Company formation in St. Lucia is great for those seeking growth and opportunity. With its pristine beaches and lush landscapes, this Caribbean island offers more than just a breathtaking view. It presents a strategic hub for companies looking to expand their footprint. Businesses in St. Lucia enjoy a supportive environment. The island’s tax benefits and incentives reduce operational costs. Programs like Citizenship by Investment attract global entrepreneurs, promising both ease and opportunity. This guide details the primary advantages that make Saint Lucia an attractive jurisdiction for foreign investors, particularly those utilizing its offshore company structure.

Key Takeaways: Doing Business in Saint Lucia

| What are the main benefits of starting a business in Saint Lucia? | Saint Lucia has a stable political environment and a developing economy. It also has tax incentives. |

| Why form an IBC? | An International Business Company (IBC) is completely exempt from local taxes. |

| What confidentiality provisions are offered to IBC owners? | While Saint Lucia’s IBC laws ensure that the names of directors and shareholders are not part of any public record, this does not mean the ownership is anonymous or hidden from legitimate authorities. |

| What is the Citizenship by Investment Program? | It is a path to a second passport for investors who contribute to the country’s economic development. |

Key Advantages of the Saint Lucian Business Environment

1. Tax Exemption through an International Business Company (IBC)

The primary benefit is the ability to conduct international business through an IBC, which is legally exempt from all forms of local taxation. This provides maximum tax efficiency for global operations.

2. High Degree of Confidentiality and Privacy

The details of the owners and directors of an IBC are not filed on any public registry, ensuring a high level of privacy for business and personal affairs.

Expert Tip: Confidentiality is Not Anonymity

From our experience, it is vital that investors understand the modern meaning of corporate confidentiality. While Saint Lucia’s IBC laws ensure that the names of directors and shareholders are not part of any public record, this does not mean the ownership is anonymous or hidden from legitimate authorities.

The licensed registered agent is required by law to know the identity of the ultimate beneficial owners and must provide this information to Saint Lucian authorities or foreign tax authorities upon a lawful request made under international agreements like the Common Reporting Standard (CRS). The system is designed to provide commercial privacy, not to facilitate illicit activities.

3. A Stable and Growing Economy

Saint Lucia has a stable political system and a developing economy focused on tourism, agriculture, and a growing international financial services sector.

4. Citizenship by Investment Opportunities

The jurisdiction offers a reputable Citizenship by Investment Program, providing a path to a second passport for investors who contribute to the country’s economic development.

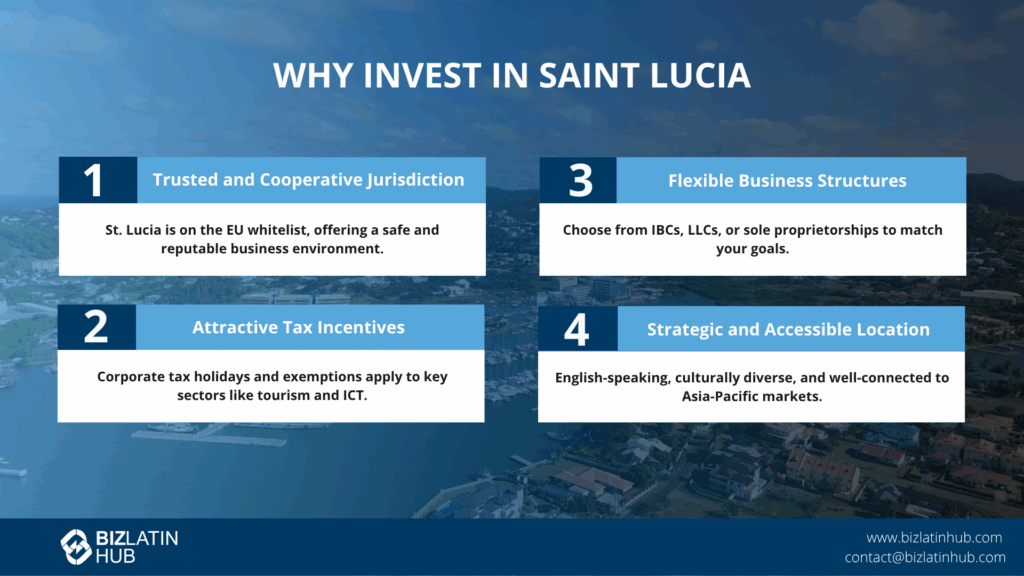

Understanding the Business Environment in St. Lucia

St. Lucia is a cooperative jurisdiction on the EU whitelist. This status ensures a safe and reputable business environment. Entrepreneurs in St. Lucia enjoy various tax and non-tax incentives. The Council of Ministers grants these benefits, which depend on business type and size.

The country’s economy thrives, supported by a robust financial system and quality infrastructure. This foundation helps businesses grow successfully. St. Lucia also offers a diverse range of company structures. Local and international entrepreneurs can choose whatever fits their needs and goals best.

A solid tax planning strategy is crucial in St. Lucia. Businesses can optimize their tax positions through territorial taxation and other tax benefits.

Here’s a quick overview of business entity options in St. Lucia:

| Business Structure | Description |

|---|---|

| Sole Proprietorship | Single owner business model |

| Limited Liability Company | Protection from personal liability |

| International Business Company | Ideal for global operations |

| Offshore Company | Tax-efficient structure for foreign investors |

Entrepreneurs should consider these options to match their business goals and benefit from St. Lucia’s incentives.

Tax Advantages and Incentives

Saint Lucia is an inviting destination for businesses due to its appealing tax advantages and incentives. The island offers corporate tax holidays for businesses in sectors such as:

- Tourism

- Manufacturing

- ICT (Information and Communications Technology)

- Renewable Energy

This approach stimulates economic growth and attracts foreign investors. Citizens of Saint Lucia gain financial benefits through tax exemptions on:

- Worldwide income

- Capital gains

- Gifts

- Wealth

- Inheritance

The absence of capital gains tax and competitive income tax rates enhances the island’s appeal, mainly for international and offshore companies. Saint Lucia also provides tax breaks related to investment amounts and jobs created, alongside duty-free concessions on capital items. Moreover, no withholding taxes on dividends, interest, or royalties for non-residents and unrestricted foreign currency transactions facilitate smooth profit repatriation.

International Business Companies (IBCs)

International Business Companies, or IBCs, in Saint Lucia enjoy considerable tax benefits, particularly on foreign-earned income. This makes the island an attractive location for global businesses. Registering an IBC in Saint Lucia is simple, encouraging international business formation. It allows a person, regardless of nationality, to establish a company with ease. Companies benefit from no taxes on wealth, inheritance, and capital gains. This effective tax management contributes to a favorable business environment. Furthermore, setting up an IBC facilitates banking operations and foreign currency transactions. This process simplifies financial activities for international companies.

Limited Liability Companies (LLCs)

Limited Liability Companies, or LLCs, in Saint Lucia provide business owners with the advantage of limited liability protection. This means personal assets are secure from business liabilities. Forming an LLC in Saint Lucia is straightforward and supports business operations effectively. The island’s tax system for LLCs promotes business growth with its simplicity. A unique company name is necessary and must meet the standards of the Saint Lucia Corporate Registry. This structure offers flexibility, which suits various entrepreneurial needs, making Saint Lucia a favorable choice for setting up an LLC.

Simplified Tax Obligations

Saint Lucia presents a straightforward tax system, benefiting businesses and investors. Key aspects include:

- No imposed taxes on capital gains or dividends.

- Corporate Tax Rate: 30% (various incentives can reduce this effective tax load).

- Withholding Tax: 25% applies to income from a non-permanent establishment in the country.

- Standard VAT Rate: 12.5%.

- VAT Registration Threshold: Businesses must surpass an annual sales threshold of EC$400,000 (Eastern Caribbean Dollars) to charge VAT.

- Expat Tax Exemptions: No inheritance or wealth taxes on global assets.

This structure is designed to simplify tax obligations for both local and international businesses.

Citizenship by Investment Program

The St. Lucia Citizenship by Investment Program, introduced in 2015, aims to attract foreign investment and boost economic growth. This program allows individuals to gain citizenship by contributing financially. Saint Lucia’s program allows for dual citizenship, meaning investors can keep their current citizenship. Investors can choose from several investment routes:

- A non-refundable donation of US$100,000 to the National Economic Fund.

- A real estate purchase valued at a minimum of US$200,000 in an approved project.

- An investment of at least US300,000ingovernmentbonds(e.g.,theNationalActionBond,whichhasaminimumofUS300,000 for a single applicant, or other qualifying bonds).

Notably, Saint Lucia provides a fast processing time for obtaining citizenship, typically within three to six months.

Benefits for Entrepreneurs

Entrepreneurs considering St. Lucia find a business-friendly environment that encourages rapid growth and global expansion. Key benefits include:

- Visa-free travel: St. Lucian citizens gain access to numerous countries (around 147, though this figure can vary and should always be verified with official sources), opening doors to international business opportunities and networking.

- Appealing tax framework: Exemptions on income, capital gains, gifts, wealth, and inheritance taxes.

- Low startup costs and minimal red tape: Streamlined processes for setting up a business.

- Modern international business regulations: Opportunities to strengthen global financial strategies.

Process Overview

Starting a business or pursuing citizenship through investment in St. Lucia involves several key steps:

- Choose the right legal entity: Options include corporations or limited liability companies for general business.

- Register the company: This allows access to local incentives and contributes to the regional economy.

- Engage a local agent (for IBCs): A local agent is necessary to set up an International Business Company (IBC) and manage the required paperwork.

- Complete Know Your Customer (KYC) process: This is a standard due diligence procedure.

- Comply with the Economic Substance Act: This is vital and includes requirements for in-country management and hiring qualified employees.

Investors in local property or government bonds may regain their initial investment after a holding period (typically five years). During ownership, real estate can be rented out, providing potential income.

Economic Sectors in St. Lucia

St. Lucia has transformed its economy from one relying on agriculture to a diverse mix of industries. This change stemmed from focusing on light industry and export processing zones that produce goods like textiles and electronic components. The country attracts investors with its stable economy, favorable tax policies, and strong infrastructure. Incentives include tax breaks and duty-free concessions, making it easier for businesses to thrive. Programs like citizenship by investment further fuel economic growth. Agriculture remains vital, especially with exports of bananas and coconuts. These sectors support St. Lucia’s development as a dynamic island economy.

Tourism Industry

Tourism plays a crucial role in St. Lucia’s economy, contributing about 65 percent to the GDP. The island’s natural beauty and stunning beaches draw visitors from around the globe. This rise in tourists boosts the hospitality sector significantly. St. Lucia has consistently demonstrated strong performance in its tourism sector, often reporting significant year-over-year growth in arrivals. Investing in tourism offers profitable opportunities due to this sustained demand. St. Lucia’s government supports tourism growth by enhancing infrastructure, ensuring a pleasant experience for both tourists and businesses within this sector.

Manufacturing and Agro-processing

Over the past 15 years, St. Lucia has developed its manufacturing sector to lessen reliance on agriculture. The creation of export processing zones has attracted foreign investment, strengthening the manufacturing landscape. Key manufacturing activities include:

- Producing plastics

- Textiles

- Industrial gases

- Assembling electronic parts

St. Lucia’s fertile soil and favorable climate support agricultural activities such as organic farming. These conditions promote agro-processing, helping meet demands for sustainable and local food. With these factors, St. Lucia offers promising opportunities in manufacturing and agro-processing.

Global Business Process Outsourcing

St. Lucia presents a beneficial environment for outsourcing firms, with features like no capital gains tax and competitive income tax rates. Businesses must register and may need specific licenses, ensuring regulatory compliance. The streamlined company registration process in St. Lucia includes obtaining taxpayer identification numbers and managing maintenance costs. The tax system favors international business, offering exemptions from various taxes. International entrepreneurs find St. Lucia appealing, as they can easily set up companies, benefiting from straightforward banking and foreign currency transactions. This favorable environment encourages global business process outsourcing in St. Lucia.

Legal and Regulatory Framework

In St. Lucia, the legal and regulatory framework supports businesses with clear guidelines. To operate a business legally, companies must register with the relevant authorities and secure necessary licenses or permits. The Companies Act provides rules for the formation and operation of companies. This includes ensuring businesses comply with the Economic Substance Act. This act requires businesses to report and meet certain management and employment conditions. The country’s tax laws further aid businesses by outlining corporate taxes, incentives, and exemptions. St. Lucia also attracts offshore companies due to no capital gains tax and competitive income tax rates.

Ease of Company Formation

Starting a business in Saint Lucia is streamlined through clearly defined steps:

- Select a unique company name: This name requires approval and registration.

- Submit required documentation: This includes a Memorandum and Articles of Association, along with IDs of directors and other compliance documents.

- Engage a local agent (for IBCs): For setting up an International Business Company (IBC), working with a local agent is essential to handle the paperwork. People from any nationality, whether they are individuals or corporations, can establish a company in Saint Lucia. Additionally, companies under the Economic Substance Act must be directed and managed within the country, ensuring local involvement in business activity.

Supportive Business Regulations

Saint Lucia’s business regulations favor international and local enterprises alike. Foreign companies and non-CARICOM citizens require a trade license to sell products or engage in trade on the island. This trade license requires annual renewal and has a nominal cost of 1,000 Eastern Caribbean dollars. Businesses benefit from duty-free concessions on import duties and consumption tax if they meet specified employment and turnover criteria. During incorporation, working with a local agent is essential. They ensure all Know Your Customer (KYC) procedures and document submissions are accurate. The absence of capital gains tax and competitive income tax rates enhance Saint Lucia’s appeal as a business hub for offshore operations.

Infrastructure and Stability

St. Lucia boasts a strong foundation for business growth with its infrastructure and stability. Entrepreneurs find modern facilities and reliable utilities essential. Efficient logistics make business operations smooth and reliable. Additionally, the country offers stable regulations, ensuring business protection and growth. Investments in particular infrastructure projects in St. Lucia not only boost its development but also present opportunities for investors. Reliable air and freight services link St. Lucia well with other regions, enhancing its status as a Caribbean business hub.

Political Stability

St. Lucia’s political system provides a solid base for economic growth. Governed by an independent, constitutional parliamentary democracy, the country holds general elections every five years. This system maintains long-term political and economic stability. St. Lucia’s stable governance supports a business-friendly regulatory environment, encouraging investors to pursue ventures. The consistent political climate assures investors, making it an attractive business destination.

Infrastructure Development

Investment in St. Lucia’s infrastructure is key to its economic progress. The country encourages focused efforts in developing ports, bridges, and highways. Such investments, including contributions to specific government-approved projects or funds like the National Economic Fund (which also supports infrastructure), can be routes within the Citizenship by Investment Program. For instance, the National Action Bond (NAB) option, designed to fund infrastructure and development projects, has a minimum investment of US$300,000. Government-approved projects improve island connectivity and are part of broader plans, including healthcare and education.

Diverse Investment Opportunities

St. Lucia provides lucrative opportunities for entrepreneurs through a variety of investment paths. These include:

- Contributing to the National Economic Fund (minimum US$100,000).

- Engaging in government-approved real estate projects (minimum US$200,000).

- Purchasing government bonds (e.g., National Action Bond from US$300,000).

- Starting enterprise projects that meet specific regulatory and investment criteria.

These diverse options are part of St. Lucia’s Citizenship by Investment Program, which allows investors to gain citizenship through financial contributions. The island nation also encourages investment in sectors such as:

- Renewable energy

- Infrastructure

- Outsourcing

These areas benefit from fiscal incentives. While general discussions might mention varying overall minimums, the specific CBI routes have clearly defined starting investment amounts as detailed. St. Lucia attracts investors seeking diverse business opportunities and the prospect of dual citizenship. The island’s policies and programs help cultivate an attractive environment for sustainable economic growth.

Tourism and Hospitality

Tourism plays a crucial role in St. Lucia’s economy, drawing millions with its beautiful beaches and vibrant natural surroundings. This sector offers numerous opportunities for entrepreneurs to launch or expand businesses, such as:

- Luxury resorts and boutique hotels catering to visitors seeking high-end accommodations.

- Restaurants that capture the island’s rich culinary heritage, appealing to food lovers.

- Essential services like tour operations and transportation, meeting the needs of both leisure and business travelers.

St. Lucia’s supportive economic environment, coupled with its favorable tax policies, enhances business prospects in the tourism industry. This growth potential ensures that tourism and hospitality remain key areas for investment.

Infrastructure and Real Estate

St. Lucia is on the lookout for investments in infrastructure, focusing on roads, ports, and bridges. These projects can qualify investors for the Citizenship by Investment program, often through routes like the National Action Bond or approved real estate linked to infrastructure development. Contributing to infrastructure development can involve a financial commitment starting from figures like US200,000(forcertainrealestate)orUS300,000 (for NABs) and can include dependents in the citizenship application. In the real estate sector, investments in approved projects grant investors permanent residency and possible rental income gains. This setup aligns with the island’s goals for sustainable development. By contributing to these areas, investors can help meet St. Lucia’s infrastructure needs while securing their place in the citizenry. The island fosters a growth-minded investment environment that rewards participation with citizenship benefits.

Manufacturing and Export

St. Lucia provides a conducive business environment for manufacturing and export enterprises. The island offers tax and non-tax benefits granted by the Council of Ministers based on business type and size. Companies registered in St. Lucia can take advantage of incentives aimed at boosting economic growth. Import duties apply to goods entering the country but exemptions or reductions are in place to facilitate manufacturing processes. St. Lucia maintains privacy protections for International Business Companies, bolstering the secure operation of export-driven businesses. The streamlined registration process for these companies makes St. Lucia an appealing base for tapping into global markets. The island’s policies promote the growth of manufacturing and export, positioning St. Lucia as a strategic hub for international trade.

Strategic Advantages for Investors

St. Lucia presents a favorable environment for investors seeking strategic advantages. Its Citizenship by Investment Program (CBI) allows foreign investors to secure citizenship by making a minimum financial contribution through one of its approved routes. This program offers significant tax benefits and visa-free access to numerous countries (around 147, though this figure can vary and should always be verified with official sources). Investment options under the CBI program include contributions to the National Economic Fund (from US100,000),realestatepurchases(fromUS200,000), government bond investments (from US$300,000), and enterprise projects. Invest Saint Lucia simplifies the process of acquiring permits and licenses, offering incentives like tax breaks and duty-free concessions. There are also no residency requirements to obtain citizenship through investment, allowing investors to benefit from the island’s tax system without necessarily living there. Businesses in St. Lucia enjoy attractive opportunities and potential citizenship, aiding both personal and strategic tax planning.

Fast Market Entry

Saint Lucia provides exceptional opportunities for fast market entry, making it a coveted destination for investors. Invest Saint Lucia oversees seven industrial parks with factory spaces ready for lease, ranging from 4,000 to 32,000 square feet. This setup allows businesses to commence operations rapidly. Upon signing a lease, companies can immediately begin interior modifications, streamlining the market entry process. The island’s geographical connectivity supports swift operations, thanks to efficient air and sea freight services. Additionally, business infrastructure like duty-free shopping areas, located near major cruise ports, boosts commercial activities. Fast access to markets in Saint Lucia is a significant advantage for businesses aiming for speedy Caribbean expansion.

Sustainable Business Growth

Saint Lucia’s thriving economy and solid financial foundation encourage sustainable business growth. The island nation provides tax and non-tax incentives targeted at fostering business development, aiding regional economic progress. The Citizenship by Investment program plays a role in boosting foreign investments, indirectly supporting sustainable business initiatives. Diverse company structures in Saint Lucia give businesses flexibility to align operations with specific goals, a vital aspect for growth in dynamic markets. Moreover, the availability of ready-to-occupy factory shells in the country’s industrial parks ensures businesses have the infrastructure needed for continuous expansion. Saint Lucia supports sustainable business development through its robust economic framework and strategic initiatives.

Frequently Asked Questions

Why is St. Lucia an attractive destination for businesses?

St. Lucia offers a strategic location, favorable tax incentives, political stability, and a streamlined process for setting up businesses. Entrepreneurs benefit from low operational costs, modern infrastructure, and a range of business structures tailored to different needs.

What are the main tax benefits for businesses in St. Lucia?

Businesses in St. Lucia benefit from no capital gains tax, no wealth or inheritance taxes, corporate tax holidays, and duty-free concessions. International companies also enjoy no withholding taxes on dividends, interest, or royalties for non-residents.

What is an International Business Company (IBC)?

An IBC is a special type of legal entity in Saint Lucia that is exempt from all local taxes. It must conduct its business entirely outside of the country.

What is the Citizenship by Investment Program?

Saint Lucia’s Citizenship by Investment Program allows foreign investors to obtain a second passport by making a significant investment in the country, such as a contribution to the National Economic Fund or an investment in approved real estate. This can be an attractive option for high-net-worth individuals seeking global mobility.

Are there any taxes on an IBC?

No. An IBC pays no corporate income tax, no capital gains tax, and no withholding tax in Saint Lucia. Its only government fee is a fixed annual license fee.

Is Saint Lucia a stable country?

Yes, Saint Lucia is a stable, independent parliamentary democracy and a member of the British Commonwealth. Its legal system is based on a mix of English Common Law and French Civil Code.

Biz Latin Hub can help you with opportunities in St Lucia

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.