A PEO payroll company in Paraguay is a great resource for testing the market and improving your business success. By managing critical HR functions, you have more time to focus on scaling operations while navigating the Paraguay’s legal and operational complexities. Collaborating with a trusted local partner is essential, and Biz Latin Hub delivers expert support with its extensive experience across Latin America. From market entry to company formation in Paraguay, we offer the services needed to help your business succeed.

| Is it legal to hire in Paraguay through PEO payroll services? | Yes it is legal to hire employees using a PEO payroll providor in Paraguay. |

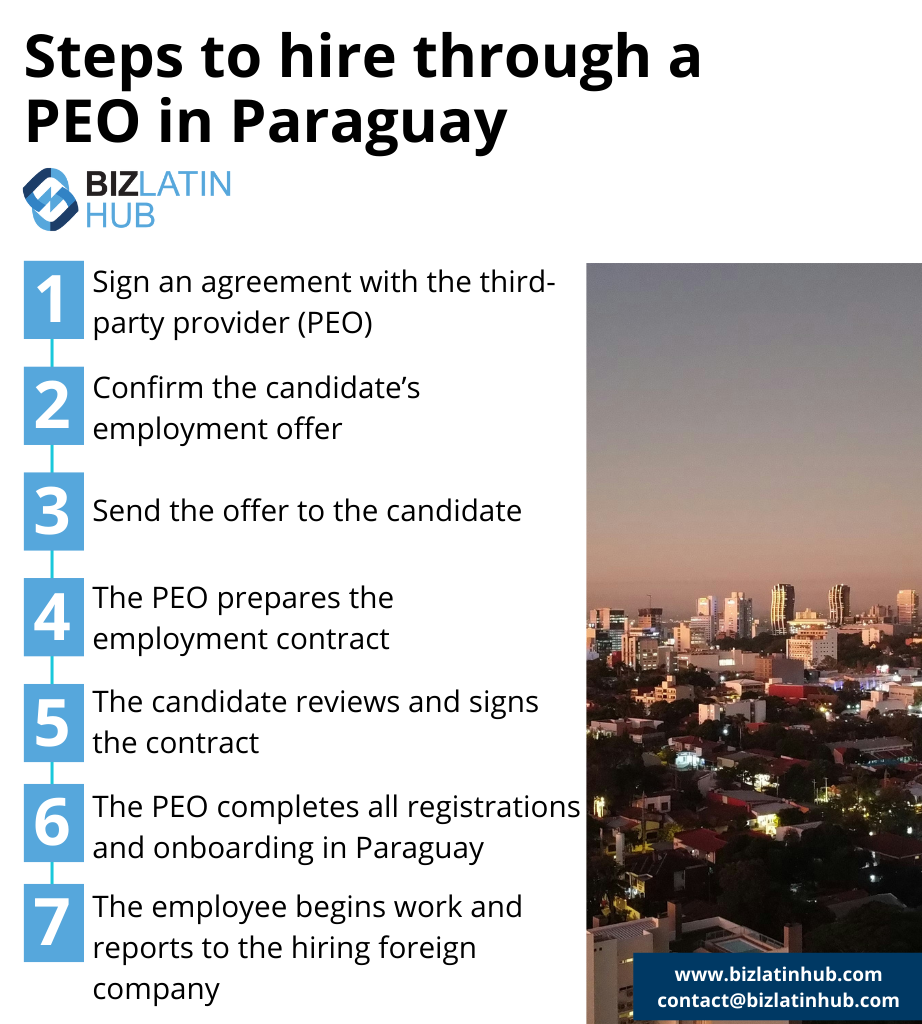

| Steps to hire through a PEO in Paraguay | Sign a service agreement with the third-party PEO. Confirm the employment offer for the candidate. Share the employment offer with the candidate. After the candidate accepts the offer, the PEO drafts the employment contract and assumes the role of the employer. The candidate reviews and signs the employment contract. The PEO completes all required employee registrations with Panamanian authorities. The employee starts work and reports to the hiring foreign company. |

| What are the working hours in Paraguay? | A standard workday in Paraguay is 8 hours. |

| What are the benefits of hiring through a PEO in Paraguay? | Paraguay has excellent trade links to the surrounding region with a capable workforce experiencing a growing tech sector fueled by foreign investments. |

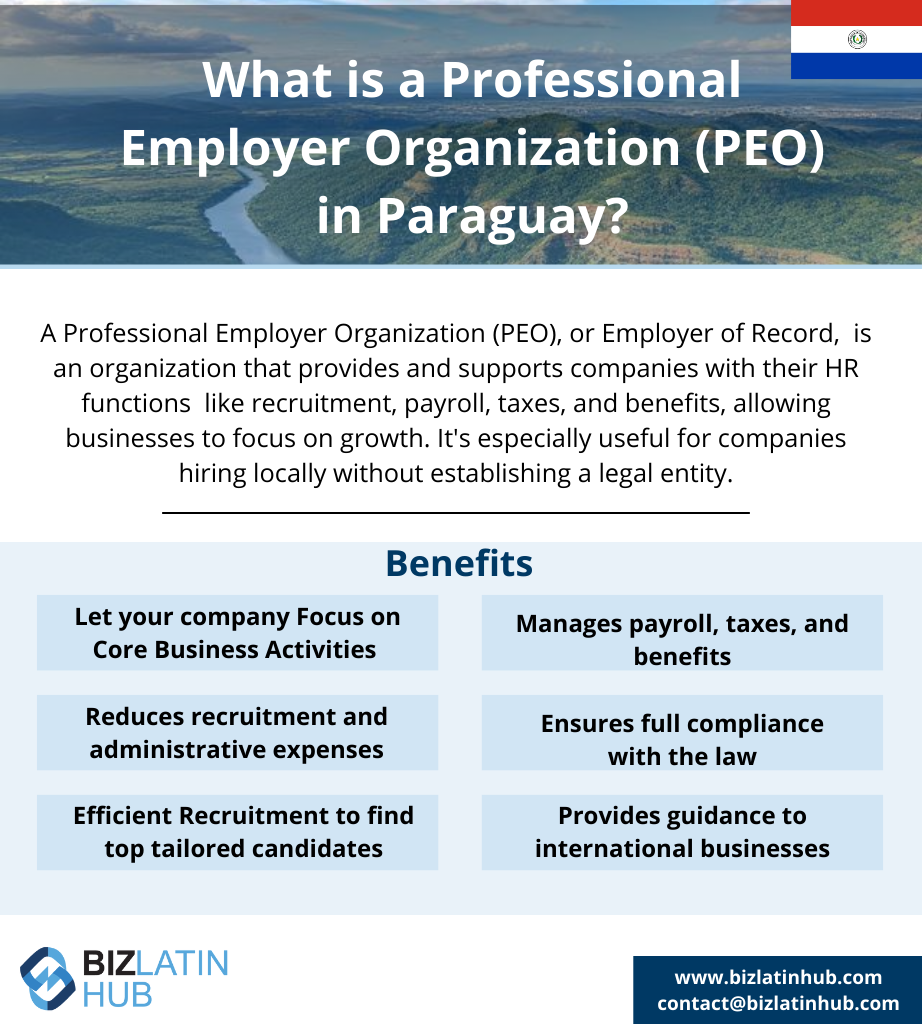

What does a PEO payroll company in Paraguay do?

A PEO payroll company in Paraguay is capable of handling various HR tasks, such as recruitment, hiring, benefits, and payroll management. It acts as the official employer, allowing you to hire without forming a separate legal entity.

With extensive knowledge of local labor and tax regulations, a PEO payroll company ensures compliance with Paraguayan authorities and streamlines administrative processes, freeing up your time for core business activities.

A PEO payroll company in Paraguay, also known as an employer of record (EOR) or a payroll outsourcing company, offers essential services for businesses expanding into Paraguay. They will act as legal employers of your workers, meaning you stay compliant while retaining full operational control. This allows you to concentrate on what you do best: growing your business.

A PEO payroll company in Paraguay also allows you to enter the market quickly and with limited commitment, meaning you can test the water and see if the market is right for you. The payroll company also handles compensation for resignations, retirements, accrued vacations, and other required payments.

Moreover, it will also share the responsibility for the safety and health of the employees in the work environment and carry out the procedures and updates required before Paraguay’s Ministry of Labor.

What are the main advantages of hiring staff through a PEO payroll company in Paraguay?

Some of the main advantages of hiring staff through a PEO payroll company in Paraguay include:

Profitability: Employing local personnel through a PEO / EOR helps save costs and avoids additional expenses.

Risk Management: A PEO / EOR ensures full compliance with local regulations and protects your organization’s interests in legal matters.

Time-Saving: Outsourcing payroll and HR tasks allows you to focus on critical aspects of your business while benefiting from PEO / EOR assistance.

Employee recruitment: A PEO payroll company in Paraguay can efficiently perform recruitment processes to identify and hire the most suitable and qualified personnel to maximize your company’s possibility of success.

Legal advice: A PEO firm will provide legal advice on labor, tax, and civil legislation in case you require it.

Get to know the market: When you hire staff through a PEO payroll company in Paraguay, you have the opportunity to gain a better understanding of the market before considering a larger-scale expansion. The PEO payroll company can hire staff on your behalf in just a few days and make it easy to exit the market. This gives you the opportunity to evaluate whether your future business plans require deeper involvement, such as company formation or branch registration.

PEO vs. EOR in Paraguay – What’s the Difference?

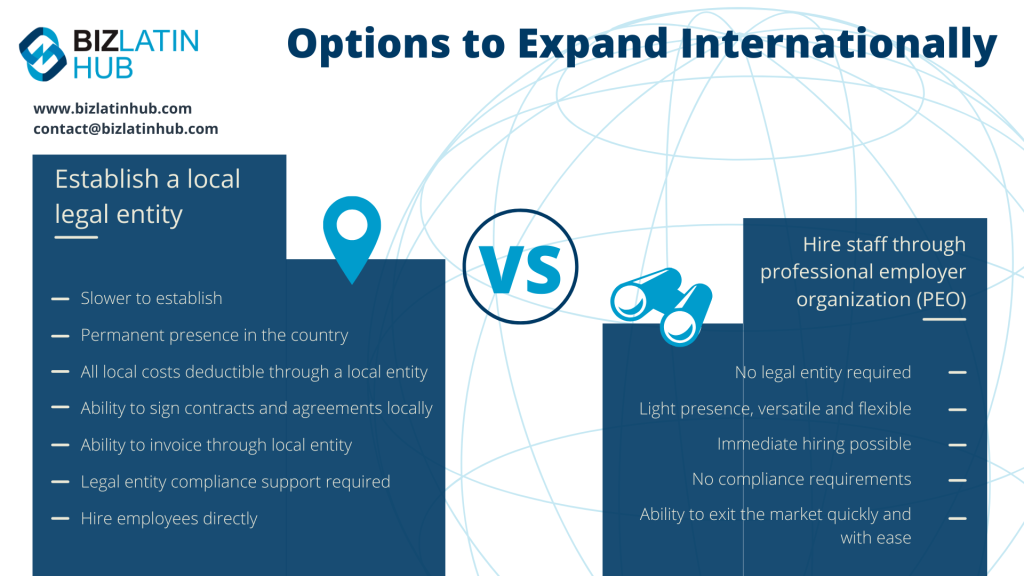

When expanding into Paraguay, businesses often choose between a Professional Employer Organization (PEO) or an Employer of Record (EOR) to hire and manage employees.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations.

Note that PEO and EOR are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms.

Important Tip: While an EOR provides a quick-entry solution, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in Paraguay. Biz Latin Hub offers both PEO and EOR solutions, helping businesses navigate regulations, establish entities, and ensure full HR compliance in Paraguay, where both services are legal. Whether you need a fast market entry or a stable long-term presence, we can guide you through the process.

How to Partner With an Professional Employer Organization in Paraguay?

To partner with a PEO payroll providor in paraguay, the hiring company enters into a contract with a third-party organization, appointing them as the professional employer Organization (PEO) for the staff they wish to hire in Panama. This arrangement ensures that, on official documentation in Paraguay, the third-party company (the PEO/EOR) is legally responsible for complying with all employment regulations for the employees.

This relieves the foreign company of the complexities of navigating Paraguayan labor laws independently. By reducing the risk of non-compliance, the foreign company can concentrate on business development and market growth.

The process of hiring an employee through an Professional Employer Organization in Paraguay is simple and involves the following steps:

- Sign a service agreement with the third-party PEO.

- Confirm the employment offer for the candidate.

- Share the employment offer with the candidate.

- After the candidate accepts the offer, the PEO drafts the employment contract and assumes the role of the employer.

- The candidate reviews and signs the employment contract.

- The PEO completes all required employee registrations with Paraguayan authorities.

- The employee starts work and reports to the hiring foreign company.

What labor laws will my PEO payroll company in Paraguay handle?

Working hours: According to employment law in Paraguay, a standard working week is 48 hours long for daytime work and 48 hours per week for nighttime work. For daytime work, each working day should be a maximum of eight hours long, while for night work it is seven hours, and employees should receive at least one rest day per week.

Overtime: Any supplementary hours worked on top of those hours must be paid in proportion to the employee’s standard rate of pay plus a supplementary addition based on the time of the additional hours. Extra hours worked overnight or during public holidays are paid double. Those extra hours cannot exceed of three per day and nine per week.

Probation: An employee can have their contract terminated without notice during their probation period — which will generally last for between one and three months depending on the type of role but can sometimes last for four months in the case of highly-qualified employees.

Termination: In the absence of conduct warranting dismissal (such as gross misconduct as set out in the contract), employers must provide an employee with notice of dismissal, which will range from 30 to 90 days, depending on the employee’s length of service. A severance payment totaling 15 days of pay for each year of service must be paid to an employee who is dismissed under such conditions.

Annual bonus: Like in many countries in Latin America, under employment law in Paraguay, employees are entitled to an annual bonus equivalent to one full month of pay, which is paid in December.

Holiday time: After completing one year of employment with the same employer, an employee is entitled to 12 days of paid leave. This is extended to 18 days of leave after five years of service, and to 45 days after ten years of service.

Public holidays: There are generally between nine and 14 national holidays that fall on weekdays per calendar year in Paraguay.

Maternity and paternity leave: New mothers are entitled to maternity leave totaling 18 weeks, which can be extended by six weeks in the event of illness during the pregnancy or complications during the delivery. New fathers, meanwhile, are entitled to 14 days of paid paternity leave.

Sick leave: Employees are entitled to be paid in the event of missing work through illness, however, they must present a document signed by a registered doctor. The cost of paid sick leave is covered by the government social security fund.

Bereavement leave: In the event of the death of an immediate family member — including a parent, sibling, spouse or partner, child, or grandchild — an employee is entitled to three days of bereavement leave.

How to use a payroll calculator

If you want to get an idea of the possible costs involved in payroll outsourcing in Paraguay, using a payroll calculator is one way to get a good estimate.

Although a payroll calculator won’t be completely accurate, it will give you the opportunity to evaluate options while varying the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, compared to what is most convenient for you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff in Paraguay would be, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

FAQs on a PEO payroll company in Paraguay

Based on our extensive experience, these are the common questions and doubts of our clients on hiring through an PEO payroll company in Paraguay:

You have the option to employ someone in Paraguay either by establishing your own legal entity within the country and utilizing it for hiring purposes, or by engaging an employer of record (EOR). An EOR, a third-party entity, enables you to recruit employees in Paraguay by serving as the legal employer. When using an EOR, you do not need a Paraguayan local entity to hire employees.

A standard Paraguayan employment contract should be written in Spanish (and can also be in English) and include the following information:

– ID and address of the employer and employee.

– City and date.

– Service location. .

– Description of tasks to be performed.

– Remuneration and bonifications/commissions (if applicable).

– Frequency and method of payment. .

– Duration of the contract.

– Probationary period.

– Working hours.

– Additional benefits (if applicable).

The mandatory employment benefits in Paraguay are the following:

– Working tools necessary to carry out the work (if applicable).

– Payment of social security contributions (health, pension, and labor risks).

– Social benefits (service premium, severance pay, and interest on severance pay).

– Paid time-off (vacation and Sunday rest).

– Disabilities (common or labor origin).

– Transportation allowance (if applicable).

– Overtime and surcharges (if applicable).

The total cost for an employer to hire an employee in Paraguay can vary based on the salary structure. This is because the employer is responsible for covering 16.5% of the social security contributions, and the employee’s salary is subject to a 9.5% retention for social security purposes. The specific amount will depend on the employee’s earnings and work hours.

Please use our Payroll Calculator to calculate employment costs.

Forming a legal entity is different to hiring an EOR in the following ways:

– It is more time-consuming.

– Creates a permanent presence in the country.

– Expenses are deductible through a local entity.

– Enables the ability to execute contracts and agreements locally.

– Facilitates invoicing through a local entity.

– Requires compliance support.

– Empowers direct hiring of employees.

While a PEO functions as co-employer, an EOR assumes the role of the formal employer for your staff. Typically, an EOR provides a wider array of services compared to a PEO.

Why invest in Paraguay?

According to Paraguay’s Minister of Economy and Finance, Carlos Valdovinos, in response to the challenges posed by the COVID-19 pandemic, Paraguay has sought to attract foreign investment through low tax rates and laws that guarantee tax exemptions to companies settling in the country.

Additionally, Valdovinos has emphasized improvements in migration processes, facilitating the acquisition of Paraguayan residency for investors. However, these processes can be time-consuming, which is why many companies choose to use a PEO payroll company in Paraguay.

Paraguay, often referred to as “the heart of South America,” has experienced consistent growth in recent years and is actively working to create an investment-friendly environment. Free trade zones, including Zona Franca Internacional and Zona Franca Global del Paraguay in Ciudad del Este, offer attractive tax incentives.

The country maintains strong trade ties with major Latin American economies such as Brazil and Argentina, contributing to its robust and growing economy. In 2022, Paraguay’s GDP reached USD$41.7 billion. The nation has also attracted significant foreign direct investment, totaling USD$207,095,460 in 2022.

Biz Latin Hub can be your PEO / EOR Payroll Company in Paraguay

At Biz Latin Hub, our multilingual recruitment and employment experts have broad experience helping foreign companies get established in Paraguay, as well as elsewhere in Latin America and the Caribbean. We can also work as a PEO payroll company in Paraguay or elsewhere.

With our full portfolio of legal, accounting, and back-office services, we can be your single point of contact to help you enter the Paraguayan market in the shortest possible time.

Contact us now to discuss your expansion options.

Learn more about our team and expert authors.