The Inter-American Development Bank (IDB) is offering to cover the costs of companies moving operations from Asia to Latin America – a trend known as “nearshoring” that has become increasingly popular over recent years.

With operating costs in China rising, a growing number of companies have been seeking to relocate to Latin America to be closer to target markets in North America, as well as the European Union.

While manufacturing and production was badly affected worldwide by the turmoil of the COVID-19 pandemic, the IDB is looking to get the nearshoring trend back on track by footing the bill for companies to relocate to Latin America.

According to IDB President Mauricio Claver-Carone, the offer is not only intended for US companies or companies focused on selling in the United States that are seeking to relocate, but any business that sees benefit in shifting production and other operations from Asia to Latin America.

“I am not [just] talking about nearshoring, thinking only of the United States, but also of Spain. If there are Spanish companies that have invested their value chain in China or other Asian countries and want to transfer that chain to Latin America, the IDB will finance it. I believe that Europeans are beginning to see this as an opportunity,” he told Spanish newspaper El Mundo.

SEE ALSO: Legal Services in Mexico: Find a Good Corporate Legal Firm

The IDB and the government of Japan are the only two institutions in the international community offering such assistance to companies seeking to relocate operations closer to home.

According to Claver-Carone, the IDB assistance comes in the form of a comprehensive financing package based on the individual needs of each company, which could cover relocation, operations, or another aspect of business.

The move complements a series of Policy-Based Loans being designed to support the relocation of operations to markets in Latin America, with key nearshoring hotspots intended for support including the likes of Colombia, Costa Rica, the Dominican Republic, Guatemala, Panama, and Uruguay.

Although, as the El Mundo report highlights, Mexico continues to be the number one destination for companies that choose nearshoring.

Claver-Carone was keen to impress the need to encourage further investment into Latin America, highlighting how commodity price rises have been responsible for a significant proportion of the growth that is being seen in Latin America.

“[Commodity price-driven growth] has happened in the past. And what was done with that money then? It was largely wasted on electoral and populist programs,” he told El Mundo.

Nearshoring on the rise

While nearshoring usually refers broadly to the movement of operations from Asia to Latin America to be closer to major markets in North America, the heavy historic dependence of US companies on Chinese labor for manufacturing goods means that in a large proportion of cases it refers specifically to the movement of production away from China — an increasingly assertive rival to the United States on the global stage.

Nearshoring has been a growing trend over recent years, with the 2019 Kearney Reshoring Index highlighting how exports from Mexico to the United States had increased by $28 billion compared to the previous year – a 10% year-over-year increase in keeping with what Kearney reported to be an historic high for US companies nearshoring to the Americas and reshoring back to the US.

The COVID-19 pandemic caused significant disruption to the trend, as shutdowns and skewed consumption affected production, with Mexico’s manufacturing exports to the United States tumbling 10% in 2020 as demand for the likes of automobiles tanked.

That saw the authors of the 2020 edition of the Reshoring Index declare it “uniquely challenging to interpret.” Nevertheless, they noted the ongoing attraction of nearshoring for US companies.

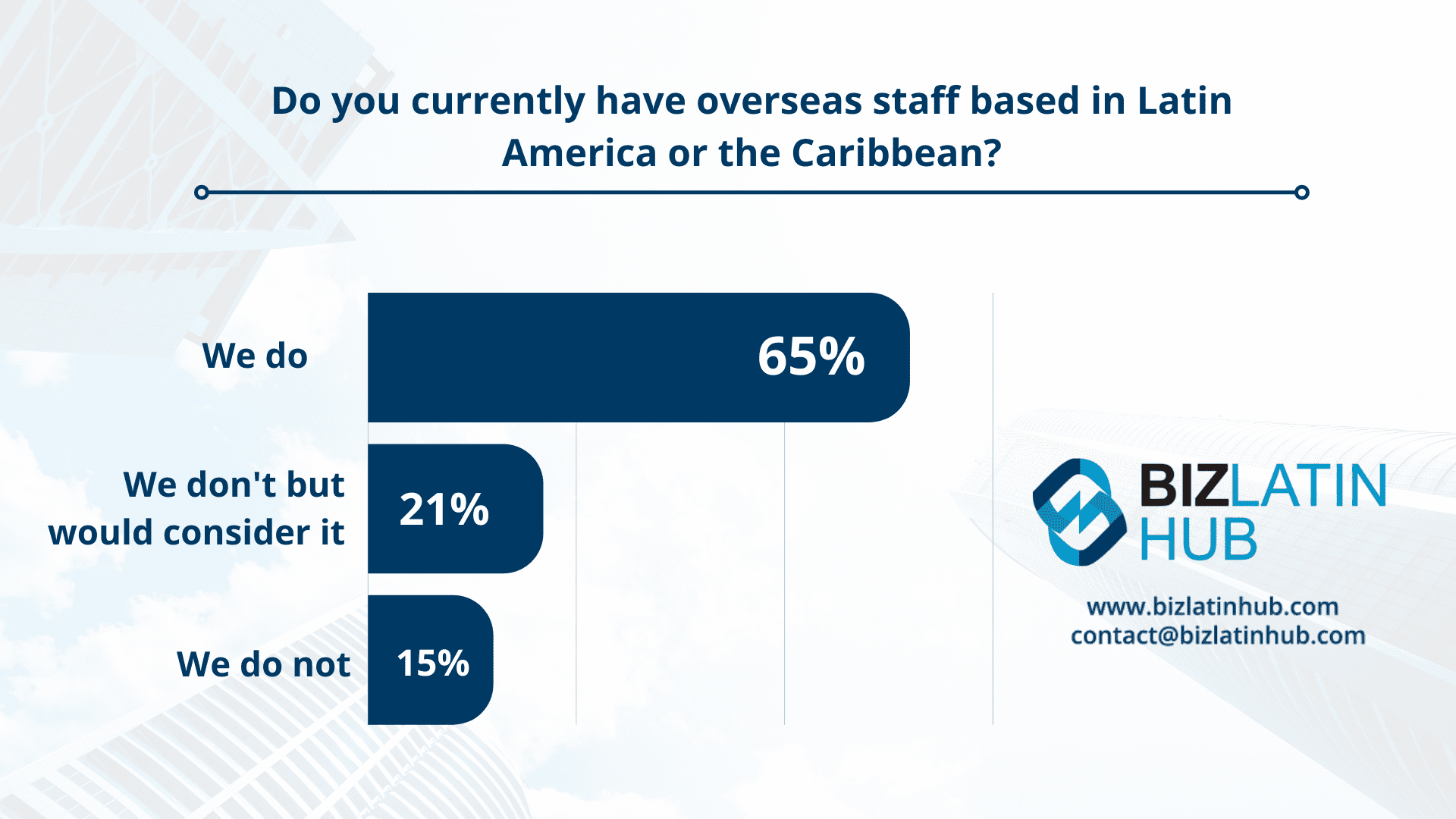

In a survey of US manufacturing executives, the study noted that many saw nearshoring even more favourably than reshoring back to the US, with larger companies particularly inclined towards the option.

Factors driving nearshoring

Two of the most widely-recognized drivers of nearshoring are rising costs in Asia and political tensions between the United States and China, however the global shipping crisis of late-2020 also highlighted another.

Nearshoring allows companies to significantly reduce costs and vulnerabilities related to shipping their products to market. In the case of firms that relocate to Mexico, in some cases goods can arrive in the United States on the same day they are dispatched from production facilities across the border.

The fact that Latin America is sat across similar time zones to the United States is another reason why nearshoring is a favoured option compared to other alternatives to China, such as Southeast Asia. That is compounded by rising English proficiency levels in Latin America – significantly higher than that seen in Southeast Asia – making nearshoring increasingly attractive to US companies.

Moreover, with Latin America increasingly recognized as a hub for tech talent at highly competitive prices, including a host of innovation hotspots being declared new ‘Silicon Valleys’ in recent years, businesses in a growing number of sectors are looking to the region.

Biz Latin Hub can assist you in Latin America

At Biz Latin Hub, we help investors bridge the cultural and linguistic barrier they encounter when doing business in Latin America and the Caribbean, providing tailored packages of integrated back-office services to suit every need.

We have offices in 16 markets around the region, and our unrivaled reach makes us ideal partners to support multi-jurisdiction market entry and cross-border operations.

Our comprehensive portfolio of services includes accounting & taxation, company formation, due diligence, hiring & PEO, and corporate legal services, among others.

Contact us to find out more about how we can assist you doing business in Latin America and the Caribbean.

Or read about our team and expert authors.