The Central American country of Belize offers exciting business opportunities for foreign investors. With its strategic location and favorable tax policies, it’s an ideal location to start a business with the help of a company formation agent in Belize. However, understanding accounting and taxation in Belize is crucial. In this article, we’ll explain why reliable accounting and tax services are essential for your success in Belize. This guide explains the distinct tax regimes for local companies versus offshore IBCs, highlighting the revenue-based Business Tax system.

Key Takeaways On Tax and Accounting Requirements in Belize

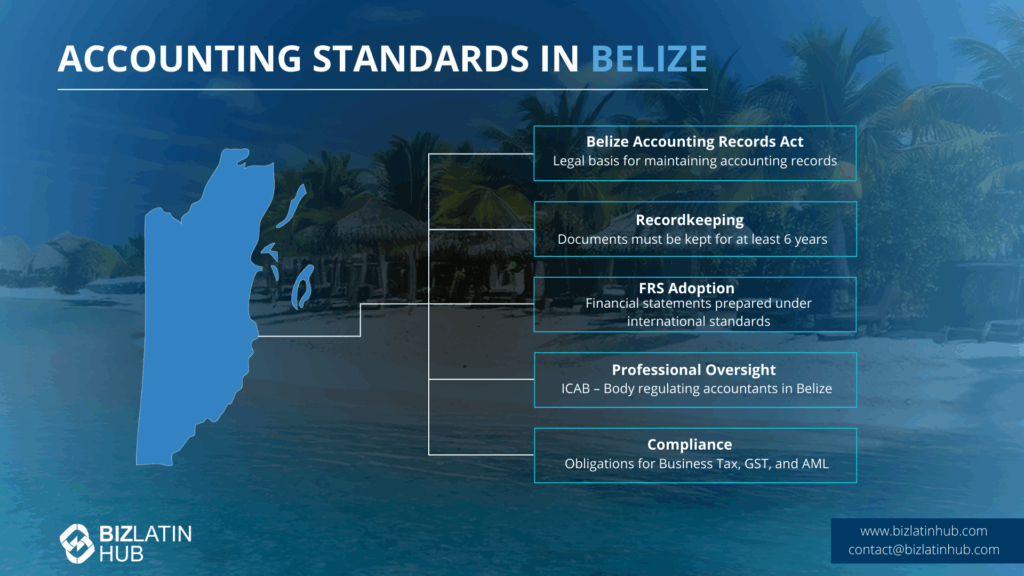

| What Are The Accounting Standards in Belize? | The Belize Accounting Records (Maintenance) Act serves as the legal basis. It applies to International Business Companies and Belize International Trust. Companies must keep records at their registered office or agent’s office. Records like assets, liabilities, sales, purchases, and financial transactions are required. |

| What Is The Corporate Tax Rate in Belize? | Oil industry companies are subjected to a fixed 25% tax rate on all profits, while other businesses pay taxes based on a specific rate determined by their profits. International Business Companies (IBCs) are exempt from all local taxes. |

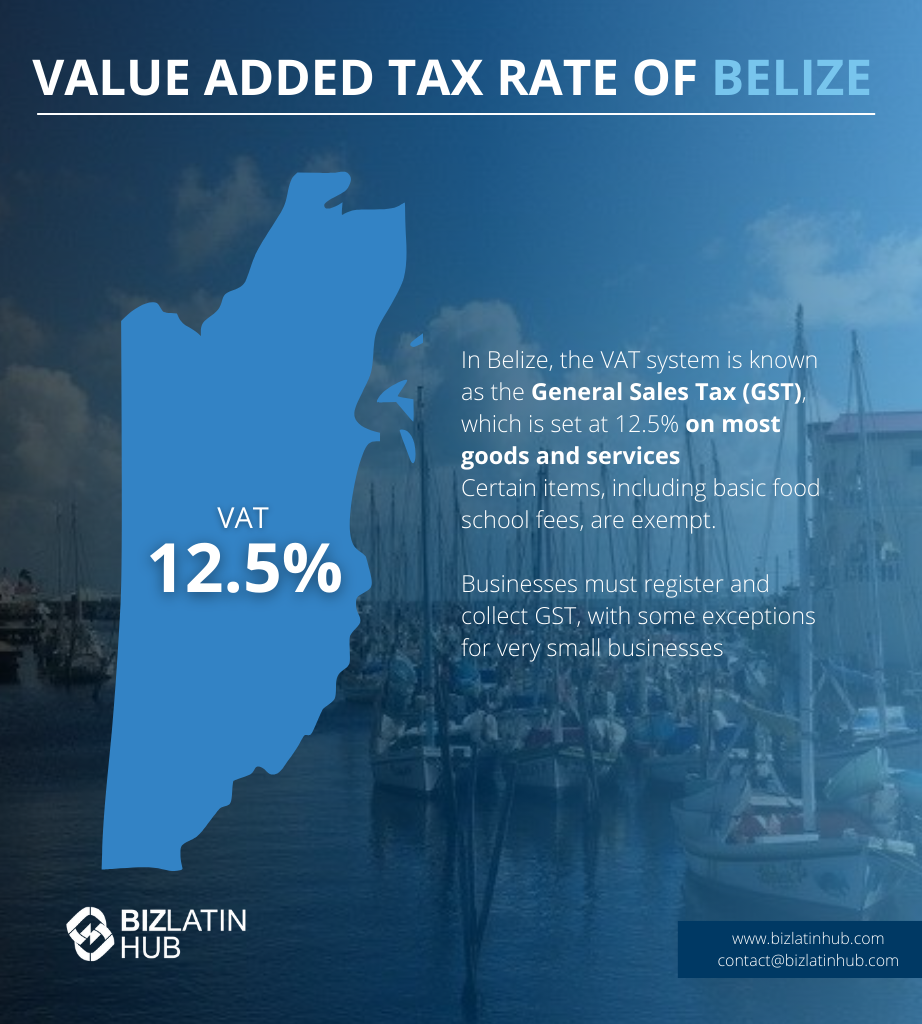

| What Is The Belizean Value Added Tax Rate? | Belize has a VAT rate of 12.5%, with exceptions for essential items. |

| Dividend Tax Rate in Belize | Dividends are subject to a withholding rate of 15%. |

| What are the two primary taxes businesses pay in Belize? | The Business Tax and the GST. |

| Can I keep an account in USD? | Financial records can be kept in any currency, but tax filings must be in Belizean Dollars. |

| What is the threshold for mandatory GST registration? | Businesses with an annual turnover exceeding BZD$75,000 must register for GST. |

Key Tax and Accounting Requirements in Belize

In Belize, taxes are based on the principle that individuals are taxed only on the income they earn within the country. However, there are specific cases where filing taxes is mandatory:

Residents of Belize must file a tax return if their taxable income surpasses the yearly threshold. This includes income from employment, business, rentals, and investments. Non-residents earning income in Belize, whether through employment, business, rentals, or investments, are also obligated to file tax returns.

Certain individuals must file taxes in Belize regardless of income, such as directors or officers of Belizean companies, recipients of dividends from Belizean companies, property owners in Belize, and beneficiaries of trusts set up in Belize.

Even if you aren’t required to file taxes, it’s essential to report specific information to Belizean tax authorities. For instance, if you hold a bank account or other financial assets in Belize, you may need to report this information annually.

1. Fulfill Business Tax Obligations

Companies must pay a Business Tax on their gross monthly revenue. These payments are then credited against the company’s annual corporate income tax assessment.

Expert Tip: Business Tax vs. Corporate Income Tax

Our experience shows that foreign investors are often confused by Belize’s Business Tax because it is not a traditional corporate income tax based on profit. The Business Tax is levied on gross receipts. However, companies can claim their monthly Business Tax payments as a credit against their annual corporate income tax liability, which is based on profits.

It is crucial to maintain meticulous records of both gross revenue and deductible expenses to manage this system correctly and avoid overpaying. We advise clients to work closely with a local accountant to optimize their tax position.

2. Manage General Sales Tax (GST)

Businesses exceeding the annual revenue threshold must register for GST, charge it to their customers, and remit the collected tax to the government on a monthly basis. They can claim credits for GST paid on their own business expenses.

3. Maintain Accounting Records

All companies must maintain accurate and complete accounting records. These records must be sufficient to explain the company’s transactions and financial position and must be kept for a minimum of six years.

4. Adhere to International Financial Reporting Standards (IFRS)

Financial statements in Belize must be prepared in compliance with IFRS. This ensures transparency and standardization in financial reporting.

Accounting and Taxation in Belize: Key Local Tax Rates

Understanding accounting and taxation in Belize is essential when entering this market. Here is a selection of key tax rates.

Income Tax: Residents and non-residents will pay a flat income tax rate of 25% on taxable income. If you make under $26,000 BZ, you’re exempt from income tax.

Corporate Tax: Companies in the oil industry pay a 25% flat tax rate on all profits. Other companies pay business tax at a set rate, depending on their profits.

Value-added Tax: Belize has a VAT rate of 12.5%

Capital Gains Tax: There is no capital gains tax in Belize.

Property Tax: In Belize, rented properties are subject to a fixed 12.5% property tax, while vacant properties incur a 2% property tax.

Social Security: Both employees and employers in Belize are responsible for Social Security taxes, which are calculated according to the weekly income earned by the individual.

Expert Tip: Business Tax vs. Corporate Income Tax

From our experience, the concept of “Business Tax” in Belize is often misunderstood by foreign investors used to profit-based tax systems. Business Tax is a turnover tax levied on gross revenue, regardless of whether the company made a profit or a loss. The rate varies by industry (e.g., 1.75% for trade, 6% for professional services).

Because deductions are not allowed against this tax, it acts as a fixed cost of doing business. We advise clients to check the specific rate for their industry code to accurately forecast margins.

International Tax Treaties

Belize has established agreements with various countries to prevent double taxation and ensure tax information exchange.

It has 14 Double Tax Treaties (DTC) with Antigua and Barbuda, Austria, Barbados, Dominica, Grenada, Guyana, Jamaica, Saint Kitts and Nevis, Saint Lucia, Saint Vincent and the Grenadines, Switzerland, Trinidad and Tobago, United Arab Emirates, United Kingdom.

Additionally, there are 14 Tax Information Exchange Agreements (TIEA) with Australia, Belgium, France, Netherlands, United Kingdom, Finland, Sweden, Denmark, Norway, Iceland, Ireland, Greenland, Faroe Island, and Portugal.

Belize has also ratified the Multilateral Convention to Prevent Base Erosion and Profit Shifting, effective from August 1, 2022.

What is Needed to Register a Business in Belize?

Below is a checklist of the important steps needed to incorporate a company in Belize.

- Conduct a name check with the Belize Companies Registry.

- Complete a Memorandum and Article of Association (M&A) and submit this to the Registrar in Belmopan along with the formation fee.

- Approval is granted by the Central Bank of Belize.

- A Certificate of Incorporation will be issued by the registrar and it should be displayed at the registered office of the company.

- Upon receipt of the Certificate of Incorporation, the first director may be appointed along with the shareholders.

- Once the company is formed, officers need to be appointed to run the business. These officers may be the directors.

- Issuance of a company seal from the relevant authorities.

The Role of the Belize Tax Service Department

The Belize Tax Service Department is the government agency responsible for the administration and collection of all national taxes, including the Business Tax and General Sales Tax (GST). All companies must register with this department and file their tax returns accordingly.

Frequently Asked Questions: Belize Tax & Accounting

Based on our extensive experience, these are the common questions and concerns of our clients when seeking to understand accounting and taxation in Belize.

Oil industry companies are subjected to a fixed 25% tax rate on all profits, while other businesses pay taxes based on a specific rate determined by their profits.

The Belize Tax Service (BTS.)

In Belize, accounting rules under the Accounting Records Act focus on document preparation, storage, accessibility, and retention. The Belize Accounting Records (Maintenance) Act serves as the legal basis. It applies to International Business Companies and Belize International Trust. Companies must keep records at their registered office or agent’s office. Records like assets, liabilities, sales, purchases, and financial transactions are required.

The Institute of Chartered Accountants of Belize (ICAB) is the exclusive professional accountancy body in Belize authorized to grant the Chartered Accountant designation.

Companies have the flexibility to prepare their accounting records and financial statements according to the International Financial Reporting Standard (IFRS) since Belize does not adhere to a specific accounting standard or framework.

The Business Tax rate varies depending on the type of business, but for most companies, it is 1.75% of gross receipts. This tax must be paid on a monthly basis.

The General Sales Tax (GST) is a consumption tax applied to most goods and services in Belize. The standard rate is 12.5%. Businesses with an annual turnover exceeding BZD $75,000 must register for GST.

An IBC is exempt from all local taxes and does not have to file tax returns. However, it is still required by law to maintain accurate financial records and underlying documentation that reflect its financial position. These records can be kept anywhere in the world.

Belize has adopted the International Financial Reporting Standards (IFRS) as its national accounting standard. All companies preparing financial statements must do so in accordance with IFRS.

Biz Latin Hub Can Help You With Accounting and Taxation in Belize

Biz Latin Hub is your trusted partner for accounting and taxation in Belize. Our dedicated team offers comprehensive market entry support and tailored back-office services to meet your specific needs.

We specialize in services such as accounting, taxation, company formation, due diligence, legal assistance, and hiring and PEO. With our extensive presence in 16 markets across Latin America and the Caribbean, we are well-equipped to support your cross-border operations and facilitate market entry across multiple jurisdictions.

Rest assured, our commitment to compliance ensures that your company adheres to all laws regarding accounting and taxation in Belize. Partner with us for seamless business operations in Latin America.

Contact us today to explore how we can assist your business ventures in Latin America or learn more about our experienced team and expert authors. Your success in the Belize market begins with Biz Latin Hub.