Despite being the seventh-largest recipient of foreign direct investment in the world. Entity health checks are used by both large businesses as well as startups before or after company formation in Brazil. Their practicality is especially prudent in nations where corporate compliance regulation is difficult and convoluted, or where penalties for corporate misconduct are harsh. Unfortunately, Brazil qualifies on both of these accounts. With the use of corporate health checks, enter the Brazil market without the fear of non-compliance penalties.

Key Takeaways: Entity Health Check Brazil

| Aspect | Details |

|---|---|

| Types of Health Checks | Legal compliance checks: Registry filings, corporate governance, statutory requirements Fiscal compliance checks: Tax obligations, social security payments, accounting standards |

| Primary Benefits | ✓ Executive oversight and business management insights ✓ Risk mitigation for penalties and reputational damage ✓ Transaction risk reduction for M&A activities |

| Legal Requirement | Not legally mandated but essential for compliance assurance and penalty avoidance |

| Who Should Conduct | Independent certified auditors with specialized knowledge of Brazilian corporate law and tax regulations |

What are entity health checks in Brazil?

An entity health check is a voluntary audit conducted by independent contractors. This independent group is made up of legal and financial experts who are employed to open up a company to inspect possible compliance issues. By delving into corporate documents, these checks assess the company’s compliance status. Corporate health checks help companies to ensure that their actions are all clean and legal.

Due Diligence vs. Entity Health Checks: Understanding the Relationship

Entity health checks form a critical component of comprehensive due diligence processes in Brazil. While entity health checks focus on ongoing compliance monitoring, legal due diligence encompasses a broader scope of investigation, particularly crucial during mergers and acquisitions or foreign investments.

Legal Due Diligence Components

Legal due diligence examines corporate structure, contractual obligations, intellectual property rights, and regulatory compliance history. When combined with entity health checks, this creates a robust framework for risk assessment that foreign investors require when entering Brazil’s complex business environment.

For companies engaging in business transactions or considering partnerships, conducting both legal due diligence and regular entity health checks ensures comprehensive protection against regulatory penalties while providing transparency to potential stakeholders.

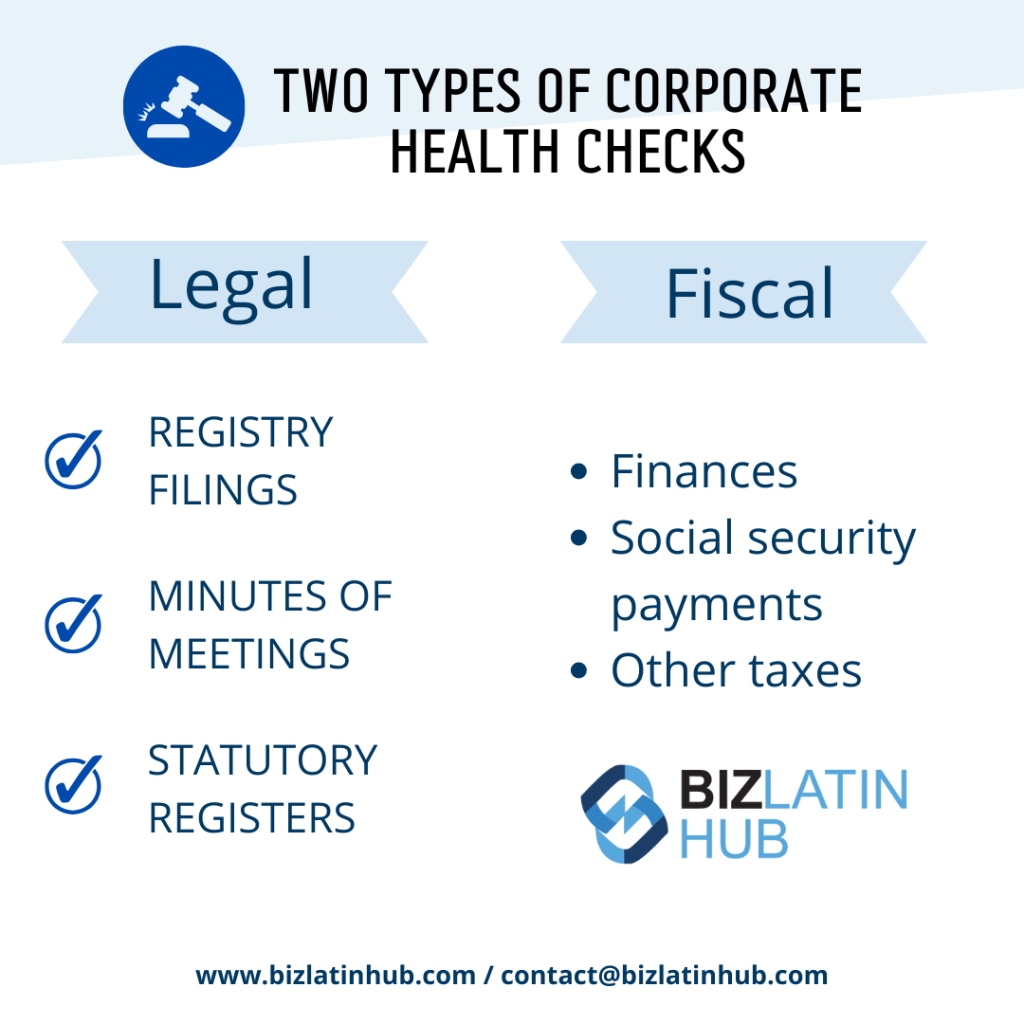

There are two types of corporate health check. One investigates the key areas of legal compliance: registry filings, meeting minutes and statutory registers. The other focuses more on fiscal and accounting compliance by examining the company’s balance sheet.

Health checkers go deep into business transactions, tax payments and employee salaries in order to find issues or gaps in the filings. By doing this, companies can know for certain that they will not incur penalties from authorities.

In compliance landscapes that are dotted with traps and stumbling blocks, it is very easy for companies to overlook certain regulations. Brazil is a prime example of a country with web-like legal and fiscal regulations. Without careful deliberation, penalties and fines can quickly stack up.

Fiscal entity health checks

Taxes in Brazil are levied across three different regional levels: federal, state and municipal government taxes. The federal tax is uniform for all; state and municipal tax rates, however, vary across different areas. The city of Manaos, for example, offers a lower rate than somewhere like Sao Paulo.

On gross revenue, companies pay two types of taxes. The first is federal, set at 1.65%. The second is a mandatory social security contribution, set at 7.6%. Businesses must also withhold personal income tax which is deducted from employee’s payment.

There are also two types of value-added tax (VAT) in Brazil. The first tax is a federal payment that is levied on the production and import of domestic and foreign goods. This rate is set at 20%. The second VAT is a state payment on goods as well as services known as ICMS. Dependent on the state this tax rate is set between 7-25%. Brazil’s accounting system plays host to a number of irregularities, outlined is a list of the most profound differences:

- Unlike some countries, Brazil’s tax year is January-December with tax returns required to be filed on the last working day of April.

- It is also worth noting that tax extensions are not offered in Brazil. The deadline is strict and, if missed, fines start to be implemented.

- Companies must report payroll and VAT filings to the Brazilian government every month.

Corporate Income Tax Obligations

Corporate income tax in Brazil follows a complex structure with rates varying based on company size and profit levels. Standard corporate income tax is levied at 15% on annual profits, with an additional 10% surtax on profits exceeding R$240,000. Companies may elect between actual profit, presumed profit, or simplified taxation regimes, each requiring different compliance procedures that entity health checks must verify.

Critical Social Security Obligations for Brazilian Entities

Beyond monthly payroll reporting, Brazilian companies face stringent social security compliance requirements that form a substantial portion of entity health check assessments. The National Institute of Social Security (INSS) mandates detailed monthly contributions for all employees, with specific rates varying by industry sector.

Social Security Payment Requirements

Social security payments include employer contributions ranging from 20% to 28.8% of gross salary, plus additional contributions to the Guarantee Fund for Length of Service (FGTS) at 8% of monthly wages. Non-compliance with social security obligations can result in severe penalties, including business license suspension and criminal liability for company directors.

Entity health checks specifically examine social security payment histories, contribution calculations, and compliance with evolving regulations to ensure companies maintain good standing with Brazilian authorities.

Without the use of local experts to perform an entity health check, non-compliance with any of these fiscal regulations can end up in substantial fines.

Entity legal health checks in Brazil

Similar to fiscal compliance, legal compliance in Brazil is equally rigorous. Company incorporation in Brazil is twice as long as any other Latin American country, involving a number of federal boards, as well as municipal and state ratifications.

Private entities in Brazil must maintain a local registered address when operating and foreign companies must have a Brazilian legal representative as a power of attorney. Every year, companies registered in Brazil must report annual returns that confirm the relevant details of their company. These details also include updates on any changes in directors and their home addresses.

Foreign companies looking to close their company in Brazil must continue employing a full-time secretary as well as an office in the country until the lengthy liquidation process is completed. Employment law also throws up a number of compliance issues.

Employers in Brazil must provide a number of additional benefits to employees such as meal allowance, life insurance, dental allowance, pensions, medical checkups as well as annual bonuses. Accurate records for these allowances must be clearly declared in employee contracts before they start work.

Any non-compliance on any of these regulations, particularly concerning employment law, can end in court hearings, expensive legal fees, and potential fines.

Anti-Money Laundering Compliance Requirements

Brazilian entities must maintain robust anti-money laundering (AML) compliance programs under the oversight of the Financial Activities Control Council (COAF). Companies are required to implement customer due diligence procedures, maintain transaction monitoring systems, and report suspicious activities to authorities.

Entity health checks examine AML policy implementation, staff training records, and compliance with reporting obligations. Non-compliance with money laundering prevention requirements can result in severe penalties, including criminal liability for company directors and potential business license revocation.

Why are corporate health checks important in Brazil?

Corporate health checks act as a company’s backstop, saving them from incurring penalties and expensive fines issued by authorities. Particularly in the case of Brazil, it is not an easy task ensuring compliance, even more so for new or foreign businesses not familiar with local law. Corporate health checks are also especially prudent after a set of reforms to corporate law have been made.

For smaller businesses, it can be very easy for these changes to slip past the net. With the help of an entity health checker you can avoid this oversight. Corporate health checks are useful to any business – large or small. Nevertheless, there are three instances where they are most commonly used, during mergers and acquisitions, startups and branch office oversight.

Mergers and Acquisitions

When purchasing another company, a lot of vigilance is required. It is very easy to be distracted by the reams of bureaucracy during a company buyout. What looks ok on the surface can easily be hidden by false figures. By using an independent corporate health checker during a merger, they can investigate the balance sheets in-depth and potentially uncover strings of debt or unpaid taxes.

Mitigating the risk of an incorrect valuation can help purchasers save large sums of money and bring negotiations to a fairer agreement. In the case of Brazil where the web of corporate law is particularly dense, a thorough and diligent examination of a company is wise before a purchase.

Startups in Brazil

In the case of startups, particularly foreign-owned startups where local law is completely alien, it can be very easy for compliance regulation to overwhelm a small office. When there are countless other tasks to complete during company incorporation, it is very easy for compliance to be put to the bottom of the pile. In Brazil, where there is no leeway for non-compliance, fines can bring a startup to its knees before it has even had a chance to grow.

The act of an entity health checker coming in will advise on regulations the company is at risk of breaching or assure a business owner that his company is compliant. The road to company incorporation in Brazil is not an easy one. Bringing on all the support available will help keep the company afloat until it can support itself.

Branch office managment

As a large company with a number of branches around the world, it can be difficult to oversee all of their actions. Compounded by the fact that each branch is likely to have different laws, it is difficult for the corporate managers to keep track of each specific branch’s compliance.

To ensure performance as well as compliance, corporate health checkers can examine the conduct of branch offices and report to head offices for detailed rundowns of operations. Non-compliance can cost the company in fines, sanctions and/or a damaged business reputation. A branch office in Brazil, as many multinational companies have, can mean compliance headaches. The best method of avoiding this is to employ a corporate health checker.

FAQs on an entity health check in Brazil

Why should you get an entity health check in Brazil?

An entity health check in Brazil helps executives monitor compliance, avoid steep tax penalties, safeguard corporate reputation, prepare for transactions, and protect directors from personal liability.

What are the typical costs of non-compliance in Brazil?

Non-compliance can lead to tax fines of 75% to 225%, employment law penalties up to R$500,000, social security penalties of 20% to 40%, late filing fines up to R$50,000, and digital system penalties starting at R$1,000 per month.

How often should companies conduct entity health checks?

New companies should perform monthly checks initially, then quarterly. Established firms typically conduct checks semi-annually, while high-risk industries require quarterly reviews. Major transactions or regulatory changes also warrant immediate checks.

Which Brazilian authorities oversee entity compliance?

Entity compliance is overseen by Receita Federal, Labor Ministry, Central Bank, state tax and environmental agencies, municipal licensing authorities, INSS, Junta Comercial, and sector-specific regulators like ANVISA and ANATEL.

What steps are involved in a comprehensive entity health check?

The process includes: (1) Information collection from financial, legal, and HR departments; (2) Validation of records through government databases and portals; and (3) Reporting with risk assessment, recommendations, and a corrective action plan.

What specific areas does an entity health check examine?

An entity health check reviews tax obligations, social security contributions, employment law compliance, corporate governance, third-party contracts, and digital filing requirements through Brazil’s SPED system.

Who can legally perform entity health checks in Brazil?

Qualified professionals include certified auditors (CRC registered), lawyers (OAB licensed), compliance firms with regulatory expertise, and accounting firms licensed for tax audits. Internal teams cannot perform independent reviews.

What happens if violations are discovered during the health check?

Violations trigger an assessment, voluntary disclosure options (with penalty reductions), installment payment plans, process improvements, and ongoing compliance monitoring to prevent recurrence.

How long does a typical entity health check take in Brazil?

Small companies typically require 2–3 weeks, medium-sized firms 4–6 weeks, and large corporations up to 10 weeks. Multi-state operations may add 1–2 weeks per state. Expedited reviews are available for urgent needs.

What documents should companies prepare for an entity health check?

Key documents include 24 months of tax filings, employment contracts, payroll and benefits records, corporate books, financial statements, compliance certificates, and digital login credentials for relevant government portals.

Sector-Specific Compliance Considerations

Manufacturing Companies

- IPI (Industrial Products Tax): Monthly obligations varying by product classification

- Environmental compliance: State-level licensing and emission monitoring

- Import documentation: SISCOMEX system integration for international suppliers

Technology and Software Companies

- Software taxation complexity: Different rates for licensed vs. developed software

- Digital service regulations: Municipal ISS compliance for cloud services

- Data protection: LGPD (Brazilian GDPR) compliance requirements

Service Providers

- Municipal ISS variations: Service location vs. company location taxation

- Cross-municipal operations: Multiple registration requirements

- Professional service regulations: Industry-specific licensing requirements

Import/Export Businesses

- SISCOMEX compliance: Integrated foreign trade system obligations

- Customs documentation: Proper classification and duty payments

- Foreign exchange controls: Central Bank reporting for international transactions

Use local experts for your entity health check in Brazil

Investing in Brazil no doubt has enormous upside potential with its booming economy, strong infrastructure, business-friendly government, and cheap workforce; however, the price to pay for this comes in the form of compliance.

Large multinationals go through in-house compliance auditing every month. They simply cannot risk the penalties in fines nor reputation. Why should it be any different for smaller companies? Insulate yourself from corporate penalties by employing an entity health checker.

Biz Latin Hub provides a range of business services to in-coming foreign companies. Partner with our expert team of lawyers and accountants to help your company navigate local compliance law. If you’re interested in our Brazilian entity health checking services, get in touch today here at Biz Latin Hub and we can ensure your fiscal and legal requirements are clear of all noncompliance.

Learn more about our team and expert authors.