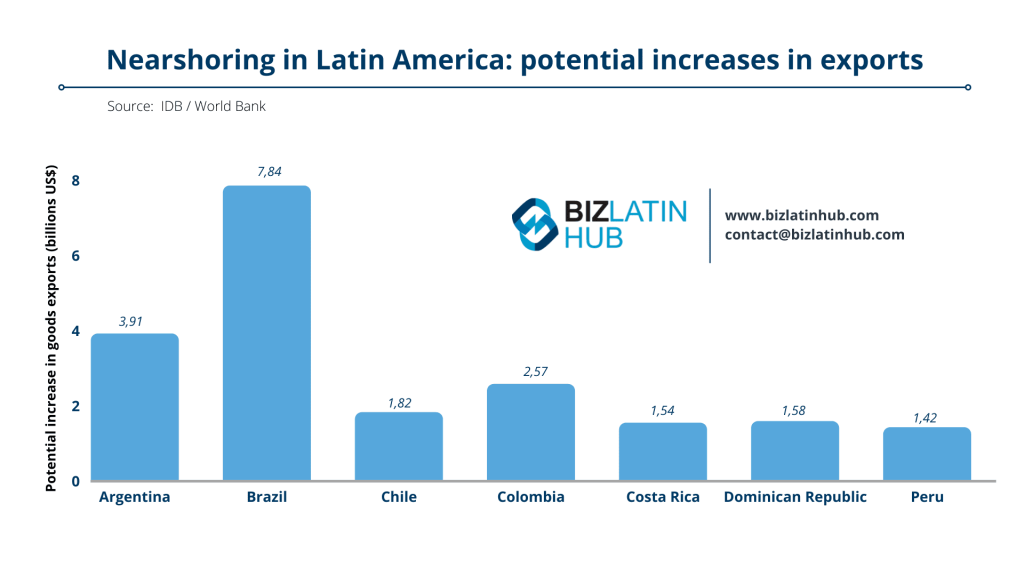

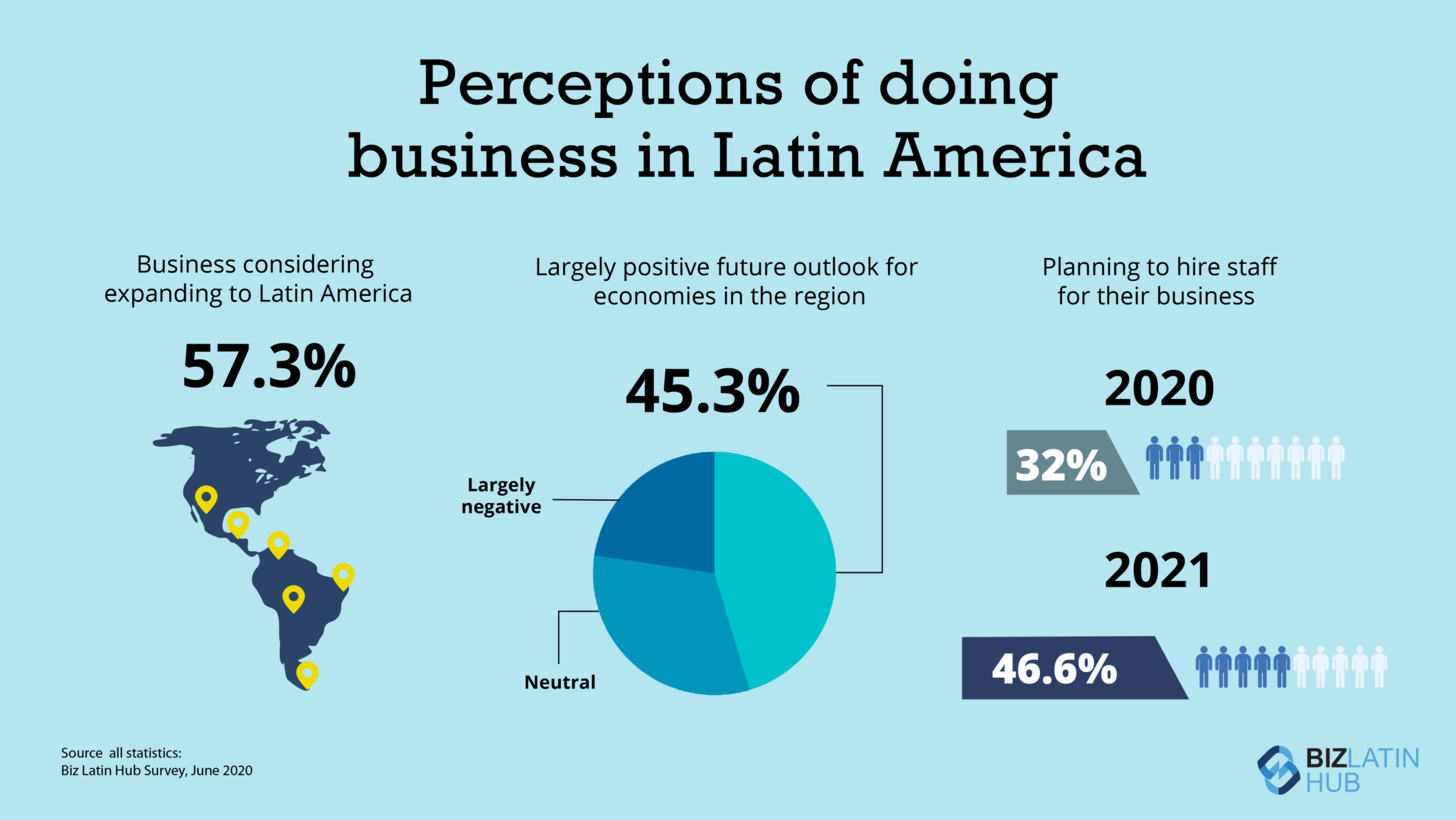

Globalization is a pivotal mechanism in the modern world, driven by features like LATAM free trade zones. It has enabled businesses to expand their operations into foreign markets, creating and exploiting new opportunities previously constrained in their respective domestic markets. Increasingly, awareness about the benefits of harnessing the international business environment through the process of nearshoring.

Some business leaders are reluctant to capitalize upon opportunities such as LATAM free trade zones. Many believe their companies will face problems when dealing with the trading and manufacturing of goods abroad. Others do not realize that in many cases it is just as easy to offer services as goods and you will now find plenty of service companies in FTZs.

If you’re a company looking to expand your global operations, continue reading to find out more information regarding LATAM free trade zones and doing business in Latin America. With Biz Latin Hub being the leading provider of back-office services in Latin America, we are here to help you better understand and realize the potential across the continent.

Our sincere thanks go to the executive director of the Association of Free Trade Zones in the Americas (AZFA), Maria Camila Moreno, for assisting in the content of this article.

What are LATAM Free Trade Zones?

A Free Trade Zone (FTZ) is a limited geographical location where a company has fiscal, customs, and international trade incentives. There are a variety of incentives for operating in an FTZ depending on the country, but there are 3 reasons that generally apply to all of Latin America, including:

- Reduced or lower income taxes

- 0% Value Added Tax (VAT)

- 0% on Tariffs

FTZs seek to simplify government restrictions without stripping away governmental authority.

However, it still means it might be necessary to pay duties to the country of any of your exported goods. FTZs do not eliminate your obligation to pay duties on the products you export. What they do offer is a strategic place where you can store and manufacture your products and make changes to your inventory with the previously mentioned incentives.

Increasingly, FTZs are becoming the home of service providers as well as goods manufacturers and importer/exporters. Countries such as Colombia are explicitly targeting these types of companies in certain FTZs, even allowing remote work for part of the labor force.

Although the traditional focus of free trade zones was on removing restrictions such as tariffs on physical goods, their shift towards broader base tax incentives such as elimination of VAT/sales tax or reduced corporation/income tax work just as well for service providers. On top of that, some LATAM Free Trade Zones have more flexible rules for employment, especially with foreign hires.

What Incentives Exist for both Goods and Services Providers?

LATAM free trade zones are commonly understood to only benefit businesses that are selling goods. This misconception completely overlooks the numerous services providers operating from FTZs in Latin America including call centers, and even hospitals.

Therefore, if you are a service company you too can also benefit from the lower income tax FTZs provide alongside the benefit of not having to pay taxes on any of the equipment you may need to provide your services.

You will find industrial and manufacturing companies in textiles, automobiles, tobacco, agriculture, medical equipment, alongside service companies in sectors that offer subcontracting, hospital services, call center services. A major challenge for any business looking to utilize FTZs is deciding on which country provides the most advantages in their favor.

FTZs accommodate a varying range of industries and sectors, with specific FTZs being more optimized under their jurisdiction depending on business activities. It is important to perform due diligence and perform your own research, or contact a regional expert to strategize a successful market entry.

What Advantages do Free Trade Zones Provide?

Aside from the economic incentives that FTZs offer, there are also other benefits that make this economic feature appealing to foreign investors.

- The safety you will feel from operating in an FTZ because of the various levels of security one needs to get through to access the area.

- FTZs fast-track your product into the market because of the concentrated and specialized attention your business will get. Every zone has administrators who are equipped to deal with whatever industry-specific obstacles and challenges that your business might face and are ready to overcome them so that you can get to the market faster.

- FTZs are communities comprised of various affiliates and partners that help manage and see through the process of successfully setting up your service or industry.

If you are looking to start operations in a LATAM free trade zone, it is worth going over to the AZFA website. The non-profit are the leaders on this topic matter and are able to go into far grater depths about how this exciting business opportunity can benefit your company. From there you will discover the most relevant resources and information about free trade zones in Latin America.

FAQs About LATAM Free Trade Zones

Yes, you will. FTZs do not eliminate your obligation to pay duties on the products you export. However, by establishing yourself in a particular country you may find yourself benefitting from trade agreements and deals.

Countries such as Chile and Peru in particular have a large number of free trade deals, meaning they export with reduced or zero tariffs to a lot of countries.

A Free Trade Zone is a limited geographical location where a company has trade incentives. These differ in specifics according to location, jurisdiction and industry focus.

However, they share many things in common – tax incentives (usually an exemption or reduction on corporate tax), fully supported infrastructure and in some cases lower or no export duties. These often come with certain conditions, but these are rarely restrictive.

Free trade zones are a great option for both goods and services, providing ample planning and strategy is carried out beforehand. An increasing number of LATAM Free Trade Zones are now targeting service companies particularly, and even allowing a certain number of remote workers. For example, Colombia’s system currently allows 50% of the workforce to work remotely.

The AZFA, which is a non-profit, has all the resources and information about the best and most secure trade zones in Latin America. In practical terms, a company such as Biz Latin Hub can help you with company formation and ongoing back-office support anywhere in the region.

You can find industrial and manufacturer companies in textiles, automobiles, tobacco, agriculture, medical equipment, and service companies in sectors that offer subcontracting, hospital services, call center services, and more.

Biz Latin Hub can support you and your business in LATAM Free Trade Zones

At Biz Latin Hub, we have vast experience helping investors from all over the world handle their businesses in a variety of LATAM free trade zones.

We have a multilingual team for legal, accounting, recruitment, and company formation services, ready and waiting to support your business efforts in the Caribbean and Latin America. Rest assured that your legal transactions are in professional hands and will be handled with confidentiality and efficiency.

Reach out to our team to learn more about how we can assist you in doing business in Latin America.

Learn more about our team and expert authors and how they are enabling commercial growth across Latin America.