Barbados welcomes foreign investors with open arms. The nation provides a regulated, transparent, and supportive investment environment. Before you launch your business, It is essential to understand the tax and accounting requirements in Barbados. In this article, we outline important accounting information and tax rates for achieving success in this market. Discover key information about doing business in this growing Caribbean nation if you want to form a company in Barbados.

Key Takeaways On Tax and Accounting Requirements in Barbados

| What Are The Accounting Standards in Barbados? | In Barbados, financial statements are prepared by either the International Financial Reporting Standards (IFRS), the International Financial Reporting Standard for Small and Medium-Sized Entities (IFRS for SMEs), or the International Public Sector Accounting Standards (IPSAS). |

| What Is The Corporate Tax Rate in Barbados? | Corporate tax is applied to profits at 25%. Small businesses enjoy a reduced tax rate of 15%. International Business Companies and Offshore Banks are subject to corporate tax at rates of 2.5%, which can decrease to 1%. |

| What Is The Bajan Value Added Tax Rate? | VAT is 17.5% of the value of various goods and services imported or provided in Barbados by VAT-registered individuals. |

| Dividend Tax Rate in Barbados | Dividends are subject to a basic withholding tax of 15% unless covered by a relevant taxation treaty. |

What is the corporate tax system in Barbados?

The place of management and control determines the residency for tax purposes in corporations. Domestic corporations are taxed on their global income, while foreign companies conducting business through a branch pay corporate tax on locally generated income and a tax on remitted branch profits.

Corporate tax is applied to profits at 25% for every complete dollar of taxable income. Small businesses, as per the ‘Small Business Development Act,’ enjoy a reduced tax rate of 15% for every dollar of taxable income under specific conditions.

In the offshore sector, locally incorporated International Business Companies and Offshore Banks are subject to corporate tax at rates of 2.5%, which can decrease to 1%. Captive Insurance Companies in this sector, however, are exempt from taxation.

Tax and accounting requirements in Barbados: What are the key local tax rates?

Navigating the accounting and taxation requirements in Barbados is crucial when entering this market. Here are the tax rates you need to know.

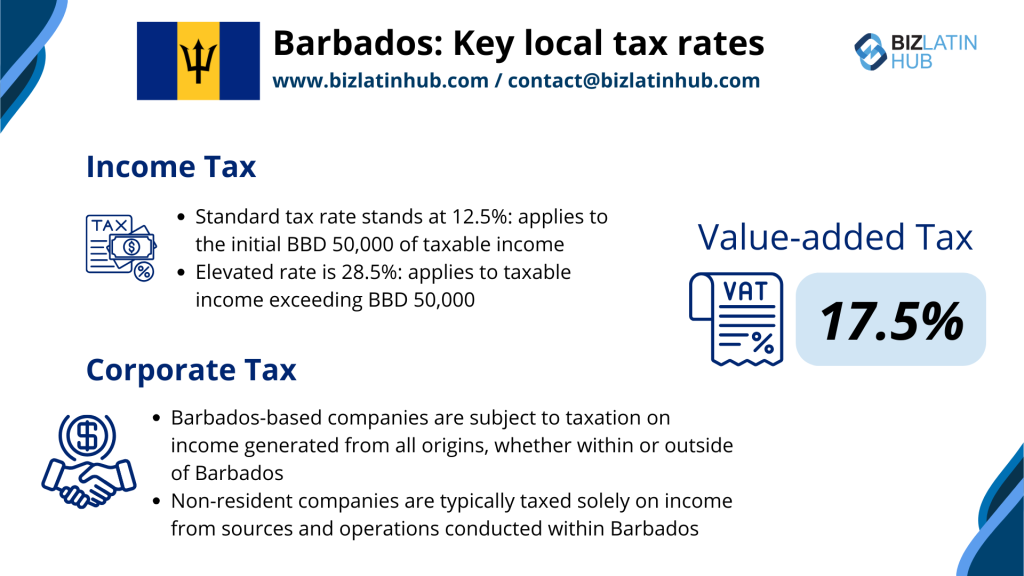

Income Tax

Starting from January 1, 2020, the standard tax rate stands at 12.5%, while the elevated rate is 28.5%. The standard rate applies to the initial BBD 50,000 of taxable income, and the higher rate of 28.5% applies to taxable income exceeding BBD 50,000.

Corporate Tax

Barbados-based companies are subject to taxation on income generated from all origins, whether within or outside of Barbados, after deducting expenses incurred to produce assessable income within a fiscal period not exceeding 53 weeks.

Non-resident companies are typically taxed solely on income from sources and operations conducted within Barbados. As an investor, you will face a corporate income tax rate ranging from a minimum of one percent to a maximum of 5.5 percent.

Value-added Tax

VAT is 17.5% of the value of various goods and services imported or provided in Barbados by VAT-registered individuals.

Certain services, such as financial services, real estate, medical services, and education, are exempt from VAT. Transactions between different groups are subject to taxation.

Entities operating under Barbados’ VAT system are required to be registered. The threshold for mandatory VAT registration is BBD 200,000, but those with an annual turnover below this amount can voluntarily register.

Capital Gains Tax

There is no capital gains tax in Barbados.

Foreign Tax Credit

Barbados permits a credit for foreign taxes (taxes paid in jurisdictions outside Barbados). However, the total credit allowed cannot diminish the overall tax liability for that income to less than 1%.

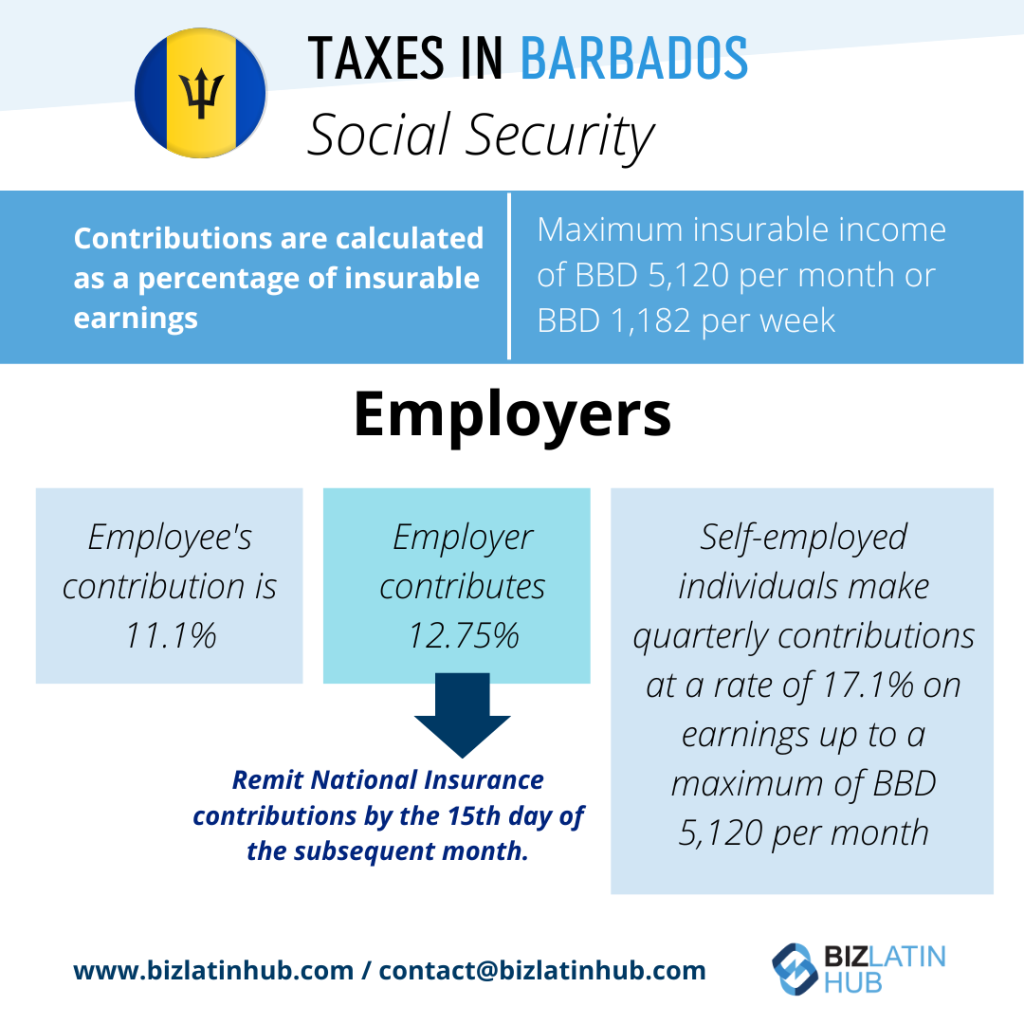

Social Security

Every individual aged 16 to 67, engaged in gainful employment in Barbados under a service contract, must be insured under the National Insurance and Social Security Act.

Contributions are calculated as a percentage of insurable earnings, capped at a maximum insurable income of BBD 5,120 per month or BBD 1,182 per week. Employers must remit National Insurance contributions by the 15th day of the subsequent month.

Starting from October 1, 2018, the employee’s contribution is 11.1%, while the employer contributes 12.75%. Self-employed individuals make quarterly contributions at a rate of 17.1% on earnings up to a maximum of BBD 5,120 per month.

Does Barbados have double taxation agreements?

Barbados has established double taxation agreements with 40 countries including:

The UK, Canada, USA, Finland, Norway, Sweden, China, Cuba, Switzerland, Venezuela, Iceland, Czech Repúblic, Austria, Cyprus, Italy, and more.

FAQ regarding tax and accounting requirements in Barbados

Using our experience, we’ve pinpointed common questions and worries our clients often have when dealing with accounting and taxes in Barbados.

Barbados implements a flexible corporate tax structure, ranging from a minimum of 1% to a maximum of 5.5%.

Businesses residing in Barbados are taxed on income earned globally, inclusive of both local and international sources, after deducting expenses related to income generation within a fiscal period not exceeding 53 weeks. Non-resident companies, on the other hand, are typically taxed solely on income derived from operations within Barbados. Notably, insurance companies face a 2% tax rate, while Captive Insurance companies enjoy tax exemption.

The revenue collection authority in Barbados is known as the Barbados Revenue Authority.

In Barbados, financial statements are prepared by either the International Financial Reporting Standards (IFRS), the International Financial Reporting Standard for Small and Medium-Sized Entities (IFRS for SMEs), or the International Public Sector Accounting Standards (IPSAS).

Barbados officially recognizes and accepts several professional accounting designations, including ACCA, CPA, CGA, and CMA, as equivalents to the Certified Public Accountant (CPA) designation.

A Permanent Establishment (PE) is defined in Barbados’s double taxation agreements (DTAs), aligning with the Organisation for Economic Co-operation and Development (OECD) Model Convention.

According to domestic legislation, a non-resident person is considered to be conducting business in Barbados and must file a CIT return if, in an income year, they either:

Produced, grew, mined, created, manufactured, fabricated, improved, packed, preserved, or constructed anything in Barbados, whether or not exported. Solicited orders or offered anything for sale in Barbados through a factor, agent, or servant.

Biz Latin Hub can organize your tax and accounting requirements in Barbados

At Biz Latin Hub, we provide an extensive range of market entry and back-office solutions in Latin America and the Caribbean.

Our team has expertise in tax and accounting requirements in Barbados, with legal services, accounting and taxation, hiring, and visa processing available.

Our strong presence in the LATAM region is supported by robust partnerships that stretch across the area. This broad network provides numerous resources to support global projects and venture into new markets in different countries.

Contact us today to learn more about our services and how we can help you achieve your business goals in Latin America and the Caribbean.

If this article about tax and accounting requirements in Barbados interests you, check out the rest of our coverage of the region. Or read about our team and expert authors.