Accounting and taxation in Paraguay must be considered in your market entry strategy, ensuring compliance with its detailed regulatory framework. This guide will help you handle Paraguay’s fiscal requirements effectively and stay compliant with the authorities. This includes SET (Subsecretaría de Estado de Tributación) which manages tax administration while IPS handles social security and payroll contributions. Biz Latin Hub offers professional support to navigate the country’s accounting standards after you incorporate a company in Paraguay.

Key Takeaways on Accounting and Taxation in Paraguay

| What Are The Accounting Standards in Paraguay? | Companies in Paraguay must adhere to the Normas de Información Financiera (NIF), which are derived from International Financial Reporting Standards (IFRS) and tailored to the local context. |

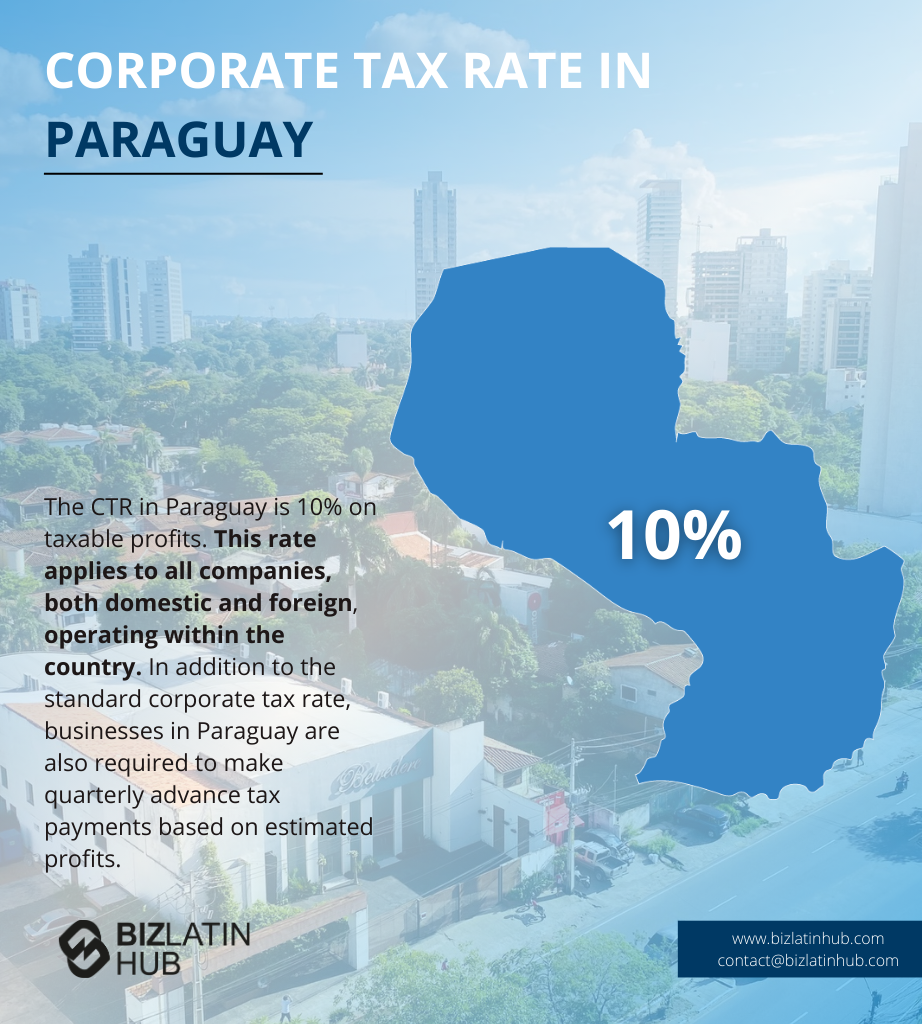

| What Is The Corporate Tax Rate in Paraguay? | This is set at a rate of 10%. |

| What Is The Paraguayan Value Added Tax Rate? | The VAT (IVA) rate in paragay is collected at 10%. Once registered for paying taxes, you’re expected to charge 10% VAT on every sale to a Paraguayan resident. |

| Dividend Tax Rate in Paraguay | Dividends are considered taxable income for non-resident recipients (or shareholders), subject to a 15% withholding tax (WHT). For Paraguayan residents, the applicable WHT is 8%. |

Overview of Paraguay’s Tax and Regulatory Framework

Paraguay is an attractive country for commercial operations with regard to corporate tax. As every country differs in its tax rates, every country poses different opportunities. The same counts for Paraguay. It is essential to take this into account before you declare your business taxes in Paraguay.

Taxes in Paraguay have the following accounting rules and rates:

- Paraguay applies a standard income tax rate of 10%.

- The country’s VAT sits at a standard rate of 10%. These returns must be filed monthly. You are required by law to register for VAT when incorporating in Paraguay.

- Dividends distributed to non-resident individuals or entities are subjected due to a 15% withholding tax rate.

- The standard tax rate makes Paraguay’s tax system simple to navigate. Further to this, there is no income tax on revenue earned outside of the country. This offers competitive tax conditions for people and businesses with additional overseas income.

- The fiscal year in Paraguay starts on 1 January and finishes on 31 December. You must submit your taxes within 4 months of the end of the previous fiscal year.

The standard tax rate makes Paraguay’s tax system simple to navigate. Further to this, there is no income tax on revenue earned outside of the country. This offers competitive tax conditions for people and businesses with additional overseas income.

The fiscal year in Paraguay starts on 1 January and finishes on 31 December. You must declare your business taxes in Paraguay within 4 months of the end of the previous fiscal year.

IFRS Financial Reporting Requirements in Paraguay

Understanding accounting requirements in Paraguay are crucial for your company’s activities and financial records. Below we specify some accounting regulations.

Paraguay requires businesses to follow accounting standards defined by local regulations. Companies must comply with the Paraguayan Generally Accepted Accounting Principles (PYGAAP), which align closely with the International Financial Reporting Standards (IFRS) for certain large entities.

Businesses must maintain books of accounts in Spanish and use the Paraguayan Guarani as the reporting currency. Mandatory records include a general ledger, journal, inventory book, and balance sheets. These records must be preserved for at least five years.

Taxpayers must file annual financial statements with the tax authorities. These statements include the balance sheet, income statement, and cash flow statement. Audited financial statements are obligatory for companies exceeding specific thresholds in revenue or asset size.

The fiscal year in Paraguay runs from January 1 to December 31. Companies must align their accounting practices with this period. Additionally, entities engaged in international trade or those with foreign investments must observe specific regulations governing transfer pricing and currency reporting.

Corporate Income Tax (IRACIS) and Withholding Rules

Paraguay has the lowest commerical tax rate in Latin America, at 10%. Other booming economies such as Brazil and Chile apply a tax rate of around 30%. Paraguay is therefore considerably more competitive. This is important to take into account when you declare your business taxes in Paraguay.

The corporate income tax is applicable to all companies no matter what practices they are involved in. This will be the most constant cost and sits at a standard rate.

Furthermore, the value-added tax (VAT) rate is one of the lowest in Latin America. Maintaining low tax expenses facilitates a welcoming environment for setting up a trading business in Paraguay.

Paraguay’s non-resident personal income tax rate also sits at a comparatively low rate. This tax sits at a rate of 10%. Nearby, non-resident personal income tax in Mexico is 15-30%. Paraguay, therefore, is a considerably beneficial option for tax declaration in terms of standardization and cost efficiency.

How to declare business taxes in Paraguay with employees and/or real estate

The following taxes apply for businesses with employees or real estate:

- Employee-related tax: Employers must contribute a total of 16.5% of an employee’s income to the employee’s social security. Moreover, employers are obliged to withhold 9% of an employee’s income.

- Real estate tax: Real estate is subject to a 1% annual tax. Surtaxes apply for specific types of property at an annual rate of 0.3% on the transfer of property.

Declare your Business taxes in Paraguay – corporate taxpayers

Before you declare your tax in Paraguay, it is important to know that income tax in Paraguay is taxed according to the resource principle. There are three tax systems in Paraguay, depending on the type of taxpayer, as follows:

- Commercial Income Tax (CIT). This tax is meant for income from commercial, industrial, and service activities. The general income tax rate of 10% applies. However, dividend distributions require an additional 5% tax. This tax must be paid on the amount of dividend approved for distribution at the shareholder meeting.

- Agriculture Income Tax (AIT). This tax is meant for income from agricultural and cattle activities. The tax rate also generally sits at 10%, however, the specific rate depends on yearly income.

- Little Taxpayer Income Tax (LTIT). This tax is for taxpayers with an annual income of less than 100 million Paraguayan guaraníes (PYG). A single tax rate of 10% applies.

Personal Income Tax in Paraguay

The personal income tax (PIT) system in the Latin American country is divided into two groups. These groups are:

- Individuals resident in Paraguay.

- Individuals living abroad.

Individuals living in Paraguay

To be eligible for this group you must be living and working in Paraguay. The general PIT rate is 10% for individuals residing in the country. These residents have to have an annual income equal to or higher than 120 monthly minimum salaries. The salary amount used to measure this is that which is in force on January 1st of every year. A PIT rate of 8% is applied to individuals whose annual income is lower than 120 monthly minimum salaries. The amount taxable is the income equal to or higher than 36 minimum salaries.

Individuals living abroad

This group is for individuals living abroad and deriving profits from activities performed inside the Paraguayan territory. The formula for calculating PIT for individuals abroad translates into an effective tax rate of 10%.

Annual bonus

Like in many countries in Latin America, under employment law in Paraguay, employees are entitled to an annual bonus equivalent to one full month of pay, which is paid in December.

UBO Reporting and RUB Compliance

Ultimate Beneficiary Owners (UBOs) must be reported to the SET via the RUB platform per Resolution 90/2021. Information required includes full name, ID, ownership %, and means of control. Any updates to the information must be submitted within 30 days or face penalties.

Maquila and tax incentives

Paraguay offers favorable regimes like the Maquila Law, which allows approved companies to pay just 1% tax on net value added. Incentives include exemption from VAT and import duties. Applications are made to CNIME and require a detailed export plan.

FAQs About Tax and Accounting in Paraguay

Based on our extensive experience these are the common questions and doubts from our clients when looking to understand accounting and taxation in Paraguay.

The corporate tax rate in Paraguay is 10% on net profits.

Businesses in Paraguay are subject to taxation based on their net profits. The tax rate is 10%, and it is calculated on the difference between total revenues and deductible expenses.

The tax administration authority in Paraguay is known as the Subsecretaría de Estado de Tributación (SET). It is responsible for enforcing tax laws and regulations in the country.

Companies in Paraguay are required to follow the Normas de Información Financiera (NIF), which are based on International Financial Reporting Standards (IFRS) adapted for the local context.

The equivalent of a CPA in Paraguay is a contador público This designation is awarded to certified public accountants who have met the necessary qualifications and requirements.

Yes, Paraguay has adopted IFRS for financial reporting. Entities, especially those of significant size, are required to prepare their financial statements following IFRS principles. However, small and medium-sized enterprises (SMEs) have the option to use simplified accounting standards.

The general VAT rate is 10%, and 5% for essentials like food and medicine. Returns must be filed monthly by the 13th using Marangatu. The government is rolling out e-Kuatia, a digital invoicing system that will become mandatory for most companies by 2025.

Employers contribute 16.5% of gross salary and employees contribute 9% to IPS. Employers must register employees with the Ministry of Labor and submit digital payrolls via the IPS REOP system each month. Labor contracts must be updated online.

Yes. UBOs must be reported to the SET via the RUB platform per Resolution 90/2021. Information required includes full name, ID, ownership %, and means of control. Updates must be submitted within 30 days or face penalties.

Paraguay offers favorable regimes like the Maquila Law, which allows approved companies to pay just 1% tax on net value added. Incentives include exemption from VAT and import duties. Applications are made to CNIME and require a detailed export plan.

Why Invest in Paraguay?

Paraguay stands out as an advantageous destination for business endeavors, driven by several key factors. Declaring taxes in Paraguay is simplified and efficient, providing businesses with a transparent and straightforward tax regime.

The country’s strategic location offers easy access to regional markets, fostering trade opportunities. It is simple to declare your business taxes in Paraguay.

Paraguay’s stock-standard taxes and limited requirements for being in the country facilitate perfect conditions for people and small businesses who travel. On the ground, expanding to Paraguay offers equally beneficial tax treatment to foreign investors. For these reasons, people and businesses are turning to Paraguay to declare their taxes.

The nation’s stable economic environment, along with the straightforward process to declare taxes, instills confidence in investors.

Overall, Paraguay’s favorable business landscape, supported by its simplified tax declaration process, positions it as an attractive hub for business growth and prosperity in South America. Continue reading to learn more about how to declare your business taxes in Paraguay.

Biz Latin Hub can Help With Accounting and Taxation Requirements in Paraguay

Understanding taxation and accounting requirements in Paraguay will make it easier for you to budget. Additionally, it will help you understand what you will have to deal with when it’s time to declare your taxes.

If you would like more information about accounting regulations or tax laws in Paraguay, Biz Latin Hub’s group of experts offer you legal and accounting assistance for your business in Bolivia. Take advantage of our large range of multilingual market entry and back-office business solutions to meet your company’s incorporation and compliance needs.

Contact us now for help in establishing a successful business in Paraguay.

Learn more about our team and expert authors.