Norms for transfer pricing in Paraguay were only introduced in 2019, as the country sought to modernize its tax system according to international standards and promote foreign investment. If you are considering market entry and will be transferring assets to or from your local entity, you will want to seek out tax advisory services in Paraguay to guarantee you are maximizing your potential benefits from local regulations.

As the country becomes ever more closely connected to the globalized economy, it is increasingly falling into line with international standards, including how to manage transfer pricing in Paraguay. This is key as the country grows richer, demonstrating its willingness to engage with foreign trade and thus making it more reliable as an investment destination.

Biz Latin Hub can help you with transfer pricing in Paraguay and elsewhere in the region, as our array of market leading back-office services is designed to keep you fully legally compliant with local regulations as well as international standards. That allows you to relax and focus on what you do best – growing your business.

Why invest in Paraguay?

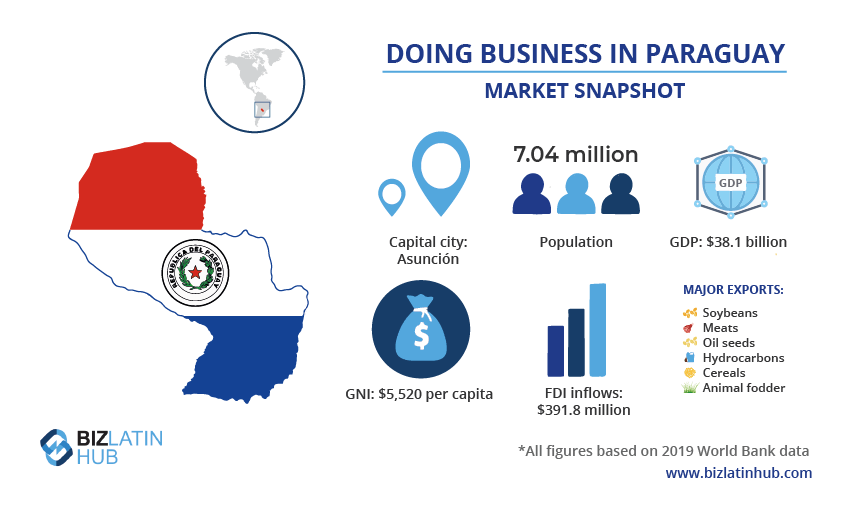

While Paraguay is not necessarily the most fashionable investment destination in Latin America, the country has experienced economic growth and a notable reduction in poverty over recent years and bounced back to 4% annual growth following the social and economic crisis caused by the COVID-19 pandemic.

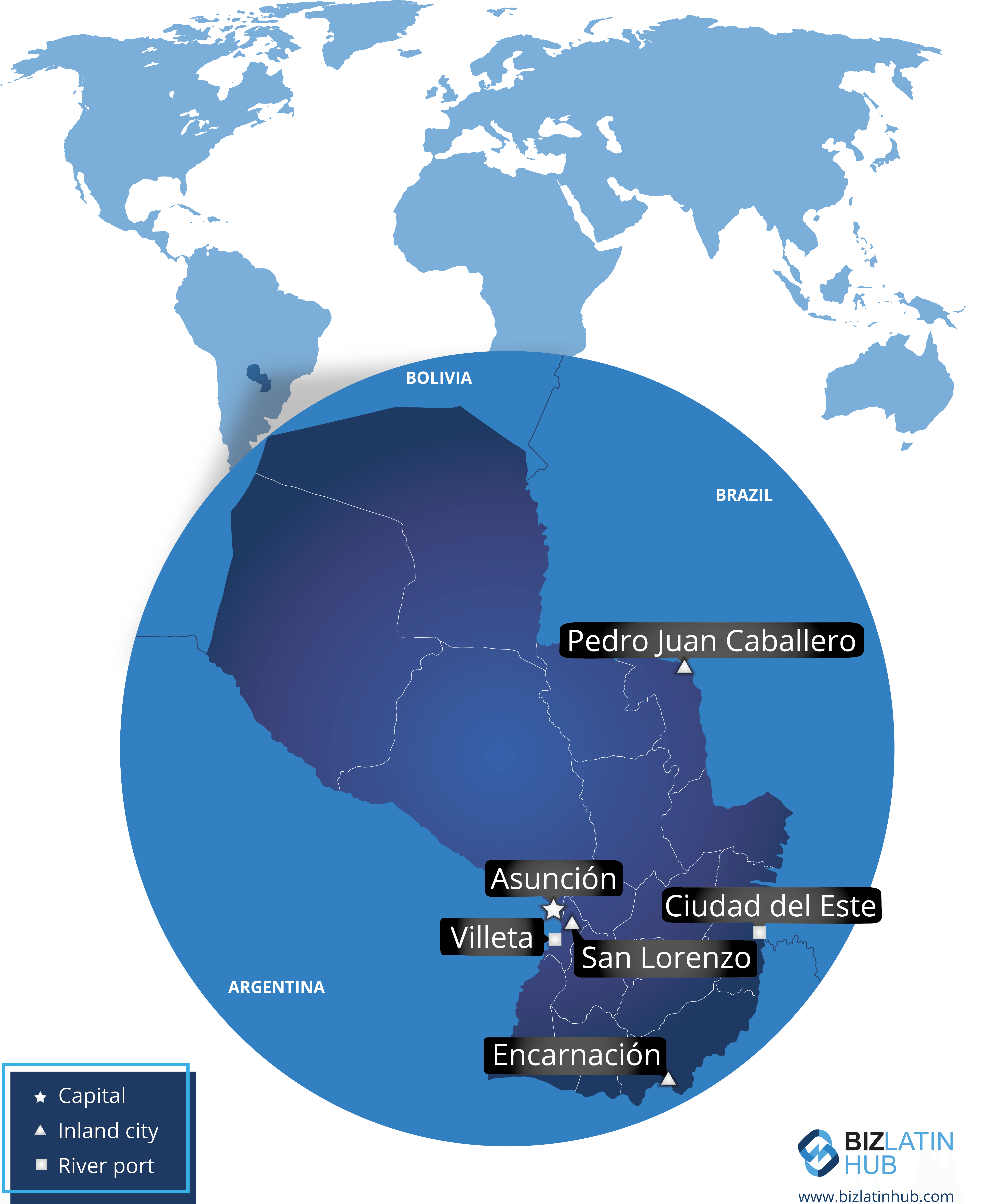

The South American country offers a favorable environment for international investors, registering positive foreign direct investment (FDI) inflows. Despite being landlocked, Paraguay has various riverine ports, with the largest being the industrial city of Villeta, some 34 kilometers south of capital city Asuncion. Some of Paraguay’s main export commodities include soybeans and related products, meat, and oil seeds.

Paraguay has several free trade zones (FTZs) located in the tri-border area, where its frontiers meet those of both Argentina and Brazil, providing companies quick access to key markets. Some of Paraguay’s free trade zones include the International Free Trade Zone and the Global Free Trade Zone of Paraguay, both of which grant tax exemptions to foreign companies.

In 2020, Paraguay’s Minister of Finance Benigno López indicated that the country was seeking to lower tax rates for foreign companies seeking to establish a commercial presence in the country, as well as improve the migration processes to grant Paraguayan residence visas to foreign investors in a shorter period of time.

Transfer pricing in Paraguay: new regulatory framework

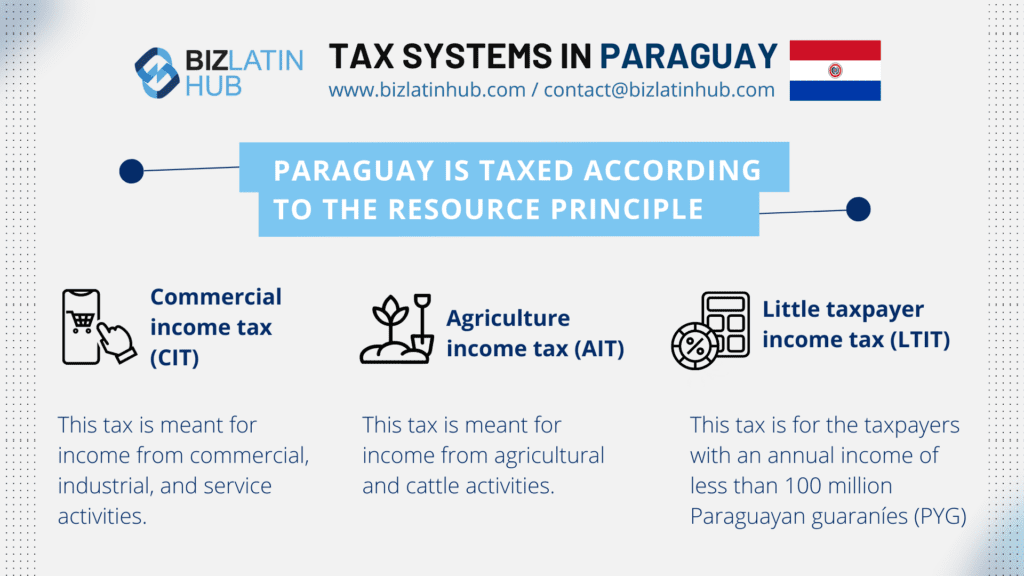

Transfer pricing rules in Paraguay were introduced under the “Modernization and Simplification of the Tax System Law” promulgated by the government in 2019, and consolidated by a decree issued in January 2021.

Those measures were intended to bring local regulations in line with Organisation for Economic Co-operation and Development (OECD) standards.

As such, the Paraguayan government has established transfer pricing methodologies based on OECD requirements, which include the likes of:

- Comparable uncontrolled pricing method

- Resale pricing method

- Aggregate cost method

- Utility partition method

- Residual profit-sharing method

- Transactional operating profit margin method

- Method for internationally listed products

Arm’s Length Principle

As part of its new transfer pricing regulations, Paraguay imposes the “arm’s length principle” enshrined in OECD standards, whereby every transaction between related parties must be made at the same price, quality and quantity conditions as if it were to be made with a non-related third party.

This is to prevent profits from being run through the lowest tax jurisdiction, and thereby denying jurisdictions the taxes they are due. The arms length principle is critical to establishing how much of a company’s profits can be attributed to an individual entity for tax purposes.

The World Customs Organization (WCO) and World Trade Organization (WTO) have effectively adopted the arm’s length principle in customs valuations.

Conducting a transfer pricing study: what is needed?

Conducting a transfer pricing study is necessary to find out the value of transferred goods or services and establish prices between two companies. A transfer pricing study in Paraguay should include the following information:

- Name, address, and tax residence of the companies involved

- Method used to carry out the transfer pricing study in Paraguay

- Financial and fiscal situation of the parties involved

Note that to carry out a transfer pricing study in Paraguay, it is strongly recommended to engage with a team of local professionals with extensive knowledge of local regulations. This will allow you to avoid penalties from local authorities or other risks that can jeopardize your commercial operations.

FAQs on transfer pricing in Paraguay

The main purpose of transfer pricing is to facilitate the proper calculation of costs for goods and services involved in any kind of transfer of assets and services between two related entities, where at least one person or entity involved in the transaction is legally resident in the country where the transfer pricing is taking place.

Conducting a transfer pricing study is necessary to find out the value of transferred goods or services and establish prices between two companies. A transfer pricing study in Paraguay should include the following information:

Name, address, and tax residence of the companies involved

Method used to carry out the transfer pricing study in Paraguay

Financial and fiscal situation of the parties involved

As part of its new transfer pricing regulations, Paraguay imposes the “arm’s length principle” enshrined in OECD standards, whereby every transaction between related parties must be made at the same price, quality and quantity conditions as if it were to be made with a non-related third party.

This is to prevent profits from being run through the lowest tax jurisdiction, and thereby denying jurisdictions the taxes they are due. The arms length principle is critical to establishing how much of a company’s profits can be attributed to an individual entity for tax purposes.

The World Customs Organization (WCO) and World Trade Organization (WTO) have effectively adopted the arm’s length principle in customs valuations.

As part of its new transfer pricing regulations, Paraguay imposes the “arm’s length principle” enshrined in OECD standards, whereby every transaction between related parties must be made at the same price, quality and quantity conditions as if it were to be made with a non-related third party.

This is to prevent profits from being run through the lowest tax jurisdiction, and thereby denying jurisdictions the taxes they are due. The arms length principle is critical to establishing how much of a company’s profits can be attributed to an individual entity for tax purposes.

The World Customs Organization (WCO) and World Trade Organization (WTO) have effectively adopted the arm’s length principle in customs valuations.

Biz Latin Hub can help with transfer pricing in Paraguay

At Biz Latin Hub, our multilingual team of taxation advisory specialists is equipped to help you navigate transfer pricing regulations in Paraguay, as well as to provide you with additional professional services to facilitate your operations in the South American nation.

With our full suite of legal, accounting, and back-office services, we can be your single point of contact to successfully expand your business in Paraguay, or any of the other countries in Latin America and the Caribbean where we are present.

Contacts us now for personalized assistance or a free quote.

Learn more about our team and expert authors.