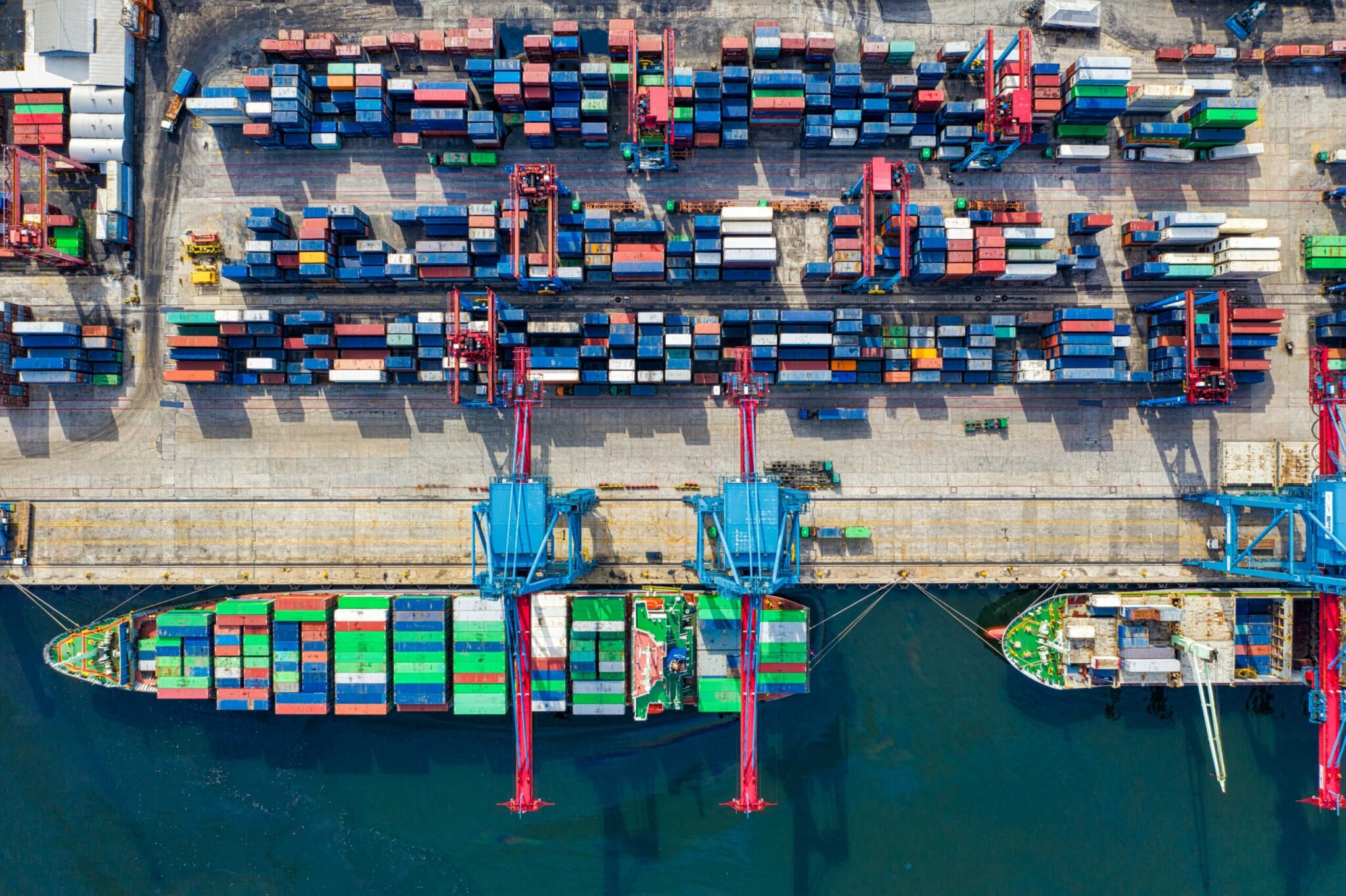

Nowadays, our world is one of communication and global exchanges. Indeed, borders have never been so easy to traverse. However, during transactions of goods, frontiers take back their rights, and it is, therefore, necessary to carry out the right administrative procedures to move products and services abroad. Mexico is becoming an increasingly attractive option for exporters, with a population of 127.8 million and growing consumer expenditure due to a swelling middle class.

To get your goods into Mexico’s market, you will have to facilitate the delivery of your goods and specific administrative procedures. You will have to use the services of a Customs Agent.

Considered as the second-largest economy in Latin America, Mexico is in expansion. The country is the world’s thirteenth-largest export economy and the thirteenth-largest importer. With the trade war between Washington and Beijing, the trade partners of the US are evolving. It was reported that during the first week of August 2019, Mexico replaced China as the United States’ top trade partner, while Canada becomes the second. We focus on how to import your products into the Mexican market.

Advice from our International Trade Legal Team – What is a Customs Agent in Mexico?

A Customs Agent is also referred to in Mexico as a Customs Broker. The essential objective for a Customs Broker is to clear importers’ products through a country’s customs processes. Customs Brokers are also in charge of the preparation of all the necessary documents and managing the taxes. This part of their work includes preparing relevant paperwork for duties and excises requirements and formal communications between the importers/exporters and the necessary government institutions.

If you want to import/export into the Mexican territory, according to the customary law, you will need to partner with local Customs Brokers to ensure compliance measures are met. Those Customs Brokers, who are qualified and authorized by the Mexican government, are the only ones who are authorized to clear products at the Mexican Customs and import them.

The government closely supervises the activities of the Brokers and their customers. During the process, your Customs Broker will need to register you and your business into Mexico’s Import Records – known locally as the “Padron de Importadores.” If you don’t register through an independent Customs Broker, you will need to employ the services of an Import Company, which may cost more. Export.gov states that an Import Company tends to charge an average of 5% of the value of your shipment.

So why engage with a Customs Broker to import in Mexico? A good Customs Broker can carry out their responsibilities without a hitch, resulting in consistent and successful international deliveries. Contracting a local professional, with a comprehensive understanding of the Mexican importation process, will ensure the legitimate registration and facilitation of your business activities in Mexico.

How do business import goods to Mexico?

To import merchandise into Mexico, the government sets several requirements that all exporters and importers must meet. To ensure companies clearly understand and comply with the importation and law system of the country, it is strongly recommended that businesses engage a local trade lawyer. With his help, you will able to manage complex bureaucratic processes.

Import procedures

Engage an importing agent to handle all the different administrative formalities and the necessary authorities in setting up your business. Your agent will help you to apply the correct taxes and duties.

They are responsible for providing:

- an import declaration (from the Secretariat of the Economy)

- a commercial invoice

- a bill of lading

- proof of exemption

- a certificate establishing the origin of the goods.

General import tax amounts for your goods: will depend on which tariff bracket they are relevant to. To know which bracket your products wall fall into, you must check the Tariff of the General Import and Export Taxes Law.

Alternatively, the Mexican Tax Allowance Scheme outlines some preferential treatment. To seek to reduce or eliminate tariffs on various sectors, the Mexican government has developed the ‘Sectoral Promotion Programmes’ (PROSEC).

For foreign-manufactured medical devices and healthcare products, you must have a legally appointed representative or distributor in Mexico who is approved and authorized by the Secretariat of Health.

Specific Import Procedures – If the goods you want to import into Mexico appear on Annex 10 of the Foreign Trade General Rules (FTGR), you’ll need to undertake different process requirements again, before you can import into the Mexican marketplace. This includes the following steps:

- You have to register your products in the Mexican Register of Importers in Specific Sectors

- To import alcoholic beverages, cigarettes, and cigars, you will pay an individual tax on production and services (IEPS) from between 25-160%.

Finally, if you are importing samples, you should classify them according to the customs list 9801.00.01 of the Legislation of General Tax for Imports and Exports.

Importing in Mexico? Let us support you in your project

Now that you know more about how to import your products into the Mexican market, you’ll need to seek out a local partner to assist in the movement of your goods.

At Biz Latin Hub, we offer support for local and foreign companies in a range of market entry and back-office services. This includes bilingual legal, accounting, finance, taxation, recruitment, commercial representation, market-entry, and administration services.

Our team of local and expatriate work achieves our clients’ specific needs. We can refer businesses to our trusted customs broker who can provide support for your importation project. Contact us today here for personalized support. We’re ready when you are.