Starting a business in Saint Lucia can be an intriguing journey. This island offers various legal structures, each with unique advantages. Understanding the types of legal entities available helps tailor your business to Saint Lucia’s specific needs. Business structures include Corporations (Domestic Companies), Partnerships, Limited Liability Companies (LLCs), Sole Proprietorships, International Business Companies (IBCs), and Branches of Foreign Companies. Each type has its own benefits and regulatory requirements. This guide details the features of the two main corporate structures available to help foreign investors choose the right entity for their goals.

Key Takeaways: Legal Entity Types in Saint Lucia

| What are the two main types of companies in Saint Lucia? | The IBC and Domestic Company. |

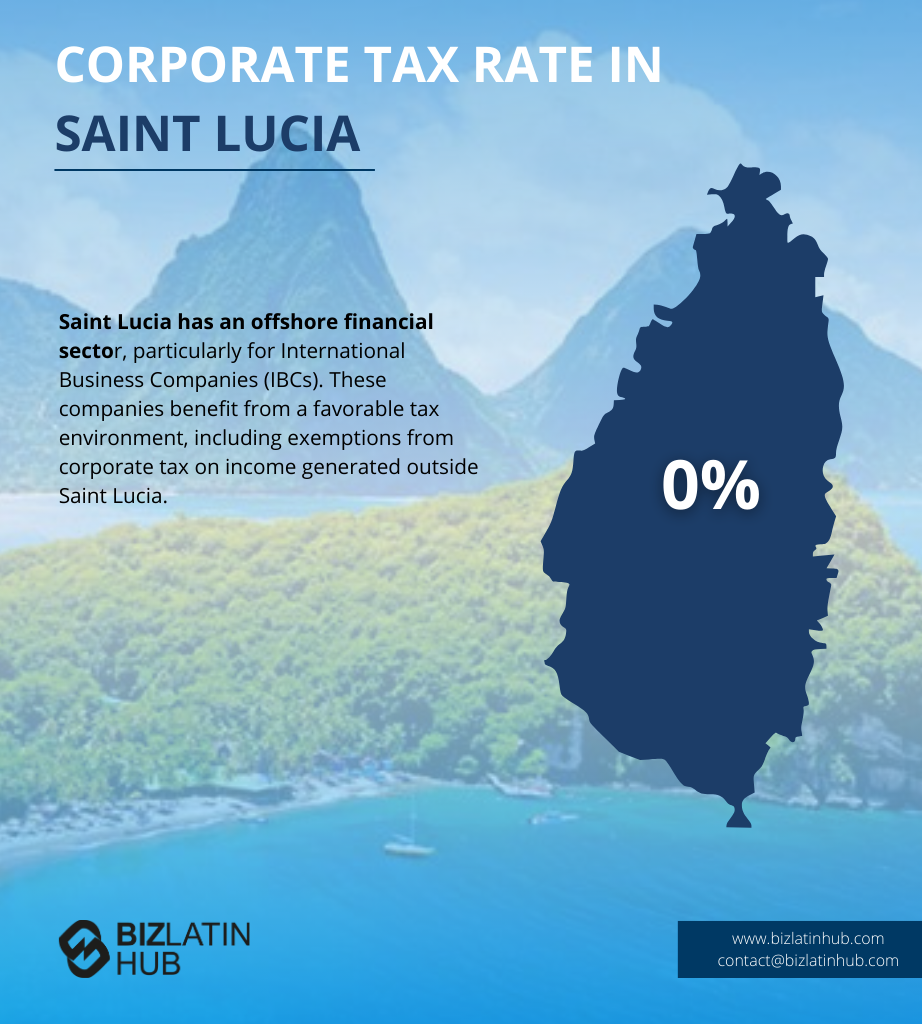

| What is an IBC used for? | An International Business Company (IBC) is designed for offshore activities and pays no local taxes. |

| What is a Domestic Company used for? | This is designed to operate within St Lucia itself. |

| Which entity is best suited for international investors? | The IBC is by far the most common. |

| Can you operate virtually? | Both company types require a registered agent in Saint Lucia. |

Primary Corporate Structures in Saint Lucia

1. The Domestic Company

This entity is designed for local commerce. It is subject to local taxes and regulations and is the appropriate choice for businesses targeting the Saint Lucian market. Formation involves filing Articles of Incorporation with the Registrar.

2. The International Business Company (IBC)

This is the most popular vehicle for foreign investors. It is legally exempt from all forms of local taxation and offers a high degree of privacy and administrative simplicity. The IBC is ideal for international trade, asset holding, and investment activities.

Expert Tip: Confidentiality Features of the IBC

Our experience shows that a primary motivator for choosing a Saint Lucian IBC is its strong confidentiality provisions. The names of the directors and shareholders of an IBC are not filed with the public registry and are not accessible to the public. This information is known only to the company’s licensed registered agent. For investors seeking privacy for their international business affairs, this is a significant advantage. However, it is important to note that this confidentiality does not exempt the IBC from complying with international tax reporting standards like CRS.

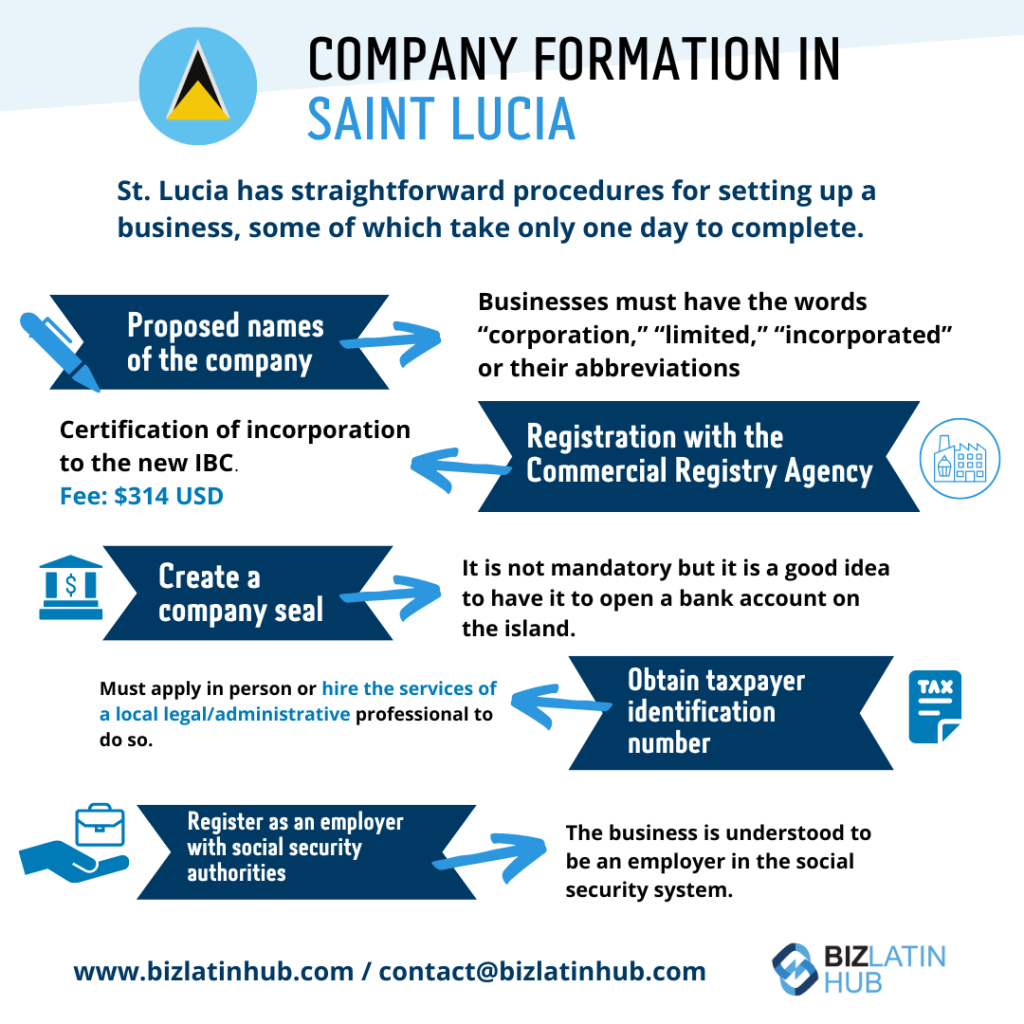

Key Considerations for Setting Up a Business

Setting up a business in Saint Lucia requires attention to detail and proper planning. The process is often facilitated by an online registration system that simplifies the submission of required documents. Typically, the entire registration takes around 10 working days if all documents are in order, though this can vary. Saint Lucia’s Companies Act guides the legal framework for domestic companies, ensuring shareholder protection with limited liability. The nation’s investment-friendly policies provide several financial incentives, including no capital gains tax. These make Saint Lucia an attractive destination for both local and foreign entrepreneurs looking to establish a business.

Overview of Legal Entity Types

Saint Lucia offers several legal entity types suitable for different business needs. The main types include sole traders, partnerships, and private companies limited by shares (often referred to as corporations). Sole traders, with minimal regulatory requirements, are best for small-scale operations. Partnerships allow two or more individuals to share profits and liabilities. Private companies provide a structured setup, offering limited liability and a clear operational framework.

Offshore solutions cater to international business needs. Entrepreneurs can set up International Business Companies (IBCs), international partnerships, and Limited Liability Companies (LLCs) designed for international operations. IBCs are particularly popular for international operations due to their tax benefits. The Registry of Companies and Intellectual Property (ROCIP) is the authority managing corporate registration. Offshore entities can enjoy privacy and tax efficiency, regulated under specific legislation like the International Business Companies Act, ensuring compliance and operational integrity.

Other Types of Legal Entities in Saint Lucia: A Comparison

Saint Lucia offers a diverse range of business structures tailored to different needs. Entrepreneurs can choose from sole proprietorships, partnerships, and various forms of limited liability companies. A sole proprietorship, also known as a sole trader, is the simplest form and is ideal for small business owners who prefer direct control. Partnerships benefit those who wish to share management and profits. Limited liability companies provide protection to shareholders or members by limiting their liability to their share capital or contributions. Each entity type requires careful alignment with local laws to ensure compliance.

In Saint Lucia, businesses can adopt various legal structures. These entities are primarily regulated by the Ministry of Commerce, Manufacturing, Business Development, Cooperatives and Consumer Affairs and ROCIP. Understanding these structures helps business owners choose the best fit.

| Entity Type | Key Characteristics | Liability | Typical Taxation | Setup Complexity | Ideal For |

|---|---|---|---|---|---|

| Corporations (Domestic Company) | Governed by Companies Act (Cap. 13.01); can be limited by shares or guarantee. | Limited (shareholders’ personal assets protected) | 30% corporate tax on local income; potential tax incentives. | Moderate | Local operations, larger businesses. |

| Partnerships | Two or more individuals/entities for economic gain; general (shared management) or limited (passive investors). | Unlimited (General Partners); Limited (Limited Partners) | Pass-through (profits taxed at individual partner level). | Moderate | Collaborative ventures, shared expertise and resources. |

| Limited Liability Companies (LLCs) | Governed by LLC Act (e.g., No. 10 of 2017); offers flexibility and protection; separate legal personality. | Limited (members’ personal assets protected) | Can be structured for pass-through taxation or taxed as a separate entity, depending on formation and operation. | Moderate | Businesses seeking liability protection with potential tax flexibility, international business. |

| Sole Proprietorships | Simplest structure; full control by owner; minimal regulatory requirements; registered under Business Names Act. | Unlimited (owner personally liable for all debts) | Profits taxed as personal income of the owner. | Low | Small business owners, individual entrepreneurs preferring autonomy. |

| International Business Companies (IBCs) | Governed by IBC Act (Cap. 12.14); designed for international business and investment. | Limited | Exempt from local taxes on foreign-earned income; can elect to pay 1% tax on profits. | Moderate | Foreign entities, international operations, tax optimization. |

| Branches of Foreign Companies | Registration of a foreign company to operate in St. Lucia; often utilizes IBC framework if activities are international. | Depends on parent company structure | Local income taxed; benefits may apply if structured as an IBC for international dealings. | Moderate | Foreign companies expanding operations to Saint Lucia. |

Partnerships

Partnerships offer a collaborative approach, bringing together two or more individuals or entities. Primary forms are general partnerships (shared management, unlimited liability for general partners) and limited partnerships (limited liability for passive limited partners).

Limited Liability Companies (LLCs)

Governed by the Limited Liability Companies Act, LLCs in Saint Lucia offer owners (members) flexibility and limited liability protection. An LLC is a separate legal entity. Depending on its structure and elections, it can achieve pass-through taxation (profits taxed at the member level) or be taxed as a distinct corporate entity. This flexibility is attractive for various business ventures, including international ones.

Sole Proprietorships

Sole proprietorships are straightforward, ideal for small business owners. Registered under the Registration of Business Names Act (Cap. 13.04), this structure offers autonomy with profits taxed as the owner’s personal income, but with unlimited personal liability for business debts.

Branches of Foreign Companies

Foreign companies can establish branches in Saint Lucia. If engaged in international activities, they might use the IBC framework. Income sourced within Saint Lucia is subject to local taxation. The Companies Registry (ROCIP) oversees their registration.

Choosing the Right Legal Entity

Selecting the right legal entity is crucial. Key structures include sole trader, partnership, domestic company (corporation), LLC, and IBC.

Factors Influencing Choice of Entity

Key factors include:

- Scale of Operations

- Risk Tolerance & Liability: Desire for limited vs. unlimited liability.

- Growth Goals & Need for External Investment

- Legal & Compliance Requirements: Administrative burden.

- Tax Implications

- Nationality of Owners & Location of Business Activities

Liability Considerations

Limited liability, protecting personal assets from business debts, is a key advantage of Corporations, LLCs, and IBCs. The Companies Act and related legislation provide for this. Perpetual existence and options for re-domiciliation add stability and flexibility.

Tax Implications

Understanding Saint Lucia’s tax landscape is pivotal.

- Foreign-Earned Income: Generally not subject to local taxation for entities like IBCs.

- Corporate Tax: A standard rate of 30% applies to the local profits of domestic companies.

- Value Added Tax (VAT):

- Standard Rate: 12.5%

- Hotel Accommodation Sector: 7%

- Other specific rates (e.g., 10% for certain tourism services) or exemptions may apply. [Fact-checked and updated VAT rates]

- International Business Companies (IBCs): Can elect to pay a 1% tax on profits. This is an option under the IBC Act, not necessarily tied only to the CARICOM Double Tax Agreement, but can be relevant in treaty contexts.

- Capital Gains Tax: Saint Lucia does not levy capital gains tax.

- Withholding Taxes: May apply on payments to non-residents (e.g., dividends, interest, royalties) unless reduced by a tax treaty. (Added for completeness)

Operational Flexibility and Control

LLCs offer a balance of protection and a flexible tax system. Saint Lucia generally welcomes foreign investors. The incorporation process can be efficient (e.g., ~10 working days if all is in order).

Legal and Regulatory Requirements

Key legal frameworks include the Companies Act (Cap. 13.01), Income Tax Act (Cap. 15.02), Registration of Business Names Act (Cap. 13.04), International Business Companies Act (Cap. 12.14), Limited Liability Companies Act, and the Economic Substance Act (No. 19 of 2019, with amendments). A local registered agent/legal counsel is typically required for incorporation.

Business Licenses and Tax Registrations

- Trade License:

- Required for: Certain businesses, particularly those involving non-CARICOM citizens/companies.

- License Fee: Varies based on business type and scale. The article previously mentioned EC500(averagestock<EC10,000) and EC1000(allothers),withanannualrenewalofEC1,000. These specific figures should be verified for current applicability as fees can change; consult official sources for the latest fee schedule. [Added cautionary note about fee verification]

- Tax Account Number (TAN): Required for all businesses, obtained from the Inland Revenue Department (IRD).

- Registered Office: Required in Saint Lucia.

- Company Secretary: May be required depending on the entity type (e.g., for domestic companies).

IBCs are generally exempt from local income tax on foreign-earned profits.

Compliance and Regulatory Obligations

Annual financial statements and tax returns must be submitted as per legal requirements. The choice of entity impacts tax liabilities and compliance. Incorporation documents (e.g., Articles of Incorporation/Organization, Memorandum of Association) are filed with ROCIP.

Governing Body: The Registrar of Companies

The Registrar of Companies and Intellectual Property is the government office in Saint Lucia responsible for the registration and administration of all legal entities. Formation documents for both Domestic Companies and IBCs are filed with the Registrar.

Advantages and Disadvantages of Each Entity Type

Benefits and Drawbacks of Corporations (Domestic Companies)

- Advantages: Limited liability, recognized structure for local trade.

- Drawbacks: 30% corporate tax on local profits, more complex compliance than sole traders.

Pros and Cons of Partnerships

- Advantages: Collaborative, pass-through taxation.

- Disadvantages: Unlimited liability for general partners, potential for disputes.

The Flexibility of LLCs: Pros and Cons

- Advantages: Limited liability, flexible management and tax structuring.

- Disadvantages: Can be more complex than sole proprietorships; compliance with LLC Act.

Simplicity of Sole Proprietorships: Pros and Cons

- Advantages: Easy setup, full control, direct profit entitlement.

- Disadvantages: Unlimited personal liability, may be harder to raise capital.

Advantages for Foreign Investors

Saint Lucia welcomes foreign investment.

- Ease of business ownership for foreigners.

- Supportive legal framework, streamlined registration for entities like IBCs.

- Significant tax advantages for IBCs on foreign income.

- Citizenship by Investment Program offers a route to citizenship through qualifying investments.

Additional Considerations

Citizenship by Investment Program

Saint Lucia offers a Citizenship by Investment Program, allowing investors to gain citizenship through financial contributions (e.g., National Economic Fund contribution, real estate purchase, enterprise investment, government bond purchase). This can provide benefits like enhanced global mobility.

Economic Substance Requirements

Companies in Saint Lucia engaged in relevant activities must comply with the Economic Substance Act. Key requirements include:

- Conducting Core Income-Generating Activities (CIGA) in Saint Lucia.

- Having adequate physical presence and local operating expenditure.

- Employing qualified personnel locally.

- Ensuring local management and control.

- Filing annual Economic Substance reports. These rules ensure companies have a genuine operational presence.

Incentives and Local Regulations

Saint Lucia offers various investment incentives, which may include tax holidays, duty-free concessions on imports, and support for specific sectors. The absence of capital gains tax is a significant general incentive.

Conducting a SWOT Analysis for Business Structure

A SWOT analysis can help evaluate entities by considering:

- Strengths: e.g., limited liability, tax benefits.

- Weaknesses: e.g., complexity, cost.

- Opportunities: e.g., access to markets, incentives.

- Threats: e.g., regulatory changes, market competition. This aids strategic decision-making.

Frequently Asked Questions

What are the main types of legal entities available in Saint Lucia?

Saint Lucia offers several legal entity types including Sole Proprietorships, Partnerships, Limited Liability Companies (LLCs), Corporations (Domestic Companies), International Business Companies (IBCs), and Branches of Foreign Companies. Each has unique legal, tax, and regulatory implications.

What is a Domestic Company?

A Domestic Company is formed under the Companies Act and is intended for businesses that will operate within the local Saint Lucian economy. It is subject to local corporate income tax at a rate of 30%.

What restrictions apply to an IBC?

An IBC is prohibited by the International Business Companies Act from transacting business with residents of Saint Lucia, owning local real estate, or offering its shares for sale to the public. Its operations must be exclusively international.

What are the annual fees for an IBC?

An IBC does not pay taxes but must pay an annual government license fee to the Registrar to remain in good standing. The standard fee is typically US $300 per year.

Does Saint Lucia have exchange controls?

For domestic companies, there are some exchange controls. However, an IBC is entirely exempt from all exchange controls, meaning it can freely transfer funds in any currency without restriction.

What is the difference between an LLC and a Corporation in Saint Lucia?

LLCs offer flexible management structures and can opt for pass-through or corporate taxation. Corporations are more formal, governed by the Companies Act, and are subject to a standard 30% tax on local income. Both offer limited liability protection.

Do foreign investors face restrictions when setting up businesses in Saint Lucia?

Foreign investors are welcome in Saint Lucia and benefit from supportive legal frameworks. Some businesses may require a trade license, especially those owned by non-CARICOM nationals, but overall restrictions are minimal.

Biz Latin Hub can help you with legal entities in Saint Lucia

At Biz Latin Hub, we offer a range of back-office services to support foreign entrepreneurs make an impression on Saint Lucia. If you’re ready to get started in the country, but don’t know the best business structure or require legal or due diligence support, you can depend on our time-served business experts who are based in the country.

To get started, get in touch with us for personalized support.