Peru is an attractive location for companies looking at Latin American expansion. As part of the process, or possibly as an end in itself, you may want to set up a branch in Peru. This allows you to keep working in the same way and take advantage of your existing systems and processes. While the local branch will be independent, it also positions you well to incorporate a company in Peru in the future if that becomes a goal.

The Peruvian economy experienced a 0.6% contraction in 2023 due to social unrest earlier in the year and weather anomalies. However, it is forecast to grow by 3% in 2024. As it bounces back, international investors or companies are increasingly looking to set up a branch in Peru. In terms of ease of doing business, the latest data shows that Peru ranks 76th out of 190 economies, showing that it is on the right track.

Familiarizing yourself with local regulations, understanding the business landscape and seeking guidance from experienced professionals will make it easier to set up a branch in Peru. By skillfully navigating these factors, you can streamline the process and position your business for success. Biz Latin Hub can help you do just that.

What is a Foreign Branch Office?

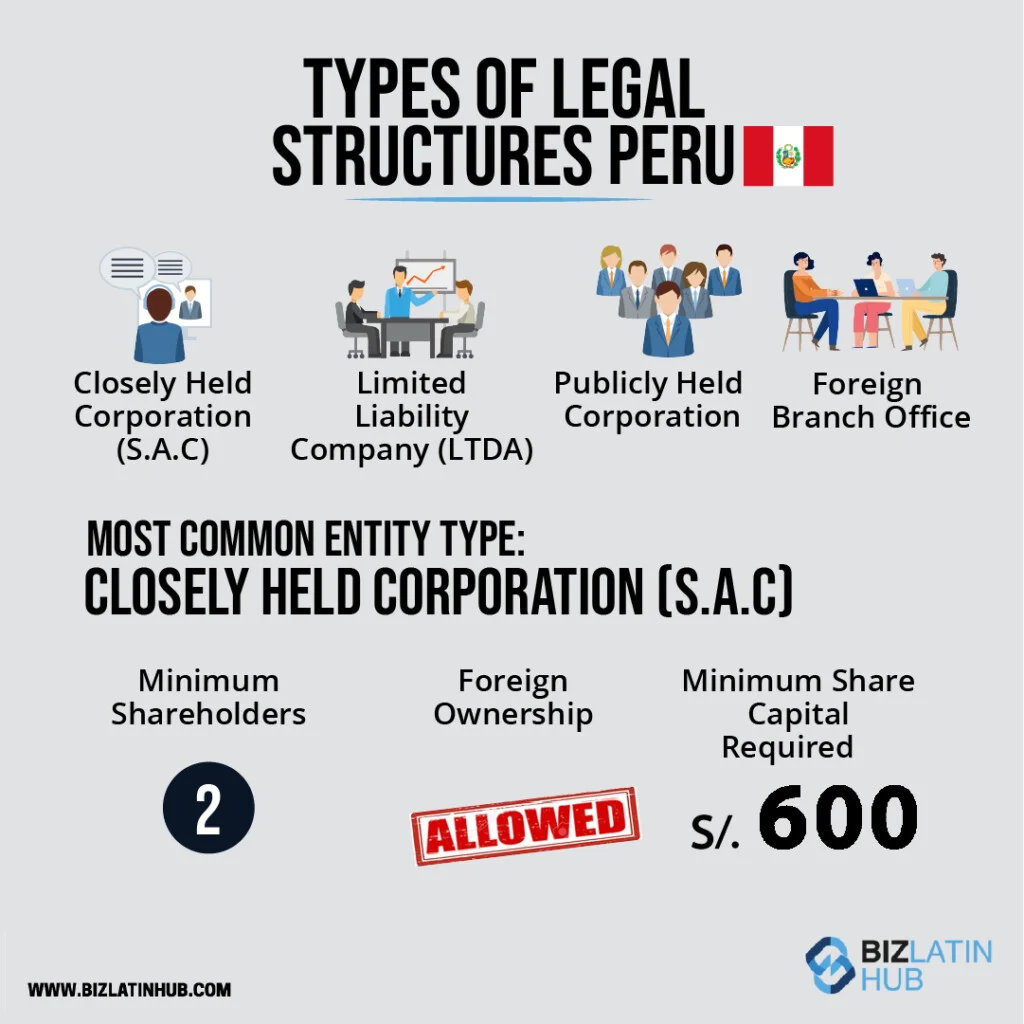

A branch office, called sucursal in Peru, is a location of business outside of the main office, which must be managed and represented by a permanent legal branch manager residing in Peru. As with all companies domiciled in Peru, branches of foreign companies are subject to a 30% Peruvian corporate tax rate. Nevertheless, foreign branches are not considered legally independent from the parent company but are still managed autonomously by the branch manager, who usually takes orders from the main office. For this reason, the parent company must already be registered and recognized by the Peruvian Mercantile Registry (RMP).

3 Advantages of having a branch

- Foreign companies can access a new market with the help of branch offices and offer its products/services to a new customer base.

- A foreign branch office isn’t set up from scratch, but rather takes on the resources and know-how from the parent company. Existing strategies and processes can be imported from head office and there will be a solid base of both hardware and software.

- Because the branch office is not considered legally independent from its origin, the parent company can still provide support to its branch office, providing investments in case of unexpected losses.

How to set up a branch in Peru

In order to set up a branch in Peru, a Public Deed of Incorporation of the Branch Office is necessary. In addition, a ‘Certificate of Good Standing’ will be needed by the parent company, including a copy of the articles of association, bylaws or equivalent instruments in the country of origin. Next, a statement of agreement to set up the branch is needed, including information about the capital stock assigned to the branch, the activities to be performed, a statement of the location of the office and the appointment of minimum one legal representative.

There are two different instances, of how this agreement statement can be validated.

- With a Haag Apostille, the Foreign Affair Ministry of Peru (Ministerio de Relaciones Exteriores, RREE) can directly accept the legal validity of this document.

- If this is not the case, the Peruvian consulate in the country of origin and the Ministry of Foreign Affairs needs to authenticate the incorporation agreement.

In addition, the company legal representative of the branch shall be given enough authority to deal with any issues that arise. The RREE needs to legalize the power of attorney appointed to the representative and thus a statement written in Spanish must be forwarded. Lastly, it is very important to have legal representation for the branch just as there would be for any other type of company being created in Peru. As with the other company categories, the legal representative must be a Peruvian citizen or a foreigner with a Peruvian residency.

FAQs on local branches in Peru

In our experience, these are the most frequently asked questions from our clients:

1. Can a foreigner own a branch in Peru?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

2. How long does it take to set up a branch in Peru?

It takes 6 weeks to set up a branch in Peru.

3. What are the key benefits of creating a branch in Peru instead of a subsidiary?

Creating a branch offers advantages such as simpler registration procedures, cost-effectiveness, it allows the use of the parent company’s brand (prior registration) and the transfer of experience and know-how. and greater operational flexibility compared to establishing a subsidiary.

4. Do I need to have a physical presence in Peru to create a branch?

While having a physical office or establishment in Peru is not mandatory, maintaining a local representative or agent is necessary for legal and administrative purposes.

Biz Latin Hub can help you set up a branch in Peru

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Lima, Peru, as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge about how to set up a branch in Peru, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent, or otherwise do business in Latin America and the Caribbean.

Or read about our team and expert authors.