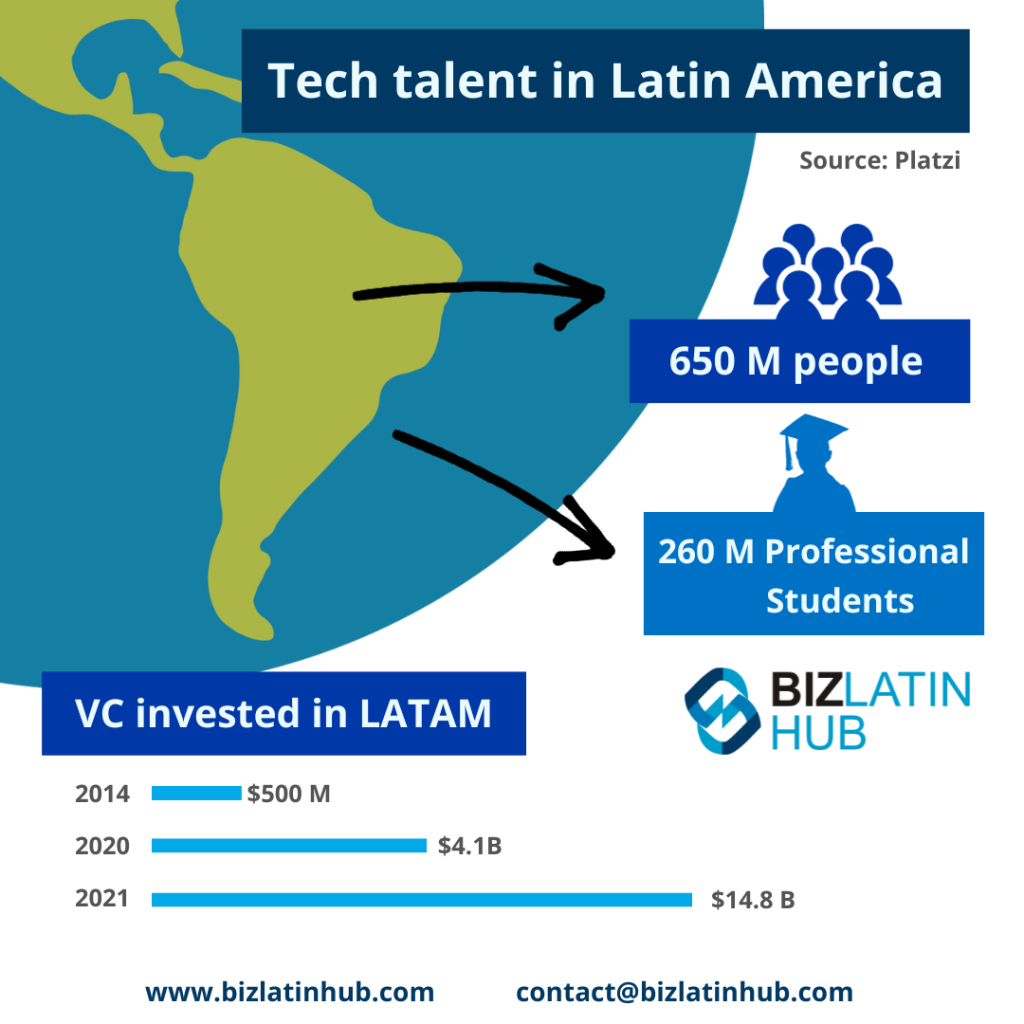

Latin America is a growing destination for international investment these days. In a time of global upheaval to trade, the region is well placed as a relatively safe haven. Whether you are looking at outsourcing, nearshoring, friendshoring or full company formation in Latin America, plenty of benefits await you. With stability and strong growth in most countries, there is great potential over the coming years.

What should you expect from your financial advisor?

Before investing, choosing the right advisor is critical and here is what you should expect from them:

- Understanding your unique investment needs

- Analyzing your options

- Tailoring an investment solution for your needs

- Carrying out your choices

- Being committed to your financial success

Here we go deeper into what you should expect from your financial advisor:

1. Understanding your investment needs – The financial advisor should understand your financial objectives, timeline and tolerance for risk

2. Analyzing your needs – The financial advisor should work with you to review your current financial situation and evaluate investment strategies and options with you

3. Tailoring an investment solution for your needs – They should evaluate and present investment options that meet your needs, timeline and risk tolerances

4. Carrying out your choices – The should communicate clearly about the chosen investment plan, and carryout your instructions to the best of their ability

5. Being committed to your financial investment success – They should remain engaged, committed, provide regular updates and be available to answer any questions.

It is important that the the financial advisor is experienced with providing wealth management and investment solutions for foreign nationals, and understands the unique nature of the lifestyle and the impact of the potential investment options on his/ her personal taxation affairs.

What are the common types of investment options in Latin America?

- High Interest Savings Accounts

- Single Investment Funds

- Portfolio Investment Funds

- Direct share investing

- Real Estate / Property Investments

- Commodity Investment

So what type of investment is best?

Most international investors choose an offshore Portfolio Investments Fund, as they present a far more liquid investment when compared to the other options, are usually denominated in USD or Euros and often have numerous tax advantages, which can vary depending on the tax residency of the Expat. Additionally with these types of investments you can make an initial once off payment and then continual investment payments on a frequency basis.

Key points when choosing where to invest?

- Liquidity of the Investment

- Flexibility of the Investment

- Security of the Investment

- Investment Risk

- Investment Timeline

- Potential Return on Investment

- How it will be affected if you move locations

What will you need to provide initially starting to invest?

This can vary based on the investment option chosen, however normally you will need to provide / do the following:

- Meeting with your chosen financial advisor

- Review your options and confirm your investment strategy

- Complete an investment application form for the chosen investment option

- Provide a copy of your ID

- Provide a proof of residential address (i.e. Utility bill or bank statement is most common)

- Confirm your country of tax residency location

- Transfer the initial deposit

Note: In some cases it may be preferred to make the investment through a legal entity rather than as an individual.

How can we help with investment advice at Biz Latin Hub?

As a market leader within the Latin American and Caribbean region, with connections across all business and investment sectors we are well positioned to steer you in the right path and to ensure that your investment needs are taken care of in a professional and competent manner. It is important that you seek professional advice when investing and we can ensure that you get the very best advice.

Contact us today to find out more about how we can assist you with your EXPAT investment needs.

Also about our team and expert authors.