A Professional Employer Organization (PEO) in Mexico is a valuable resource for testing market entry and establishing your business successfully. By managing critical HR functions, a PEO enables you to focus on scaling operations while navigating Mexico’s legal and operational complexities. Collaborating with a trusted local partner is essential, and Biz Latin Hub delivers expert support with its extensive experience across Latin America. From market entry to company formation in Mexico, we offer the services needed to help your business succeed in Mexico and the wider region.

Key Takeaways

| Is it legal to hire in Mexico through PEO services? | Yes it is legal to hire employees through a PEO in Mexico. |

| What are the benefits of hiring through an PEO in Mexico? | Hiring through a PEO in Mexico provides quick access to the market without the need to establish a local entity, letting you focus on scaling-up. |

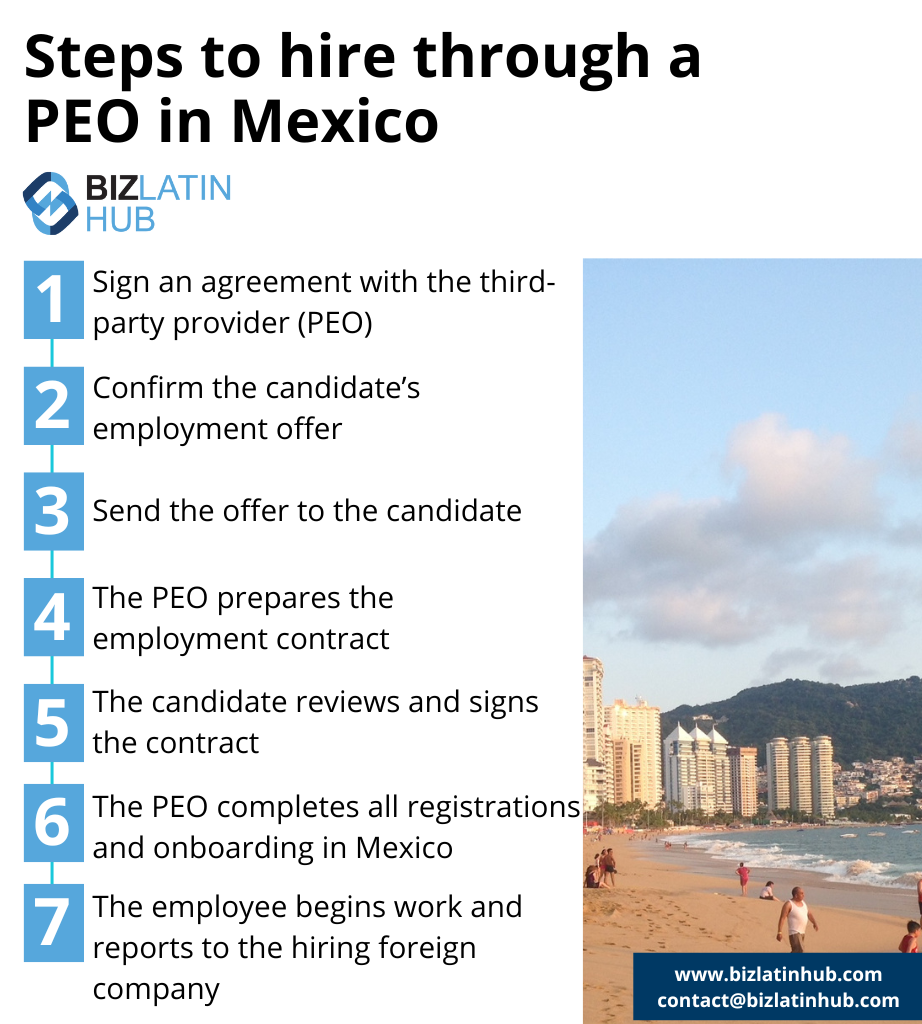

| Steps to hire through a PEO in Mexico | Sign an agreement with the third-party provider (PEO). Confirm the employment offer for the candidate. Send the employment offer to the candidate. Once the candidate accepts the offer, the PEOprepares the employment contract, acting as the employer of record. The candidate reviews and signs the employment contract. The PEO, as the employer of record, completes all mandatory employee registrations in Mexico. The employee begins work and reports to the hiring foreign company. |

| Why employ Mexican workers? | Hiring employees in Mexico allows businesses to tap into a skilled and cost-effective workforce while gaining access to a growing market. |

Why use a PEO or professional employer organization in Mexico?

If you are looking to test the market in Mexico, PEO services are an excellent tool by handing over the responsibility for the management of the salaries and benefits of those workers, with the PEO firm also able to assist with their recruitment and drawing up and processing all legal documentation, such as contracts.

That is an attractive arrangement for anyone who only needs a small number of local representatives, handling sales or overseeing operations. It can also be a good arrangement when hiring a team for a short-term project such as software developers delivering an individual project.

Hiring through a professional employer organization in Mexico is also a good way of getting to know the market before making a deeper commitment through full company incorporation.

As well as the advantages in terms of time-saving and guaranteed compliance that come with hiring through a PEO firm in Mexico, another major bonus is the fact that the provider will have a well-established recruitment network and a good understanding of the local job market in terms of the best educational institutions and former employers to look for on candidate profiles.

What will a PEO or professional employer organization in Mexico do for you?

Hiring local staff through an employer of record in Mexico will avoid the pressure of going through a company incorporation process when developing commercial activities for a short period of time and will assist you with time-consuming HR tasks. This includes recruiting, hiring, firing, managing employee payroll, and paying all taxes and social benefits to local employees, ensuring your business is fully compliant with local regulations at all times.

Moreover, with a broad knowledge of labor and tax regulations, an employer of record in Mexico will hire the most suitable and qualified personnel for your company and ensure all employee contracts comply with current legislation. Some of the main benefits of working with an employer of record in Mexico include:

Employee management: An employer of record will be capable of recruiting the most suitable and adequate employees for your organization based on your needs and resources.

Legal advice and representation: Any claim related to your company’s employees will be directed to the employer of record, who is capable of representing your business and resolving many legal issues that you may encounter in relation to employees.

Time-saving: Working with an employer of record in Mexico saves you from having to deal with bureaucratic processes, and reduces administrative obligations.

Migration advice: An employer of record will guide you through the local migration system, and will oversee the process of acquiring business visas or residency permits for foreign employees, if needed.

How to Partner With an Professional Employer Organization in Mexico?

To partner with a PEO, the hiring company signs a contract with a third-party organization, designating them as the professional employer of record (EOR) for the staff members they wish to hire in Mexico. This means that, on official documentation in Mexico, the third-party organization (the PEO/EOR) assumes responsibility for complying with all employment regulations for the staff member.

This arrangement allows the foreign company to avoid the complexities of understanding and adhering to Mexican employment laws on its own. Consequently, the foreign company reduces its risk of non-compliance and can direct its focus toward business development and market growth in Mexico.

The process of hiring an employee through an employer of record in Mexico is straightforward. Below is an outline of the steps involved:

- Sign an agreement with the third-party provider (PEO).

- Confirm the employment offer for the candidate.

- Send the employment offer to the candidate.

- Once the candidate accepts the offer, the PEO prepares the employment contract, acting as the employer of record.

- The candidate reviews and signs the employment contract.

- The PEO, as the Professional Employer Organization, completes all mandatory employee registrations in Mexico.

- The employee begins work and reports to the hiring foreign company.

PEO vs. EOR in Mexico – What’s the Difference?

When expanding into Mexico, businesses often choose between a Professional Employer Organization (PEO) or an Employer of Record (EOR) to hire and manage employees.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations.

Note that PEO and EOR are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms.

Important Tip: While an EOR provides a quick-entry solution, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in Mexico. Biz Latin Hub offers both PEO and EOR solutions, helping businesses navigate regulations, establish entities, and ensure full HR compliance. Whether you need a fast market entry or a stable long-term presence, we can guide you through the process.

Employer Responsibilities in Mexico

As part of PEO payroll company services, your PEO or professional employer organization in Mexico will oversee the following regulations and employee benefits:

- Working hours: Under Mexican law, the working week is a maximum of 48 hours long, with at least one full day of rest.

- Minimum wage: Mexico has two minimum wages, based on geography, with a higher minimum wage in the US border regions.

- Bonuses: Mexican employees are entitled to a 13th-month bonus which must be paid by December 20th.

- Profit sharing: Companies in Mexico are obliged to share 10% of their net annual profits with their employees.

- Vacation: Employees are entitled to six days of paid vacation after one year of service, with that allowance increasing by two days per year up until the fifth year.

- Sick Leave: An employee receives 60% of their salary if they are unable to attend work for more than 3 days due to illness.

- Parenthood leave: Paid maternity leave in Mexico totals 12 weeks, starting six weeks before the due date. Paternity leave totals five days.

How to Use a Payroll Calculator

If you want to get an idea of the possible costs involved in payroll outsourcing in Mexico, using a payroll calculator is one way to get a good estimate.

Although a payroll calculator won’t be completely accurate, it will give you the opportunity to evaluate options while varying the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, compared to what is most convenient for you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff in Mexico would be, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

FAQs on Hiring Through a PEO, or Professional Employer Organization in Mexico

1. How does one hire employees in Mexico?

You have the option to employ someone either by establishing your own legal entity within the country and utilizing it for hiring purposes, or by engaging a professional employer organization in Mexico or employer of record (EOR). An EOR, a third-party entity, enables you to recruit employees in Mexico by serving as the legal employer.

2. What is in a standard employment contract in Mexico?

A standard Mexican employment contract should be written in Spanish (and can also be in English) and should include the following details:

- ID and address of the employer and employee.

- City and date.

- The location where the service will be provided.

- Type of tasks to be carried out.

- Remuneration and bonifications/commissions (if applicable).

- Method payment frequency.

- Duration of the contract.

- Probation period.

- Work hours.

- Additional benefits (if applicable).

3. What are the mandatory employment benefits in Mexico?

The mandatory employment benefits in Mexico are the following:

- Aguinaldo.

- Vacation.

- Vacation premium.

- Social security.

- Profit sharing.

- Maternity/paternity leave.

- Sunday premium.

- Paid time-off for national holidays.

For more information on mandatory employment benefits read our recent article on employment laws in Mexico

4. What is the total cost for an employer to hire an employee in Mexico?

The total cost for an employer to hire an employee in Mexico can vary depending on the salary. However, as an indication, the cost to the employer for mandatory employment benefits is 40% to 50% on top of the employee’s gross salary, although this can vary depending on specific conditions and agreements.

Please use our Payroll Calculator to calculate employment costs.

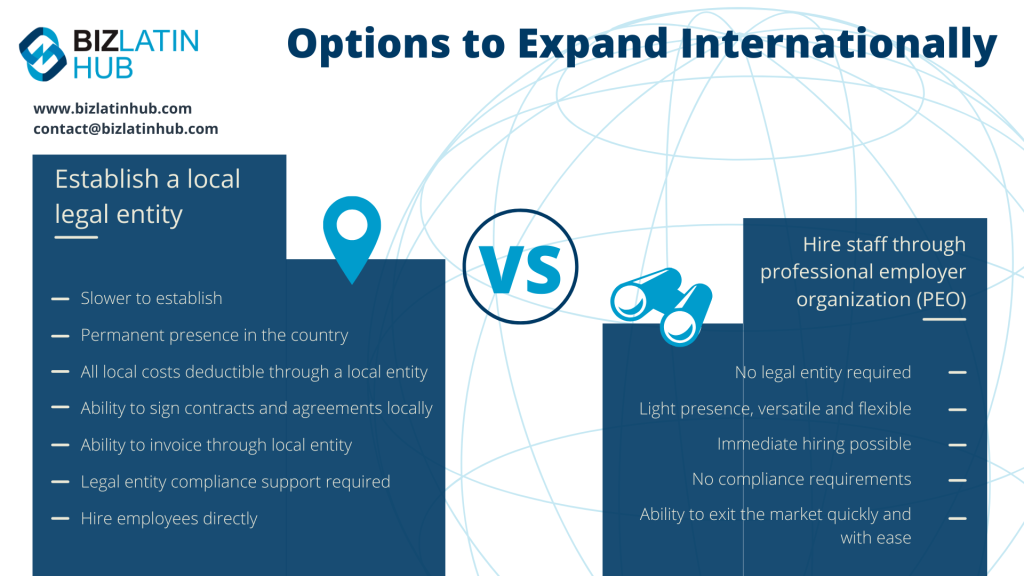

5. How does the process of forming a legal entity differ from hiring through an EOR?

Forming a legal entity is different to hiring an EOR in the following ways:

- It is more time-consuming.

- Creates a permanent presence in the country.

- Expenses are deductible through a local entity.

- Enables the ability to execute contracts and agreements locally.

- Facilitates invoicing through a local entity.

- Requires compliance support.

- Empowers direct hiring of employees.

6. What is the difference between a PEO and an EOR?

While a PEO functions as co-employer, an EOR assumes the role of the formal employer for your staff. Typically, a PEO provides a wider array of services compared to a EOR.

Why Invest in Mexico?

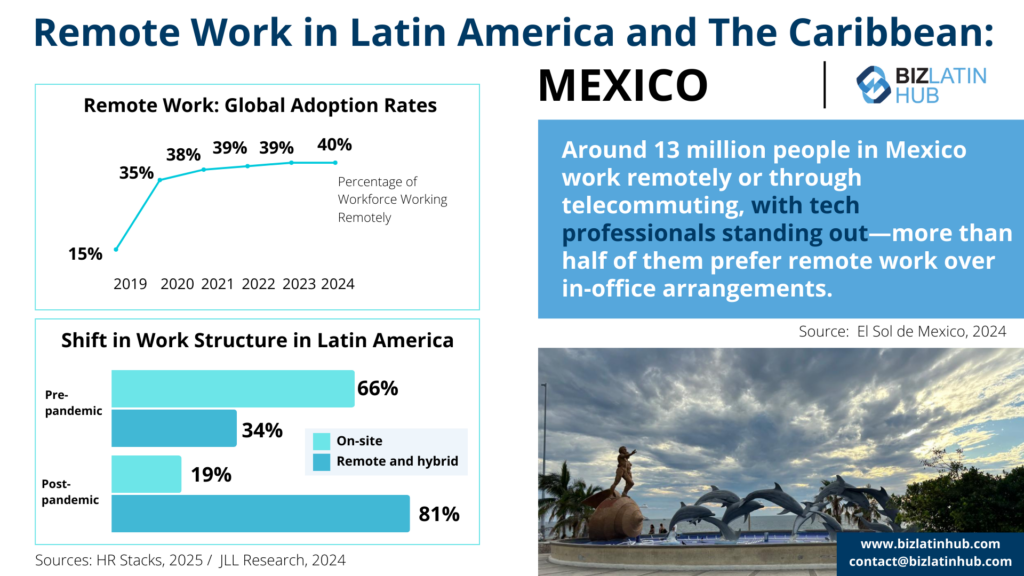

Mexico is the second-largest economy in Latin America and is projected to be in the top 10 global economies by 2050. The opportunities for investment are endless, with an ever-growing selection of emerging industries offering good prospects for doing business.

With a gross domestic product (GDP) exceeding USD$1trillion, Mexico has the second-largest economy in Latin America, second only to Brazil. It attracts more than USD$29 billion in foreign direct investment (FDI) inflows.

Mexico is known as a major trade hub. It has more than $1.7 billion in goods crossing its border with the United States each day. Its major ports serve both the Pacific and Atlantic oceans. There’s also a large agricultural sector and industrial output, with a heavy concentration of manufacturing facilities along the border with the United States. The country is also home to an increasingly influential tech and innovation sector.

As such, whatever type of business you are doing, Mexico has the human capital available. However, partnering up with a local provider with a good understanding of the market and all aspects of employment law in Mexico will help you secure the best talent while remaining in full compliance with the law. For that reason, hiring via a professional employer organization (PEO) in Mexico might be your best option.

Biz Latin Hub can be Your Professional Employer Organization (PEO) in Mexico

At Biz Latin Hub, we provide market entry and back-office services throughout Latin America and the Caribbean, with offices in 17 key cities around the region, meaning we are ideally placed to support multi-jurisdiction market entries.

Our portfolio includes accounting & taxation, company formation, due diligence, hiring & PEO, and corporate legal services.

Contact us today to find out more about how we can assist you.

If you found this article on finding a professional employer organization in Mexico of interest, you may want to check out the rest of our coverage of this North American country Or read about our team and expert authors.