This guide focuses on performing an Entity Health Check in St Lucia. An Entity Health Check is vital for business formation in St Lucia and legal operation. It reviews key areas like corporate compliance, tax status, and labor law adherence. We will examine each area important for your St. Lucia company’s health and a comprehensive Entity Health Check in St Lucia. A Health Check requires careful review of legal duties. This guide explains the value of a proactive compliance review and details the main areas that must be assessed to ensure a company in St. Lucia is in good legal standing.

Key Takeaways: Entity Health Check in St. Lucia

| What is a corporate entity health check? | An entity health check is a preventative audit of a company’s statutory records and obligations. |

| What are the key differences in compliance for an IBC vs. a Domestic Company? | The latter have to go through a much more thorough process. |

| Does a health check in St Lucia check annual commitments? | A health check ensures the annual registration fee has been paid. |

| Why is an entity health check in St Lucia particularly important for an IBC? | It verifies that the company maintains a registered agent in St. Lucia. |

| Why is a health check important for maintaining corporate integrity? | It keeps you compliant, avoids fines and maintains good standing. |

The Importance of a Corporate Health Check

An entity health check is a preventative audit of a company’s statutory records and obligations. The goal is to identify any compliance deficiencies, such as failure to pay annual government fees, and resolve them before they can lead to the company being struck from the register.

Key Areas of a Saint Lucian Entity Health Check

Expert Tip: Verifying the Registered Agent’s Status

From our experience with International Business Companies (IBCs) in St. Lucia, a critical and unique point to verify in a health check is the status of the company’s registered agent. The law requires every IBC to have a licensed registered agent at all times. We have encountered situations where a registered agent has lost their license, retired, or gone out of business without properly transferring their client companies.

This leaves the IBC non-compliant and at risk of being struck off. A thorough health check must include direct confirmation that the current registered agent is in good standing and holds a valid license from the Financial Services Regulatory Authority (FSRA).

1. Corporate Status with the Registrar

This review verifies that the company is listed as “active” on the public registry and that all annual government license fees have been paid on time.

2. Registered Agent and Office Compliance

This check confirms that the company has a valid, licensed registered agent and a physical registered office address in St. Lucia, as required by law.

3. Review of Corporate Records

This audit ensures that the company is maintaining its statutory records, such as the register of directors and the register of shareholders, even if these are held outside of St. Lucia.

4. Tax and Social Security Status (for Domestic Companies)

For companies operating locally, this review verifies compliance with the Inland Revenue Department (IRD) for tax filings and with the National Insurance Corporation (NIC) for employee contributions.

Understanding St. Lucia Business Rules for Your Entity Health Check

Performing a thorough Entity Health Check in St Lucia requires knowing local laws. Companies must follow legal rules for employment contracts. As part of the Entity Health Check in St Lucia, these contracts need review. They must clearly state salary, benefits, work hours, and how employment ends.

The Business Companies Act sets director rules. An Entity Health Check in St Lucia verifies a company has at least one director. Public companies require at least three directors. For International Business Companies (IBCs), an Entity Health Check in St Lucia confirms shareholder and director privacy is maintained. It also verifies IBCs do not conduct prohibited business with St. Lucian residents, like real estate or local financial services. This rule is important for checking an IBC’s operational scope during your Entity Health Check in St Lucia.

St. Lucia has specific labeling rules for products like clothes and textiles. An Entity Health Check in St Lucia should verify that all sold items have correct labels. Labels must show manufacturer/importer and fiber details if applicable. Checking these labels is part of an operational health check within your overall Entity Health Check in St Lucia.

Key Points for a St. Lucia Entity Health Check:

- Verify employment contracts detail salary, benefits, and work conditions by law.

- Confirm the company’s director structure matches the Business Companies Act.

- For IBCs, check that operations correctly avoid business with St. Lucian residents.

- Ensure product labeling, if used, follows local standards.

This structured review, essential for an Entity Health Check in St Lucia, helps confirm businesses operate legally in St. Lucia.

Corporate Secretarial Compliance: Key to an Entity Health Check in St Lucia

A key part of any Entity Health Check in St Lucia is verifying its corporate secretarial status. This check confirms the company follows the St. Lucia Business Companies Act. It also shows the company maintains its legal status. Managing these duties helps a company stay in good standing and avoid legal problems. The Entity Health Check in St Lucia should review annual filings, statutory records, and registered agent details.

Recruitment Practices Review for an Entity Health Check in St Lucia

A key part of an Entity Health Check in St Lucia is reviewing recruitment practices. This ensures compliance with local labor laws and employment rules. Employers need clear employment contracts. The Entity Health Check in St Lucia must confirm contracts detail salary, benefits, work hours, and termination terms. Both employers and employees pay into the National Insurance Scheme. Verifying these payments from salaries is a check item for the Entity Health Check in St Lucia. The Labour Act gives rules on worker rights, work hours, and overtime. The Entity Health Check in St Lucia confirms adherence. Foreign workers in Saint Lucia need a work permit. The Entity Health Check in St Lucia verifies permits are obtained correctly, usually by application at least two months before work starts. This review helps ensure fair treatment and protects against unfair dismissal claims.

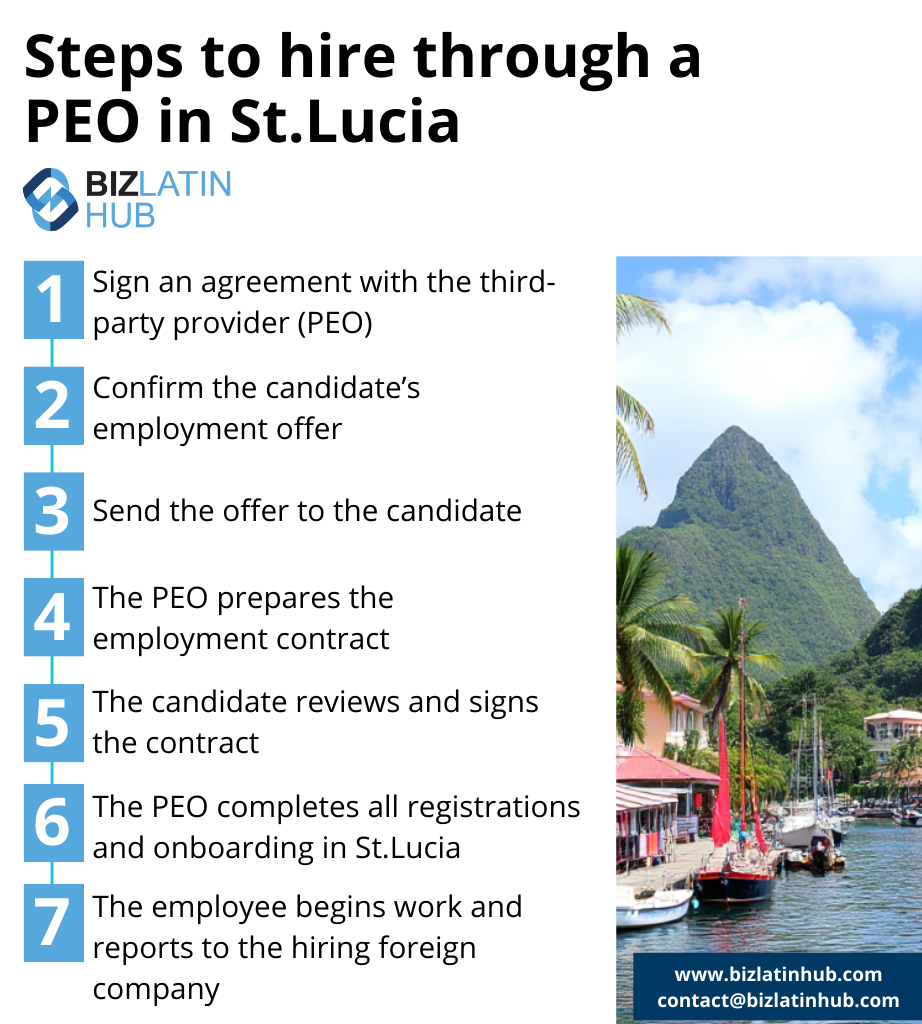

EOR and PEO Arrangements: Considerations for an Entity Health Check in St Lucia

If your St. Lucia entity uses an Employer of Record (EOR), the Entity Health Check in St Lucia must review this arrangement. An EOR is the legal employer. It manages payroll, taxes, and labor law compliance. The Entity Health Check in St Lucia verifies the EOR agreement ensures your company’s compliance and that the EOR itself is compliant. This is important if your company has no local office.

If a Professional Employer Organization (PEO) is used, the Entity Health Check in St Lucia will also review this. A PEO is a co-employer. It shares duties with your company. The Entity Health Check in St Lucia examines how payroll, taxes, and compliance are managed under the PEO agreement. It ensures clarity on responsibilities and compliance.

Labor Law Compliance: A Core Part of an Entity Health Check in St Lucia

A St. Lucia Entity Health Check must closely examine labor law compliance. This review is important to ensure fair work practices and avoid fines. The Entity Health Check in St Lucia verifies employers pay overtime correctly. Overtime is 1.5 times the normal pay rate for work over 40 hours a week. It also checks that night shift workers (10 PM to 6 AM) receive 1.25 times their normal pay.

The Entity Health Check in St Lucia confirms employment contracts meet Saint Lucia’s legal standards. Contracts must list salary, benefits, work hours, and termination details. It also verifies employers classify employees correctly for overtime. This ensures employment practices are clear, fair, and compliant. Following these legal standards is vital for your company’s health and reputation, as confirmed by your Entity Health Check in St Lucia.

Legal Employment Standards: Reviewing for Your St. Lucia Entity Health Check

A St. Lucia Entity Health Check reviews specific legal employment standards. These standards maintain a good workplace. The rules cover overtime, employee rights, and work conditions. Verifying compliance ensures legal operation and helps avoid disagreements. The Entity Health Check in St Lucia confirms adherence to Saint Lucia’s labor laws, including minimum wage (currently $6.52 XCD per hour as of 2024) and work conditions.

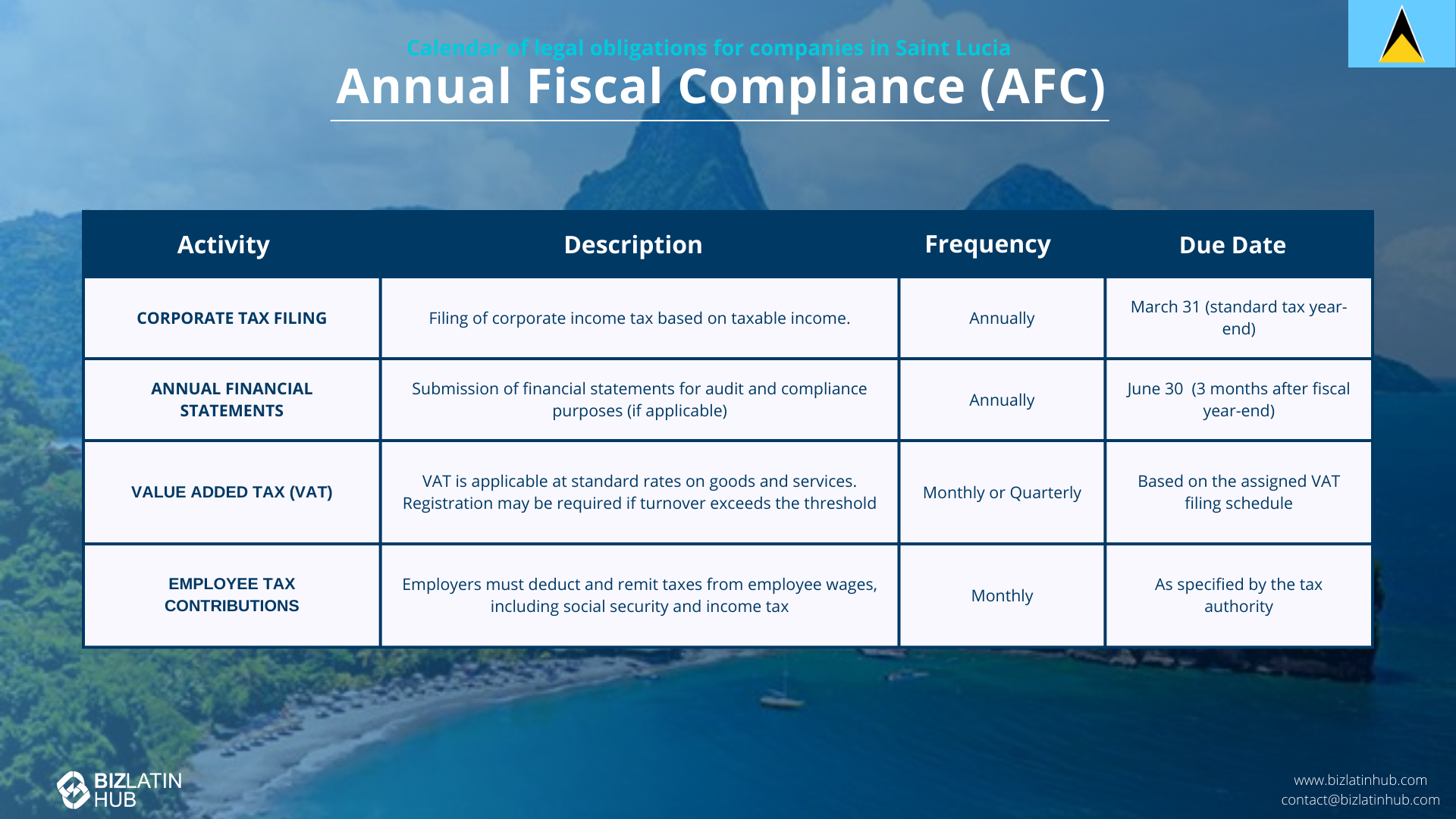

Tax duties are another check point for your Entity Health Check in St Lucia. Resident companies in St. Lucia pay a 30% corporate tax on income earned within Saint Lucia. Non-resident companies also pay taxes on their St. Lucia-sourced income. The Entity Health Check in St Lucia verifies correct tax reporting.

Foreign workers need a work permit from the Labour Department. This permit needs annual renewal. The Entity Health Check in St Lucia confirms foreign employees have valid permits. It also verifies applications were made correctly, and work did not start before permit issuance.

Employment Contracts Verification in Your St. Lucia Entity Health Check

The Entity Health Check in St Lucia closely examines employment contracts. These contracts are the legal guide for worker-employer relations in St. Lucia. Contracts can be spoken or written but must be clear. The Entity Health Check in St Lucia ensures contracts state key details: salary, benefits, work hours, and termination rules. This confirms compliance with labor laws and protects employee rights. Contracts must also include notice periods and training times. The Entity Health Check in St Lucia reviews if repeated use of fixed-term contracts might be seen as creating indefinite employment, which can affect obligations.

Work Permit and Visa Rules: A St. Lucia Entity Health Check Component

An Entity Health Check in St Lucia confirms all foreign nationals working in Saint Lucia have a valid work permit or exemption. This is a key legal compliance point. An entry visa (non-immigrant visa) is also needed for work. The Entity Health Check in St Lucia verifies these are in place. The Labour Department issues annual work permits. The Entity Health Check in St Lucia ensures applications were submitted correctly, including justification for hiring foreign nationals.

A St. Lucia Entity Health Check includes auditing social security and payroll duties. Employers and employees pay into the National Insurance Corporation (NIC). This supports pensions, health care, and unemployment benefits. Each side pays 5% of the employee’s insurable monthly income (up to a ceiling). The Entity Health Check in St Lucia verifies these 10% total payments are correct. Employers must use the PAYE (Pay As You Earn) system for income taxes. The Entity Health Check in St Lucia ensures accurate calculation, withholding, and sending of these taxes. Payroll is usually monthly. The Entity Health Check in St Lucia reviews NIC payment records and tax remittances.

Payroll Tax Management: Confirming for an Entity Health Check in St Lucia

The Entity Health Check in St Lucia confirms proper management of payroll taxes. Employers must withhold income tax from employee earnings via PAYE and send it to authorities. It verifies both employee and employer NIC contributions (5% each) are correctly handled. The check ensures timely payments to the Inland Revenue Department and NIC. Mistakes here can cause legal issues. Accurate calculations and timely sending are vital for financial health, as verified by an Entity Health Check in St Lucia.

Employee Benefits Management Review in a St. Lucia Entity Health Check

The Entity Health Check in St Lucia reviews employee benefits management. This ensures compliance with labor laws and contract terms. Detailed employment contracts must cover benefits. The Entity Health Check in St Lucia confirms adherence to these agreements. It also verifies employers keep exact work hour records for correct overtime pay. Proper benefits management is key to upholding employee rights and avoiding legal problems.

General Labor Law Review: Integral to an Entity Health Check in St Lucia

A broad review of labor law compliance is essential in a St. Lucia Entity Health Check. This helps avoid fines and maintain a good workplace. The Entity Health Check in St Lucia ensures familiarity with employment law details like overtime, employee rights, and work hour management. It verifies employment contracts clearly define salary, benefits, and termination terms per legal standards. If EOR services are used, their compliance contribution is assessed during the Entity Health Check in St Lucia. This comprehensive review helps prevent disagreements and protect worker rights.

Income Tax Duties Verification for Your St. Lucia Entity Health Check

An Entity Health Check in St Lucia verifies all income tax duties are met. For individuals, St. Lucia uses a progressive income tax system. Rates are:

- 0% for income up to EC$18,400

- 10% for EC18,401toEC28,400

- 15% for EC28,401toEC38,400

- 20% for EC38,401toEC48,400

- 30% for income over EC$48,400

The Entity Health Check in St Lucia ensures company and employee tax affairs align with these rules. It also confirms corporate income tax (30% on St. Lucia-sourced income) is correctly handled. Managing social security payments is also checked. The Entity Health Check in St Lucia verifies all taxes are paid to ensure eligibility for a tax clearance certificate. This certificate is vital for many business processes.

VAT Requirements: Checking in Your St. Lucia Entity Health Check

VAT compliance is a key part of the St. Lucia Entity Health Check. The standard VAT rate is 12.5%. It applies to selling goods/services and importing goods. The Entity Health Check in St Lucia verifies correct application of VAT. Some items may have reduced rates (10% or 7%), zero rates, or exemptions. The VAT registration threshold is an annual turnover of $400,000 XCD from taxable supplies. The Entity Health Check in St Lucia confirms registration if this threshold is met. It ensures the company understands and applies VAT rules correctly.

Health and Safety Standards Check for an Entity Health Check in St Lucia (ISO 45001 Reference)

An Entity Health Check in St Lucia should assess compliance with occupational health and safety (OHS) standards. Using ISO 45001 principles can be a reference for this part of the review. This involves checking the company’s OHS management system. It verifies that processes are in place to establish, use, and improve safety practices.

OHS Compliance Verification: Part of Your St. Lucia Entity Health Check

St. Lucia’s labor laws require employers to provide safe workplaces and protect employees from dangers. The Entity Health Check in St Lucia verifies compliance with these OHS laws. It ensures the company promotes fair treatment, prevents discrimination, and maintains a safe work environment. Using a system like ISO 45001 helps show commitment to effective safety management, which is reviewed during the Entity Health Check in St Lucia.

Ongoing Legal Monitoring for Your St. Lucia Entity Health Check

Continuously monitoring legal requirements is an ongoing part of a St. Lucia Entity Health Check. Businesses must follow specific laws to work smoothly. The Entity Health Check in St Lucia verifies that employment contracts are clear about salary and benefits, protecting employee rights. For IBCs, it confirms adherence to rules on director and shareholder privacy. It also checks compliance with labeling rules for goods. The Entity Health Check in St Lucia also reviews how fixed-term employment contracts are used to avoid issues of misclassification.

Preventing Penalties: Compliance Actions in an Entity Health Check in St Lucia

A key goal of an Entity Health Check in St Lucia is to help avoid legal fines. The check ensures employers keep exact work hour records. This is vital for compliance. It verifies adherence to legal agreements on salary, benefits, and work hours. Not following these rules can lead to serious legal results. The Entity Health Check in St Lucia ensures employment contracts meet all St. Lucia legal standards. This protects the company from fines and legal actions.

Employee Rights Protection Check in Your St. Lucia Entity Health Check

The Entity Health Check in St Lucia confirms that employee rights are protected. It verifies mandatory overtime pay for work over the standard 40-hour week. It checks that employers keep accurate work hour records. Not following legal agreements on employee rights can have serious legal results. The Entity Health Check in St Lucia ensures fair treatment and safe work environments as per St. Lucian labor laws.

Operational Structure Compliance: An Entity Health Check in St Lucia Perspective

For existing St. Lucia entities, an Entity Health Check in St Lucia verifies ongoing compliance related to its operational structure. This is true for companies under the International Business Companies Act. If the entity uses EOR or PEO services, the Entity Health Check in St Lucia reviews these to ensure hiring and compliance processes are sound. It confirms work permits for foreign workers are correctly managed, including showing attempts to hire locals. The Entity Health Check in St Lucia verifies compliance with payroll and social security tax obligations. It ensures employment contracts clearly state duties, pay, and meet minimum wage rules.

Business Incentives Compliance Verification in a St. Lucia Entity Health Check

If your St. Lucia entity receives business incentives, the Entity Health Check in St Lucia must confirm ongoing eligibility. It also verifies compliance with all terms and conditions of the incentive. The Entity Health Check in St Lucia ensures that employment terms, company structure (director numbers), and IBC operations (confidentiality and restrictions on local business) align with any incentive requirements and general law.

Maintaining Good Standing via an Entity Health Check in St Lucia: Future Benefits

Ensuring good legal and financial standing through regular health checks is important, specifically, through a regular Entity Health Check in St Lucia. While this guide focuses on compliance for existing entities, a healthy company is better positioned for future growth or investment. Maintaining clear records, following labor laws, and ensuring all contracts are legally sound contributes to a stable and reliable business reputation. This is a positive outcome of consistent Entity Health Checks in St Lucia.

Frequently Asked Questions: Entity Health Check in St. Lucia

For an International Business Company (IBC), the health check focuses on corporate good standing, payment of annual fees, and maintaining a registered agent, as IBCs are tax-exempt. For a Domestic Company, the health check is more extensive and includes a review of tax filings with the IRD and social security contributions with the NIC.

This is the government office in St. Lucia responsible for the incorporation and registration of all companies. The health check verifies the company’s status on this official registry.

If an IBC fails to pay its annual government license fee, it will incur penalties. If the fee remains unpaid, the Registrar has the authority to strike the company’s name from the register, at which point it ceases to be a legal entity.

No. A financial audit is a detailed examination of a company’s financial statements to verify their accuracy. An entity health check is a broader compliance review that looks at legal, corporate, and statutory filings, in addition to confirming that proper financial records are being kept.

Biz Latin Hub can help you with an entity health check in St Lucia

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.