Mexico is one of the most preferred destinations for investors wishing to set up a company in Latin America, thanks to its low operating costs and easy access to the U.S. and Canadian markets. If you are considering setting up a business in Mexico, the following guide to incorporating a company may be helpful.

For those with limited or short-term business interests, you can always take advantage of local labor by hiring through an official employer in Mexico. This means that the company will hire employees on your behalf, eliminating the need to incorporate.

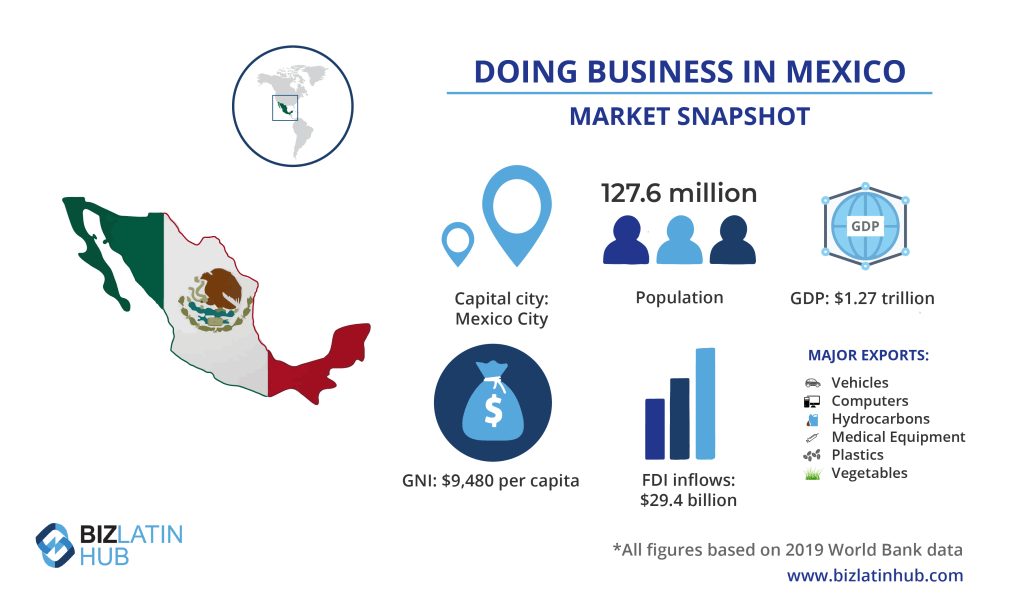

As Latin America’s second largest economy, Mexico is a beacon of regional trade. Proof of this are the more than 50 free trade agreements (FTAs) it has signed with countries and regional blocs in the Americas, Europe and Asia.

Ranked as the 17th largest exporter in the world, Mexico enjoys unique trade privileges with the rest of North America under the United States-Mexico-Canada Agreement (USMCA). In addition, as a founding member of the Pacific Alliance – an economic and political association that includes Chile, Colombia and Peru – Mexico aims to extend its influence beyond the region.

With major seaports providing access to the Pacific and Atlantic oceans, Mexico is the region’s fourth largest oil producer, producing around two million barrels per day.

If you are considering starting a business in Mexico, read on to learn how to form a company in the country, or go ahead and contact us now to discuss your market entry options.

Starting a business in Mexico: 5 key considerations

While the business-friendly ecosystem and low labor costs are two good reasons for entering the market, anyone thinking about starting a business in Mexico should consider the following necessities that could affect the success of the operation:

- Identify business opportunities: Before starting a business in Mexico, it is strongly recommended to engage with an experienced company formation services provider, able to help you identify business and investment opportunities, to avoid entering a highly saturated market.

- Entity type: You must decide which type of company will best fit your business needs before starting a business in the country. Note that your tax burden and other corporate requirements may vary depending on the legal entity you choose. The most common types of companies chosen by investors in Mexico are Limited Liability Company (SRL) and Sociedad Anónima (S.A.).

- Identify the main economic activity: When looking to form a company in Mexico, it is important to identify and define the main economic activity of your company. This is not only a requirement set by the local authorities, but it is also a good way to become an expert in your industry.

- Appoint a dependable legal representative: All companies legally established in Mexico must appoint a legal representative, who will be in charge of representing the organization before governmental entities and signing legal documents to carry out business transactions with partners and clients. Note that this person must reside in Mexico.

- Corporate tax requirements: When establishing a company in Mexico, it is important to hire a local tax advisory provider capable of helping you navigate Mexico’s tax system to maintain your company in good standing with the local authorities.

In addition, keep in mind that according to Mexican regulations, your company must fulfill the following monthly tasks:

- Renewal of the commercial register before the Undersecretariat of Industry, Commerce, and Competitiveness

- Management of accounting books

- Employee payroll

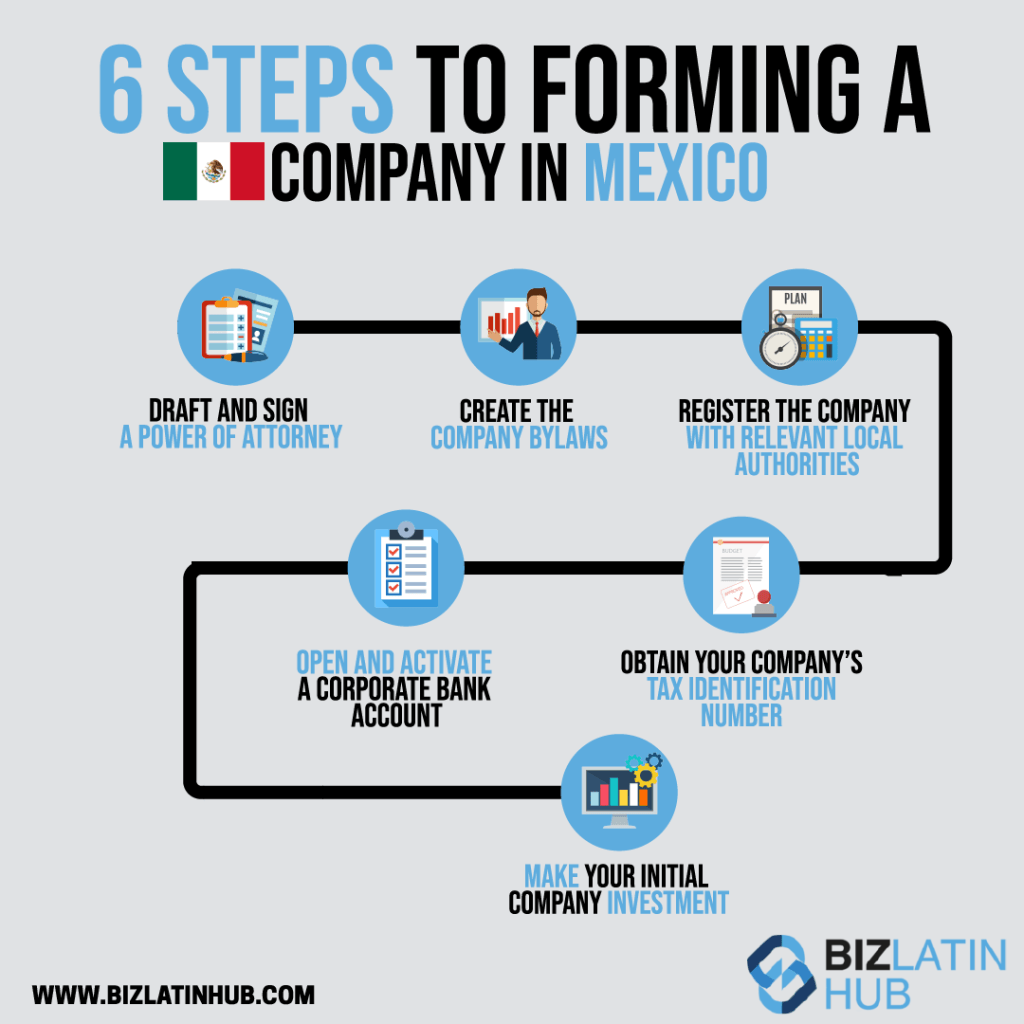

How to form a company in Mexico: 6 key steps

Starting a business in Mexico involves several essential steps that you must follow. Whether you are an entrepreneur or an investor, understanding the process is crucial to the successful formation of a business. Below are the key steps to establishing your business in Mexico:

- Step 1 – Draft and sign a power of attorney (POA).

- Step 2 – Create the company’s bylaws.

- Step 3 – Register your company before local authorities.

- Step 4 – Obtain the company and tax ID number.

- Step 5 – Open and activate a corporate bank account.

- Step 6 – Make your initial investment.

1) Draft and sign a power of attorney (POA):

Your legal representative must draft and sign a POA — a legal document that will allow you to incorporate a power of attorney on your behalf.

2) Create the company’s bylaws:

Your company bylaws are a document that will describe your business purpose and how it will function. Please note that these statutes must be legalized before a notary public.

3) Register your company before local authorities:

You must register your company with the Public Registry of Property and Commerce, specifying the real estate that makes up your business, as well as its commercial purposes, objectives, and goals.

4) Obtain the company and tax ID number:

Request and obtain your taxpayer identification number before the Tax Administration System (SAT).

5) Open and activate a corporate bank account:

Once you choose a legal representative for your company, they can take care of all the necessary procedures to open a corporate bank account at a local bank.

Here are some banks where you can open your corporate bank account:

- Banorte.

- HSBC Mexico.

- BBVA.

6) Make your initial investment:

Once all the paperwork is completed, you are ready to start your business. Make your initial investment and start running your business abroad.

Biz Latin Hub can help with company formation in Mexico

At Biz Latin Hub, our team of multilingual company formation professionals has years of experience supporting foreign investors starting a business in Mexico. With our complete portfolio of corporate legal, recruitment, and tax advisory services, we can be your single point of contact to ensure the success of your commercial operations in the South Pacific, as well as any of the other 15 countries across Latin America and the Caribbean where we are present.

Reach out to us now for personalized assistance or a free quote.

Learn more about our team and expert authors.