The thriving business market in Barbados is very welcoming to foreign investors and business people. For example, it has double taxation treaties with 40 countries. Understanding how to open a corporate bank account in Barbados is an essential step for success, and also an absolutely vital part of company formation in Barbados if you are establishing a presence there. Barbados is known for its well-developed banking sector, bilateral tax treaties, and foreign investment support. It is a top choice for regional headquarters.

Key takeaways on how to open a corporate bank account in Barbados

| Which are the best banks with which to open a corporate bank account in Barbados? | Republic Bank Barbados Limited Scotiabank Barbados CIBC First Caribbean International Bank RBC Royal Bank First Citizens Bank |

| The process to open a corporate bank account in Barbados: | To open a bank account in Barbados you must follow these steps: Gather your documents Apply in person or online Wait for the bank to verify your documents Make a minimum deposit |

| Are there Know Your Customer requirements? | You will have to provide detailed financial information. |

| What documents do you need? | Due Diligence information for all Shareholders, Directors, Officers, and Signatories; Full corporate profile of company operations and activity, Barbados Foreign Currency Permit, Declaration of Source of Funds, Copy of Company By-Laws |

| Do all banks follow the same process? | This is a general guide: you will need to check individual banks’ rules or contact one of our advisors for more detailed rules |

| Can you open a corporate bank account in Barbados online? | Most banks offer an online option as well as in-person, but check with individual banks for the complete process. |

How to Open a Corporate Account Step-by-Step

Once you have chosen a provider to bank with, you are ready to begin the process of opening a corporate account. To open a bank account in Barbados you must follow these steps:

- Gather your documents

- Apply in person or online

- Wait for the bank to verify your documents

- Make a minimum deposit

Below is more information on each of the steps outlined above.

Gather your documents

See below for full details, but be advised that there is an extremely lengthy list of documents you will have to have in order. They are largely fairly straightforward, so should not be a problem but there may be some bureaucratic delays. Be aware that any that are not in English will likely have to be translated by an official translator.

Go to the branch in person or online

Most banks in Barbados are flexible, allowing account formation either over email, online or in person. If you are delegating this to a person other than a director, you will have to provide Power Of Attorney (POA) proof.

Wait for the bank to verify your documents

The bank will go through your documentation to make sure everything is in order. This may take some time, so be prepared to wait and stay attentive in case they have any queries.

Make a minimum deposit

This varies from bank to bank, with significantly higher levels for certain endeavours such as finance and wealth management.

Challenges Faced by Foreign-Owned Entities

Opening a bank account in Barbados doesn’t require residency or prior visits to the Caribbean Islands. You can open a non-resident corporate account with certain banks from anywhere, eliminating the need for in-person visits or meetings with bank representatives.

However, most banks in Barbados don’t immediately accept foreign or non-resident companies. This can be overcome by having an existing relationship with the bank, a clear reason for opening a corporate account in the country, or making a large deposit.

Regulated by the Central Bank of Barbados. Banks enforce AML rules and may require interviews with beneficial owners. Documentation must often be certified or apostilled. This is an important part of the tax and accounting requirements in the Barbados.

Documents Required for Opening a Business Account

To start the process of opening a corporate bank account in Barbados, you will be required to complete a comprehensive application and provide a company registration certificate, articles of association, personal and corporate identification documents, proof of address, and business activity overview. Reference letters may be required.

- Complete the bank’s application paperwork.

- Submit certified copies of corporate filings.

- Provide copies of government-issued identification and related proofs for each shareholder and director.

- Submit company financials and additional required documents.

- Generally, most banks in Barbados follow these procedures for opening a corporate bank account.

Partner with a local expert to simplify the process

Engaging with law firms or consultants is the optimal approach to start the bank opening procedure. While opening a corporate bank account in Barbados is fairly easy, certain aspects need consideration. Therefore, collaborating with a local partner becomes crucial, ensuring comprehensive assistance throughout the process.

Leading Banks in Barbados

Banks in Barbados offer tailored solutions designed to meet your company’s unique needs, whether it’s establishing investment accounts, accommodating flexible payment methods, or facilitating international transfers. Choosing a bank that aligns perfectly with your business requirements is crucial. Banks such as Republic Bank, CIBC FirstCaribbean, and Scotiabank are commonly used. Most offer business checking and foreign currency accounts.

Here are five notable banks in Barbados:

- Republic Bank Barbados Limited: A subsidiary of Republic Financial Holdings Limited, one of the Caribbean’s largest banking groups, provides a comprehensive array of financial services. This includes personal and business banking, investment services, and international banking, with a widespread network of branches and ATMs across Barbados. Renowned for competitive interest rates and a variety of credit products, the bank is particularly favored for its international banking services, catering to customers’ needs for seamless overseas transactions.

- Scotiabank Barbados: As a subsidiary of the Bank of Nova Scotia, one of Canada’s largest banks, Scotiabank Barbados has served the country for over 60 years with an extensive network of branches and ATMs. Providing a variety of personal and business banking services, including savings, investments, credit products, and international banking, Scotiabank is recognized for outstanding customer service. The bank actively supports the local community through corporate social responsibility initiatives and offers convenient digital banking solutions such as online and mobile banking, enhancing customer convenience.

- CIBC First Caribbean International Bank: CIBC, operates in 16 Caribbean countries, including Barbados. With branches and ATMs in Barbados, the bank provides personal and business banking, investment services, and international banking. Known for robust customer service and local community support, it offers a popular range of credit products for various projects.

- RBC Royal Bank: One of Canada’s largest banks, has a century-long presence in Barbados with a widespread network of branches and ATMs across the nation. Renowned for competitive interest rates on savings and investment accounts, as well as a variety of credit products for businesses and individuals, RBC Royal Bank also provides convenient digital banking solutions, including online banking, mobile banking, and user-friendly apps for enhanced customer convenience.

- First Citizens Bank: One of Trinidad and Tobago’s largest banks, has served Barbados for over two decades with branches and ATMs across the country. The bank is recognized for its popular credit products catering to businesses and individuals seeking financing for various projects. With a robust presence in the Caribbean region, it offers a diverse array of banking services, including personal and business banking, wealth management, and insurance.

Our recommendation: RBC or CIBC FirstCaribbean International Bank

Comparison Table:

| Feature | Barbados | Jamaica | Trinidad & Tobago |

| Minimum Deposit | $1,000–$5,000 | $1,000 | $2,000 |

| Account Opening Time | 2–3 weeks | 2–4 weeks | 3–5 weeks |

| Foreign Ownership Allowed | Yes | Yes | Yes |

| Remote Opening | Rare | Limited | Rare |

Additional FAQs About Banking in Barbados

Based on our extensive experience these are some common questions from clients opening a bank account in Barbados.

All corporate bank accounts are opened online now as stipulated by the institution. The required forms and due diligence information are submitted for approval.

Due Diligence information for all Shareholders, Directors, Officers, and Signatories; Full corporate profile of company operations and activity, Barbados Foreign Currency Permit, Declaration of Source of Funds, Copy of Company By-Laws

Any member of the company that is authorized by company shareholders can have access to the bank account.

Royal Bank of Canada, CIBC, FirstCaribbean International Bank

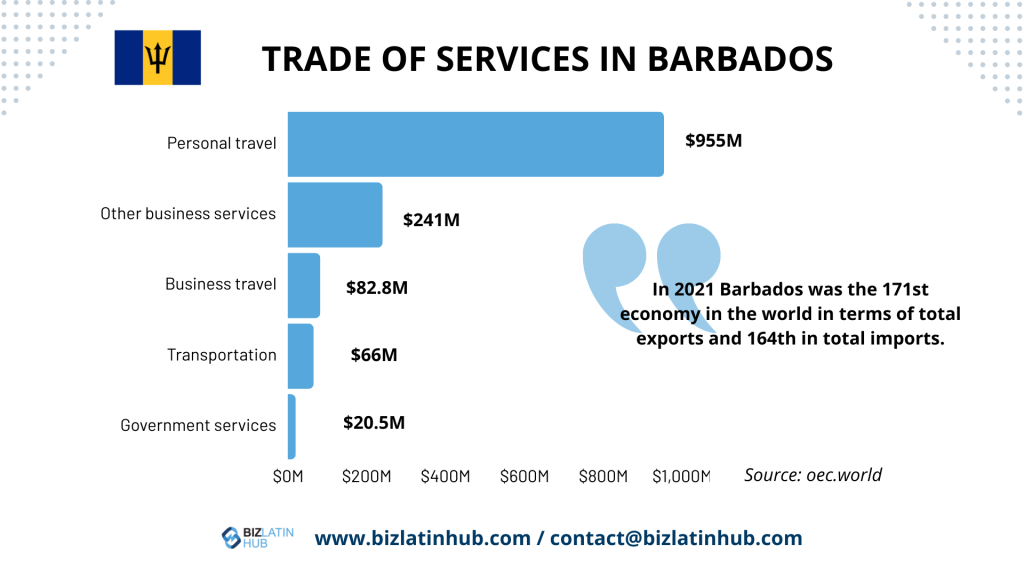

Companies may open bank accounts in Barbados for tax advantages, a stable economy, a well-regulated financial sector, ease of doing business, currency stability, access to international markets, and confidentiality. Barbados’ business-friendly environment makes it an attractive destination for those seeking favorable conditions for financial operations and international trade.

Submit company documents, ID for UBOs, a bank reference, and a business plan. Attend an interview (in person or virtual) and await compliance clearance.

While the Barbados dollar is pegged to USD, foreign currency transactions must be justified and reported in accordance with exchange control regulations.

Not always, but some banks may prefer a local signatory or representative to facilitate communication.

Between 2 and 3 weeks, assuming no delays in KYC and all documents are properly certified.

Biz Latin Hub can help you open a corporate bank account in Barbados

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in major cities in the region.

We also have trusted partners in many other markets. Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross-border operations.

As well as knowledge about how to open a corporate bank account in Barbados, our portfolio of services includes hiring & PEO accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to learn more about how we can assist you in finding top talent or doing business in Latin America and the Caribbean.

If this article on how to open a corporate bank account in Barbados was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.