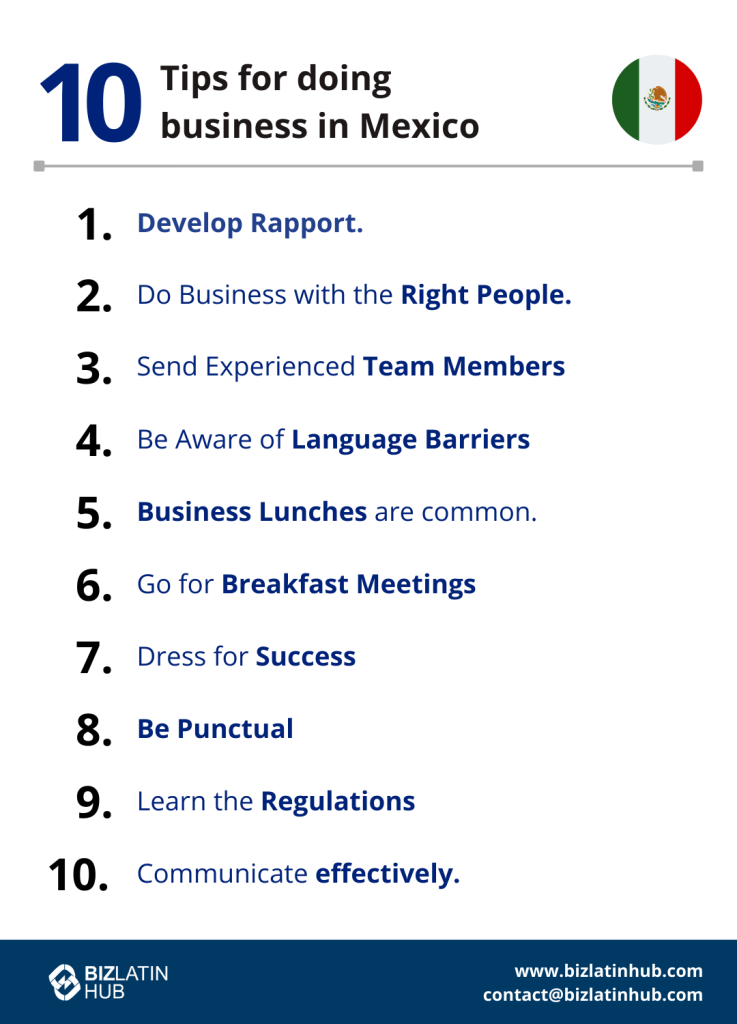

Explore essential tips for doing business in Mexico in 2025, including cultural nuances, legal requirements, and strategic advice for successful market entry.

Doing business in Mexico in 2025 offers significant opportunities for foreign investors, thanks to its strategic location, skilled workforce, and robust manufacturing sector. It’s important to learn about the new culture where you undertake business and to respect and adhere to local laws and customs. Read on to explore 10 cultural tips to use for entering the market or company formation in Mexico. The country is on the way to becoming a top-ten economy in the world within the next decade. Companies doing business in Mexico benefit from its extensive free trade agreements, proximity to the U.S. market, and a growing emphasis on nearshoring operations.

Key takeaways on doing business in Mexico

| Is foreign ownership allowed in Mexico? | Yes, 100% foreign ownership is permitted in the country. |

| Most important sectors in Mexico | Key sectors in Mexico include: Tech developers Heavy industry e-commerce Fintech Customer support |

| Are there Free Trade Zones in Mexico? | The entire northern border zone with the USA is known as a hassle-free zone in which import and export taxes are not applied. |

| Incentives for Foreign Direct Investment in Mexico | The government brought in rules to incentivise nearshoring operations in 2023. These provide tax exemptions on infrastructure necessary for business operations and other benefits for companies that commit to the country for a set number of years. |

| International links | Mexico has 13 free trade agreements, but the most important is its membership of the USMCA area, meaning preferential treatment in the US economy. |

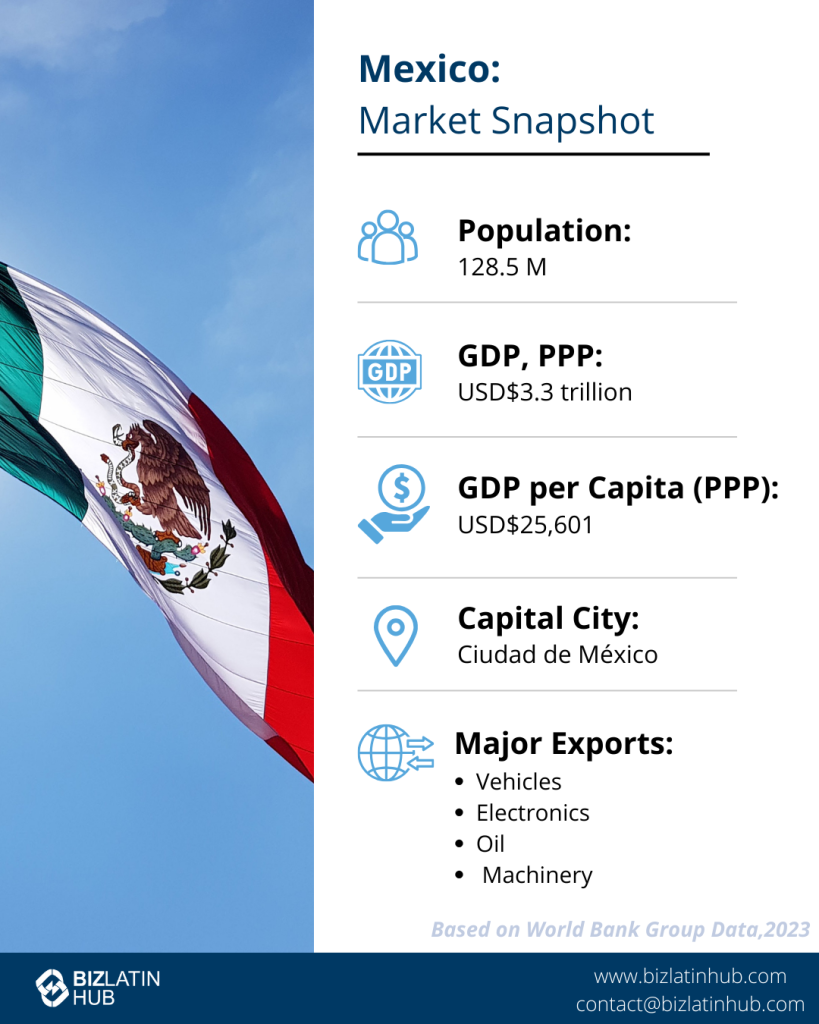

An overview of the economy for doing business in Mexico

It could be said that for every company that quits China amid heightened tensions with the US and a de-facto trade war between the two powers, there’s a company ready to nearshore in Latin America. Nearshoring in Mexico is perhaps the most visible place to see this. Businesses are flocking to the country to ensure secure shipping routes and logistical connections.

A growing number of US companies sooner or later realized they couldn’t rely on China. Disruptions in global supply chains brought on by a variety of global events have led many companies to move their operations closer to home. Expanding a presence to countries with proximity to a company’s customer base, seemed like a logical move for many. More often than not, nearshoring in Mexico has become the country of choice.

From Monterrey to Porto Alegre, remote working has created technology and innovation hubs across LATAM, and beyond the capitals of its countries. The fintech sector proliferated after the pandemic, as a great number of Mexicans started to bank online. Key sectors for doing business in Mexico include automotive manufacturing, electronics, aerospace, information technology, and renewable energy.

According to articles listed on Bloomberg online, there are three key cities that are home to a significant number of startups: 232 in Mexico City, 46 in Monterrey, and 36 in Guadalajara (commonly referred to as the Mexican Silicon Valley). The biggest global IT companies also have offices located in Monterrey. Hiring tech talent in Mexico is getting easier nowadays.

Coursera Global Skills report 2022 mentions that in México – technology skills proficiency levels are up. With more than 600 technology companies in Guadalajara, skilled workers do not lack job opportunities. The good news for employers is that skill levels are rising.

1. Doing Business in Mexico – Develop Rapport

Developing personal relationships are very important in Mexico as locals prefer to do business with those they know and trust. Building relationships will play a key role in the formation of strategic partnerships in the region. Mexicans strongly value personal relations, and rightly or wrongly, they will often not do business without them.

2. Do business with the right people

Find out who are the key decision makers and be sure to connect with them. Knowing the right person will make things more simple when beginning business operations. Organizations tend to be more hierarchical than you might expect, meaning you need to be speaking to the person who really makes things happen.

3. Send experienced team members to Mexico when doing business

If you choose to send team members to Mexico, make sure that they are of the proper seniority and experience level. Do not send new employees to do this; this may insult your potential Mexican business partners. They will want to feel that they are important to you.

4. Be aware of language barriers in Mexico

Be aware that although the you may need to bring an interpreter or have contact with a bilingual business partner who can help you navigate the Spanish language.

5. Business lunches in Mexico are common

Lunch in Mexico, called ‘la comida’, is the most leisurely and largest meal of the day. It consists of about four courses that include soup or salad, an entree, a main dish and a dessert. Due to its casual nature, ‘la comida’ is not the time or meal to discuss business over.

6. Breakfast meetings is how to do business in Mexico

A normal Mexican breakfast is earlier in the morning and often more simple, such as a cup of coffee or eggs and tortillas. It is common to discuss business at breakfast meetings.

7. Dress for success when doing business

Dress according to the weather, the Mexican culture, and the area of the country you are in. In Mexico City and other cities, individuals are expected to dress more formally than in the suburbs.

8. Be punctual

If doing business in Mexico City, make sure that you have enough time to travel to your destination. It is important to be punctual out of respect for your business partners’ time. The city doesn’t always make this easy, so plan ahead and leave plenty of time for delays.

9. Learn the rules and regulations of Mexico

Knowing the rules and regulations of the Mexican business environment will prevent potential bumps in the road during business dealings. Legislation to be familiarized with includes employment law, import/export laws and customs requirements.

10. To do business you must communicate effectively

Communication is very important when doing business. In Mexico, it is custom to stand at a close physical distance when speaking to one another. Standing farther away, as is the custom in the U.S, may be construed as unfriendly.

Why Mexico Remains a Prime Investment Destination in 2025

Mexico continues to be a top choice for foreign investors in 2025, offering a stable economy, strategic geographic location, and a pro-business environment. The country’s commitment to infrastructure development and economic diversification further enhances its appeal.

Key reasons to invest in Mexico:

- Strategic Location – Serving as a bridge between North and South America, Mexico is a logistical hub with access to major markets.

- Favorable Trade Agreements – Mexico has 13 free trade agreements, including the USMCA, providing preferential access to numerous markets.

- Robust Manufacturing Sector – Mexico is a global leader in automotive and electronics manufacturing, attracting significant foreign investment.

- Skilled Workforce – A growing pool of bilingual professionals supports diverse business operations.

- Government Incentives – Various programs offer tax incentives and support for foreign investors in key sectors.

Local Tip:

When establishing a presence in Mexico, consider leveraging the benefits of industrial parks and special economic zones to maximize operational efficiency and cost savings.

Company formation in Mexico

To start a company in Mexico, foreign investors must choose a legal structure (commonly a Sociedad Anónima or Sociedad de Responsabilidad Limitada), register with the Public Registry of Commerce, obtain a Tax Identification Number (RFC) from the Tax Administration Service (SAT), and comply with local labor and social security regulations. The process typically takes 4–6 weeks with proper legal assistance.

Doing business in Mexico requires compliance with local regulations, including company registration with the Public Registry of Commerce, obtaining a Tax Identification Number (RFC), and adhering to labor and social security laws.

Local Insight for 2025:

Mexico’s emphasis on nearshoring and its extensive trade agreements continue to create new opportunities for foreign investors, particularly in sectors aligned with sustainable growth and innovation.

FAQs on doing business in Mexico

Answers to some of the most common questions we get asked by our clients.

1. Can a foreigner own a business in Mexico?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

2. Are there Free Trade Zones in Mexico?

| The entire northern border zone with the USA is known as a hassle-free zone in which import and export taxes are not applied. |

3. How long does it take to register a company in Mexico?

Registering a company in Mexico takes 10-12 weeks.

4. Which sectors are important in Mexico?

Key sectors in Mexico include:

Tech developers

Heavy industry

e-commerce

Fintech

Customer support

5. Does Mexico have trade agreements with other countries?

Mexico has 13 free trade agreements, but the most important is its membership of the USMCA area, meaning preferential treatment in the US economy.

6. What entity types offer Limited Liability in Mexico?

In Mexico, the S.R.L (Sociedad de Responsabilidad Limitada) is a limited liability company.

7. Is Mexico a good country for doing business in 2025?

Yes. Mexico offers a stable economy, strategic location, and investor-friendly policies, making it an attractive destination for foreign businesses.

8. What types of businesses succeed in Mexico?

| Businesses in manufacturing, automotive, electronics, information technology, and renewable energy thrive due to Mexico’s strategic advantages and supportive regulatory environment. |

Biz Latin Hub can help with doing business in Mexico

Doing business in Mexico is a great opportunity to expand your business horizons. There is so much to learn about the culture and about how Mexicans do business. If you’re considering doing business in Mexico in 2025, Biz Latin Hub offers comprehensive support for company formation, legal compliance, and strategic market entry.

If you would like personalized advice, Biz Latin Hub has a group of experts that can offer you guidance for your business in Mexico. In addition to company formation and incorporation, we offer professional accounting, legal, and financial services tailored to you and your company’s needs. Contact us here at Biz Latin Hub for help on getting your business set up in Mexico.

Also, you can learn more about our team of professionals and how they are enabling commercial growth across Latin America.