Explore why doing business in Peru in 2025 remains a smart choice for foreign investors, with insights into market strengths, legal setup, and growth sectors.

Doing business in Peru in 2025 continues to attract international attention due to its strong economic fundamentals, trade agreements, and expanding middle class. With low inflation rates, a thriving tourism sector and a government that actively encourages foreign investment in a variety of sectors, company formation in Peru represents an attractive opportunity for companies. Companies doing business in Peru benefit from one of Latin America’s most open economies, pro-investment legislation, and a transparent process for company formation.

Is it easy to do business in Peru?

Peru was recently ranked #31 out of 137 countries on the BTI Transformation Index, ahead of Colombia, Mexico, Ecuador, and Paraguay. The index analyzes and evaluates how countries are steering social change toward democracy and a market economy.

Although there was some recent political turmoil, in February the government revealed 30 new public-private projects worth almost $9 billion, which is positive news for companies that want to do business in Peru.

Top 5 reasons to do business in Peru

Here are top 5 reasons to do business in Peru:

- Strong mining industry.

- Growing economy.

- Favorable tax system.

- Few foreign investment rules.

- Developing talent pool.

Below is a more in-depth analysis of these five reasons why Peru is a great country to do business.

1 – Open to foreign investment

In Peru, both foreign and local investors enjoy equal rights over their investments as per the country’s legislation.

It prohibits any authority from discriminating based on nationality, economic activity type, geographic location in the country, regarding prices, exchange aspects, tariffs, non-custom duties, or business information.

Most business in Peru does not have any specific restrictions or requirements on foreign investment. This favorable business environment for foreign investors makes Peru a perfect location for expansion.

2 – Favorable tax system

The Peruvian government offers foreign tax credits for income taxes paid due to the foreign-source income levied by the Peruvian Income Tax Law (PITL).

To attract more business in Peru, special economic zones have been created. These zones offer tax breaks and other benefits to companies operating within their borders.

Also, these zones provide essential infrastructure, such as high-speed internet, power, and transportation, which make it easier for companies to establish themselves in the country.

There is also a special deduction program for scientific research, technological development, and innovation projects. This program allows taxpayers investing in such projects to deduct either 150% or 175% of the expenses incurred, depending on the project’s nature.

3 – Growing economy

Peru’s growing economy has shown resilience and potential, attracting both domestic and foreign investment. The country continues to explore avenues for diversification to ensure sustainable growth and address persistent socioeconomic issues.

4 – Strong mining industry

Peru has rich deposits of copper, gold, silver, zinc, lead, and natural gas. The mining sector drives Peru’s economy and contributes 8.5% to its GDP. Mineral exports make up the majority of the country’s total exports, amounting to 63.9%.

The sector has attracted significant investment in the last two decades, leading to an upsurge in exploration and development activities. Peru is one of the world’s leading producers of mineral commodities, with copper and gold being the most valuable mineral exports.

Due to its geological potential and low production costs, Peru’s mining industry is an attractive investment opportunity.

5 – Developing skilled talent

Due to the government’s investments in Science, Technology, Engineering, and Mathematics education in recent years, Peru has a flourishing tech industry.

As a result, it is among the top 10 countries per capita for tech entrepreneurial activity, with 25% of Peruvians starting a business within the last four years.

Peru boasts a vast and expanding tech talent pool, with approximately 30,000 skilled and proficient software engineers.

Local Insight for 2025:

Peru’s strategic location on the Pacific coast and its wide network of FTAs make it an ideal springboard for companies looking to serve both the North and South American markets from a single LATAM hub.

Why Peru Remains a Top Business Destination in 2025

Peru continues to be one of Latin America’s most attractive countries for doing business, thanks to its solid macroeconomic management, diversified export base, and investor-friendly reforms. Even with periods of political uncertainty, its economy has proven resilient.

Key reasons foreign companies choose Peru include:

- Free trade access to over 50 countries, including the U.S., China, and the European Union.

- Strategic Pacific coast location with efficient port infrastructure for regional and global trade.

- Natural resource wealth, particularly in copper, gold, silver, and lithium — attracting global mining and processing companies.

- Growing middle class creating demand in sectors like finance, education, e-commerce, and health services.

- Legal protections for foreign investors, including the ability to repatriate capital and profits freely.

Local Tip:

Most foreign companies incorporate in Lima due to its infrastructure, access to banking and legal services, and proximity to decision-makers in both government and private industry.

Company formation for doing business in Peru

To incorporate a company in Peru, foreign investors must select a legal structure (typically SAC or SRL), register the company with SUNARP, obtain a RUC tax ID from SUNAT, and open a corporate bank account. The incorporation process generally takes 3–5 weeks and may require a local legal representative and statutory capital.

Doing business in Peru requires proper registration with SUNARP (Public Registry), SUNAT (Tax Authority), and compliance with Peru’s General Corporations Law.

What are the top 3 industries for business in Peru?

With a population of over 34 million, Peru has an emerging, social market economy with many free trade agreements including the U.S. and China. For companies doing business in Peru, top-performing sectors include mining, agribusiness, clean energy, logistics, and professional services.

Here are the top three industries for business in Peru:

- Mining.

- Tourism.

- Agribusiness.

1. Mining

As mentioned earlier, the mining and metals sector is the top industry in Peru. It has approximately 200 operating mines employing over 235,000 workers and several large projects in development. Peru continues to be an attractive destination for mining investments with large metal and mineral reserves. There is also no discrimination between domestic and foreign companies under Peruvian laws, regulations, and customs.

2. Tourism

One of the primary attractions in Peru is the ancient Inca city of Machu Picchu, a UNESCO World Heritage site. This archaeological wonder is Peru’s most famous destination and attracts visitors from all over the world. The Sacred Valley, located nearby, is also a popular tourist spot with its stunning landscapes and Inca ruins.

3. Agribusiness

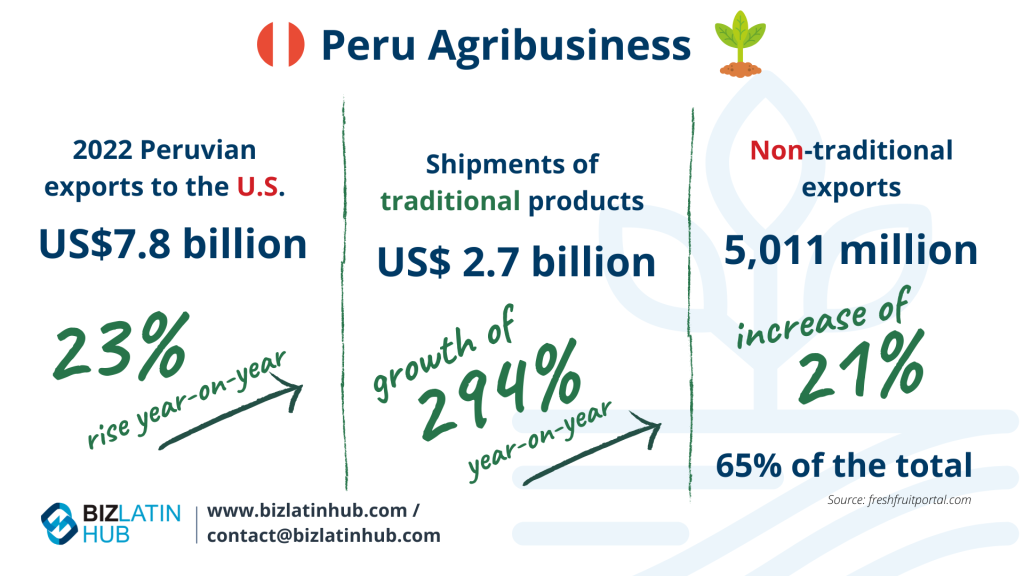

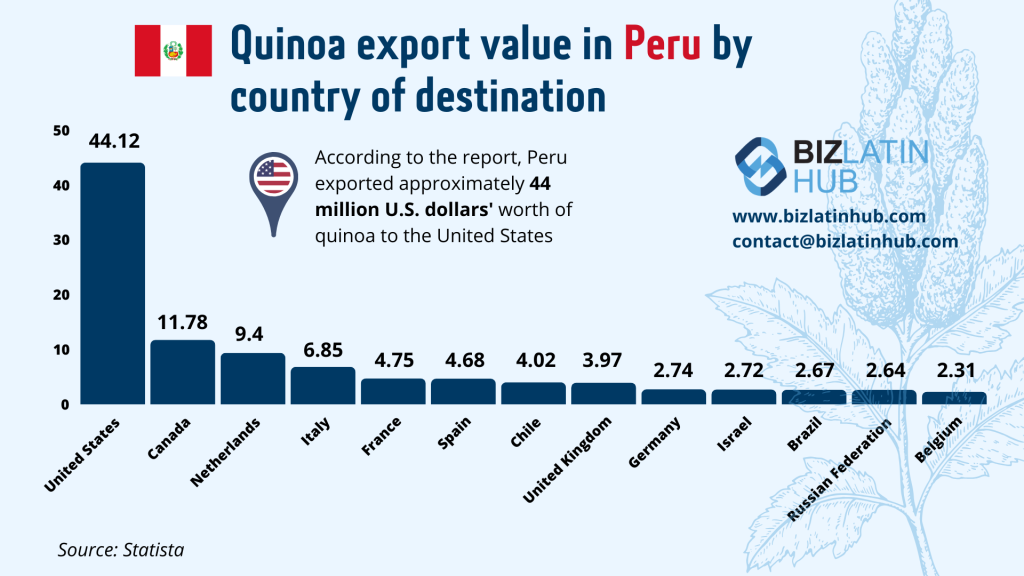

Peruvian exports to the U.S. rose 23 percent between January and November in 2022. This growth, fueled by Peru’s agriculture and livestock industry, had an accumulated growth of 367 percent.

The agribusiness industry in Peru has grown from 582 companies in 2009 to over 945 exporting companies today. Blueberries, fresh asparagus, grapes, and avocados led the way.

These leading industries offer exciting investment and business opportunities in Peru this year and into the future.

FAQs on doing business in Peru

Because of its economic stability, trade openness, low corporate tax rates, and ongoing demand in key sectors such as mining, agriculture, and infrastructure.

Yes. Foreigners can fully own a company in Peru, and there are no restrictions on repatriation of capital or profits.

With professional support, the process takes approximately 3–5 weeks depending on the type of entity and readiness of documentation.

There are currently four Free Trade Zones in the country, with a further four being developed. These zones are overseen by the Ministry of Commerce and offer tax exemptions, simplified customs processes and specialized on-site exportation and importation support. Specific zones also offer particular perks for certain industries.

It takes up to 15 business days to complete the company formation process should the founding partners be in Peru at the time of incorporation. However, if they are unable to be in the country, registered powers of attorney are required. This can take up to 15 additional business days.

Historically, mining has always been one of the strongest sectors for Peru’s economy. The country currently produces copper, gold, silver, lead, tin, molybdenum, iron, cadmium, mercury, selenium and indium among others. The efficient mining practices in the country have enabled Peru to become one of the largest mining producers in both the region and the world.

Government investments in Science, Technology, Engineering and Mathematics (STEM) education over the past decade have paid off, and Peru now has a thriving tech scene. It ranks in the top 10 countries with the highest per-capital levels of tech entrepreneurial activity (1 in 4 Peruvians have started a business in the past four years).

Whether it is foreign companies or entrepreneurs who want to start a business in Peru, or are thinking of hiring software developers there, the jurisdiction has never looked better, with the strong growth predicted to continue for at least the rest of the decade.

Biz Latin Hub can help grow your business

Biz Latin Hub can serve as your exclusive partner for establishing and conducting business in Peru. If you’re planning on doing business in Peru in 2025, Biz Latin Hub offers expert legal and administrative support to simplify your entry and ensure long-term compliance.

Our team of bilingual corporate support specialists in Lima can provide you with a customized package of services. These include company formation, accounting and taxation, legal support, hiring, and PEO.

To discover more about how we can assist you in doing business in Peru and the rest of Latin America, contact our expert team today.