Saint Lucia has specific legal requirements for employment practices, including overtime, employee rights, and working conditions. Compliance protects businesses from penalties and ensures a harmonious workplace. Anyone involved in starting a business in Saint Lucia and/or employment must understand these regulations to avoid disputes and uphold worker rights. This guide details the essential requirements for employers as stipulated by the Labour Act, from hiring and contracts to termination and severance.

Key Takeaways: Saint Lucia Labour Law

| What is the Saint Lucia Labour Act? | This act establishes a legal framework for fair and equitable employment practices. |

| Are oral contracts legal? | Employers must provide a written statement of employment particulars to employees. |

| What is the role of the National Insurance Corporation (NIC)? | The NIC handles: Pensions Sickness pay Disability allowances |

| How do you terminate an employee in St Lucia? | There are specific rules for calculating severance pay based on years of service. |

| What is a probationary period? | During this time (up to 3 months), either the employer or the employee can terminate the employment contract without notice. |

Key Obligations Under the Labour Act

Employment in Saint Lucia is primarily governed by the Labour Act Cap 16.04 of the Revised Laws of 2021. This act establishes a legal framework for fair and equitable employment practices. It ensures that all employees receive equal treatment regardless of race, sex, religion, colour, or ethnic origin. Employers are mandated to adhere to these laws to promote a healthy and productive work environment. Understanding these practices is essential for both employers and employees to ensure smooth operations.

1. Provide a Written Contract and Probationary Period

Employers must provide a written statement of particulars (contract) to employees. A probationary period of up to three months can be established in this contract.

2. Adhere to Minimum Wage and Working Hours

Employers must pay the statutory minimum wage applicable to their business category. The standard work week is 40 hours over five days, and overtime rates apply for extra hours.

3. Make National Insurance Corporation (NIC) Contributions

It is mandatory for employers to deduct and remit NIC contributions for each employee every month. The employer also pays their own portion.

4. Comply with Termination and Severance Pay Rules

Termination must be for a valid reason. Employers must provide a statutory notice period or payment in lieu of notice. Employees with more than one year of service are entitled to severance pay if terminated for redundancy.

Expert Tip: Accurately Calculating Severance Pay

From our experience, the calculation of severance pay is a frequent point of error for employers. The Labour Act provides a clear formula: payment is calculated based on the employee’s wages and their number of continuous years of service. It is a significant financial liability that accrues over time.

We strongly advise clients to accrue for this future liability in their financial statements. Failing to budget for severance pay can lead to significant and unexpected cash flow problems when an employee is terminated for reasons of redundancy.

Overview of Saint Lucia Labor Laws

The Labour Act Cap 16.04 is the cornerstone of Saint Lucia’s employment regulations. It covers various aspects, including prohibition of workplace discrimination, protected under Section 267. Under this act, employees are safeguarded against discrimination based on race, sex, religion, colour, ethnic origin, and social status. Employers must have a legitimate reason for terminating employment as stipulated in the act, which makes sure the process is fair. Additionally, the act regulates working hours and overtime pay. Employees should be compensated 1.5 times their regular hourly rate for overtime work. This ensures fair treatment and proper compensation for all employees.

Importance of Compliance

Following labor laws in Saint Lucia is crucial for legal operation and positive employee relations. Compliance creates a stable workforce by encouraging balanced employment practices. Adherence to regulations regarding working hours and overtime protects employees’ well-being, ensuring they are treated fairly. Employers who do not follow these laws face significant penalties. Therefore, it is essential to understand and respect the termination laws outlined in the Labour Act Cap. 16.04. This knowledge helps in maintaining a fair workplace and ensuring legal employment practices. Compliance is not just a legal duty but a public duty, maintaining a safe and fair working environment for all.

Overtime laws in Saint Lucia are governed by the Labour Act. This legal framework protects workers’ rights and accommodates business needs. In Saint Lucia, employees earn overtime pay at 1.5 times their regular rate. This applies to work exceeding the standard 40-hour work week. Night shift work, from 10 PM to 6 AM, earns 1.25 times the regular rate. It is crucial for employers to follow these regulations. This ensures fair labor practices and helps avoid penalties. Saint Lucia’s labor laws are designed to balance worker rights with business operations.

Eligibility for Overtime

Determining eligibility for overtime is an essential part of Saint Lucian labor law. Several categories of employees can earn overtime pay:

- Salaried employees: Eligibility is determined by converting their salary into an hourly rate.

- Piecework or commission workers: These employees also receive overtime compensation, requiring accurate recording of hours.

Overtime is generally defined as work performed beyond an 8-hour day or a 40-hour work week. A special rate applies to night workers (those working between 10 PM and 6 AM), who earn 1.25 times their regular rate. Employers must align their business practices with these laws to ensure fair overtime pay, supporting a balanced working environment.

Compensation Calculations

In Saint Lucia, calculating overtime involves all significant earnings. The law includes bonuses in total remuneration for overtime. This ensures employees are fairly paid for extra hours. Employers must record every overtime hour. This recording ensures compliance with labor laws.

- Weekday overtime: Paid at 1.5 times the regular wage.

- Work on Sundays or public holidays: Compensated at a rate of not less than 2.0 times the regular wage.

Keeping precise records and calculations is critical. This practice supports fair compensation and complies with Saint Lucia’s labor legislation.

Resolving Overtime Disputes

Overtime disputes in Saint Lucia are handled within the Labour Act’s guidelines. Employees can first try to resolve disputes with internal grievance procedures. If this fails, assistance from the Department of Labour is available. They provide conciliation and mediation services. If disputes remain unresolved, the Labour Tribunal is a further option. Addressing fair compensation is essential for compliance. It also protects worker rights. This framework supports maintaining fair employment practices within Saint Lucia.

Recognizing Exemptions

Certain exemptions may affect overtime eligibility in Saint Lucia. The Labour Act outlines these specific exemptions. Eligibility covers various employment types. These include hourly, salary, piecework, and commission-based work. Employers must know which employees qualify for overtime. Understanding exemptions is crucial for compliance with labor laws. Clear knowledge of these rules helps avoid disputes. Exemptions ensure fair compensation while respecting labor regulations.

Penalties for Non-Compliance

Saint Lucia’s labor laws require employers to pay correct overtime rates. Failing to do so can lead to serious penalties. Non-compliance can result in severe legal consequences. Employers must keep accurate records of working hours. Not maintaining proper records can incur penalties. Adherence to statutory agreements is essential. This adherence prevents punitive actions. Laws ensure employee rights are protected in Saint Lucia. Employers who violate these rights face legal repercussions, underscoring the importance of compliance.

Ensuring Employee Rights

Saint Lucia’s labor laws prioritize employee rights and safety. These laws ensure workers are treated fairly within safe environments. Employees work a standard 40-hour week. Overtime pay is mandatory when they exceed this limit. Different types of workers, such as hourly and salaried, benefit from overtime compensation. Discrimination and harassment are strictly prohibited by the Labour Act Cap 16.04. This includes discrimination based on race, sex, religion, and social standing. It’s crucial for employers to maintain accurate records of working hours. They must also follow required rest periods to ensure compliance. These practices are vital for fostering positive employee relations.

Termination Procedures

In Saint Lucia, terminating an employment contract requires adherence to specific protocols. Both employers and employees can end a contract, but they must have valid reasons. Acceptable grounds for termination include misconduct and redundancy. The Labour Act Cap 16.04 mandates a lawful cause for every job termination.

Key aspects of termination procedures include:

- Notice Periods (based on continuous employment):

- More than 12 weeks but less than 2 years: 1 week’s notice.

- 2 years or more but less than 5 years: 2 weeks’ notice.

- 5 years or more but less than 10 years: 4 weeks’ notice.

- 10 years or more: 6 weeks’ notice.

- Severance Pay: If an employee is terminated without just cause, they are entitled to severance pay. The calculation for severance pay, particularly in cases of redundancy, can be more detailed than a flat rate and may involve a tiered system based on years of service (e.g., a certain number of weeks’ pay for the first set of years, and a different number for subsequent years). It’s important to consult the Labour Act for precise calculation methods.

These procedures ensure fair treatment during the termination process.

Anti-Discrimination Measures

The Constitution and labor laws in Saint Lucia protect employees against discrimination. Equal opportunities are required in areas like hiring and training. Employees must not face less favorable treatment due to protected characteristics, such as race or political opinion. The Labour Act prevents preferential hiring based on these traits but ensures protection against discrimination. Employees facing discrimination can seek help through dispute mechanisms. Employers have a legal duty to promote equal opportunities and prevent discrimination in the workplace. These laws are crucial for maintaining a fair work environment for all.

Safe Working Conditions

Ensuring safe working environments is a priority in Saint Lucia. Labor laws require employers to maintain safe conditions. Compliance with these laws helps protect employees from hazardous situations at work. Businesses must ensure equitable employment practices. Following these guidelines fosters a stable and productive workforce. The laws also emphasize fair treatment and safety, which are essential for a positive work environment. Employers must understand and comply with these laws to ensure their employees’ well-being and safety.

Workplace Safety Standards

Workplace safety in Saint Lucia is governed by strict regulations. These ensure that employees work in safe environments. Employers must adhere to specific safety standards as part of their employment practices. Compliance with these standards is vital for maintaining positive employee relations. It also helps create a stable workforce. The legal framework guards against unfair treatment. It promotes safety and aims to create a balanced work environment. Employers must understand and follow these regulations to provide a safe workplace for all employees.

Managing Working Hours and Conditions

Understanding working hours and conditions is essential for both employers and employees in Saint Lucia. The labor laws are designed to protect workers and ensure they are treated fairly. Adherence to these regulations helps maintain a productive and healthy work environment. Employers must follow these rules to avoid legal complications and promote a positive workplace.

Legal Working Hours

In Saint Lucia, the legal working hours are clearly defined:

- Daily limit: 8 hours per day.

- Weekly limit: 40 hours per week.

This framework establishes a clear standard. Any work performed beyond these hours qualifies as overtime.

- Standard Overtime Rate: 1.5 times the regular hourly rate.

- Night Shift Overtime Rate (10 PM to 6 AM): 1.25 times the regular hourly wage. All workers deserve fair pay for their efforts, and these rules ensure that standard is met.

Required Rest Periods

Adequate rest is vital for maintaining worker health and safety. Saint Lucian labor laws mandate that employees receive suitable rest periods during and between workdays. Within a 24-hour period, workers are entitled to a minimum uninterrupted rest period. The Labour Act of Saint Lucia outlines these requirements to ensure employees have the necessary breaks to remain healthy and productive. Employers must comply with these regulations to support fair and safe working conditions.

Night Shift Regulations

Specific rules govern night shift work in Saint Lucia. Night shifts, defined as work between 10 PM and 6 AM, come with enhanced wage rates. Employees working these hours receive 1.25 times their regular hourly rate. This regulation is part of the broader labor laws designed to protect workers’ rights. Employers must follow these compensation rules to remain compliant with the law. Proper compensation ensures that employees are fairly rewarded for their efforts during less conventional working hours.

Time Recording Obligations

Accurate time recording is a critical responsibility for employers in Saint Lucia. They must track all overtime hours precisely to ensure correct payment. The Labor Act requires employers to document hours worked beyond the standard schedule. Proper systems for tracking hours are essential to adhere to the overtime pay rates. These rates, like 1.5 times the regular rate for weekdays and double for Sundays or public holidays, must be followed. This accountability protects employee rights and ensures they receive the compensation they deserve.

Broader Labor Laws

The Labor Act Cap 16.04 of Saint Lucia outlines employment rules. It was revised in 2021 to cover fair treatment and safe work settings. This law bans workplace discrimination, as stated in Section 267. Discrimination based on race, sex, religion, color, ethnic origin, and social status is not allowed. Employers must justify any employee termination under this law. Workers earned overtime pay for hours worked beyond standard hours. This even applies on weekends and public holidays.

The Role of the Department of Labour

The Department of Labour is the government body in Saint Lucia responsible for enforcing the Labour Act. It provides guidance on employment standards, conciliates disputes between employers and employees, and promotes a stable industrial relations climate.

Income Tax and VAT Obligations

Saint Lucia’s taxation system includes several key components:

- Income Tax: A progressive system with rates ranging from 0% to 30%, applied across different defined income brackets.

- Value Added Tax (VAT): Standard rate of 12.5%.

- Social Security Contributions: Employees contribute 5% of their income, with employers also contributing.

These taxes and contributions fund public services and ensure fiscal responsibility.

Social Security Requirements

Social security contributions are mandatory in Saint Lucia, with the following structure:

- Contribution Rate: Both workers and employers contribute 5% of the worker’s monthly income each.

- Managing Body: These contributions fund the National Insurance Corporation (NIC).

- Benefits Provided by NIC:

- Pensions

- Sickness pay

- Disability allowances These contributions are vital for supporting workers and their families in times of need.

Work Visa Regulations

Foreign nationals seeking employment in Saint Lucia must adhere to specific visa regulations:

- Work Permit: A valid work permit is required for all foreign workers.

- Entry Visa: A non-immigrant visa (either single or multiple entry) is necessary for work purposes.

- Permit/Exemption: Foreign workers must possess either a permit or a valid exemption.

- Employer Responsibility: Employers are obligated to verify these permits; failure to do so can result in penalties.

- Dependents: Spouses and dependents of foreign workers must secure their own work permits if they intend to work.

- Transfer of Employment: Workers cannot transfer their employment to another employer in Saint Lucia without obtaining the appropriate permit adjustments.

Staying Updated and Engaged

Businesses in Saint Lucia must pay attention to labor laws to ensure fair and equitable treatment of employees. The Labour Act Cap 16.04 sets rules to protect workers from discrimination and harassment. Compliance with these laws ensures a balanced workplace. Employers must pay attention to overtime rules, which require recording hours worked and paying statutory rates for extra hours. Both employers and employees should understand the need for rest periods, which improve health and productivity. Staying informed about updates in labor law helps keep employment practices lawful and fair.

Regular Reporting Practices

Employers in Saint Lucia need to report on overtime work to comply with the Labour Act. This ensures employees receive correct pay for extra hours. Employment contracts should be checked often to confirm they meet legal standards on work hours and termination. Monitoring the workplace is essential to ensure safety and fair treatment. Employers must track leave entitlements, like maternity leave, to meet legal requirements. Staying up-to-date on laws about discrimination and harassment protects employee rights.

Supervisory Feedback Mechanisms

Unfortunately, there is no background information available to elaborate on supervisory feedback mechanisms within the context of Saint Lucia’s labor laws.

Employer and Worker Organization Insights

Employers in Saint Lucia must follow the Labour Act Cap 16.04. This law covers employment issues like termination, discrimination, and harassment. A typical workweek is 40 hours over five days, with overtime pay for extra hours. Adhering to labor laws ensures fair practices and stable employment relations. Employers must deduct National Insurance Contributions (NIC) from salaries. Both employers and employees share this cost. Labor laws offer protection against unfair dismissals. They also ensure a structured framework for fair treatment. This safeguards employees and maintains productivity.

Conclusion and Best Practices

In conclusion, staying compliant with labor laws in Saint Lucia is essential for employers. Employers need to understand and adhere to the Labour Act, which outlines workers’ rights from hiring to termination. Key areas include standard working hours, overtime pay, and maintaining employment records.

Best Practices:

- Calculate Overtime Correctly:

- Include bonuses in overtime pay rates.

- Ensure correct rates for Sundays and public holidays (not less than 2.0x regular wage).

- Adhere to Standard Working Hours:

- Allocate adequate rest breaks.

- Maintain Accurate Records:

- Keep detailed employment and pay records.

- Prohibit Discrimination and Harassment:

- Follow Section 267 of the Labour Act.

- Deduct National Insurance Contributions:

- Ensure deductions for pensions and unemployment insurance.

- Follow Correct Termination Procedures:

- Adhere to statutory notice periods based on length of service.

- Understand and correctly apply severance pay calculations, especially for redundancy.

Table: Key Compliance Areas

| Compliance Area | Requirement |

|---|---|

| Working Hours | Standard limits with rest breaks |

| Overtime | Includes bonuses; specific rates for Sundays/public holidays (min. 2.0x) |

| Termination | Statutory notice periods; correct severance pay calculations |

| Discrimination and Harassment | Prohibited under Section 267 of the Labour Act |

| National Insurance Contributions | Deducted for pensions/unemployment insurance |

By following these practices, employers can ensure they operate within legal requirements, fostering a fair and productive work environment.

Frequently Asked Questions: Saint Lucia Labour Law

What is the primary labor law governing employment in Saint Lucia?

The primary labor law in Saint Lucia is the Labour Act Cap 16.04 of the Revised Laws of 2021. It governs employment relationships, including employee rights, working hours, termination procedures, and anti-discrimination measures.

What are the standard working hours in Saint Lucia?

The standard working hours in Saint Lucia are 8 hours per day and 40 hours per week. Any work beyond this is considered overtime and must be compensated accordingly.

How is overtime calculated in Saint Lucia?

Overtime in Saint Lucia is paid at 1.5 times the regular hourly rate for weekday overtime. Work on Sundays or public holidays must be compensated at no less than twice the regular hourly rate. Night shift work (10 PM to 6 AM) is paid at 1.25 times the regular rate.

What is the probationary period?

The Labour Act allows for a probationary period of up to three months. During this time, either the employer or the employee can terminate the employment contract without notice. This period must be agreed upon in the written contract.

What are the minimum wage rates?

Saint Lucia has different minimum wage rates depending on the category of worker. For example, as of 2021, the rate for office clerks is different from the rate for shop assistants. Employers must consult the Minimum Wages Order to ensure they are paying the correct rate for their industry.

What is the National Insurance Corporation (NIC)?

The NIC is the social security organization in Saint Lucia. All employers and employees must make monthly contributions to the NIC, which provides benefits for sickness, maternity, retirement, and other contingencies.

What is redundancy?

Redundancy is a valid reason for termination that occurs when the employee’s position is no longer needed due to changes in the operational requirements of the business, such as the introduction of new technology or a downturn in business. An employee terminated for redundancy is entitled to severance pay.

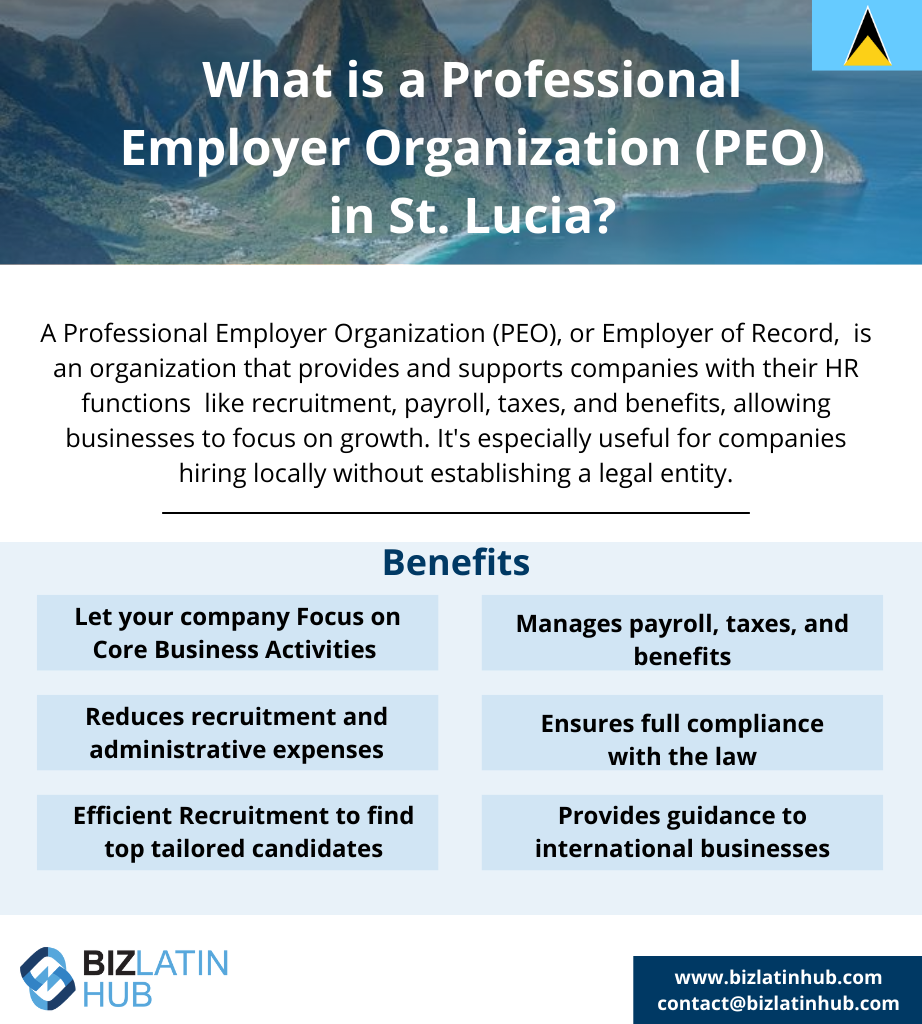

Biz Latin Hub can help you with labor laws in St Lucia

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.