To open a corporate bank account in Paraguay is a crucial step in facilitating financial transactions to ensure compliance with local regulations and conducting business operations efficiently. Paraguay is an attractive destination for regional operations due to low tax rates and pro-investment policies. Its banking sector is reliable but conservative with onboarding. A bank account is a key part of the process to register a company in Paraguay, helping you enter the market smoothly.

Key takeaways on a corporate bank account in Paraguay

| Which are the best banks to open a corporate bank account in Paraguay? | Banco Itaú. Banco Continental. Banco Regional. Banco Familiar. Basa Bank. Sudameris Bank. Atlas Bank. Amambay Bank. |

| The three step process to open a corporate bank account in Paraguay: | Step 1 – Partner with a local expert in Paraguay. Step 2 – Find a Paraguayan bank well-suited to your business needs. Step 3 – Prepare required banking documentation. |

| Do all corporate bank accounts follow the same process? | This is a general guide: you will need to check individual banks’ rules or contact one of our expert advisors for more detailed rules. |

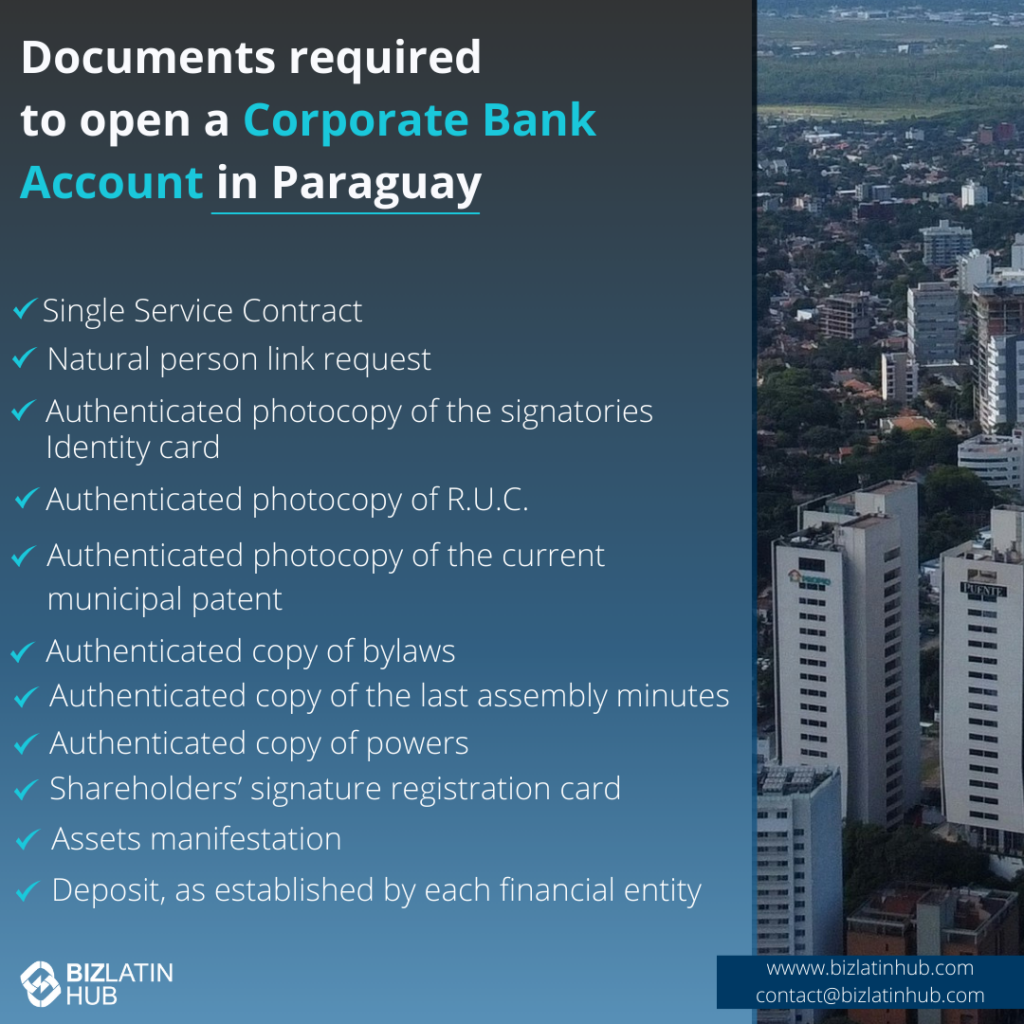

| What are the necessary documents when opening a corporate bank account in Paraguay? | Single Service Contract. Natural person link request. Authenticated photocopy of the signatories Identity card. Authenticated photocopy of R.U.C. Authenticated photocopy of the current municipal patent. Authenticated copy of bylaws. Authenticated copy of the last assembly minutes. Authenticated copy of powers. Shareholders’ signature registration card. Assets manifestation. Deposit, as established by each financial entity. |

Account Setup Process in Paraguay

To open a corporate bank account in Paraguay you must follow these 3 steps:

- Step 1 – Partner with a local expert in Paraguay.

- Step 2 – Find a Paraguayan bank well-suited to your business needs.

- Step 3 – Prepare required banking documentation.

Step 1: Partner with a local expert in Paraguay

Opening a corporate bank account in Paraguay is a relatively easy process, but it can be more difficult for foreign companies. It may involve overcoming language barriers, and understanding tax regulations, cultural nuances, and the rules around hiring local staff. You may choose to partner with a local law firm or consultancy to facilitate the process.

Working with a trusted local partner ensures compliance with local legislation and contributes to the success of your business.

Step 2: Choose a Paraguayan bank

Paraguay has a number of banks companies can choose from. Each bank provides a unique array of services, and some will be better suited to match your business needs. The two banks recommended by Biz Latin Hub, with suitable experience offering services to foreign companies, are Banco Itaú and Sudameris.

Step 3: Prepare required documentation

When you request the opening of a corporate bank account, banks in Paraguay will require a number of documents to make sure you are eligible. Preparing these documents can take some time. Once you have handed them over, the bank will validate them and if your application is successful, you will be provided with the details needed to activate your newly opened corporate account.

Recommended Banks for Business Clients

Recommended institutions include Banco Itaú Paraguay, Banco Continental, and BBVA Paraguay are widely used. They require local presence and in-person onboarding. Each of these banks offers a range of services tailored to the needs of international companies. It is advisable to study the offers, fees and specific requirements of each bank to find the one that best meets the needs of your business in Paraguay.

- Banco Itaú.

- Banco Continental.

- Banco Regional.

- Banco Familiar.

- Basa Bank.

- Sudameris Bank.

- Atlas Bank.

- Amambay Bank.

We recommend the following banks for foreign companies: Banco Itaú and Sudameris.

Comparison Table:

| Feature | Paraguay | Uruguay | Bolivia |

| Minimum Deposit | $1,000 | $1,000 | $500–$1,000 |

| Account Opening Time | 3–5 weeks | 2–4 weeks | 2–4 weeks |

| Foreign Ownership Allowed | Yes | Yes | Yes |

| Remote Opening | Rare | Limited | Not common |

Documentation Required for Account Opening

Financial institutions have some autonomy to set their customer admission policies, but there are standard requirements imposed by the banking law and the Central Bank of Paraguay. Generally, customers wishing to open a corporate account in Paraguay must submit documents including the Incorporation certificate, RUC (tax ID), shareholder ID, power of attorney, local representative, and economic activity disclosure.

All documents must be in Spanish. Sometimes a deposit may be required by the bank as necessary for opening a corporate account. Banks are overseen by the Superintendencia de Bancos. Due diligence involves UBO identification, AML checks, and FATCA/CRS. This is part of tax and accounting requirements in Paraguay.

Some of the documents required to open a corporate bank account in Paraguay are:

- Single Service Contract.

- Natural person link request.

- Authenticated photocopy of the signatories Identity card.

- Authenticated photocopy of R.U.C.

- Authenticated photocopy of the current municipal patent.

- Authenticated copy of bylaws.

- Authenticated copy of the last assembly minutes.

- Authenticated copy of powers.

- Shareholders’ signature registration card.

- Assets manifestation.

- Deposit, as established by each financial entity.

Additional FAQs About Paraguayan Banking

Based on our extensive experience, these are the most common concerns for our clients on opening a company bank account in Paraguay:

1. Can I open a corporate bank account online in Paraguay?

No. However, you can open a bank account from abroad with the support of a local attorney empowered through a power of attorney (POA).

2. What documents do I need to open a company bank account in Paraguay?

The following documents are required to open the company bank account:

- Copy of the articles of incorporation of the company.

- Certificate of good standing for the company.

- Commercial license, where applicable.

- Bank reference letter. If the company doesn’t have a bank reference letter, the shareholders of the company will need to provide it.

- Evidence of income can be proven through a copy of the income tax declaration of the shareholders.

- Passport copies for all shareholders and members of the company.

Letter of authorization from the shareholders or owners of the company.

3. Who can have access to a company bank account?

Any member of the company that is authorized by company shareholders can have access to the bank account.

4. What is the best bank in Paraguay for foreign companies?

We recommend the following banks for foreign companies: Banco Itau and Sudameris.

5. Why do companies open bank accounts in Paraguay?

Companies choose to open bank accounts in Paraguay due to the economic and political stability, the ability to hold currency in US Dollars, the territorial taxation system, and banking privacy.

6. Does Paraguay have bank secrecy?

In Paraguay bank secrecy is a commitment to the bank’s policies and the confidentiality of financial information.

7. Can a foreign company open a bank account in Paraguay?

Yes, with a local entity and legal representative, foreign companies can open a business bank account.

8. What currency are corporate accounts held in?

Primarily Paraguayan Guaraní (PYG), but USD accounts are also available.

9. What is the account opening timeline?

3 to 5 weeks, depending on document certification and compliance clearance.

Why Open a Corporate Bank Account in Paraguay?

Opening a bank account in Paraguay is a valuable step for investors seeking to leverage its growing economy and strategic location in South America. Paraguay has experienced remarkable economic growth, with a consistent 4.5% annual growth rate in recent decades.

Fiscal and debt adjustments have contributed to the country’s economic stability and strong GDP. A local bank account simplifies transactions, minimizes currency exchange costs, and provides direct access to the country’s financial system, which is increasingly open to foreign investors.

Additionally, it’s also the quickest and most secure way to provide your business’s financial records for inspection before local authorities. Furthermore, those who open a corporate bank account in Paraguay can benefit from the advantages offered by Mercosur for Micro, Small, and Medium Enterprises (MSMEs) and foreign entrepreneurs investing in the region. Paraguay’s banks are renowned for their efficiency and reliability of services.

Biz Latin Hub can help you open a corporate bank account in Paraguay

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Bogota and Cartagena as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge about how to open a corporate bank account in Paraguay, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent, or otherwise do business in Latin America and the Caribbean.

If this article about how to open a corporate bank account in Paraguay was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.