If you choose to buy property in Colombia you will be exposed to a welcoming environment, with a straightforward process for real estate purchase, potential residency benefits, and a variety of investment opportunities to explore. Foreigners are permitted to buy property in Colombia. The government values foreign investment and has facilitated the process of buying property for foreign individuals.

See also: Incorporate a company in Colombia

Acquiring property in Colombia can potentially lead to a residency permit. Depending on the magnitude of the investment, individuals can apply for a one-year or five-year visa, granting them the opportunity to reside in the country. The potential for obtaining residency permits makes Colombia an appealing destination for real estate investment. Not only does buying property in Colombia provide a tangible asset, but it also offers the possibility of an extended stay or relocation.

If you want to buy property in Colombia, it is advisable to engage the services of a knowledgeable local real estate agent or lawyer to receive guidance throughout the process and ensure compliance with legal requirements. Biz Latin Hub can help you with this, as no one knows Latin America and the Caribbean better than we do.

Why buy property in Colombia?

There are numerous advantages if you buy property in Colombia. With its rich cultural heritage, stunning landscapes, and growing economy, Colombia is a favorable environment for property ownership and investment. These are some of the reasons to invest in real estate in Colombia:

- Colombia boasts a diverse range of landscapes, from beautiful Caribbean beaches to lush Amazon rainforests and picturesque colonial towns. This variety provides an array of options for property ownership, allowing individuals to find their ideal location.

- Colombia has experienced significant economic growth and political stability in recent years. This stability has positively impacted the real estate market, with steady appreciation in property values. Additionally, the government has implemented measures to encourage foreign investment, making it easier for international buyers to own property in the country.

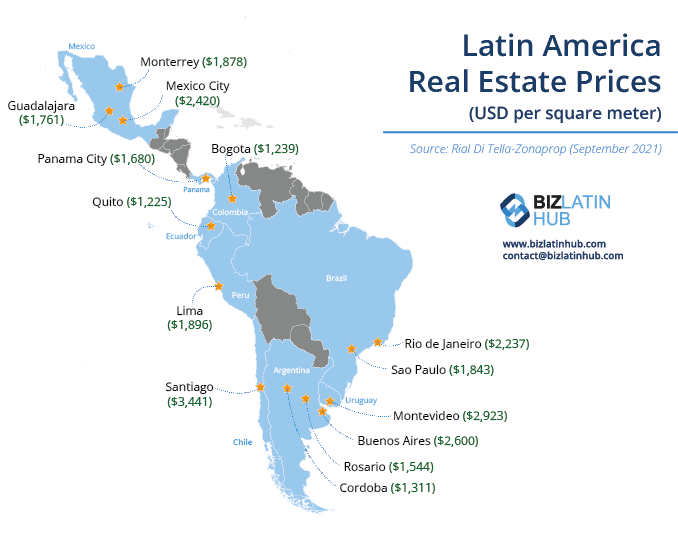

- Colombia offers a relatively low cost of living compared to other Latin American countries, making it an affordable destination for property ownership. The availability of a wide range of property types, including apartments, houses, and rural estates, caters to diverse preferences and budgets.

- The Colombian government has implemented legal frameworks to protect property rights, ensuring a secure environment for property owners. This includes a transparent legal system and streamlined processes for property transactions.

- Colombia’s vibrant culture, warm climate, and friendly people contribute to an enjoyable lifestyle for property owners. The country offers a wide range of recreational activities, including outdoor adventures, vibrant festivals, and delicious cuisine.

Overall, diverse landscapes, a growing economy, affordable cost of living, secure property rights, and an attractive lifestyle make it ideal to buy property in Colombia.

Below we will consider the various necessary steps when considering buying a property in Colombia.

What do you need to do to buy property in Colombia?

Read on to learn about the steps necessary to buy property in Colombia.

1. Acquire a Certificate of Tradition and Liberty

If you have decided to buy property in Colombia, you must obtain a Certificate of Tradition and Liberty, or ‘Certificado de Tradición y Libertad,’. This certificate is crucial as it provides comprehensive information about the property, including its history, ownership records, mortgage details, legal claims, and any renovations conducted. To ensure a thorough evaluation of the property, it is highly advisable to engage the services of a local lawyer who can assist in verifying the certificate and conducting a due diligence check.

The Certificate of Tradition and Liberty can be obtained from the local registry office at a cost of COP$15,700. It is an important document for the property transaction. By acquiring this certificate and conducting due diligence, potential issues or complications associated with the property can be identified and addressed, ensuring a smoother and more secure purchase. This is the first step you must complete if you want to buy property in Colombia.

2. Pay the necessary taxes and fees

When you buy property in Colombia, it is important to be aware of the required taxes and fees. Before proceeding with the purchase, you should ensure that the previous owner has paid all outstanding taxes on the property. To verify this, you will need to obtain two separate certificates directly from the owner.

The first certificate is the Tax Free Property Certificate (Paz y Salvo Predial), which guarantees that all municipal taxes associated with the property have been paid. The second certificate is the Tax Free on Value Gained Property Certificate (Paz y Salvo de Valorización), which ensures that all taxes related to the increase in property value have been paid.

At the time of purchase, the buyer is responsible for paying various taxes and fees, which amount to a total of 1.65% of the property’s value. This can be broken down as follows: a 1% tax on the property’s value for registration, a 0.5% registration fee, and a 0.15% notary fee. In addition, the seller of the property is obligated to pay between 3.63% and 4.79% of the total property value in taxes and fees. This includes a 0.15% notary fee and a 3-4% fee (including 19% VAT) for real estate agents.

It is necessary that both the buyer and seller are aware of these fees to ensure compliance with legal requirements and a smooth transaction process. These processes must be abided by when you buy property in Colombia.

3. Sign the Public Deed or ‘Escritura Pública’

The final step in the process is the signing of the Public Deed, also known as the ‘Escritura Pública,’ which legally confirms you as the new owner of the property. To sign the Public Deed, it is necessary to engage the services of a notary.

During this final step, certain taxes and fees are applicable. These include a 0.25% fee of the property’s value for the notary services. Additionally, it is required to make an advance payment of 1% of the transaction value, which will be applied to the income tax.

Once the Public Deed is signed and the necessary payments are made, it is registered at the registry office and subsequently at the Cadastre or ‘Subdirección de Catastro’. You will then be registered as the new legal owner of the property, providing you with the legal rights associated with property ownership in Colombia.

It is important to ensure that all necessary taxes and fees are paid and that the Public Deed is properly registered to complete the property purchase and establish your ownership rights in a transparent and legally recognized manner.

FAQs on buying property in Colombia

Yes, there are absolutely no differences in the process for nationals or non-nationals in the country.

At the time of purchase, the buyer is responsible for paying various taxes and fees, which amount to a total of 1.65% of the property’s value. This can be broken down as follows: a 1% tax on the property’s value for registration, a 0.5% registration fee, and a 0.15% notary fee. In addition, the seller of the property is obligated to pay between 3.63% and 4.79% of the total property value in taxes and fees. This includes a 0.15% notary fee and a 3-4% fee (including 19% VAT) for real estate agents.

Acquiring property in Colombia can potentially lead to a residency permit. Depending on the magnitude of the investment, individuals can apply for a one-year or five-year visa, granting them the opportunity to reside in the country. The potential for obtaining residency permits makes Colombia an appealing destination for real estate investment. Not only does buying property in Colombia provide a tangible asset, but it also offers the possibility of an extended stay or relocation.

Although it is not possible to guarantee this, it is likely. The market has gained value dramatically in recent years, especially in parts of the capital Bogotá and second city Medellín.

Biz Latin Hub can help with property in Colombia

If you want to buy property in Colombia or you would like more information about the process, feel free to contact us at Biz Latin Hub. We have a team of professional lawyers with the experience and specialism in Colombian real estate law ready to answer any questions or queries you may have. Feel free to contact us now for further details on how we can help.

Do you want to learn more about why you should invest in Colombia? Check out the video below for more information!