Starting a business in Paraguay may not be the most common choice among entrepreneurs in Latin America. However, the country offers important advantages for investors, such as low taxes and a simple immigration system that makes it easy to obtain residency. Consequently, it represents an attractive opportunity for investors looking to expand into new markets.

If you are considering starting a business in Paraguay but prefer not to incorporate, an alternative option is to use an employer of record (EOR) in Paraguay. Depending on your business requirements, opting for an employer of record (EOR) may represent a simpler path compared to a full company formation.

Table of Contents

In the past decade, Paraguay averaged four per cent yearly GDP growth. The main drivers of its economy are agriculture, livestock, retail, and construction. Paraguay has a low tax burden and low public debt. There are strong trade relations with its neighbors, especially Brazil and Argentina. Starting a business in Paraguay also means membership of the Mercosur trade bloc.

Why should you think about starting a business in Paraguay?

Paraguay’s rapid growth has been met with a concomitant increase in interest among international investors, with foreign direct investment (FDI) inflows growing to USD$207 million. Despite being a landlocked country, it is in a strong position for trade due to its proximity to Brazil and Argentina. These two countries have the region’s largest and third-largest economies, and gaining access to their markets is a strong reason for starting a business in Paraguay.

Paraguay is one of the four founding members of the Southern Common Market (Mercosur) -along with Brazil, Argentina, and Uruguay- a free trade initiative that recently celebrated its 30th anniversary. Paraguay has several bilateral free trade agreements (FTAs), including a major one with Chile.

The 5 Most Common Entity Types in Paraguay

In Paraguay, there are several types of companies that can be incorporated, each with its own legal requirements and characteristics:

- Sociedad Anónima (S.A.): This is the most common type of company in Paraguay. It is similar to a public limited company (PLC) in other jurisdictions. It requires at least two shareholders and a minimum capital contribution of 1,000 times the monthly legal minimum wage.

- Sociedad de Responsabilidad Limitada (S.R.L.): This is similar to a limited liability company (LLC) in other countries. It requires at least two partners and a minimum capital contribution of 1,000 times the monthly legal minimum wage.

- Sociedad en Comandita por Acciones: This is a limited partnership with shares. It requires at least one partner with unlimited liability and one with limited liability. The liability of the limited partners is limited to the amount of their capital contribution.

- Sociedad en Nombre Colectivo: This is a general partnership where all partners have unlimited liability.

- Sociedad Anónima Simplificada (S.A.S.): This is a simplified stock corporation designed to provide a more straightforward and faster incorporation process compared to the traditional S.A. and S.R.L. companies. It requires at least one shareholder and has no minimum capital requirements.

What are The Minimum Requirements to Incorporate a Sociedad Anónima in Paraguay?

To incorporate a Limited Company (Sociedad Anónima) in Paraguay, you’ll need to adhere to certain legal requirements and follow specific procedures. Here’s an overview of the minimum requirements:

- Shareholders: A minimum of two shareholders is required to form a Limited Company. Shareholders can be individuals or legal entities, and they can be of any nationality.

- Capital: There is no minimum capital requirement stipulated by law, but you must define the initial capital in the company’s bylaws.

- Articles of Incorporation: Draft and notarize the company’s Articles of Incorporation (Estatutos Sociales), which should include details such as the company’s name, objectives, address, duration, capital structure, and governing bodies.

- Registered Address: Provide a physical address in Paraguay where the company will be located. This can be a commercial office or the address of a legal representative.

- Legal Representative: Appoint a legal representative who must be a resident of Paraguay. This individual will act on behalf of the company and can be held responsible for legal matters.

- Tax ID: Obtain a Tax Identification Number (RUC – Registro Único del Contribuyente) from the Paraguayan tax authorities (SET – Secretaría de Estado de Tributación) for the company.

- Publication of Incorporation: Publish a notice of the company’s incorporation in a local newspaper for legal purposes.

- Registration: Register the company with the Public Registry (Registro Público) and obtain a registration certificate.

Starting a Business in Paraguay: Some Considerations

Some considerations to take into account when starting a business in Paraguay include:

- Choosing your legal representative: if you are not going to be in the country permanently, you will need to appoint a legal representative in Paraguay. This can be anyone of legal age who is a resident of Paraguay and is not otherwise barred from such a role. However, you will ideally want to appoint someone with a good understanding of the country’s corporate legal framework.

- Entity type: the type of entity you choose when starting a business in Paraguay depends on the desired enterprise structure, your liability acceptance, and capital investment. Foreign investors can choose from various entity types, including limited liability companies (Sociedad de Responsabilidad Limitada — SRL) and stock companies (Sociedad Anónima — S.A), based on their business goals and capital investment.

- Economic activity: it is essential to correctly identify your commercial activity and all sources of revenue to ensure compliance with local regulations and taxation requirements. When you register a company in Paraguay, it is highly recommended you work with a reliable corporate lawyer who can guide you on properly defining your operations in the official documentation.

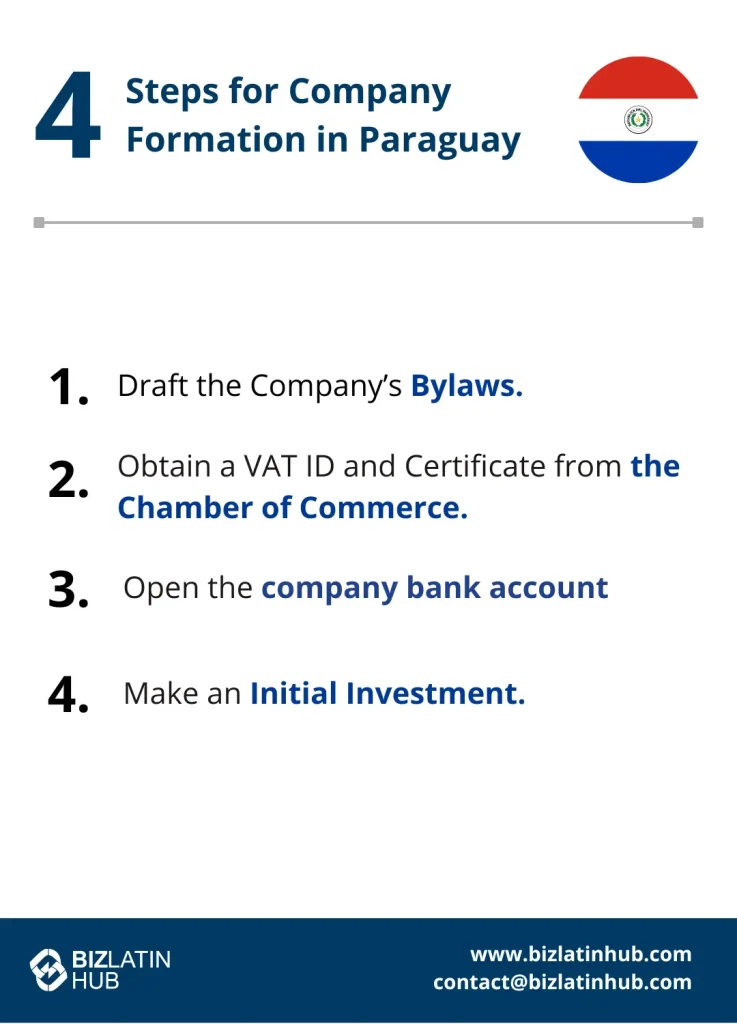

How to Form a Company in Paraguay: 4 Key Steps

Starting a business in Paraguay involves four key steps, as explained below:

- Step 1 – Draft the Company’s Bylaws.

- Step 2 – Obtain a VAT ID and Certificate from the Chamber of Commerce.

- Step 3 – Open a Corporate Bank Account.

- Step 4 – Make an Initial Investment.

Step 1: Draft the Company’s Bylaws

Begin by preparing your company’s bylaws. You must include information on the subscribed capital, fiscal address, and legal representative. Please note that this process may take up to 12 weeks.

Step 2: Obtain a VAT ID and Certificate from the Chamber of Commerce

Register with the local authorities to obtain a VAT ID and registration certificate. Depending on the type of legal entity you choose, you may need to declare the final beneficiaries. If you are hiring local employees, you will need to register at the Labor Ministry.

Step 3: Open a Corporate Bank Account

Open a corporate bank account for your company. A Paraguay-based legal representative can suggest the ideal corporate bank account provider for your business based on type and location.

Step 4: Make an Initial Investment

Once your company is registered with the appropriate government agencies and a corporate bank account is open, you can make your initial investment. This completes the process of starting a business in Paraguay.

Steps for EAS Formation in Paraguay:

- Company name reservation.

- Draft the bylaws.

- Registration of EAS.

- Tax registration.

Common FAQs when Forming a Company in Paraguay

Here are some answers to some of the most common questions we get asked by our clients.

Can a foreigner own a business in Paraguay?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

What is the Paraguay Company Tax ID?

The Paraguay Company Tax ID is known as RUC (Registro Único de Contribuyentes), which translates in English to Single Taxpayer Registry, a unique identification number for tax purposes in Paraguay.

How long does it take to register a company in Paraguay?

Registering a company in Paraguay takes 8 weeks.

What does an S.A. company name mean in Paraguay?

The S.A. in a company name in Paraguay refers to a Sociedad Anónima, which is similar to a Joint Stock Company. This legal framework establishes the company as a separate entity from its shareholders, with each shareholder possessing shares that represent their ownership stake. Importantly, the financial responsibility of shareholders is confined solely to the value of their shares, crafting a safeguarded boundary. The S.A. structure is popular in Paraguay due to its exceptional adaptability and flexibility.

What does a S.A.S. company name mean in Paraguay?

In Paraguay, S.A.S means Sociedad por acciones Simplificada, which is similar to an LLC elsewhere. This is a type of commercial company with legal personality and assets independent from those of its owners. Shareholders are liable only up to the amount of their respective contributions corresponding to the integration of the shares they subscribe to or acquire. Shareholders are not liable for labor, tax, or any other type of obligations incurred by the company beyond its contribution, except if the legal personality of the company is declared unenforceable.

What entity types offer Limited Liability in Paraguay?

In Paraguay, both “S.A.S” (Sociedad por Acciones Simplificada) and “S.A” (Sociedad Anónima) are limited liability entity types.

What are the main differences between a S.A.S. and an S.A in Paraguay?

| Aspect | S.A.S (Sociedad por Acciones Simplificada) | S.A (Sociedad Anónima) |

|---|---|---|

| Number of Shareholders | Can have from one to an unlimited number of shareholders. | Must have at least two shareholders. |

| Responsibility of Shareholders | Shareholders are not liable for labor, tax, or any other type of obligations incurred by the company beyond their contribution. | Shareholders are not liable for labor, tax, or any other type of obligations incurred by the company beyond their contribution. |

| Incorporation Process | Can be incorporated in 15 days. | Requires the approval of the Internal Audit (Sindico). Can act as “in formation” until formalities are completed. |

| Object of the Company | Any lawful commercial activity can be established in a general way as an object. | One or more specific objects or lines of business must be established in the bylaws. |

Biz Latin Hub can help with company formation in Paraguay

At Biz Latin Hub, our multilingual team of company formation experts has years of experience supporting foreign investors starting a business in Paraguay. With our complete portfolio of back-office services, including legal, accounting, tax advisory, and recruitment, we can be your single point of contact for all of your business needs in Paraguay, or any of the other 17 countries across Latin America and the Caribbean where we operate.

Reach out to us now for personalized assistance or a free quote.

Learn more about our team and expert authors.