Uruguay’s Free Trade Zones (FTZs) are areas within its territory that have certain tax, duties and other exemptions, and allow freedoms in the flow of goods and assets. They are one of the most common reasons that international investors typically register a business in Uruguay.

Market observers predict that in the last 10 years, Uruguay’s Free Trade Zones facilitated investment into the country of over US$5.7 billion. This investment amount is so significant that it is now a key contributor to the country’s economy. Successive governments have supported the legal framework for these zones for over 25 years.

Biz Latin Hub can help you form a company and enter Uruguay’s Free Trade Zones, whether that is to provide services or produce goods. We can also provide an array of market leading back-office services to support you throughout your time in the country and keep you legally compliant. That in turn allows you to relax and focus on what you do best – growing your business.

Uruguay – What are Free Trade Zones?

Uruguay’s 11 Free Trade Zones allow businesses to conduct a range of commercial activities with lowered or zero national tax rates, investment incentives and exclusion from customs duties. The Free Trade Zone Area is the local authority in charge of managing these zones, which reports to the Ministry of Economy and Finance.

FTZs support several activities in manufacturing, logistics, and warehouse operations, identified under FTZ law to be of national interest. This includes storage, assembly, marketing, handling, deposit, installation and operation, financial services and banking activities.

The Zones are occupied by local and multinational companies across various industries, including beverages, services, wood processing, printing, toy production and pharmaceuticals.

Where are they?

The FTZs offer a mix of private and state ownership. The single government-owned FTZ lies in Nueva Palmira, on the border of Argentina. The 10 others are private-owned, found in:

- Montevideo

- Florida

- Rivera

- Colonia

- Nueva Helvecia

- Río Negro

Pulp-plants owned and run by UPM, a Finnish company, and Stora Enso-Arauco, are recognized as Free Trade Zones in and of themselves.

These zones encourage investment and business and job growth within their borders. Companies based in the Zones are exempt from certain intellectual property and other intangible asset costs.

Working in a Free Trade Zone

Companies working within FTZs are treated to national tax exemptions, lowering the cost of ongoing commercial activity significantly. In order to enjoy the tax benefits of FTZ operations, companies must accept and adopt certain by-laws in their company constitution. By-laws are policies by which the company regulates itself.

Additionally, companies wanting to enter FTZs must form an agreement with the owner or operator of that zone – be it the government or a private firm. The agreement must then be filed with the Free Trade Zones Area. Uruguayan citizens must make up at least 75% of the payroll. However, for service providers that can drop to 50%.

From inside the FTZ, companies can work with foreign businesses or customers, local departments and other companies inside the FTZ. Commercial actors inside the Zones are not allowed to conduct normal business with others in Uruguayan territory, outside of those Zones.

Tax treatments

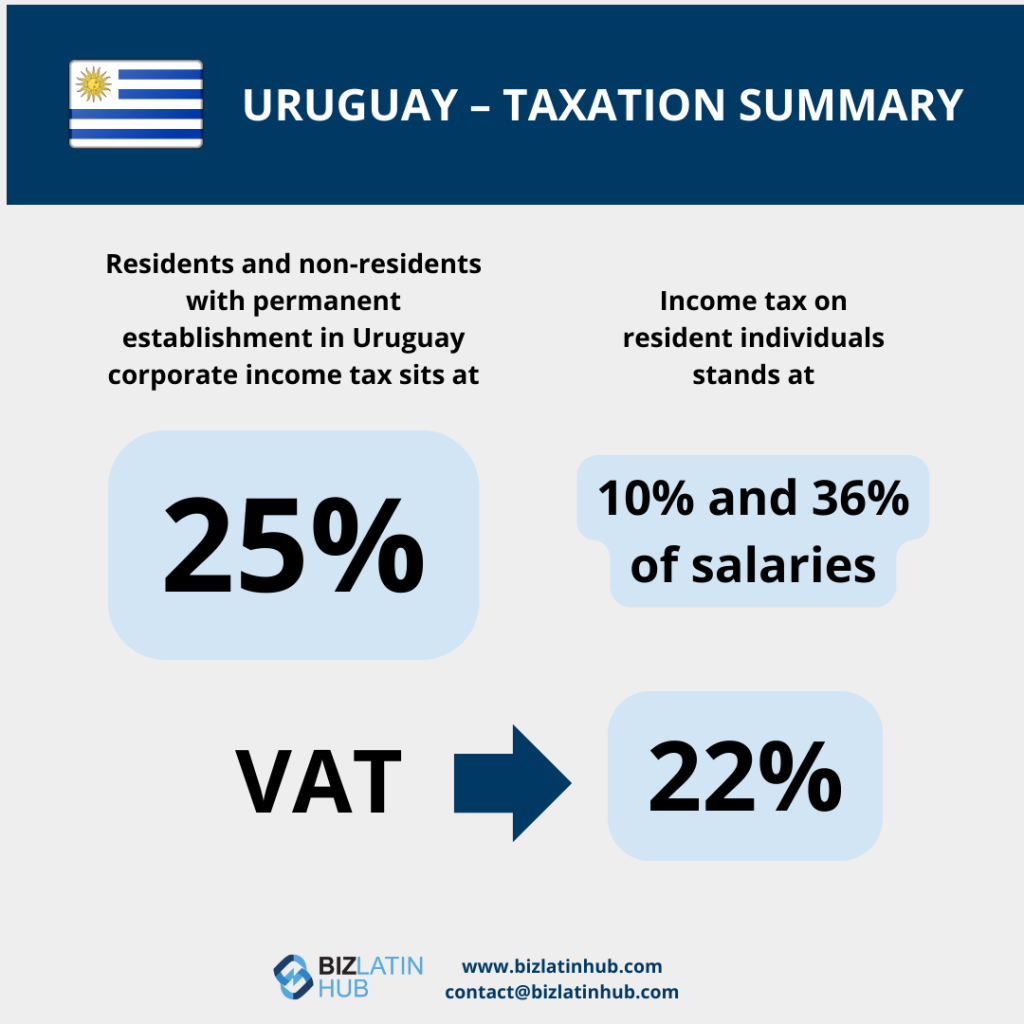

The relevant taxes that FTZ operators enjoy exemptions from include:

- Corporate Income Tax: this is known as Impuesto a las Actividades Economicas (IRAE) and is applied at a rate of 25%

- Net Equity Tax: called Impuesto al Patrimonio (IP), applied at a rate of 1.5%

- Value-Added Tax: called Impuesto al Valor Agregado (IVA), with a rate of 22%

- Specific Internal Tax or ‘Excise Tax’: known as Impuesto Específico Interno (IMESI), applied at several different rates

- Tax on Control of Corporations: called Impuesto de Control a las Sociedades Anónimas or ICOSA. This is a set rate of around US$500, paid annually.

Dividends to foreign-based shareholders also enjoy tax-free transactions.

Though exempt from national tax, companies in FTZs must still pay social security taxes. However, foreign staff in an FTZ-based company may choose to exclude themselves from the country’s social security system. In this case, the company and foreign staff are exempt from social security tax obligations.

Instead, foreign staff members may pay a ‘Non-Residents Income Tax,’ known as Impuesto a la Renta de los Non Residentes (IRNR). This tax sits at a flat rate of 12%, which is potentially lower than the rate of the local personal income tax, which can range between 10-30%.

Customs duties exemptions in an FTZ

Tax exemptions apply to goods and services moving to and from FTZ areas. This includes those coming into one of the Zones from a non-FTZ operating business based in Uruguay.

The objective nature of this policy means that the exemption applies regardless of how the buyer or seller may benefit from it. This includes shipments of goods from FTZs to international buyers.

However, goods moving from one of the Zones into Uruguayan territory are subject to import duties. Note that commercial entities may not use the Free Trade Zones to conduct business with customers or other businesses working outside of those Zones in Uruguayan territory.

Some special exceptions are made for international telecommunications (such as call centres), postal services, technology services and training, and education by correspondence.

Commercial freedom

The FTZs don’t have state-owned market monopolies working within the borders, which encourages free and healthy competition in areas such as gas supply and telecommunications. Foreign currency trading, and trade with precious resources such as gold and other metals, is also free.

Commercial transactions in the FTZs are done without the involvement of Uruguay’s Central Bank, or any other economic authority. Once the investing/incorporating company strikes an agreement with the FTZ operator, the liability for maintaining the tax exemptions and other incentives lies with the state of Uruguay.

FAQs on Uruguay’s Free Trade Zones

What is the main benefit to having a free trade zone?

By using an free trade zone in Uruguay, companies avoid the time-consuming process of duty drawback. Users who destroy goods in an FTZ do not pay duties on the goods they destroy, which can benefit a company with fragile imports or manufacturing processes that generate large quantities of scrap.

What is the free trade zone in Uruguay?

Uruguay’s free trade zones are specialized frameworks designed to encourage investment, production and trade in goods and services. They play a crucial role in attracting investment, creating skilled employment opportunities and expanding the scope of exports.

What is the primary benefit of a free-trade Zone?

The primary benefit of a free trade zone is It allow companies to defer or reduce duty payments on imported goods, in addition to other cost-saving advantages.

What are the requirements to operate within Uruguay’s Free Trade Zones?

The sole stipulation for companies operating within an FTZ is that 75% of their workforce must consist of Uruguayan citizens. However, in the services sector, a company can seek approval to employ only 50% local labor.

- There is no requirement for company officers to be locals.

- To operate within an FTZ, a company must establish a Special Purpose Vehicle (SPV), and submit its user/lease agreement along with a business plan to the Finance Ministry.

Can payroll outsourcing save costs for businesses in Uruguay?

Payroll outsourcing in Uruguay can indeed save costs for businesses. Here are some key points to consider:

- Labor Cost Reduction.

- Compliance and Efficiency.

- Affordability.

Biz Latin Hub can help you work in Uruguay’s Free Trade Zones

With areas for free trade and flow of goods and services, Uruguay offers highly competitive business and investment conditions for foreign commercial actors. The foreign business-friendly government offers long term tax benefits for entrepreneurs looking to gain a foothold in Latin America.

To ensure your company incorporation runs as smoothly and successfully as possible, consider partnering with a local group for guidance. Biz Latin Hub has the knowledge and expertise to offer customized business solutions in Uruguay and Latin America. We can tailor our services to suit your needs, and make sure your business stays compliant with local obligations

Reach out to us here at Biz Latin Hub for more specialized information regarding Uruguay’s company formation process.