Central American nations are no exception to the ebbs and flows of the global economy. Yet, their resilience and tactical strategies in the face of these challenges offer invaluable insights into fiscal management in turbulent times. Belize fiscal strategies show promise, as does its economy in general.

Belize fiscal strategies have increased in popularity due to the sensible policies of its financial institutions such as banks. The country is famous for the flexibility of its banking system and offers generous conditions to investors. That’s why an increasing number of CEOs are now looking at company formation in Belize or elsewhere in Central America.

Biz Latin Hub can help you with Belize fiscal strategies or other options within either Central America or the Caribbean. No one knows the region better than we do, with a network of 18 dedicated local offices throughout the isthmus and islands.

Unpacking Macroeconomic Indicators

The most important point of consideration is to not just focus on macroeconomic indicators, such as GDP, inflation, and exchange rates, but also on how individuals are faring within their countries. It’s not merely about whether the economy is growing on a broad scale, but whether this growth is being felt at an individual level. Are people’s lives improving? Are they experiencing the benefits of economic growth?

In 2020, the world faced an unprecedented contraction of economic activity. There was a sharp decrease in production, exports, and imports. Governments and businesses worldwide adopted various measures to mitigate the impacts of the downturn and to foster recovery.

What Was The Price of Reactivation?

A significant strategy adopted globally, especially in developed countries, was the expansion of public spending. This led to an injection of more money into circulation than what was needed, giving rise to inflation by the end of 2021. As a result, demand for goods surpassed supply, causing scarcity in the market and further driving up prices.

This inflation mostly impacted Central American countries in the form of “imported” inflation, resulting in rising prices. However, it’s important to understand that this was more a consequence of international price escalation rather than a direct outcome of these countries’ policies.

Balancing Inflation and Interest Rates

Countries worldwide adopted a dual strategy of increasing public spending and lowering interest rates in 2020 and 2021 to facilitate economic recovery. But with the rise in inflation, there was a need to hike these interest rates to combat it. As a result, growth in developed countries began to slow down. This slowing growth then impacts the exporting countries, as they are reliant on the buying power of the developed nations.

What is The Role of Belize Fiscal Strategies in Inflation Management?

To tackle inflation, Central American nations employed a variety of methods, including subsidies to maintain consumer spending levels. However, this approach, although beneficial in the short term, can lead to more financial strain in the long run as it depletes the government’s resources.

There’s a need for these countries to strike a delicate balance between short-term relief and long-term economic stability. Inflation is expected to decrease, but the ongoing geopolitical challenges suggest that the global conditions may remain unchanged for a while. As such, Central American countries need to prepare for this continued environment.

How To Manage Interest Rates?

While increasing interest rates may help reduce inflation, it’s also essential to consider the effects on different sectors. Certain industries, such as construction, could be more adversely affected due to the higher costs of borrowing. Therefore, while adjusting interest rates is a crucial tool in managing inflation, it must be done with a thorough understanding of the potential impacts on various sectors of the economy.

Where Do Belize Fiscal Strategies Fit In?

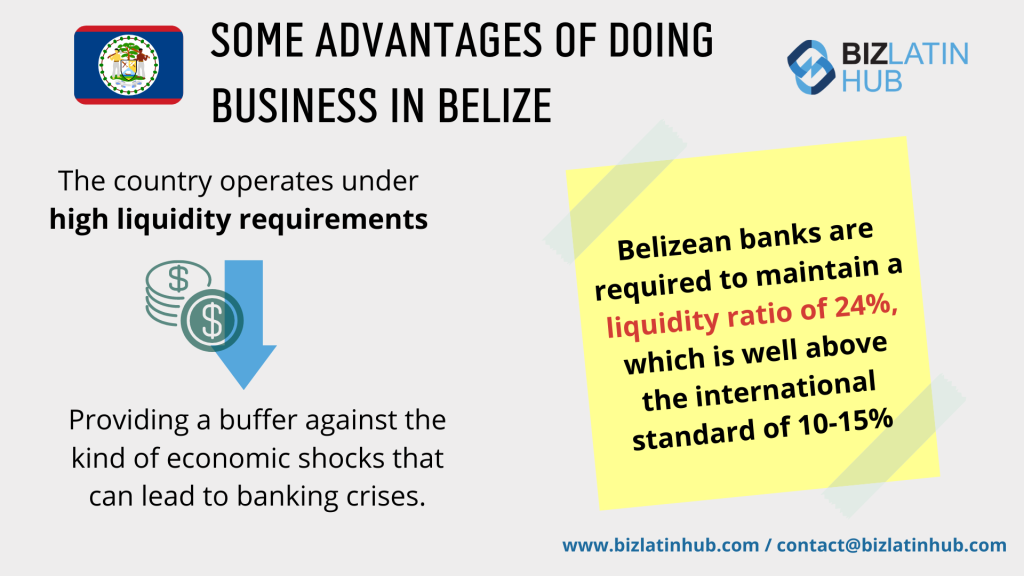

In the grand scheme of the Central American fiscal landscape, Belize occupies a unique position. The country operates under high liquidity requirements, which provides a buffer against the kind of economic shocks that can lead to banking crises. While banks in Western countries are facing a crisis of their own, Belize’s financial system has proven to be remarkably stable.

This is, in part, because Belizean banks are required to maintain a liquidity ratio of 24%, which is well above the international standard of 10-15%. This additional capital buffer ensures that banks in Belize are better equipped to handle unexpected financial stress, and therefore, could offer a safe haven during these turbulent times.

Post COVID, Belize’s economy has shown signs of recovery and resilience. The country, known for its vibrant tourism industry, was heavily impacted by the pandemic due to travel restrictions and reduced international visitor arrivals. However, as travel restrictions eased and vaccination efforts progressed, Belize experienced a gradual revival in tourism.

The government implemented robust health and safety protocols to instill confidence in travelers, and the pristine beaches, Mayan ruins, and diverse marine life continued to attract visitors. This resurgence in tourism has played a crucial role in boosting the country’s economy, generating employment opportunities, and revitalizing related sectors such as hospitality, transportation, and entertainment.

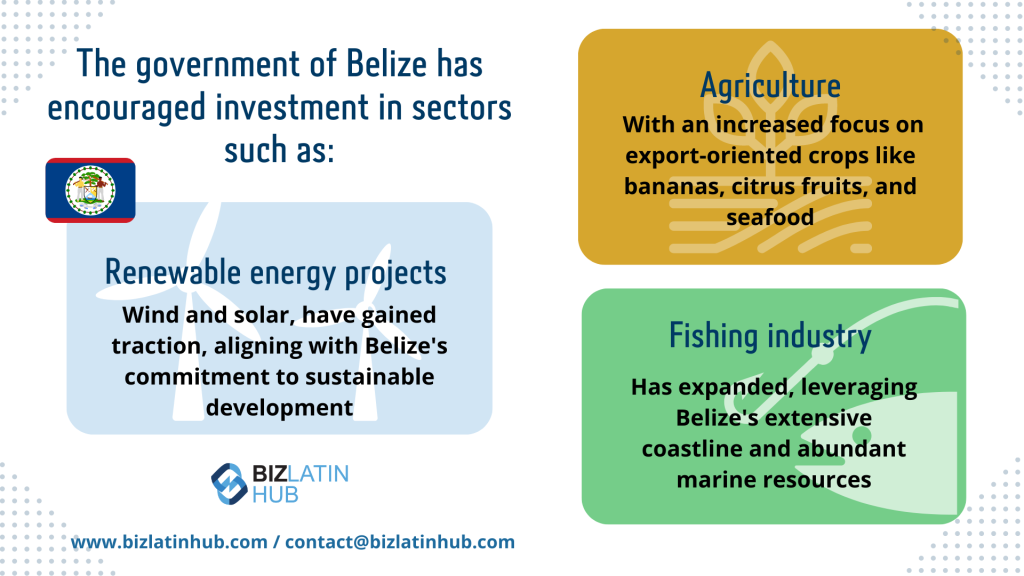

Furthermore, Belize has actively sought to diversify its economy beyond tourism, recognizing the vulnerabilities exposed by the pandemic. The government has encouraged investment in sectors such as agriculture, fisheries, and renewable energy. Agriculture has witnessed growth, with an increased focus on export-oriented crops like bananas, citrus fruits, and seafood.

The fishing industry has also expanded, leveraging Belize’s extensive coastline and abundant marine resources. Additionally, renewable energy projects, including wind and solar, have gained traction, aligning with Belize’s commitment to sustainable development and reducing reliance on fossil fuels. These efforts have helped to strengthen the country’s economic foundation and promote long-term stability.

Despite the challenges posed by the pandemic, Belize has also continued to attract foreign direct investment (FDI). The government has actively pursued policies to enhance the business climate and facilitate investment in key sectors. Infrastructure development, including the expansion of road networks and the improvement of ports, has been prioritized to support economic growth and facilitate trade.

Moreover, the government has sought partnerships with international organizations and neighboring countries to leverage resources and expertise. These initiatives have bolstered Belize’s economic prospects, attracting investments in sectors such as tourism infrastructure, agriculture, and technology.

With a resilient economy and ongoing efforts to diversify and attract investment, Belize is steadily recovering from the impact of COVID-19 and positioning itself for future growth.

This resilience, combined with Belize’s strategic geographic location and stable economy, is attracting the attention of global investors seeking diversification in resilient economies. With these attributes, Belize not only fits into the Central American economic narrative but also stands out as a beacon of stability amidst global financial uncertainty.

Looking ahead

The economic journey of Central American countries through these challenging times offers several lessons in fiscal management. According to Panama City based attorney, Idaliz H. Guiraud, “this highlights the importance of a balanced approach, taking into consideration both macroeconomic indicators and the effects on individuals within the economy.” Thus, it’s not just about weathering the storm but doing so in a way that ensures long-term growth and stability.

Biz Latin Hub can assist you with Belize fiscal strategies

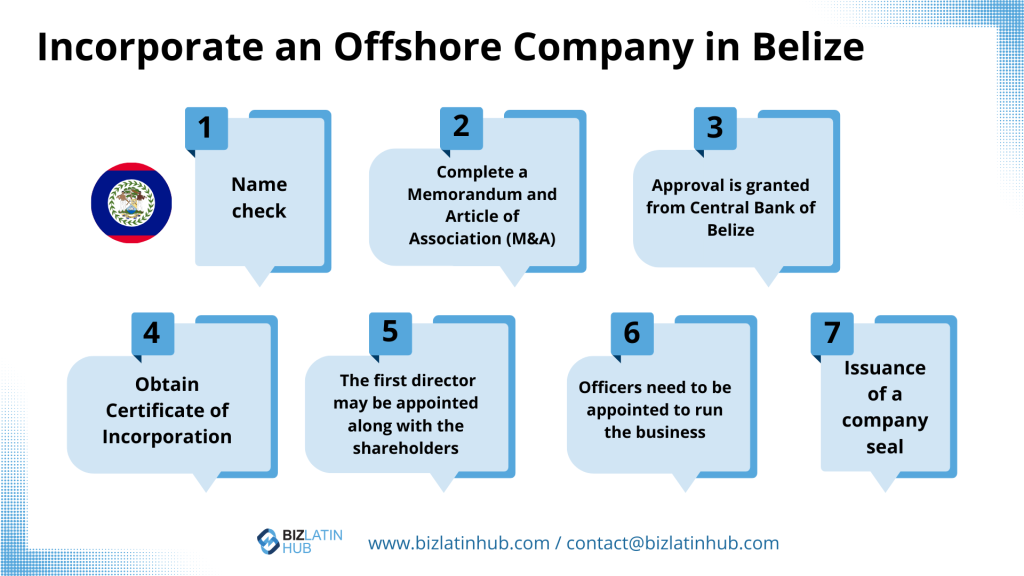

At Biz Latin Hub, our team of corporate support specialists is available to assist you in entering and opening an offshore company in the Caribbean country.

Our comprehensive portfolio of back-office services includes company formation, accounting & taxation, corporate legal services, visa processing, and hiring & PEO, and we provide tailored packages of services to meet every need.

We have teams in place in 17 markets around Latin America and the Caribbean, plans to expand into more markets, and trusted partners taking our coverage to almost every corner of the region, meaning we are well-placed to assist with multi-jurisdiction market entry and operations.

Contact us today to find out more about how we can support you.

Or read about our team and expert authors.