The combination of a favorable business environment, strategic advantages, and a commitment to progress positions Barbados as an attractive market for foreign business owners seeking growth and success in the Caribbean region. To gain a competitive advantage, investors can use an Employer of Record (EOR) in Barbados to help streamline global expansion. It also ensures a solid foundation for your company’s growth and success in this tropical paradise and/or a step towards company formation in Barbados.

Key Takeaways

| Is it legal to hire through a PEO in Barbados? | Yes, hiring in Barbados through a PEO is legal. It ensures compliance with labor laws, handles payroll and taxes, and simplifies employment without needing a local entity. |

| What are the benefits of hiring through a PEO in Barbados? | Hiring through an PEO in Barbados offers quick market entry without a local entity, ensures compliance with complex labor laws, manages payroll and taxes, reduces legal risks, and allows you to focus on core business operations effortlessly. |

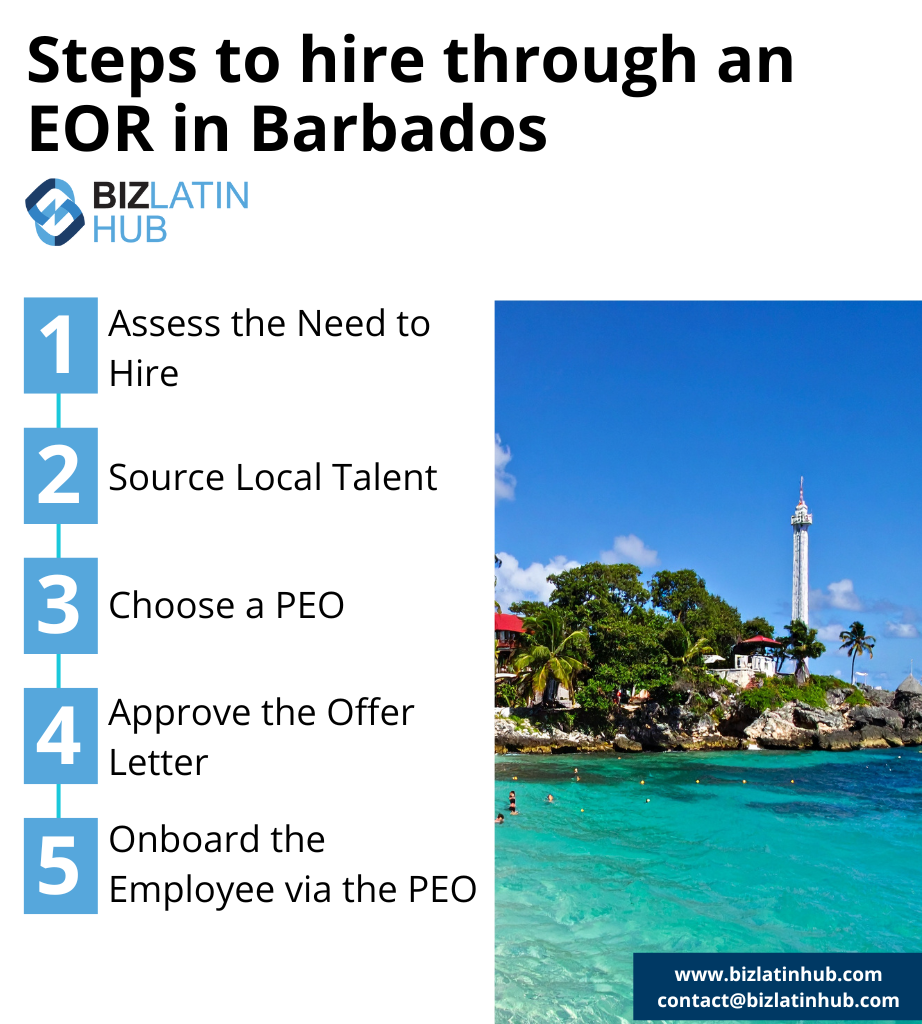

| Steps to hire through a PEO in Barbados | Assess the Need to Hire in Barbados Source Local Talent Choose a PEO Approve the Offer Letter Onboard the Employee via the PEO |

| Why employ Bajan workers? | Employing workers through a PEO in Barbados streamlines market entry by managing HR, payroll, and legal compliance, allowing you to hire local talent quickly and focus on business growth without establishing a local entity. |

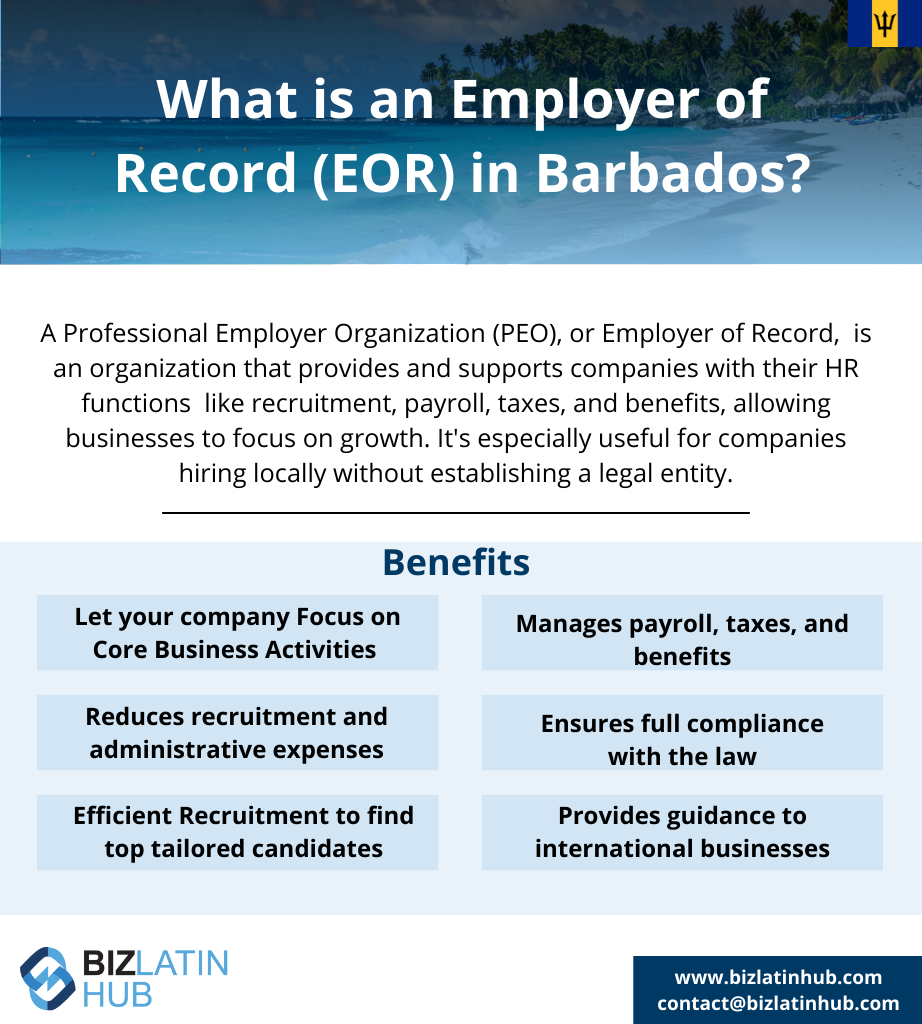

What is an Employer of Record (EOR) in Barbados?

An Employer of Record (EOR) in Barbados can be an indispensable partner for new businesses in the market. EORs handle tricky HR tasks like hiring, taxes, and benefits admin, letting businesses focus on growing without having to do time-consuming paperwork and rules.

It’s convenient if a company wants to hire local workers but wants to avoid the hassle of setting up a legal presence in Barbados. The EOR makes things smoother by handling these details, making it easier for businesses to expand and work with local talent.

Top benefits of working with an Employer of Record (EOR) in Barbados?

Partnering with an Employer of Record (EOR) in Barbados enables companies to swiftly enter the local market, ensuring rapid commencement of business operations. Using an EOR for talent acquisition provides various advantages, such as:

- Focus on core business

- Cost-effective approach

- Efficient hiring process

- Time savings

- Local expertise and compliance

- Fast setup

Focus on core business

By passing HR duties to an EOR in Barbados, your company liberates valuable time and resources. This strategic move allows your organization to channel its energy into core operations and direct employee management. With admin issues lifted, there’s room for an enhanced focus on business growth and innovation.

Cost-effective approach

Hiring an EOR saves money by cutting down recruitment and administrative costs. This is especially beneficial if you want to hire local staff but have not launched your company in Barbados.

Efficient hiring process

An EOR helps find the right employees by sourcing and selecting suitable candidates tailored to your company’s needs. This saves time and effort in hiring the ideal employees.

Time savings

Outsourcing payroll and other HR tasks to an Employer of Record (EOR) in Barbados means you don’t have to do time-consuming paperwork. Allowing you to use your time and resources more efficiently for strategic business activities.

Local expertise

Working with an EOR in Barbados guarantees strict compliance with local labor laws and regulations for your company. Their in-depth local knowledge ensures that all employment relationships align with legal mandates, significantly minimizing the risk of fines or legal complications.

Fast setup

An EOR service in Barbados should be recognized as a legal entity, so using it will allow you to rapidly enter the market. There is no need for a lengthy entity establishment.

EOR vs. PEO in Barbados – What’s the Difference?

When expanding into Barbados, businesses often choose between an Employer of Record (EOR) or a Professional Employer Organization (PEO) to hire and manage employees.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations. EORs are legal in Barbados and can be an indispensable partner for new businesses in the market.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

Note that EOR and PEO are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms.

Important Tip: While an EOR provides a quick-entry solution, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in Barbados. Biz Latin Hub offers both EOR and PEO solutions, helping businesses navigate regulations, establish entities, and ensure full HR compliance. Whether you need a fast market entry or a stable long-term presence, we can guide you through the process.

Hiring Employees in Barbados with an EOR

A professional Employer of Record (EOR) in Barbados can handle the complexities of different employment contracts in the country. The essential employment regulations managed by an EOR are:

Working Hours: The standard workweek spans 40 hours, with every employee entitled to two rest days a week.

Holidays: Barbados observes 13 national holidays. An employee who works for an employer for a year gets a yearly vacation of at least 3 weeks if their employment is less than 5 years. If the employee has been with the employer for 5 years or more, they are entitled to a yearly vacation of at least 4 weeks.

Sick Leave: Barbados has minimal regulations concerning sick leave, providing flexibility to establish rules and limitations in the employment contract. According to labor laws, sick leave requires certification by a doctor after a two-day absence.

Maternity/Paternity Pay: Unless an employee expresses a different preference, maternity leave must be a minimum of twelve weeks and should be organized to accommodate the employee’s needs.

Tax: If you live and have your permanent home in Barbados, you are taxed on your income from all around the world.

Value Added Tax (VAT): A 17.5% Value Added Tax (VAT) is applied to the value of various goods and services when they are imported or provided in Barbados by individuals or businesses registered for VAT.

Social Security: Every individual between the ages of 16 and 65, who is gainfully employed in Barbados under a contract of service, must be insured under the National Insurance and Social Security Act.

Termination of Contracts: Workers who have been continuously employed for one year have the right to ask for a written explanation of why they were dismissed. This is outlined in Sections 22 and 23(2) of the Employment Rights Act (ERA). The notice period for dismissal depends on the length of service and how often wages are paid.

Common FAQs when hiring through an Employer of Record (EOR) in Barbados

Based on our experience these are the common questions and doubts of our clients.

You can hire an employee by incorporating your own legal entity in Barbados, and then using your own entity to hire employees or you can hire through an Employer of Record (EOR), which is a third party organization that allows you to hire employees in Barbados by acting as the legal employer. Meaning you do not need a Barbados legal entity to hire local employees.

A standard Barbados employment contract must contain the following information:

-ID and address of the employer and employee

-City and date

-The location where the service will be provided.

-Type of tasks to be carried out

-Remuneration and bonifications/commissions (if applicable)

-Method payment frequency

-Duration of the contract.

-Probation period

-Work hours

-Additional benefits (if applicable)

The mandatory employment benefits in Barbados are the following:

-Social Security contributions

-National Insurance Scheme (NIS) contributions

-Vacation leave

-Public holiday pay

-Sick leave

Biz Latin Hub Can Help You With an Employer of Record (EOR) in Barbados

At Biz Latin Hub, we offer an extensive range of market entry and back-office solutions in Latin America and the Caribbean.

We have expertise with EORs in Barbados, legal services, accounting and taxation, company incorporation, and visa processing.

Our presence extends across major cities in the region, bolstered by robust partnerships in numerous other markets. This extensive network equips us with a wealth of resources ideally tailored to facilitate cross-border initiatives and market entry strategies in diverse countries.

Contact us today to learn more about our services and how we can help you achieve your business goals in Latin America and the Caribbean. If this article on EORs in Barbados was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.