Businesses operating in Paraguay need regular entity health checks to maintain compliance with local regulations. Law No. 6480 and other key regulations govern corporate entities in Paraguay. This guide explains how to conduct effective corporate due diligence in Paraguay and maintain compliance through entity verification processes.

Paraguay’s 4.5% annual economic growth (World Bank) attracts international businesses and increases regulatory scrutiny. Companies failing compliance audits face financial penalties, operational restrictions, and reputational damage that affects market operations.

Key Takeaways on Entity Health Check in Paraguay

| Topic | Key Information |

|---|---|

| Main compliance areas | Corporate structure, tax obligations, banking regulations, beneficial ownership disclosure, entity registration |

| Critical deadlines | Annual tax declarations (March 31), monthly tax filings, beneficial ownership updates (30 days), CCT renewal |

| Who needs health checks | All companies in Paraguay, foreign subsidiaries, financial institutions, companies with foreign capital |

| Frequency recommended | Annual reviews for most companies, quarterly for financial institutions and high-risk sectors |

| Common violations | Outdated shareholder records, missed tax deadlines, incomplete beneficial ownership data, expired CCT certificate |

| Cost-saving tip | Combine entity health checks with annual tax filings to reduce advisory fees by up to 25% |

Why Corporate Due Diligence Matters in Paraguay

Corporate due diligence in Paraguay protects businesses from regulatory violations following economic reforms implemented after 1990s financial challenges. These reforms created stricter compliance requirements affecting all business sizes.

Paraguay entity verification ensures:

- Valid operating licenses and permits

- Protection from penalties (warnings to $100,000+ fines)

- Access to foreign investment and partnerships

- Qualification for government contracts

- Banking relationships and favorable financing terms

International partners require proof of compliance before entering agreements. Clean entity health check reports facilitate mergers, acquisitions, and joint ventures.

Paraguay Legal Framework for Entity Health Checks

Paraguay’s regulatory structure combines civil law principles with modern transparency requirements. The framework continues evolving as Paraguay aligns with international standards, particularly in anti-money laundering and corporate transparency.

Administrative Register of Legal Entities

Law 6446/2019 established Paraguay’s Administrative Register of Legal Entities, with Decree 3241 providing implementation guidelines. The Ministry of Finance manages this register through a dedicated agency maintaining comprehensive entity databases.

Registration requirements:

- Current shareholder information

- Control structure details

- Corporate documentation updates

- Annual confirmations (even without changes)

- 30-day update deadline for ownership changes

Penalty Alert: Late submissions incur fines starting at 50 minimum wages, increasing with non-compliance duration.

Ultimate Beneficial Owner Requirements

Paraguay requires identification of natural persons ultimately controlling businesses, aligning with international anti-money laundering standards. Financial institutions enforce these requirements through Know Your Business (KYB) procedures.

Disclosure obligations include:

- Natural persons owning 25%+ of shares (direct or indirect)

- Individuals exercising control via voting agreements or contracts

- Complete ownership chains for complex structures

- Annual UBO information confirmations

Companies unable to provide clear beneficial ownership face banking access restrictions and transaction limitations.

Essential Components of Paraguay Entity Health Checks

Comprehensive entity health checks examine multiple compliance aspects beyond surface-level documentation, providing deep insights into regulatory standing.

Legal Due Diligence Paraguay

Legal due diligence forms the foundation of entity health checks through systematic examination of corporate documentation. Independent auditors with specialized local knowledge typically lead these reviews.

Key review areas:

- Corporate registrations: Public Registry filings and current status

- Bylaws compliance: Alignment with regulations and corporate purpose

- Board governance: Meeting minutes, resolutions, director duties

- Powers of attorney: Scope definition and format compliance (critical for foreign-owned entities)

- Licensing validity: Permits covering all business activities

- Employment compliance: Contracts, social security registration, labor law adherence

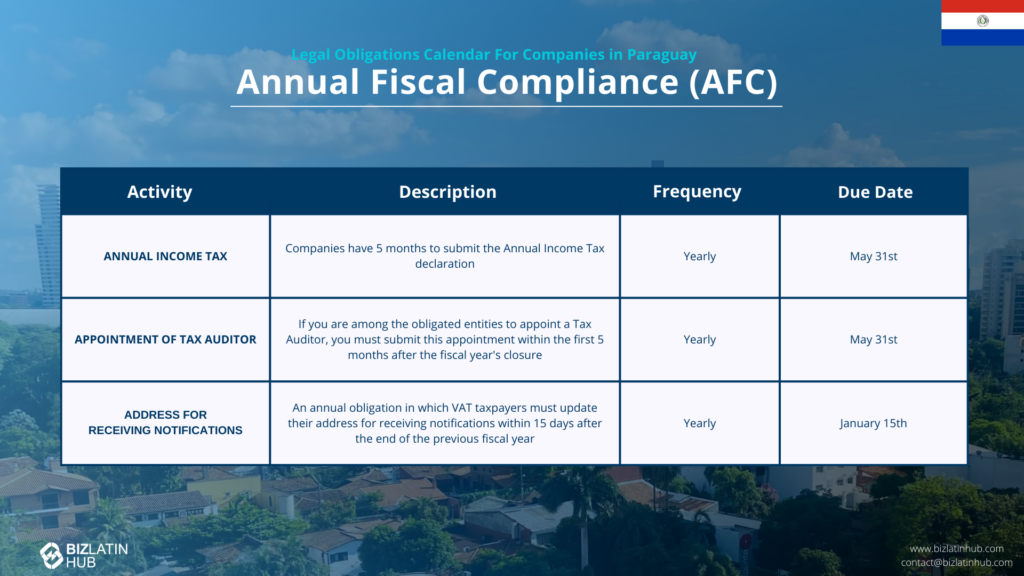

Fiscal Compliance Audit

Fiscal audits examine tax compliance across all obligation types, identifying risks and process improvement opportunities.

Audit scope includes:

- Income tax: Annual declarations, advance payments, withholdings

- VAT: Invoice sequences, collection/remittance, input tax credits

- Payroll taxes: Employer/employee contributions, reporting accuracy

- Municipal taxes: Local business licenses and payments

- CCT validity: Tax Compliance Certificate maintenance

- Transfer pricing: Documentation for related-party transactions

Critical Note: CCT certificates enable government contracts and private business relationships. Begin renewal 60 days before expiration.

Corporate Structure Review

Paraguay entity verification ensures operational reality matches legal structure through examination of:

- Shareholder registers with pledges, restrictions, special rights

- Director appointments following proper procedures

- Branch office documentation and parent company authorization

- Foreign investment declarations and updates

- Investment promotion agreement compliance

Step-by-Step Process for Entity Health Checks in Paraguay

Effective entity health checks follow systematic processes typically spanning 20-30 business days. Complex structures or identified issues may extend timelines.

Phase 1: Document Collection (Days 1-5)

Essential documents for compilation:

- Formation papers, bylaws, amendments

- Tax filings (3-year history)

- Financial statements (statutory and management)

- Employment records (current staff and recent terminations)

- Regulatory licenses and permits

- Banking relationships documentation

- Insurance policies and claims history

Missing documents require immediate retrieval from government registries or former service providers.

Phase 2: Compliance Review (Days 6-15)

Auditors examine documentation against current regulations, identifying subtle compliance issues through:

- Legal document analysis for procedural compliance

- Tax obligation verification across all filing types

- Multi-agency regulatory filing cross-checks

- Beneficial ownership accuracy assessment

- Internal procedure evaluation for ongoing compliance capability

Phase 3: Gap Analysis (Days 16-20)

Analysis transforms findings into prioritized action items:

- Compliance deficiency identification with business impact assessment

- Risk prioritization by severity and timeline

- Penalty calculation for violations

- Remediation cost estimation

- Systemic issue identification requiring process changes

Phase 4: Remediation Plan (Days 21-25)

Concrete action plans address identified issues through immediate fixes and long-term improvements. Plans include specific responsibilities, deadlines, and success metrics for each item.

Timing Strategy: January health checks align with tax preparation, allowing issue correction before March deadlines. Transaction-related checks need 90-day lead time.

Industry-Specific Compliance Requirements

Different sectors face unique obligations beyond baseline requirements, requiring specialized compliance approaches.

Financial Institutions

Banks operate under Paraguay’s strictest framework per Law No 861/96:

Prudential Requirements:

- Capital adequacy ratios (BCP-monitored)

- Liquidity management systems

- Risk-weighted asset calculations

- Quarterly Superintendency reporting

- Resolution No 16 governance standards

Board members must demonstrate relevant experience, independence from conflicts, and understanding of business models and risk profiles.

Companies with Foreign Investment

Foreign-owned entities manage additional compliance layers:

Specific Obligations:

- Foreign capital registration with ongoing updates

- Local power of attorney clarity

- Quarterly foreign exchange reporting

- Transfer pricing documentation (arm’s length demonstration)

- Parent company reporting requirements

- Investment incentive compliance

Risk Management Through Regular Health Checks

Sustainable compliance requires integrated systems beyond periodic reviews.

Compliance Calendar Implementation

Effective calendars include:

- All deadlines with 30-day advance alerts

- Distributed responsibilities by expertise

- Quarterly calendar updates for regulatory changes

- Team meetings for deadline coordination

- Buffer time for preparation and review

Documentation Systems

Modern compliance requires:

- Digital storage with search capabilities

- Version control tracking changes

- Audit trails showing access/modifications

- Secure backups maintaining confidentiality

- Legal validity preservation procedures

Internal Control Framework

Controls preventing errors include:

- Segregated duties across processes

- Dual approval for significant filings

- Monthly internal compliance reviews

- Structured checklists with flexibility

- Continuous staff training programs

Selecting Paraguay Advisory Partners

Qualified advisor characteristics for corporate due diligence in Paraguay:

- Deep regulatory knowledge including interpretation patterns

- Industry-specific experience with peer benchmarking

- Proven track record with similar companies

- Rapid response capability for urgent matters

- Transparent fee structures with detailed estimates

- Professional association registrations

Selection Process: Interview three firms minimum, contact industry references, verify credentials, and test compatibility through limited initial engagement.

Common Violations and Prevention Strategies

Understanding frequent violations enables focused prevention efforts across all company types.

Primary Compliance Failures

1. Beneficial Ownership Updates

- Quarterly review implementation

- Automated change alerts

- Comparison against filed reports

2. Tax Filing Completeness

- Monthly reconciliation processes

- Professional tax advisor engagement

- Staff training on requirements

3. Corporate Governance Gaps

- Standardized documentation templates

- Professional secretarial services

- Regular board training

4. Employment Record Deficiencies

- HR audit procedures

- Specialized payroll providers

- Compliance requirement updates

5. Registration Maintenance

- Centralized expiration tracking

- Renewal process ownership

- Relationship building with registries

Investment Analysis: Compliance Program Value

Regular Paraguay entity verification delivers measurable returns justifying compliance investments.

Program Costs:

- Annual health checks: $3,000-10,000

- Issue remediation: $1,000-5,000

- Monthly advisory: $500-2,000

Quantifiable Benefits:

- Penalty avoidance savings

- Transaction facilitation

- Financing access improvements

- Contract qualification expansion

Strategic Advantages:

- Management confidence in compliance status

- Employee operational clarity

- Partner relationship strengthening

- Market opportunity access

Frequently Asked Questions

What determines entity health check frequency in Paraguay?

Annual reviews align with fiscal-planning cycles and suffice for most businesses. Financial institutions and other regulated sectors require quarterly assessments to address heightened risk. Any major transaction—acquisition, divestiture, or capital raise—warrants an immediate, out-of-cycle review.

Which documents are essential for Paraguay entity verification?

Core files include corporate registrations, CCT (Registro Público de Comercio) certificates, beneficial-ownership declarations, board and shareholder resolutions, recent financial statements, and complete employment records. Consistent organisation ensures rapid retrieval during reviews.

Why use local professionals for Paraguay compliance checks?

Regulations favour registered Paraguayan auditors who maintain current knowledge, cultivate regulator relationships, and resolve grey-area issues efficiently. Their fees are modest compared with the financial and reputational cost of non-compliance.

How quickly must companies complete entity health checks?

Typical engagements take 20-30 business days. Simple structures can finish in 15-20 days, whereas complex groups may need 30-45 days. Expedited services can produce a basic report within 10-15 days.

Do small businesses require formal compliance reviews?

Yes. Resource-constrained small enterprises face proportionally higher regulatory-breach risk. An annual health check identifies problems early, before they threaten the business’s viability.

Implementation Roadmap

Immediate Actions (This Week):

- Verify CCT certificate validity

- Review beneficial ownership accuracy

- Check pending government correspondence

Short-term Priorities (This Month):

- File required ownership updates

- Meet with compliance advisors

- Begin documentation assembly

Medium-term Goals (This Quarter):

- Complete comprehensive health check

- Implement priority recommendations

- Establish monitoring systems

Long-term Objectives (This Year):

- Deploy automated compliance tracking

- Train staff on procedures

- Build advisory relationships

Paraguay’s economic growth rewards compliant businesses through expanded opportunities. Professional entity health checks protect investments while enabling sustainable expansion. Begin strengthening your Paraguay compliance position today through qualified local advisory partnerships.

Partner with Biz Latin Hub for Paraguay Entity Health Checks

Biz Latin Hub can help with comprehensive entity health checks and corporate due diligence throughout Paraguay. Our local team combines deep regulatory knowledge with practical business experience, having conducted hundreds of compliance reviews for international companies across all sectors. We provide end-to-end support from initial document collection through remediation implementation, ensuring your business maintains full compliance with Paraguay’s evolving regulations. Our multilingual professionals understand both local requirements and international business standards, delivering reports that satisfy stakeholders while identifying practical solutions to compliance challenges. Contact us today to schedule your Paraguay entity health check and protect your business investment with the confidence that comes from working with the region’s leading corporate services provider.