For anyone looking to register a business in Paraguay or already doing business there, understanding and complying with employment law in Paraguay will be important to maintaining the good standing of your company and giving it the best possible chance of success. Below, a basic guide to employment law in Paraguay is provided, including standard working hours, the most common types of employment contracts used by investors, details on statutory leave allowances, and the contributions and deductions an employer must oversee.

Key Takeaways

| What are the working hours mandated by employment law in Paraguay? | Employment law in Paraguay sets a maximum work schedule of 8 hours per day and 48 hours per week, not including overtime. |

| What is the minimum wage in Paraguay? | The current minimum wage as of January 2025 is COP$2,798,309 (aprox USD$350). |

| Types of Employment Contracts in Paraguay | Fixed-term. Indefinite-term. Learning Contracts. |

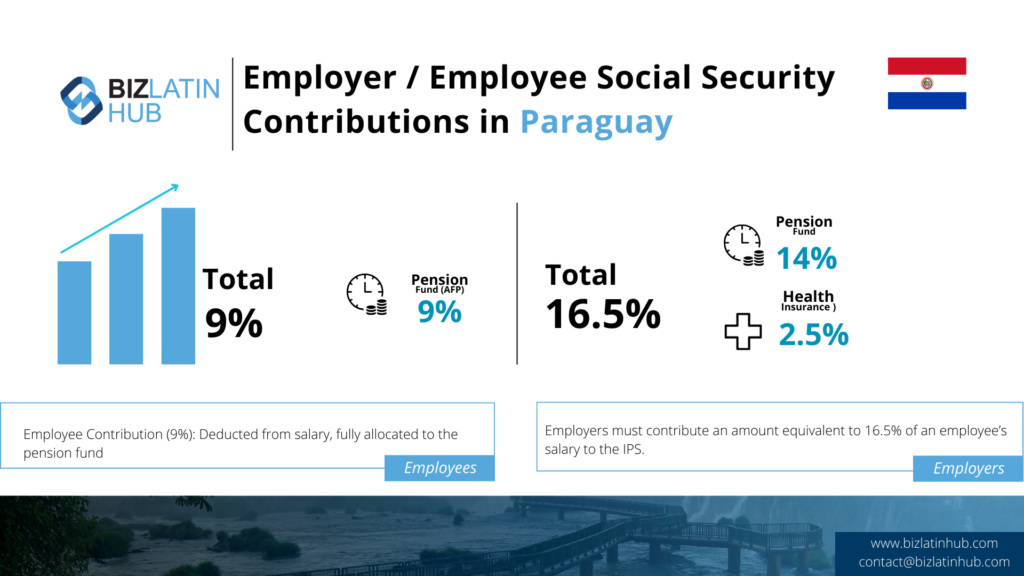

| What percentage of an employee’s salary is contributed to social security in Paraguay? | Employers must contribute an amount equivalent to 16.5% of an employee’s salary to the IPS. |

Employment law in Paraguay: common employment contracts

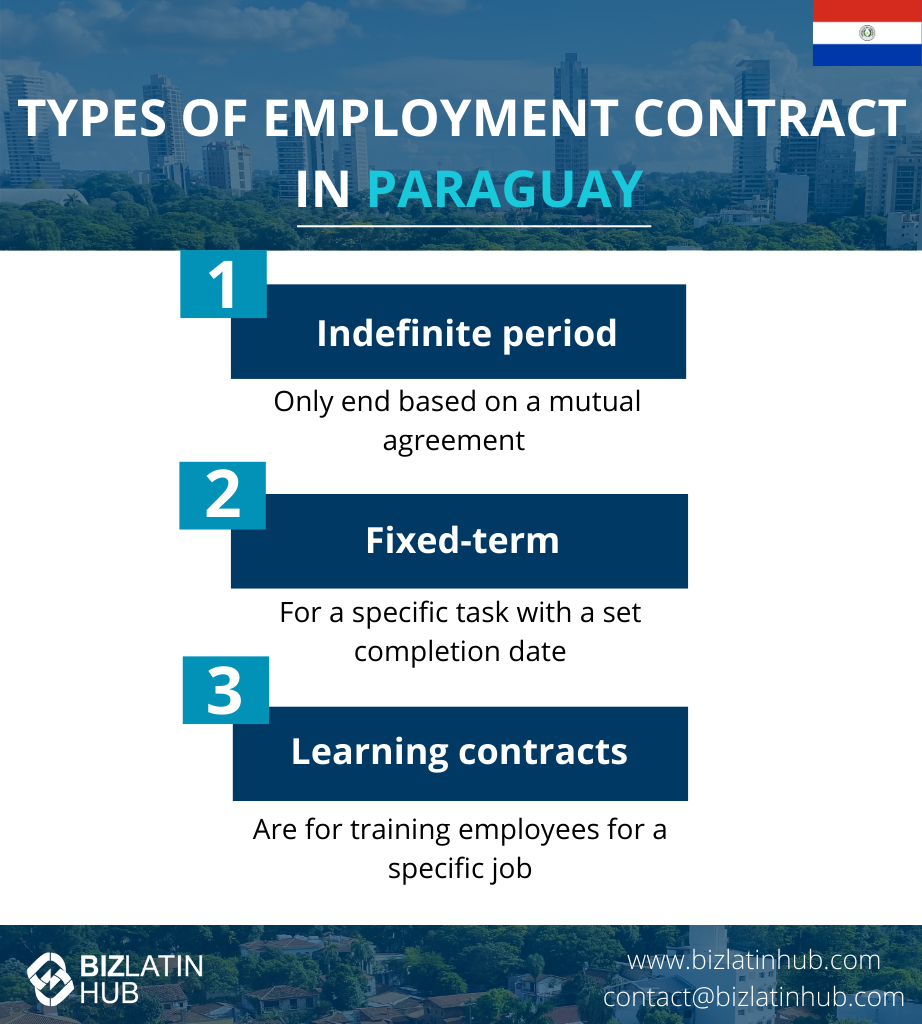

There are three main types of contract allowed under employment law in Paraguay that are used by foreign investors:

- Indefinite-term employment contracts are the most common type of contract and run until both the employer and the employee mutually agree to the termination, or until one party has the right to act unilaterally — such as in the event of the employee resigning or engaging in behavior that constitutes misconduct and justifies their removal under the terms of the contract.

- Fixed-term employment contracts can only be used when the circumstances warrant it, such as when employing someone for a particular task or project with a clear completion date. The period of employment must be explicitly stated within the contract.

- Learning contracts are intended for an employee or employees to learn skills relevant to a specific job and are generally issued to individuals between the ages of 16 and 18 years old. A learning contract should involve working for no more than 24 hours per week and must include a salary of at least 60% of the minimum wage.

Working hours under employment law in Paraguay

According to employment law in Paraguay, a standard working week is 48 hours long for daytime work and 48 hours per week for nighttime work.

For daytime work, each working day should be a maximum of eight hours long, while for night work it is seven hours, and employees should receive at least one rest day per week.

Any supplementary hours worked on top of those hours must be paid in proportion to the employee’s standard rate of pay plus a supplementary addition based on the time of the additional hours. Extra hours worked overnight or during public holidays are paid double. Those extra hours cannot exceed of three per day and nine per week.

Note that there are generally between nine and 14 national holidays that fall on weekdays per calendar year in Paraguay.

Vacations, leave, and other absences under Paraguayan law

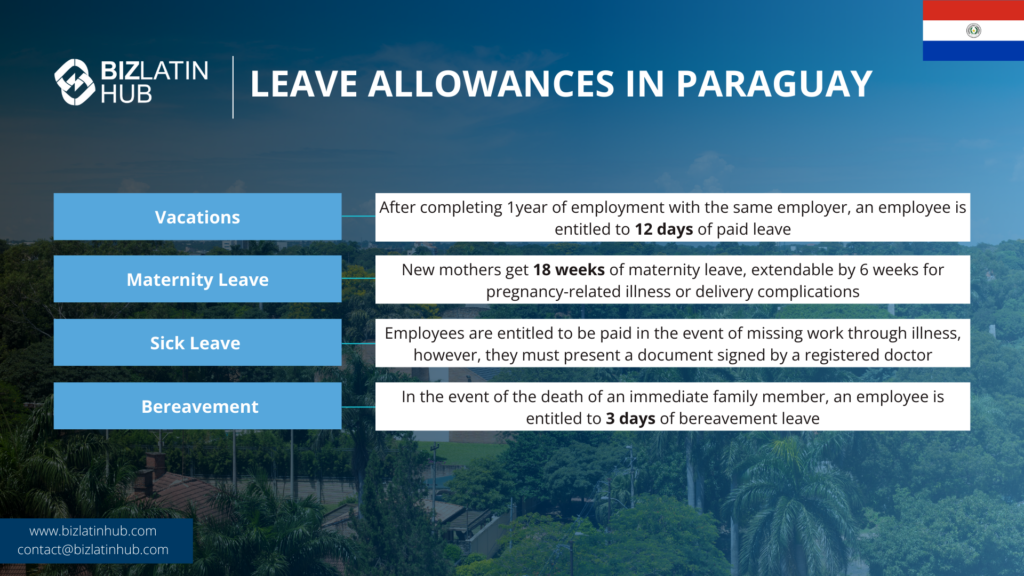

After completing one year of employment with the same employer, an employee is entitled to 12 days of paid leave. This is extended to 18 days of leave after five years of service, and to 45 days after ten years of service.

Note that, once an employee has completed ten years of service. under employment law in Paraguay, they cannot be removed from their role without proper justification.

Maternity and paternity leave

New mothers are entitled to maternity leave totaling 18 weeks, which can be extended by six weeks in the event of illness during the pregnancy or complications during the delivery. New fathers, meanwhile, are entitled to 14 days of paid paternity leave.

Note that, in the event of an adoption, where the child is below six months of age, new adoptive mothers are entitled to 18 weeks of maternity leave, while for children above six months old, the allowance totals 12 weeks of paid leave.

Sick leave

Employees are entitled to be paid in the event of missing work through illness, however, they must present a document signed by a registered doctor. The cost of paid sick leave is covered by the government social security fund.

Bereavement leave

In the event of the death of an immediate family member — including a parent, sibling, spouse or partner, child, or grandchild — an employee is entitled to three days of bereavement leave.

Statutory contributions under employment law in Paraguay

Annual bonus

Like in many countries in Latin America, under employment law in Paraguay, employees are entitled to an annual bonus equivalent to one full month of pay, which is paid in December.

How does termination and severance work?

An employee can have their contract terminated without notice during their probation period — which will generally last for between one and three months depending on the type of role but can sometimes last for four months in the case of highly-qualified employees.

Outside of the probation period, and in the absence of conduct warranting dismissal (such as gross misconduct as set out in the contract), employers must provide an employee with notice of dismissal, which will range from 30 to 90 days, depending on the employee’s length of service.

A severance payment totaling 15 days of pay for each year of service must be paid to an employee who is dismissed under such conditions.

Note that an employee can resign from their position with a single day of notice under employment law in Paraguay.

FAQs about employment law in Paraguay

In our experience, these are the common questions and doubtful points of our Clients.

In Paraguay, the standard workweek spans 48 hours, and employment contracts can be either fixed-term or indefinite. The country sets a national minimum wage to ensure fair compensation. Maternity leave is provided with full pay, demonstrating a commitment to employee well-being. Social security contributions encompass health and retirement benefits, and Paraguayan labor laws emphasize the significance of collective bargaining and the right to strike. They are overseen by the ministry of labor.

Employees in Paraguay work 48 hours per week or 8 hours per day. Overtime is limited and employees are compensated for it. The minimum wage in Paraguay is adjusted regularly to ensure it covers the cost of living, which includes expenses for food, housing, clothing, transportation, security, culture, and recreation.

A standard work day in Paraguay consists of 8 hours. However, for employees who work between 8:00 pm and 6:00 am, the work week cannot exceed 48 hours and must be compensated at 130% of their regular pay rate

The minimum wage in Paraguay is currently PYG$2,798,309 per month (USD$350) as of July 2024. This data is published monthly by the Central Bank and reviewed periodically. Adjustments usually take place in the summertime with July being standard.

Overtime in Paraguay is paid at different rates depending on the time of day and whether it falls on a public holiday. During daytime hours, overtime is paid at 150% of the regular pay rate. For overtime during night hours and public holidays, the rate is increased to 200% of the regular pay. It is important to note that the maximum overtime hours allowed are 3 hours per day and 9 hours per week. Additionally, employees who work on a rest day are entitled to a compensatory rest day.

If an employee is terminated for justified reasons such as misconduct or poor performance, they are not entitled to receive severance pay in Paraguay. However, if an employee is terminated without cause, they are entitled to receive 15 days of severance pay for every year of service.

To terminate an employee in Paraguay, the employer must provide written notice of termination. The length of the notice period depends on the employee’s length of service. If the termination is justified, such as for misconduct or poor performance, the employee is not entitled to severance pay.

When an employee quits in Paraguay, they are required to give one day of notice. If the reason for termination is justified, such as misconduct or poor performance, the employee is not entitled to severance pay. However, if the employee is terminated without cause, they are entitled to receive 15 days of severance pay for each year of service. It is important to note that the maximum severance pay that can be received is 50% of the employee’s annual salary.

Biz Latin Hub can assist you with employment law in Paraguay

At Biz Latin Hub, our bilingual team of corporate support specialists is on hand to assist you in navigating employment law in Paraguay, or any other aspect of entering and doing business in the country.

We offer a comprehensive portfolio of back-office services, including company formation, accounting & taxation, corporate legal services, visa processing, and hiring & PEO, meaning that we can provide tailored packages of integrated support to suit every need.

We have teams in place in 16 markets around Latin America and the Caribbean, and trusted partners that take our coverage to almost every corner of the region, meaning that wherever you are doing business, we can help you, and we specialise in multi-jurisdiction market entry.

Contact us today to receive more information about how we can support you doing business in Paraguay.

Or learn more about our team and expert authors.