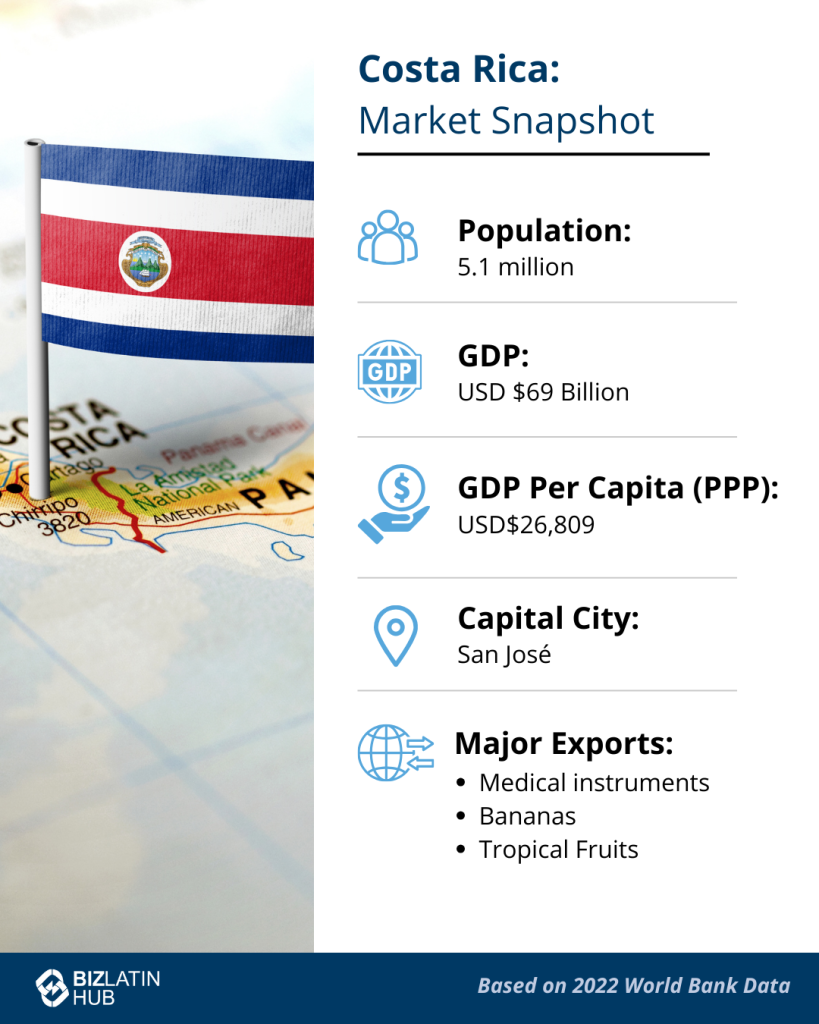

Costa Rica sometimes flies under the radar a little, but this small Central American nation packs a powerful punch economically. With both Atlantic and Pacific coasts, it is able to trade in both directions. With a high GDP per capita by regional standards, there are an increasing number of people looking to import and export in Costa Rica.

It is a politically and economically stable country, and for several years now, it has experienced substantial economic growth, with its GDP having tripled since 1960. With international trade underpinning this economic success story, it is no surprise that import and export in Costa Rica is seen as a key priority for the government.

In recent years, the trade sector has been expanding with many lucrative opportunities available for those interested in forming a company in Costa Rica. At Biz Latin Hub, we can help you import and export in Costa Rica or elsewhere in the region, as we have 18 dedicated local offices across Latin America and the Caribbean.

What is the economic outlook for import and export in Costa Rica?

Conditions for trading in Costa Rica are aimed at attracting investors. The liberalization of trade in Costa Rica has augmented Foreign Direct Investment (FDI), productivity growth and economic diversification.

Costa Rica’s main imports:

- Electrical Machinery (US$1.56 billion)

- Motor Vehicles and Cars (US$1.48 billion)

- Industrial Machinery (US$1.38 billion)

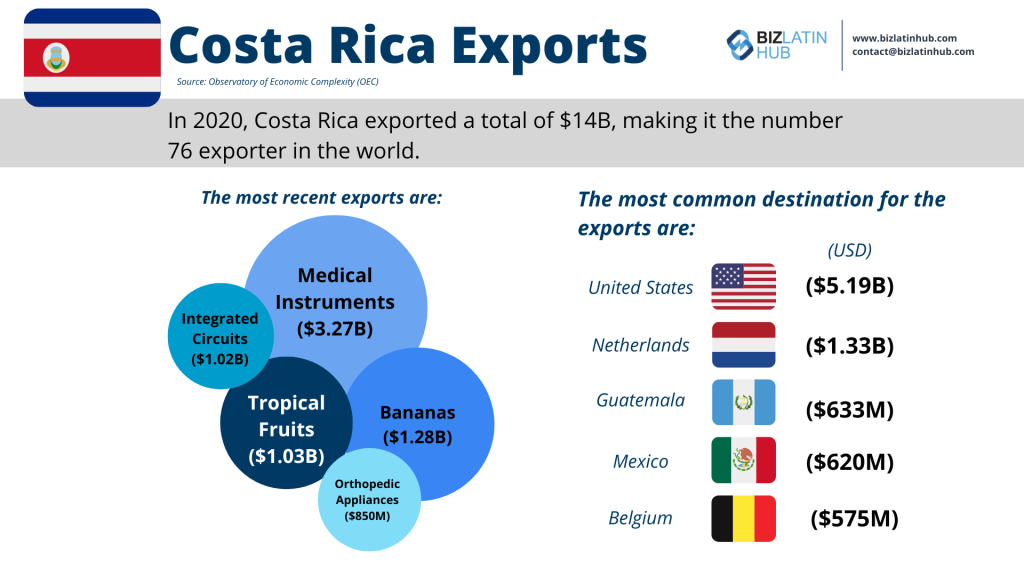

In 2017, Costa Rica shipped US$10.6 billion worth of goods to countries worldwide. Costa Rica’s main exportation destinations include the United States, Netherlands, Panama, Belgium, and Nicaragua.

Costa Rica’s main exports:

- Medical and Technical Equipment (US$2.60 billion)

- Fruit and Nuts (US$2.07 billion)

- Electrical Components (US$436 million)

There are plenty of exciting business opportunities in Costa Rica and many worth exploiting. One sector to keep an eye on is the electrical components sector. With the arrival of Intel, the world’s largest manufacturer of PC microprocessors, the exportation of electrical components has increased exponentially. Companies in any of the aforementioned industries, but particularly the new and thriving electrical components industry, should look to Costa Rica as an attractive business venture.

Benefits of Trading in Costa Rica.

Free Trade Agreements

Costa Rica is a member of the World Trade Organisation (WTO) and it has a number of crucial Free Trade Agreements (FTAs). It has established FTAs with Latin American countries including Mexico and Chile, CARICOM (the Caribbean States Community), the US, Central America and Dominican Republic (CAFTA-DR) and with the EU (European Free Trade Association). These FTAs provide for easier and dynamic trading relations with the countries involved.

Tax Exemption

- Free Trade Zones – Companies trading within Costa Rica’s enjoy numerous fiscal advantages that contribute to the country’s success in international trade. One of the most important benefits is the 100% tax exemption for customs duties on imports and exports. There are several different types of companies that can benefit from the Free Trade Zone System Regime. One such example is manufacturing companies that are investing more than USD$6.5 million. These companies can enjoy 100% tax exemption for an eight-year period and a subsequent 50% tax exemption for the following four years.

- Exportation – Exporting products from Costa Rica are tax-exempt although there are some exceptions in regards to the product to be exported.

- Tourism – Tourism companies are subject to several incentives and benefits under the Incentives Law for the Development of Tourism (ILDT), provided they comply with certain requirements.

- Products originating from Central America – The Central American Integration Treaty (Sistema de la Integración Centroamericana (SICA)), signifies that specific products are exempt from paying ‘Tarifa de Derecho Arancelarios a la Importacion’ (DAI) and this is done through the Central American Customs Form (FAUCA).

In order to start trading in Costa Rica, it is essential to be aware of the existing legislation and requirements for importation and exportation.

Legal Process and Requirements to Import and Export in Costa Rica

Importation Requirements

- Register as an Importer at PROCOMER (Office of Foreign Trade Promotion of Costa Rica) to begin the process of market entrance.

- Find a Customs Agent (Agente Aduanero) and give them the relevant information about your company:

- They act on behalf of third parties and can assist companies with the legal requirements to nationalise their product.

- Product Registration – Declaration of Merchandise (DM) before the Customs General Office.

- Import licenses/permits are required for certain products and these must be obtained from the respective Ministries or departments:

- For example, when importing food, a license is needed from the Department of Agriculture and Animal Control (Ministerio de Agricultura y Ganadería).

- Certification – Obtain an Origin Certificate (Certificado de Origen – C.O):

- The Unit of Origin has to verify and certify the origin of goods.

Importation Tariffs

Import Tariffs (Derechos Arancelarios a la Importación (DAI)) are paid to the Costa Rican Treasury Department (Ministerio de Hacienda). The DAI ranges from 1% to 15%, depending on the classification of the goods (e.g. 1% for a book and 13% for a PC Processor).

In addition to the DAI, imports are also subject to a general sales tax of 13% (certain basic products such as school uniforms are exempt) as well as the surcharge tariff of 1% for the CIF (cost, insurance, freight) value only, excluding the CAFTA-DR countries. These are the principal import tariffs and taxes, however, businesses must take into account other Costa Rican accounting and company tax requirements.

Exportation Requirements

- Register as an Exporter at PROCOMER to begin the relatively straightforward process of exportation from Costa Rica.

- Certification – Obtain an Origin Certificate (Certificado de Origen (C.O.)):

- The Unit of Origin has to verify and certify the origin of goods.

- Presentation of relevant exportation documentation including permits and licenses for the commercialisation of your product. Depending on the goods to be exported, additional documentation may be needed.

- Export operation logistics to be determined by the company.

FAQs on import and export in Costa Rica

Yes, businesses can be foreign-owned.

The Costa Rican Treasury Department (Ministerio de Hacienda) is responsible for this.

Incoterms are developed and regulated by the International Chamber of Commerce (ICC). With 3 distinct letters, the ICC uses incoterms to define the responsibilities and obligations of the exporter and importer. It takes into account, in particular, loading and transport information, type of transportation used, insurance, risks, and place of delivery.

Main imports include:

Electrical Machinery (US$1.56 billion)

Motor Vehicles and Cars (US$1.48 billion)

Industrial Machinery (US$1.38 billion)

Main exports include:

Medical and Technical Equipment (US$2.60 billion)

Fruit and Nuts (US$2.07 billion)

Electrical Components (US$436 million)

To import:

Register as an Importer at PROCOMER (Office of Foreign Trade Promotion of Costa Rica) to begin the process of market entrance.

Find a Customs Agent (Agente Aduanero) and give them the relevant information about your company: They act on behalf of third parties and can assist companies with the legal requirements to nationalise their product.

Product Registration – Declaration of Merchandise (DM) before the Customs General Office.

Import licenses/permits are required for certain products and these must be obtained from the respective Ministries or departments: For example, when importing food, a license is needed from the Department of Agriculture and Animal Control (Ministerio de Agricultura y Ganadería).

Certification – Obtain an Origin Certificate (Certificado de Origen – C.O): The Unit of Origin has to verify and certify the origin of goods.

For exporting:

Register as an Exporter at PROCOMER to begin the relatively straightforward process of exportation from Costa Rica.

Certification – Obtain an Origin Certificate (Certificado de Origen (C.O.)): The Unit of Origin has to verify and certify the origin of goods.

Presentation of relevant exportation documentation including permits and licenses for the commercialisation of your product. Depending on the goods to be exported, additional documentation may be needed.

Biz Latin Hub can help you with import and export in Costa Rica

Costa Rica, in the heart of the Americas, has an expanding economy with the perfect conditions to do business in. International trade in Costa Rica, although somewhat complicated at times, is not difficult provided companies are well-informed and that they have the right local support.

Biz Latin Hub can provide you with a professional and personalised service, assisting you with the legal processes involved with exportation and importation in Costa Rica. Reach out to our bilingual team at Biz Latin Hub Costa Rica, and see how we can support you and your business.