Conducting M&A due diligence in Brazil is an important aspect of any merger or acquisition, providing a guarantee that you will make informed decisions during the process and avoid legal inconveniences later on. Because by conducting due diligence ahead of partnering up with or buying out another company, you will be able to assess whether that company’s internal and external policies comply with corporate law in Brazil, as well as verify that its accounting records are accurate.

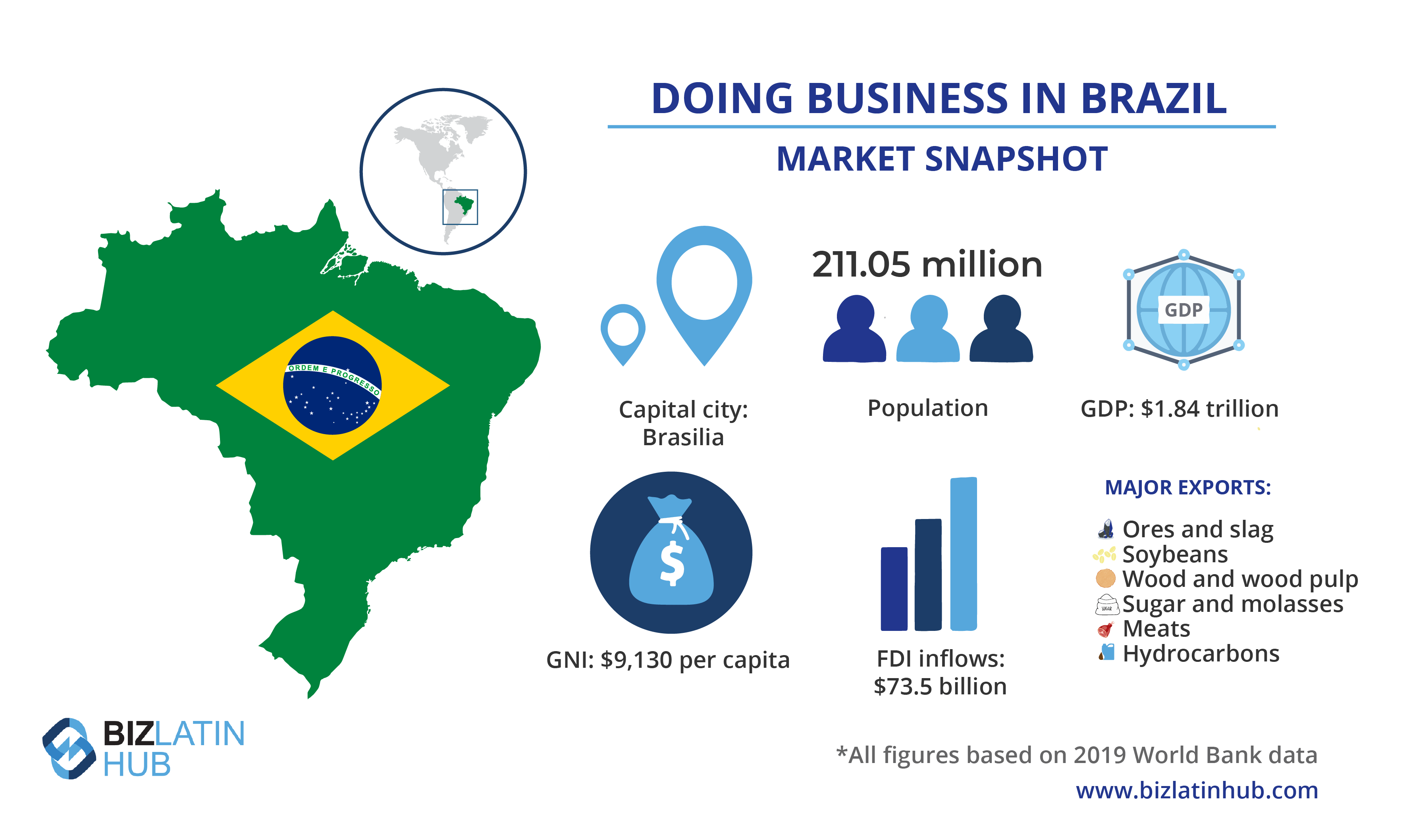

Brazil is Latin America’s largest economy by gross domestic product (GDP), and the eighth largest in the world, registering a GDP of $1.84 trillion in 2019 (all figures in USD). That same year, gross national income (GNI) — a key marker of general prosperity — hit $9,130 per capita, placing Brazil as an upper-middle-income country, according to standards established by the World Bank.

Brazil is home to a growing middle class and its services sector has expanded significantly in recent decades to become considered one of the most developed in the region. That and its bountiful natural resources are key to Brazil’s status as a major destination for international capital, with the country being the world’s fourth-largest recipient of foreign direct investment (FDI), which reached $73.5 billion in 2019.

Commonly known and ‘The South American Giant’, Brazil is a founding member of the Southern Common Market (Mercosur), an economic and political association that also includes Argentina, Paraguay, and Uruguay, and which recently celebrated its 30th anniversary. Some of Brazil’s prime exports include ores and slag, soybeans, timber, and coffee. The main destinations for Brazilian goods include Argentina, Chile, China, the Netherlands, and the United States.

If you are considering doing business in this Latin American powerhouse, or have already established a commercial presence in the country, read on to understand the importance of conducting M&A due diligence in Brazil. Or go ahead and contact us now to discuss your business options.

M&A due diligence in Brazil: what does it mean?

M&A due diligence in Brazil is conducted when a company is looking to merge with or buy a local organization. It is carried out to detect business risks, noncompliance issues, or financial inconsistencies that could place the suitability of the transaction in doubt or suggest potential problems for your business operations later down the line.

A comprehensive M&A due diligence process in Brazil will involve a detailed investigation of sales figures, business records, and asset ownership, as well as an examination of environmental policies and labor practices. On top of that, a study of judicial records will be made to identify if that company has ever been sanctioned or penalized by local authorities. All of this information will allow you to make an informed decision about whether to continue, defer, or abandon the merger or acquisition process.

Some of the documents that are thoroughly examined during an M&A due diligence process include:

- Bank loans obtained

- Balance sheets and tax returns

- Income statements

- Minutes of shareholders’ annual meetings

- Invoice receivable and payable reports

- Reports of deposits and cash payments

- Utility bills

So when you engage with a trusted local firm that offers due diligence services, you will receive impartial and critical insight into the target company, allowing you to go into the transaction with complete confidence.

Types of due diligence processes

There are a number of due diligence processes that can help you protect your business interests from any risk. These include:

Legal due diligence: consists of examining the legal situation of an organization and verifying if it complies with all local corporate regulations. In addition, in the event that the investigated company is involved in a litigation process, a more in-depth investigation will be carried out to determine possible business risks or financial losses. Some of the documents reviewed when conducting legal due diligence in Brazil include:

- Articles of Incorporation

- Company taxpayer number

- Registration of foreign capital with the Central Bank of Brazil

- Certificate of settlement of labor debts

- Labor agreements and payroll information

Financial due diligence: assesses the financial status of a company and its tax compliance. In addition, financial records are also reviewed to determine whether a business has been profitable and whether its operations will be economically sustainable in the future. Some of the documents that are reviewed during a financial due diligence process include:

- Income statements for the previous five years

- Certification of company assets

- Copy of monthly reports for the last five years

- Balances sheets

Labor and employment due diligence: verifies whether a company fully complies with local labor regulations, maintains adequate working conditions to ensure the well-being of all its employees, and meets all statutory requirements in terms of benefits and social security contributions.

Environmental due diligence: evaluates the environmental practices of an organization operating in Brazil, including its biological risk and waste management strategies, as well as its practices to reduce the environmental impact of its operations, if applicable.

Biz Latin Hub can conduct M&A due diligence in Brazil

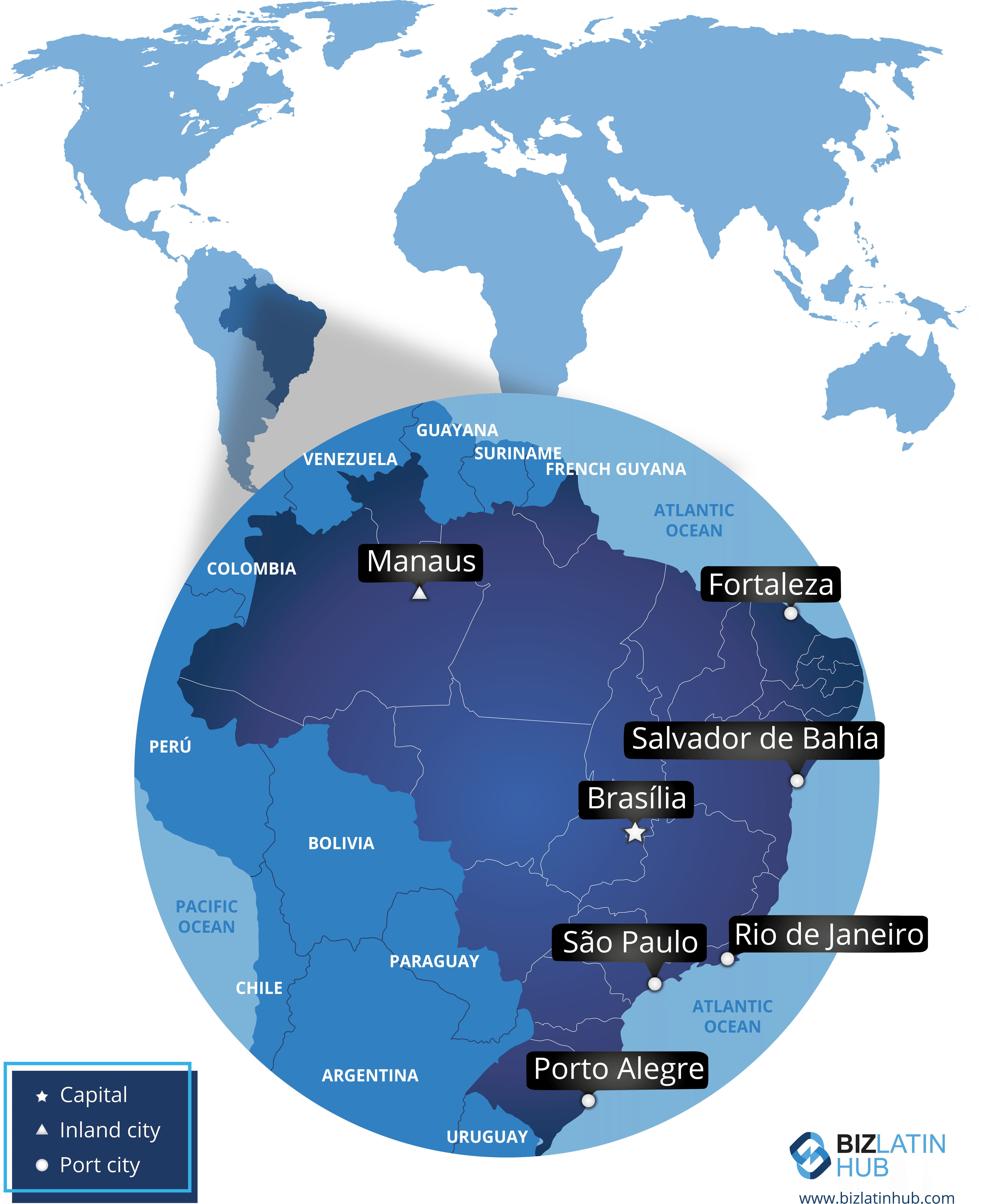

At Biz Latin Hub, our multilingual team of due diligence agents has vast experience conducting detailed examinations of companies in Brazil, identifying risks and inconsistencies that can affect your commercial objectives or jeopardize your business operations. With our complete portfolio of high-quality legal, accounting, and recruitment services, we can be your single point of contact to support your business expansion in Brazil, and any of the other 15 countries in Latin America and the Caribbean where we operate.

Reach out to us now for more information or a free quote.

Learn more about our team and expert authors.