A company must have a corporate bank account in Brazil if they wish to carry out financial transactions in the country, such as the receipt of amounts and the payment of suppliers and employees. The process involves submitting documents to the Central Bank of Brazil for review and will regulate all future accounts. The process will require establishing an LLC in Brazil or a branch, preparing documentation, and partnering with a bank suitable for your intened activitites. Brazil is Latin America’s largest economy, attracting foreign companies across industries. Corporate banking in Brazil is regulated and requires close compliance with local legal standards.

Key Takeaways

| A range of banks to choose from to open a corporate bank account in Brazil: | Itaú. Banco do Brasil. Banco Bradesco. Caixa Economica Federal. Santander. Brazilian Development Bank. Banco Safra. BTG Pactual. Banco BV. Banrisul. Citibank. |

| There is a four step process to open a corporate bank account in Brazil: | Step 1 – Incorporate a Company. Step 2 – Prepare company documents. Step 3 – Prepare personal documents. Step 4 – Enter into agreement with the bank. |

| Each corporate bank account in brazil will vary slightly: | This is a general guide: you will need to check individual banks’ rules or contact one of our expert advisors for more detailed rules. |

| You will need to provide documents when opening a Brazilian corporate bank account: | Corporate national tax ID (CNPJ). Company’s articles of incorporation/statutes. Chart with the company’s shareholding structure chart with full disclosure of UBOs (Ultimate Beneficial Owners). Additional documents regarding UBOs may be required. The company’s legal representative’s personal documents, including: Personal ID (RG/RNE) and Individual Tax ID (CPF), proof of residence. |

Step-by-Step Corporate Account Setup in Brazil

Once you have chosen a provider you would like to bank with, and have started to gather the required documents, you can begin the process of opening a corporate account. Once your account is activated, you will be ready to begin operations, and see your business grow.

To open a corporate bank account in Brazil you must follow these 4 steps:

- Step 1 – Incorporate a Company.

- Step 2 – Prepare Company Documents.

- Step 3 – Prepare Personal Documents.

- Step 4 – Enter into Agreement With the Bank.

Below is more information on each of the four steps you must complete to open a bank account in Brazil.

1. Incorporate a Company

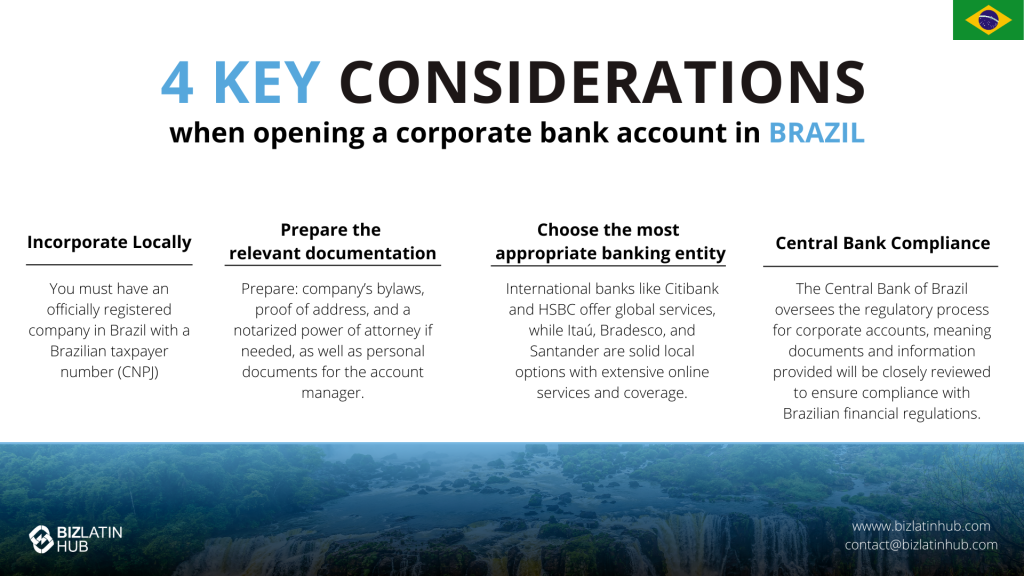

To open a corporate bank account in Brazil, you must first incorporate a company in Brazil. Once your company has been officially registered in Brazil, you will receive a taxpayer number (CNPJ), which is necessary in the process of opening a bank account in order to comply with the tax and accounting requirements in Brazil.

2. Prepare Company Documents

If you have already incorporated your company and received a taxpayer number, you should finish preparing the necessary company documents. Banks require all documents to be translated into Portuguese and in some cases notarized or consularized. Appointing a legal representative in Brazil is mandatory. Brazil’s AML laws require full KYC, source of funds, and beneficial ownership disclosure.Your local director should be ready to present the following list of documents to the bank:

- A copy of the taxpayer number issued by the Federal Revenue through its website.

- A copy of the company’s bylaws duly registered in Brazil.

- Proof of address of the company.

- A copy of a public (notarized) power of attorney, if the individual opening the bank account is not the local director.

3. Prepare Personal Documents

In addition to company documents, the provider will ask for documents for the person designated to be in charge of the account. The local director(s) must present the following personal documents for this individual:

- A copy of the ID card.

- A copy of the individual’s taxpayer number (CPF).

- Proof of address.

4. Enter into Agreement With the Bank

Once you have prepared all the necessary documents, you may hand them over to the bank and request the opening of a corporate account. The bank may ask for additional information depending on internal policies. At this point, the bank and the company enter into an agreement. The agreement will set forth, among other provisions:

- The characteristics of the account and the basic rules for its operation. This includes the available forms of movement, the procedures around charging fees, and the deadlines for providing vouchers, receipts, and other documents.

- Security measures for the purpose of handling the account.

- The rights and obligations of the account holders.

Banks in Brazil, at their own criteria, define a minimum balance that must be deposited to keep the bank account active.

After a period of analysis, which varies from bank to bank, the corporate bank account is duly opened.

Requirements for Opening a Business Account in Brazil

When you apply for a corporate bank account in Brazil, you will be asked to provide a number of official documents. These may be company documents or personal documents for the person in charge of the account. The exact list of required documents varies by provider, but there are some that every bank asks for. Here is a list of documents you should be prepared to provide when opening a corporate account in Brazil:

- Corporate national tax ID (CNPJ).

- Company’s articles of incorporation/statutes.

- Chart with the company’s shareholding structure chart with full disclosure of UBOs (Ultimate Beneficial Owners).

- Additional documents regarding UBOs may be required.

- The company’s legal representative’s personal documents, including: Personal ID (RG/RNE) and Individual Tax ID (CPF), proof of residence.

Leading Banks for Foreign Businesses in Brazil

Brazil has many banks for your business to choose from. Ultimately, the best choice for your business will depend on your specific needs. Here is a list of some popular banks in Brazil:

- Itaú.

- Banco do Brasil.

- Banco Bradesco.

- Caixa Economica Federal.

- Santander.

- Brazilian Development Bank.

- Banco Safra.

- BTG Pactual.

- Banco BV.

- Banrisul.

- Citibank.

Our recommendation: If your company operates worldwide or needs international banking services, consider banks with a strong international presence, such as Citibank or HSBC. These banks can offer specialized services for international businesses, but often require prior relationships. If you want to stay fully local, we recommend that you pick a bank with good online platforms and national coverage, such as Itaú, Bradesco, and Santander.

Comparison Table:

| Feature | Brazil | Argentina | Chile |

| Minimum Deposit | R$500–R$2,000 | $1,000 | $500 |

| Account Opening Time | 3–6 weeks | 4–6 weeks | 2–4 weeks |

| Foreign Ownership Allowed | Yes | Yes | Yes |

| Remote Opening | No | Rare | Sometimes |

Additional FAQs About Brazil Business Banking

Based on our extensive experience, these are the common questions and doubts of our clients on opening a company bank account in Brazil:

1. Can I open a corporate bank account online in Brazil?

Yes, most banks in Brazil offer this option.

2. Who can have access to a company bank account in Brazil?

Usually, the legal representative will be granted master user access, and will then be able to grant access to other users. Most banks will require that all users be registered with a national tax ID and a Brazilian cell phone number. Some international banks may not require this from users.

3. Why do companies open bank accounts in Brazil?

Companies will have bank accounts to handle their local operations and the payments that need to be made locally. Brazil does not allow USD or other foreign currency accounts, so it is necessary to convert money into BRL. Also, most commerce and service providers operate by using boletos (a bar code document linked to a transaction) to receive payments, and national banks’ platforms are adapted to read such codes and have such payments completed. Most taxes to be paid in Brazil are charged via boletos.

4. Does Brazil have bank secrecy?

Yes, Brazil has bank secrecy and it can be broken only by a court decision.

5. What is the best bank in Brazil for foreign companies?

We recommend that you pick a bank with good online platforms and national coverage, such as Itaú, Bradesco, and Santander.

6. What are the types of corporate bank accounts in Brazil?

You may open either a checking account, which is best for ongoing financial transactions, or a savings account, which is best for storing your money.

7. What documents do I need to open a company bank account in Brazil?

The process will require the following documents:

- Corporate national tax ID (CNPJ).

- Company’s articles of incorporation/statutes.

- Chart with the company’s shareholding structure chart with full disclosure of UBOs (Ultimate Beneficial Owners).

- Additional documents regarding UBOs may be required.

- The company’s legal representative’s personal documents, including Personal ID (RG/RNE) and Individual Tax ID (CPF), proof of residence.

8. Can a foreign company open a bank account in Brazil?

Yes. Foreign companies can open a bank account, but they must first register with the Brazilian tax authority (CNPJ) and appoint a legal representative.

9. What are the steps for opening a business account in Brazil?

Incorporate locally, obtain a CNPJ, prepare certified and translated documents, appoint a legal representative, and attend a bank meeting to submit KYC documentation.

10. Can a business account be opened remotely in Brazil?

No. A local legal representative must attend the bank in person to finalize the onboarding process.

11. How long does it take to open a business bank account in Brazil?

It typically takes 3 to 6 weeks depending on how quickly compliance documentation is approved.

Benefits of Corporate Banking in Brazil

Opening a bank account in Brazil is a key step for investors, enabling seamless management of funds and access to local opportunities like real estate, stocks, and bonds. It simplifies currency exchange, minimizes international transfer costs, and ensures compliance with Brazilian financial regulations, making it an indispensable tool for investment.

A local account also boosts credibility with businesses and authorities and offers access to tailored financial products and advice. It allows investors to navigate Brazil’s dynamic economic environment effectively, adapt to regulatory changes, and capitalize on growth opportunities, providing a strong foundation for successful investments.

Get Professional Support When Opening a Corporate Bank Account in Brazil

Opening a corporate bank account in Brazil might be a challenging experience for a foreign company. We strongly recommend partnering with accounting and legal experts for local support. With the right market entry strategy, your Brazilian expansion can achieve long-term success.

At Biz Latin Hub, our team of multilingual specialists offers comprehensive market entry and back-office services. We provide customized business solutions to suit your needs and we can help you to open your corporate bank account. Contact our Brazilian business experts for personalized advice.

Learn about our team and expert authors.