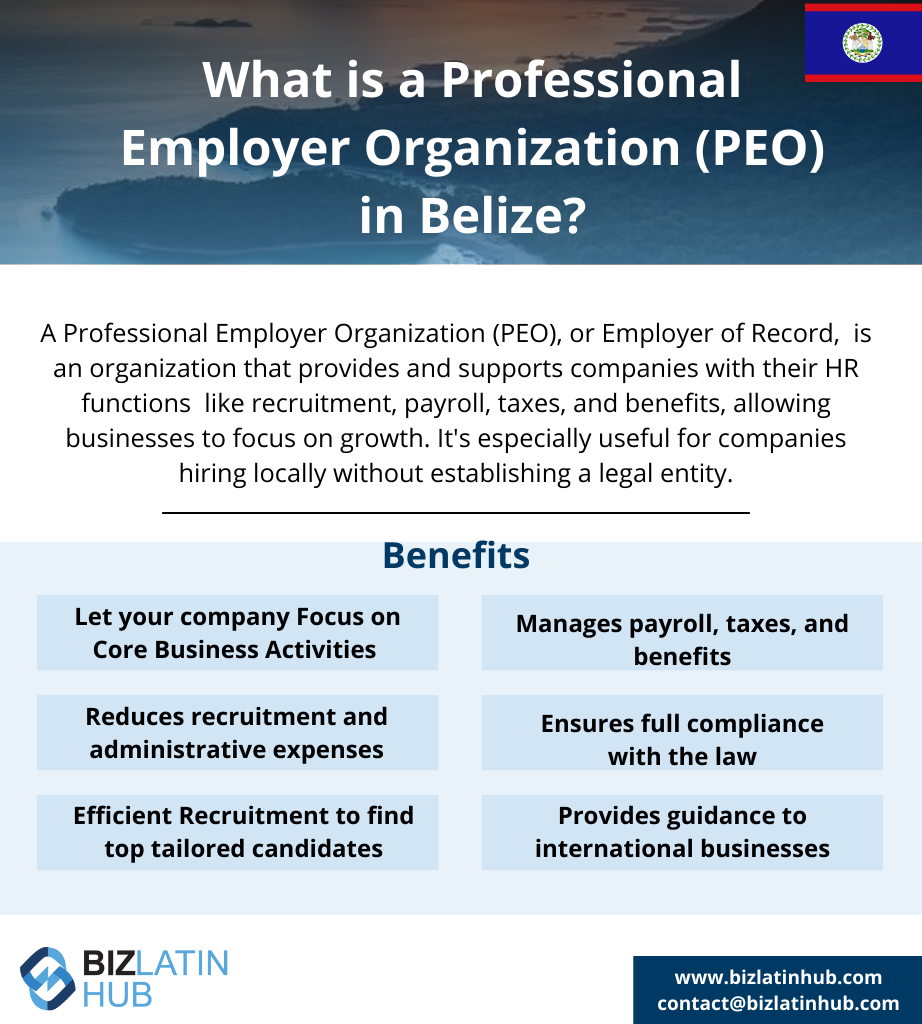

| What is a Professional Employer Organization (PEO)? | A Professional Employer Organization (PEO), is a company that legally employs workers on behalf of companies who do not have an established office in a given country. |

| How does a PEO facilitate market entry without establishing a local entity? | It allows you to hire employees immediately, before you have completed full company formation. |

| What are the main benefits of using a PEO service? | A PEO manages all HR functions, including payroll and statutory contributions. |

| Is PEO legal in Belize? | Using a PEO ensures compliance with Belizean labor law. |

How Does a PEO in Belize Work?

A PEO in Belize operates through a co-employment model. The PEO becomes the official employer of your chosen candidate on paper, hiring them through its own locally registered and compliant legal entity. This makes the PEO responsible for all legal and administrative aspects of employment, while you retain control over the employee’s day-to-day work and responsibilities.

Imagine having a trusted partner in your business journey – that’s what a PEO in Belize is. It tackles the complex world of HR, from hiring employees to tax and benefits compliance. A PEO handles crucial yet time-consuming jobs. So, business owners and investors can focus on growing the company without the burden of local rules and regulations.

This partnership is a game-changer, particularly for companies eager to employ local talent but hesitant about the complexities of establishing a legal presence in the country.

Key Benefits of Using a PEO in Belize

Working with a PEO in Belize allows companies to rapidly enter the local market, ensuring that the business hits the ground running.

Hiring local talent through a PEO offers many advantages, including:

- 1. Faster Market Entry

- 2. Reduced Administrative Burden

- 3. Ensured Local Compliance

- 4. Increased Flexibility

Expert Tip: Distinguishing Between a PEO and a Staffing Agency

From our experience, clients often confuse a PEO with a traditional staffing agency. It is essential to understand the difference: a staffing agency finds and supplies temporary workers from its own pool of candidates. A PEO, however, onboards your chosen candidate into a long-term employment relationship. You find the talent, and the PEO handles the legal and HR infrastructure. This distinction is critical for businesses looking to build a dedicated, long-term team in Belize without the overhead of creating a local company.

1. Faster Market Entry

Utilizing a PEO service in Belize, which is already a recognized legal entity, grants you quick access to the market without the need for a lengthy entity establishment process. A PEO allows you to hire employees and begin operations in a matter of days or weeks, bypassing the lengthy process of incorporating a local company.

A PEO aids in identifying suitable candidates tailored to your company’s needs, saving time and effort in the search for ideal staff.

2. Reduced Administrative Burden

The PEO manages all human resources tasks, including contract generation, payroll processing, tax deductions, and benefits administration, freeing up your internal resources.

Outsourcing payroll and other HR tasks to a PEO eliminates the need for time-consuming paperwork, allowing you to allocate your time and resources more efficiently for strategic business activities.

Engaging a PEO saves money by reducing recruitment and administrative expenses, making it especially advantageous if you want to employ local staff without completing your company’s full setup in Belize.

3. Ensured Local Compliance

The PEO has expert knowledge of Belizean labor law, ensuring that all employment contracts, salary payments, and statutory contributions are fully compliant, which mitigates legal risks.

A PEO in Belize manages compliance with all local employment laws and regulations. Their expertise guarantees that your company’s employment relationships align with legal requirements, minimizing the risk of fines or legal complications.

4. Increased Flexibility

Using a PEO provides a low-commitment way to test the Belizean market. It allows you to build a team without the significant upfront investment and long-term liability of a local subsidiary.

By entrusting HR duties to a Belizean PEO, your company can concentrate on its primary functions and directly manage employees. This focus enables a stronger emphasis on business growth and advancement.

How to Onboard an Employee Through a PEO

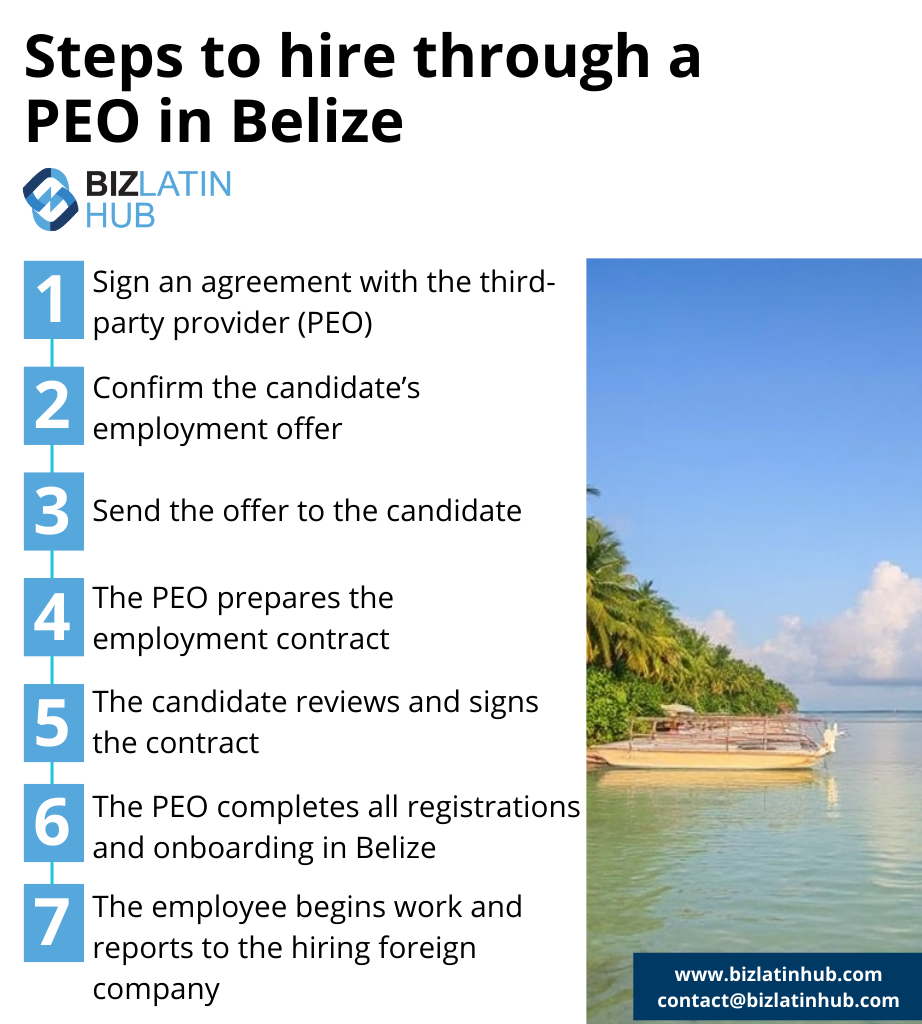

A quality Professional Employment Organization (PEO) in Belize can navigate and manage the complexities of employment contracts available in the country. While similar to an Employer of Record (EOR) in Belize, there are distinct differences in how the employment relationship is legally structured. Based on our experience, the process typically follows these steps:

- Assess the Need to Hire in Belize – Analyze your business needs and determine the necessity of hiring locally.

- Source Local Talent – Identify skilled candidates through direct search or with assistance from local recruitment agencies.

- Select a Professional Employment Organization (PEO) – Choose a dependable PEO partner and review their services and pricing.

- Approve the Offer Letter – Finalize the employment terms, including compensation, benefits, and compliance with local labor laws.

- Onboard the Employee via the PEO – Facilitate a seamless onboarding process, with the PEO managing legal and administrative requirements.

A reputable PEO in Belize can navigate the complexities of various employment agreements within the country. The core employment regulations managed by a PEO in Belize comprise:

Working Hours: The standard workweek spans 45 hours, 9 hours per day. All employees are entitled to at least one day of rest per week. The overtime rate is one and one-half times the regular hourly pay.

Holidays: Belize observes 13 national holidays, and employees are entitled to 2 weeks of annual leave after completing 150 days in a job.

Bonuses: It is customary for employees to receive a Christmas bonus.

Sick Leave: Employees are entitled to 16 days of sick leave per year provided they work no less than 60 days within 12 months.

Maternity/Paternity Pay: By law, a female worker is entitled to a 14-week paid maternity leave period.

Tax: Income tax is charged at a rate of 25%, and for residents of Belize, the first $26,000 of their annual income is exempt. Pension income is also exempt. To qualify for residency, an individual must be present in Belize for 183 days or more during a calendar year.

Value Added Tax (VAT): Taxable activities for purposes of the Belize sales tax are sales of goods or supplies of services within Belize and the import of goods.

The standard rate is 12.5%. Certain goods and services may be zero-rated or exempt.

Social Security: This is payable to all employees who are over fourteen years old and under sixty-five years old for each contribution week during the whole or any part of which such person is employed in insurable employment. The employer is liable to pay the total contribution due, both his or her own share and the share deducted from the employed person’s salary. The contributions are payable by the employer by the 14th day of each month for the previous month. The weekly contribution is related to the weekly insurable earnings, which, in turn, are related to actual earnings.

Termination of Contracts: Upon contract termination, employers must settle any outstanding salary and proportional bonuses. If termination lacks just cause, severance pay might be offered.

EOR vs. PEO in Belize – What’s the Difference?

When expanding into Belize, businesses often choose between an Employer of Record (EOR) or a Professional Employer Organization (PEO) to hire and manage employees.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations. Note that Belize does permit EOR arrangements for foreign businesses.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

Note that EOR and PEO are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms.

Important Tip: While an EOR provides a quick-entry solution, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in Belize. Biz Latin Hub offers both EOR and PEO solutions, helping businesses navigate Belize’s regulations, establish entities, and ensure full HR compliance with local employment laws. Whether you need a fast market entry or a stable long-term presence, we can guide you through the process.

Frequently Asked Questions: PEO Services in Belize

The terms PEO and EOR are often used interchangeably. Both services hire employees on your behalf. Technically, under a PEO model, there is a “co-employment” relationship. With an EOR, the provider is the sole legal employer. For practical purposes in international hiring, both achieve the same result.

Yes, but to do so, you must first establish your own legal entity in Belize (e.g., a limited liability company). This process involves company registration, obtaining a tax ID, and setting up local payroll, which can take several months. A PEO bypasses this requirement.

The PEO is responsible for processing the payroll, deducting taxes, making social security contributions, and paying the employee’s net salary. You, the client company, provide the gross funds to the PEO to cover all these costs, plus the PEO’s service fee.

The hiring process through a PEO is significantly faster than establishing a local entity. Once you have selected your candidate, a compliant employment contract can be drafted and signed, and the employee can be onboarded in as little as one to two weeks.

Biz Latin Hub Can Assist You With a PEO in Belize

At Biz Latin Hub, we offer a comprehensive range of market entry and back-office solutions in Latin America and the Caribbean.

We have expertise in being a PEO in Belize, with legal services, accounting and taxation, company incorporation, and visa processing available.

We retain a large presence in LATAM with strong partnerships throughout the region. This far-reaching network gives us lots of tools to help with international projects and entering new markets in different countries.

Contact us today to learn more about our services and how we can help you achieve your business goals in Latin America and the Caribbean.