Discover how to form an NGO in Panama, also known as a non-governmental organization. Panama is an exciting country with many opportunities to do business, including for those focused on non-profit activities.

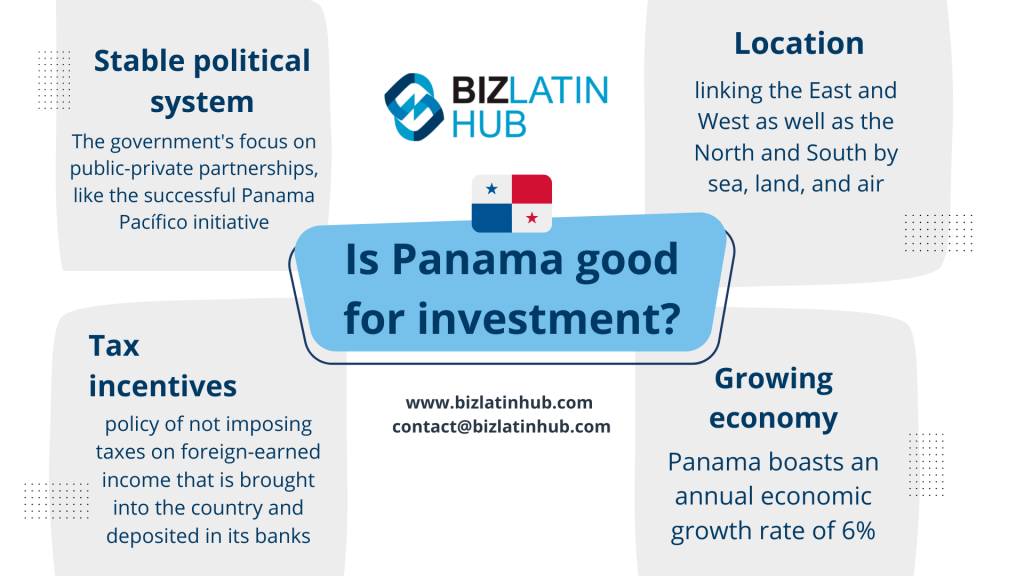

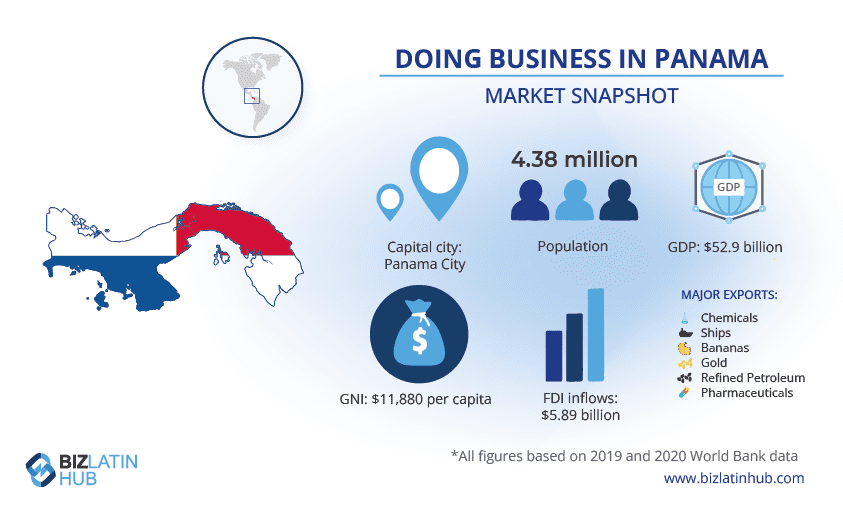

Deciding to form an NGO in Panama supports the development of the country’s economic, social, and other landscapes. The economy itself has shown consistent, positive growth year on year, reflecting a healthy environment for new people to start a non profit or register a company in Panama.

Biz Latin Hub can help you form an NGO in Panama, as well as support you throughout your company’s life cycle. Our array of market leading back-office services is here to make sure you stay fully compliant with both legal and fiscal obligations under local laws so that you can relax and focus on what you do best – running your organization.

What is an NGO in Panama?

To be able to understand the process to incorporate an NGO in Panama, it’s important to understand the structural and governance characteristics of this legal entity.

The NGO in Panama can be a public or private entity with the essential characteristic of being a non-profit association. The statutes of an NGO cannot stipulate ways to generate income by themselves.

Panama’s Constitution allows the incorporation of any association insofar as its operations are considered to align with public order and morality. Private, non-profit NGO entities need to acquire a legal status before the Ministry of Justice.

Steps to form an NGO in Panama

The process to incorporate an NGO in Panama can take several months, and is broken down into 4 essential steps:

- Obtaining the legal status as an NGO at the Ministry of Justice of Panama.

- Authentication at the public notary and registry of the association statutes at the Public Registry of Panama and official registration at the Ministry of Justice of Panama.

- Register as an Entity that can receive donations before the Ministry of Economy and Finances of Panama.

- Register at the National Tax Authority (Dirección General de Ingresos) and obtain Tax ID or R.U.C (registro único de contribuyente).

1. Obtain legal status as an NGO at the Ministry of Justice of Panama

Through this first step, your association seeks and obtains authorization to start the process of incorporating an NGO in Panama.

The requirements to apply for this legal status are regulated by the Executive Order 62 of 2017. This Order establishes the following requirements that will need to be presented by any person or association interested in forming an NGO in Panama:

- Act of incorporation of the entity, members of the board of directors, statutes signed by the president and secretary of the entity

- Present copy of the personal identification of all the members of the board of directors (minimum of three). If one member of the board directors is going to be a company, this one will need to present a copy of the act that authorizes the company to form part of the NGO in Panama and provide a certificate of good standing

- The members of the board of directors can be Panamanian, foreigners that have residence or domicile inside of Panama, or a company with registered address in Panama.

To form your NGO, you will need to submit the following information:

- Name of the NGO to operate in Panama. The name can’t be similar to any extant or previous NGO

- Address of the NGO in Panama. Note any change in address will need to be communicated to the Ministry of Justice of Panama

- Specific geographic area where the NGO in Panama will develop its activities

- Clear objectives of the NGO with an explanation detailing their social objective and its characteristics

- Activities that the NGO will carry out

- Obligations and rights of the members of the NGO in Panama

- Appoint the Legal Representative of the NGO

- Procedures to modify the statutes of incorporation

- The ways allowed to keep the accounting records

- Dissolution and liquidation process of the NGO in Panama.

If the Ministry of Justice makes an observation on the application, the Applicant will have 60 days to make any necessary modifications.

What if the NGO to be formed in Panama is a subsidiary of a foreign NGO?

In this case, the required documents will be simplified to the following:

- Authorization of the legal representative of the foreign NGO to establish a subsidiary in Panama

- Certificate of incumbency of the foreign NGO and the statues of incorporation.

- List of the members of the board of directors of the NGO to be formed in Panama.

- Address in Panama

- Appoint the legal representative

- All documentation will need to be legalized and translated (if is not in Spanish).

2. Receive authentication at the public notary and official registration

Once the Ministry of Justice has granted the authorization to register as an NGO, you’ll need to authenticate the statutes of the association in a Public Notary. Following this, you must register them, along with the resolution from the Ministry of Justice, at the public registry.

You’ll then need to present the subscribed statutes to the Ministry of Justice to finalize the registration of your NGO.

3. Register to receive donations before the Ministry of Economy and Finances

For NGOs in Panama, it’s very important to be subscribed as an entity capable to receive donations, because is the only way that they can receive their income.

To register at the Ministry of Economy and Finances of Panama, you’ll need to present similar documentation to the one presented to the Ministry of Justice, such as the list of members, address, planned activities for the following five years, authorization to perform as an NGO provided by the Ministry of Justice and proof of the activities your NGO in Panama do in benefit of the country.

4. Obtain Tax ID or RUC (registro único de contribuyente)

All entities have the obligation to obtain the tax identification, known locally as a RUC (registro único de contribuyente). NGO entities in Panama that are recipients of donations must retain taxes over any salaries they pay to employees.

NGO operators can also explore other options to hire employees, such as through PEO service providers, depending in the roles of the staff members.

Benefits of forming an NGO in Panama

NGOs in Panama can deduct all the donations received from income tax declarations. Since NGOs will receive donations, this type of entity will be exempt from the income tax payment.

An NGO in Panama will also be exempt from other tributary obligations when receiving donations, such as property tax and Valued Added Tax. As a non-profit association, an NGO also does not have the obligation to get a Commercial License, so they will not need to pay taxes over the capital or assets of the NGO obtained through donations.

How to maintain your NGO entity in Panama

To maintain the operational validity of your NGO before local authorities, it will need to regularly comply with certain fiscal obligations.

1. Planilla 03: Retention sworn statement

NGOs in Panama that hire employees will need to present the “Planilla 03 o declaración jurada de rentenciones.” This report involves information related to retentions made to the salaries of the employees and must be presented before 31 May of every calendar year.

2. Report of donations received

Every NGO in Panama must present a report outlining received donations before 31 March of every calendar. This report replaces the income tax declaration, as NGOs in Panama are exempt of income tax.

This report must include the following information:

- RUC or tax Id to the donor (if is a legal entity)

- Id of the donor (natural person)

- Date of the donation

- Amount of the donation

- And, an indication detailing the method of payment.

3. Declaration

NGOs incorporated in Panama that receive gross income of USD$1 million or that have total assets of USD$3 million will need to present this declaration report monthly.

The NGOs that do not possess this amount of income or assets will need to present report 20 (formulario 20).

The report must include the following payments made by the NGO:

- Payments related to professional services.

- Leases of property

- Commissions

- Works contracts or subcontracts

- Representation expenses

- Brokerage expenses.

FAQs on how to form an NGO in Panama

Yes, foreign ownership is 100% allowed for most projects.

The NGO in Panama can be a public or private entity with the essential characteristic of being a non-profit association. The statutes of an NGO cannot stipulate ways to generate income by themselves.

Panama’s Constitution allows the incorporation of any association insofar as its operations are considered to align with public order and morality. Private, non-profit NGO entities need to acquire a legal status before the Ministry of Justice.

The process to incorporate an NGO in Panama can take several months

Name of the NGO to operate in Panama. The name can’t be similar to any extant or previous NGO

Address of the NGO in Panama. Note any change in address will need to be communicated to the Ministry of Justice of Panama

Specific geographic area where the NGO in Panama will develop its activities

Clear objectives of the NGO with an explanation detailing their social objective and its characteristics

Activities that the NGO will carry out

Obligations and rights of the members of the NGO in Panama

Appoint the Legal Representative of the NGO

Procedures to modify the statutes of incorporation

The ways allowed to keep the accounting records

Dissolution and liquidation process of the NGO in Panama.

NGOs in Panama can deduct all the donations received from income tax declarations. Since NGOs will receive donations, this type of entity will be exempt from the income tax payment.

An NGO in Panama will also be exempt from other tributary obligations when receiving donations, such as property tax and Valued Added Tax. As a non-profit association, an NGO also does not have the obligation to get a Commercial License, so they will not need to pay taxes over the capital or assets of the NGO obtained through donations.

Biz Latin Hub can help you form an NGO in Panama

Forming an NGO in Panama is a great way to promote social and other non-profit causes. Panama offers the facilities and benefits necessary for your NGO entity to succeed and grow.

Our team of legal and accounting experts can guide you through all required company formation processes, providing security and assurance of the correct establishment and compliance of your NGO in Panama.

We offer a full suite of multilingual market entry and back-office services, enabling you to expand into Panama and Latin America with a single point of contact.

Contact us here at Biz Latin Hub for more information.

Learn more about our team and expert authors.