Recruiting the right talent is vital for any business, but it becomes complex in different locations. Saint Lucia, a West Caribbean jewel, presents unique recruitment and staffing dynamics. Saint Lucia’s recruitment landscape is shaped by various factors, including labor laws and available talent. Recruitment is necessary after company formation in St Lucia. This guide outlines a step-by-step process for a successful recruitment cycle and explains how a Professional Employer Organization (PEO) can manage the legal and administrative aspects of hiring.

Key Takeaways: Recruitment and Hiring in Saint Lucia

| What are the main steps in the hiring process? | Step 1: Define the Job Profile Step 2: Recruit and Select Candidates Step 3: Draft a Compliant Employment Contract Step 4: Onboard the New Employee Step 5: Manage Payroll and Compliance |

| Why use EOR/PEO services? | A PEO or Employer of Record (EOR) can hire staff without a local entity. |

| What are the employer’s obligations to the National Insurance Corporation (NIC)? | All employers must register with the NIC and make monthly contributions for their employees, which covers a range of benefits including pensions and sick pay. |

| Are oral contracts legal? | A written statement of employment particulars is required by law. |

| How can a recruitment agency assist in finding talent? | Agencies simplify complex hiring landscapes and ensure compliance with labor laws. |

The 5-Step Hiring Process in Saint Lucia

Step 1: Define the Job Profile

Clearly outline the duties, responsibilities, and required qualifications for the position to attract the right candidates.

Step 2: Recruit and Select Candidates

Advertise the position and conduct interviews. You can manage this process internally or use a professional recruitment agency to help source local talent.

Step 3: Draft a Compliant Employment Contract

Prepare a written statement of particulars that complies with the Labour Act, detailing all key terms of employment.

Expert Tip: Specifying the Probationary Period in the Contract

From our experience, a crucial element to include in the written employment contract is the probationary period. The Saint Lucia Labour Act allows for a probationary period of up to three months, during which either party can terminate the employment without notice.

For this to be legally enforceable, it must be explicitly stated in the written employment agreement provided to the employee at the start of their employment. We advise all clients to include this clause as standard practice, as it provides critical flexibility during the initial phase of a new hire.

Step 4: Onboard the New Employee

Handle all administrative onboarding tasks, including registering the employee with the National Insurance Corporation (NIC).

Step 5: Manage Payroll and Compliance

Set up a local payroll system to manage monthly salary payments and the deduction and remittance of all statutory contributions.

Understanding the Recruitment Landscape in Saint Lucia

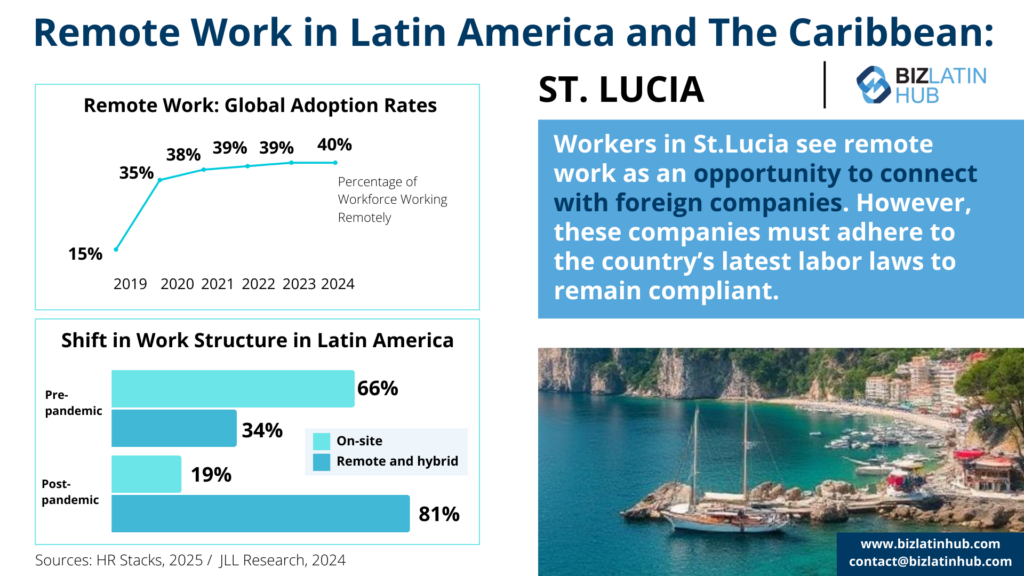

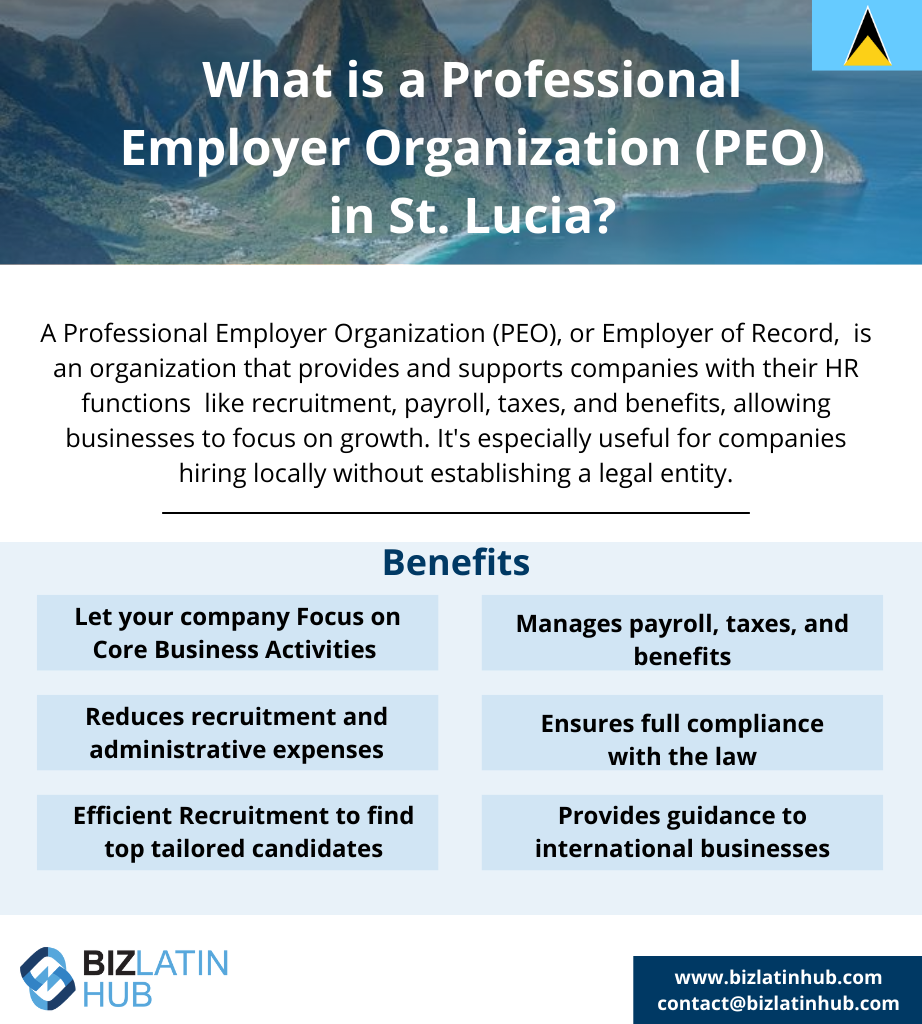

Hiring employees in Saint Lucia requires a clear understanding of the local recruitment landscape. Businesses have two main options: establish a legal entity or work with a global employment solutions provider. A Professional Employer Organization (PEO) can help manage skilled remote teams and handle complex tasks like payroll and benefits.

Here’s what you need to know:

- Legal Entity vs PEO: Setting up a legal entity provides a direct presence but involves long processes. A PEO simplifies hiring without needing local incorporation.

- Foreign Nationals: They must obtain a work permit for legal compliance.

- Local Labor Laws: Familiarize yourself with Saint Lucia’s labor laws, including minimum wage regulations and employment conditions.

- Employment Essentials: Managing payroll, social security contributions, and taxes require local expertise.

- Cultural Considerations: Respect and understand local customs and practices for effective recruitment and retention.

Understanding these elements will help streamline hiring and ensure legal compliance in Saint Lucia.

The Role of an Employer of Record (EOR)

An Employer of Record (EOR) plays a crucial role for businesses entering Saint Lucia. It acts as the legal employer, assuming all employment responsibilities. The EOR manages payroll, taxes, and compliance with local labor laws. This service allows companies to enter the market swiftly, bypassing the need to establish a local entity. While the EOR handles administrative tasks, the client company retains control of the employees’ day-to-day activities. Thus, the EOR model offers a strategic advantage, enabling fast market entry and compliance adherence. For international companies, it provides a low-risk way to test business viability in Saint Lucia.

Benefits of Using an EOR

Using an EOR offers numerous benefits for businesses looking to expand into Saint Lucia. These advantages include:

- Simplified Hiring: Takes charge of legal and administrative duties, streamlining the hiring process.

- Payroll and Tax Management: Handles payroll processing and tax compliance, which is essential for maintaining good standing.

- No Local Subsidiary Needed: Allows companies to expand operations without the time and resources required to form a local subsidiary.

- Quick Market Access: Facilitates rapid entry into new regions, providing a crucial competitive edge.

- Focus on Core Activities: Enables businesses to concentrate on their primary operations while the EOR manages employee-related legal responsibilities.

- Ensured Compliance: Helps ensure adherence to Saint Lucia’s employment laws.

- Reduced Setup Hassle: Minimizes the complexities and burdens of establishing local infrastructure.

Key Considerations When Choosing an EOR

Choosing the right EOR requires careful consideration of several factors to ensure a smooth and compliant partnership:

- Effective Task Management: The EOR must capably manage legal and administrative tasks, including precise payroll and tax handling.

- Compliance Assurance: It’s crucial that the EOR ensures full compliance with local tax obligations and employment laws to prevent potential legal issues.

- Market Entry Facilitation: Assess the EOR’s ability to enable quick market entry without the prerequisite of establishing a local entity.

- Compliant Contract Drafting: Evaluate the EOR’s proficiency in creating employment contracts that adhere to local legal standards.

- Employee Leave Management: The EOR should be adept at managing employee leave in accordance with Saint Lucian regulations.

Due diligence in selecting an EOR can streamline operations, providing peace of mind regarding Saint Lucia’s labor compliance requirements.

Using a PEO as a Hiring and Onboarding Solution

A Professional Employer Organization (PEO), also known as an Employer of Record (EOR), provides an efficient way to hire in Saint Lucia. Once you have selected your ideal candidate, the PEO can legally employ them on your behalf. This means the PEO handles the employment contract, payroll, social security contributions (NIC), and all other compliance matters, allowing you to focus on managing your new employee’s integration into your team.

It aids in establishing local entities, managing payroll, ensuring HR compliance, and handling benefits. This involves an initial investment but creates a stable working environment and helps develop company culture. Partnering with a PEO minimizes risks when entering a new market. Businesses can manage employees better and gain confidence with PEO support. This makes PEOs a popular option for companies expanding to new regions like Saint Lucia.

Advantages of PEOs for Businesses

Working with a PEO in Saint Lucia offers several advantages, allowing companies to navigate the local employment landscape more effectively:

- Focus on Core Operations: Enables companies to concentrate on their primary business activities.

- HR and Compliance Management: Handles HR responsibilities and ensures compliance with local regulations.

- Local Market Understanding: Provides insights into the local talent market.

- Efficient Resource Utilization: Uses resources efficiently to benefit the client company.

- Reduced Learning Curve: Helps businesses bypass the steep learning curve associated with foreign labor laws.

- Benefits Management: Efficiently manages annual leave and other employee benefits according to Saint Lucian labor laws.

- Simplified Compliance: Facilitates easier maintenance of compliance with all employment regulations.

- Reduced Administrative Burden: Lessens the direct administrative load on the company.

What is the difference between EOR and PEO Services

While the terms EOR and PEO are sometimes used interchangeably, they serve distinct functions, particularly concerning the legal employment relationship and the need for a local entity.

| Feature | Employer of Record (EOR) | Professional Employer Organization (PEO) |

|---|---|---|

| Legal Employer | Acts as the legal employer of record for the client’s staff. | Typically establishes a co-employment relationship; the client company often remains an employer. |

| Local Entity | Generally eliminates the need for the client to set up a local entity. | May assist with setting up a local entity, or it might be a prerequisite for the client. |

| Primary Focus | Hires and pays employees on behalf of the client, managing payroll, taxes, and compliance for swift market entry. | Offers a broader suite of HR outsourcing services, including payroll, benefits, HR administration, and compliance. |

| Typical Use Case | Ideal for quick market entry, testing new markets, or hiring staff in a country where the client has no established legal presence. | Suited for businesses seeking comprehensive, ongoing HR support and management, often when they have or are establishing a local presence. |

An EOR is particularly handy for quick market entry without setting up a local entity, a common approach for foreign firms testing the Saint Lucian market. The EOR handles legal and administrative employment tasks, allowing the company to focus on daily operations and core business activities.

Effective Recruitment Methods

Recruiting in Saint Lucia requires a blend of traditional and modern practices. The island’s economy involves key sectors like tourism, finance, agriculture, construction, and growing industries such as IT and renewable energy. Companies must understand employment costs, labor laws, and local practices to attract and retain skilled workers. Foreign nationals need work permits, a responsibility that falls on employers to handle immigration compliance. Using a Professional Employer Organization (PEO) can simplify legal processes. PEOs manage payroll and tax requirements without needing a local entity. Employers remain responsible for daily management and employee development. Effective recruitment is key to navigating Saint Lucia’s hiring landscape.

Leveraging Local Recruitment Agencies

Partnering with a local recruitment agency in Saint Lucia is a smart move. Agencies simplify complex hiring landscapes and ensure compliance with labor laws. They provide critical insights into the labor market and identify top talent in sectors like tourism, agriculture, and manufacturing. Local experts manage onboarding, payroll, and other employment tasks, reducing hiring stress. Agencies also assist with obtaining work permits for foreign nationals, ensuring compliance with immigration rules. Using local recruitment agencies facilitates easier market entry and removes the necessity of setting up a local entity directly.

Utilizing Online Platforms for Hiring

Online platforms revolutionize the hiring process in Saint Lucia. By partnering with an Employer of Record (EOR), businesses can hire swiftly and remain compliant with local laws. An EOR platform can hire and pay employees in as little as 24 hours using their app or online system. This method aligns with the monthly payroll cycle as per employment contracts. EORs handle administrative tasks, such as government registration and benefits management, ensuring accurate and timely payroll. Online platforms enable fast market entry and compliance without needing a local setup, allowing businesses to focus on core operations.

Freelancing Opportunities in Saint Lucia

Freelancing in Saint Lucia is growing quickly. Businesses are now choosing independent contractors for specialized projects. These freelancers allow for flexible work without long-term commitments. It is important to classify workers correctly.

Workers can be employees or independent contractors. This decision depends on factors like control, tools, integration, and profit potential. Independent contractors control their own schedules. They provide their own tools and take on financial risks.

This is different from employees who are more integrated into the company. Understanding these roles helps businesses navigate the workforce easily.

Navigating the Freelance Market

Saint Lucia’s freelance market offers many opportunities. Businesses often hire contractors for project-based work. Proper classification of workers is vital to avoid legal issues. Independent contractors have more freedom in their work. They decide their schedules and provide their own tools. They also handle financial risks. Employees, on the other hand, are more controlled and integrated into a company’s operations. Careful classification and documentation are necessary. This ensures compliance with local employment regulations. This way, businesses can effectively manage freelancers and mitigate potential legal risks.

Popular Freelance Platforms

Freelancers in Saint Lucia can benefit from many online platforms. These platforms help with hiring and managing independent contractors. Various online platforms can assist with this, streamlining the hiring process and ensuring compliance with local laws. Platforms like these manage contracts and payroll. They help businesses hire quickly. Another solution is the Employer of Record (EOR) service. EOR services can simplify onboarding and ensure businesses follow legal requirements. Freelancers usually provide their own tools and face more financial risks. These platforms make transitioning into freelance work easier and efficient.

Work Permits and Visas for Hiring Talent

Employers in Saint Lucia must navigate specific requirements when hiring foreign nationals. Work permits and visas are essential for legal employment. The process involves presenting a job offer, proof of skills, medical tests, and a police clearance. Employers must prioritize hiring locals before considering foreign workers. Annual renewals are necessary, keeping employment permits current.

Types of Work Permits

Saint Lucia offers several types of work permits catering to distinct employment needs. Understanding these categories is key for compliance:

- Temporary Permits: Typically issued for short-term projects or specific assignments.

- Permanent Permits: Suited for long-term employment needs.

- Specialist Permits: May be available for individuals with unique or highly specialized skills not readily available locally.

Employers must apply for the appropriate permits even if foreign workers already possess a residence permit. This ensures compliance with legal requirements and maintains fair hiring practices. Each permit type has specific criteria, including proof of qualifications and professional expertise.

Application Process for Visas

Securing a work visa for a foreign national involves a detailed application process. Employers must typically submit the following:

- A formal job offer.

- Proof of the applicant’s qualifications and relevant skills.

- A medical report or certificate.

- A police clearance certificate from the applicant’s country of origin or residence.

These documents support the application for work permits and visas. Processing typically takes 4 to 8 weeks, though this can vary with the visa type and application volume. Non-immigrant visas may be issued for single or multiple entries, serving different business travel and employment needs. A crucial aspect of the process is that employers should generally demonstrate that attempts were made to hire Saint Lucians first, thereby endorsing local job opportunities. Compliance with these steps secures legal work authorization for foreign talent.

Key Legal Aspects of Employment

Employment in Saint Lucia requires careful attention to labor laws and regulations. Employers must establish clear employment contracts detailing job duties, salaries, work hours, and termination conditions. The minimum wage in Saint Lucia is $6.52 XCD per hour. Statutory leave, including sick and vacation leave, is mandatory for employers to provide. Termination of employment must be justified with a valid reason, a notice period, and severance pay if terminated without cause. Employers must also register with the National Insurance program, with both employer and employee contributing to the scheme.

Understanding Labor Laws

Saint Lucia’s labor laws focus on fairness and safety in workplaces. Discrimination based on race, gender, or sexual orientation is prohibited. Employment contracts should include important clauses like job descriptions, compensation, and conditions of termination to follow local laws and prevent disputes. Standard work conditions involve a 40-hour week, with overtime pay at 1.5 times the regular rate. Employees are entitled to meal breaks and a day off weekly. Employers and employees each contribute 5% to the National Insurance Corporation (NIC) for social security benefits. Termination must follow specific notice periods and may need severance pay unless justified by misconduct.

Income Tax and VAT Obligations

Saint Lucia uses a progressive income tax system. After a personal allowance (for example, XCD 20,000 per annum, though this figure can be subject to change), taxable income is taxed at varying rates. For illustrative purposes, these rates might be structured as 10% on an initial portion of taxable income (e.g., the first XCD 20,000), 15% on the next segment (e.g., up to XCD 30,000), 20% on a further segment (e.g., up to XCD 50,000), and 30% on taxable income exceeding that amount. It is crucial to consult the latest official tax schedules for precise current rates and brackets. The standard VAT rate is 12.5%. Employers must apply the PAYE (Pay As You Earn) system to deduct income tax from employment earnings and remit it to the authorities. Both employers and employees also contribute 5% each to the National Insurance Corporation (NIC), based on earnings up to a ceiling (e.g., XCD 5,000 monthly or XCD 60,000 yearly, subject to official updates). Understanding these tax and VAT obligations ensures compliance and smooth business operations in Saint Lucia.

In Saint Lucia, both employers and employees must pay social security contributions to the National Insurance Corporation (NIC). This contribution is typically 10% of the employee’s insurable monthly income (up to a specified ceiling), split equally: 5% from the employer and 5% from the employee. These contributions fund essential benefits such as pensions, health care, and unemployment insurance. Employers are responsible for deducting the employee’s share from their salaries and remitting the total contribution to the NIC. Salaries are typically paid monthly, following the terms set out in the employment contract.

Structuring Payroll in Compliance with Local Laws

To comply with Saint Lucia’s payroll and tax regulations, employers must handle income tax withholdings (PAYE) and NIC contributions accurately. This involves calculating, withholding, and remitting necessary payments to the Inland Revenue Department and the NIC respectively. Employers need to ensure that National Insurance Contributions are managed correctly. Partnering with an Employer of Record (EOR) can help businesses handle these responsibilities. An EOR can manage contracts, payroll, taxes, and benefits according to local laws. The payroll cycle is usually monthly, which aligns with employment contracts. A Professional Employer Organization (PEO) can further aid businesses by supervising payroll compliance, making complex labor laws easier to deal with.

Calculating and Paying Payroll Taxes

In Saint Lucia, it is mandatory for employers to deduct National Insurance Contributions (NIC) from salaries. This deduction pays for benefits like sickness and pension. The total NIC contribution rate is generally 10% of insurable earnings (up to a ceiling), with both the employer and employee contributing 5% each. Employers must also calculate and withhold income tax from employees’ earnings under the PAYE system. Employers must follow local laws to ensure all payroll obligations are met accurately. This includes making sure that NIC payments and income tax deductions are correctly calculated and remitted. Payments follow a monthly cycle, as specified by employment agreements. Adhering to these practices ensures that payroll processes remain lawful and straightforward.

Employee Contracts and Benefits

In Saint Lucia, understanding employee contracts and benefits is essential for businesses. Contracts can be permanent or fixed-term, each serving different employment needs. Permanent contracts provide job security and benefits like health insurance and retirement plans. Fixed-term contracts, however, are designed for temporary tasks and have clear start and end dates. Employers must ensure that all employment terms comply with Saint Lucia’s labor laws. These laws protect employees’ rights, whether through direct hire or third-party organizations like an Employer of Record (EOR).

Crafting Compliant Employment Contracts

Crafting a compliant employment contract in Saint Lucia involves careful attention to legal details. Contracts can be oral or written but must clearly outline terms in a language both parties understand. If a fixed-term contract extends over two years for an ongoing role, it may be deemed indefinite by law under certain conditions. The contract should mention important aspects like salary, benefits, working hours, and termination conditions. Notice periods and training durations are also necessary elements. An EOR helps ensure compliance by drafting and managing these contracts according to local regulations.

Standard Employee Benefits in Saint Lucia

Standard benefits are a vital part of employment in Saint Lucia. Employees receive medical assistance, retirement, and pension contributions as part of their benefits package. These elements help ensure financial stability after employment ends. Paid leave is also a statutory right, allowing workers time off as needed. Social security benefits cover aspects like sickness and maternity leave. Employers must offer these benefits in line with local labor laws, including health insurance and statutory leave provisions. Ensuring all benefits meet legal standards is crucial for maintaining a fair workplace environment.

Avoiding Misclassification Risks

In Saint Lucia, clear differences exist between contractors and full-time employees. Misclassifying a worker can lead to fines and penalties. It is essential to understand these distinctions to maintain compliance with local labor laws. Correct classification ensures that both employers and employees meet legal obligations and rights. Using an Employer of Record (EOR) helps businesses avoid these risks. By doing so, companies can ensure proper worker classification without establishing a local entity.

Identifying Potential Risks

Employers face several challenges when navigating Saint Lucia’s employment regulations. Missteps can lead to legal and financial repercussions. Key risks include:

- Complexity without Local Expertise: Managing payroll, benefits, and onboarding processes can become highly complex and error-prone without specialized local knowledge.

- Legal Presence Requirements: Businesses lacking a legal entity in Saint Lucia must either establish one (a potentially lengthy and costly process) or partner with a global employment solutions provider.

- Understanding Local Laws: Navigating the nuances of Saint Lucian labor law can be a significant obstacle.

- Immigration Compliance: Hiring non-nationals brings the added complexity of adhering to work permit and visa requirements, where non-compliance can lead to serious penalties.

Best Practices for Classification

Using an EOR can significantly streamline the hiring process in Saint Lucia. An EOR handles all employment-related tasks, ensuring compliance with labor laws. This approach frees businesses from establishing a local entity while also managing payroll, taxes, and benefits efficiently. Compliance with HR standards includes respecting employment contracts, minimum wage laws, and statutory leave entitlements. An EOR ensures that employees receive their rights and benefits through compliant contracts. EOR services also allow for scalable workforce management, letting businesses adjust their staff numbers in response to changing needs. This flexibility can be invaluable for meeting business demands without long-term commitments.

Ensuring HR Compliance

Ensuring HR compliance in Saint Lucia involves following local labor laws. Companies must ensure employment contracts meet legal standards. Contracts should cover salary, benefits, working hours, and termination terms.

Key Compliance Requirements:

- Employment Contracts:

- Must detail salary and benefits.

- Include working hours and termination terms.

- Mandatory Benefits:

- Health insurance.

- Pension contributions.

- Statutory leave.

- Payroll Management:

- Calculate and distribute salaries.

- Deduct income taxes (PAYE) and social security (NIC) contributions.

Businesses should manage payroll according to Saint Lucia’s laws. This includes correct tax and social security deductions. Compliance ensures peace of mind and efficient operations. Adhering to these standards meets legal obligations and supports fair workplace conditions.

Frequently Asked Questions

What are the benefits of using a local recruitment agency in Saint Lucia?

Local recruitment agencies provide insights into the job market, assist with compliance, and help identify qualified candidates. They also handle onboarding, payroll setup, and immigration paperwork, making it easier for companies to hire without forming a local entity.

What are the key differences between an Employer of Record (EOR) and a Professional Employer Organization (PEO) in Saint Lucia?

An EOR acts as the legal employer, handling all employment-related compliance and payroll without requiring a local entity. A PEO, by contrast, usually supports companies that either already have or are establishing a local presence, offering co-employment services including HR, benefits, and payroll. EORs are ideal for rapid market entry; PEOs provide long-term HR infrastructure.

What is the difference between a recruitment agency and a PEO?

A recruitment agency helps you find and vet candidates for a role. A PEO does not find candidates; instead, it provides the legal and administrative infrastructure to employ the candidate you have already chosen.

Can I hire a non-national?

Yes, but to hire a non-national employee, you must apply for a work permit from the Department of Labour. You will generally need to demonstrate that no qualified Saint Lucian was available for the position.

What are the standard employee benefits required in Saint Lucia?

Mandatory benefits in Saint Lucia include statutory paid leave (vacation, sick leave), health and pension contributions through the National Insurance Corporation (NIC), and minimum wage compliance. Employers must also provide written employment contracts that detail job terms and benefits.

Is there a national minimum wage?

Yes, Saint Lucia has a minimum wage, but it is set by sector and job category. Employers must consult the Minimum Wages Order to determine the correct rate for their specific employee’s role.

What is the National Insurance Corporation (NIC)?

The NIC is the social security body in Saint Lucia. All employers must register with the NIC and make monthly contributions for their employees, which covers a range of benefits including pensions and sick pay.

Biz Latin Hub can help you with hiring in St Lucia

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.