The Cayman Islands attract entrepreneurs with its sunny beaches and a significant financial sector. These islands provide political and economic stability. They also feature advantageous tax laws and a business-friendly environment. This article explains key benefits of establishing a business in the Cayman Islands, focusing on tax advantages, asset protection laws, and comprehensive financial services. This guide details the primary advantages of the jurisdiction, from its tax-neutral status to its robust regulatory framework, which make it a premier destination for international business.

Key Takeaways: Starting a Business in the Cayman Islands

| What is the primary advantage of the Cayman Islands’ tax system? | The region operates a tax-neutral system and there are no direct taxes. |

| Are the Cayman Islands a safe place to do business? | The jurisdiction offers a stable political and economic environment. |

| What is the most common type of company for international business? | The most popular legal entity for foreign investors is the Exempted Company. |

| Is it easy to incorporate a company in the Caymans? | Yes, the company formation process is efficient and straightforward. |

| Can a company be 100% foreign-owned? | Yes, it can. |

Top 4 Reasons to Do Business in the Cayman Islands

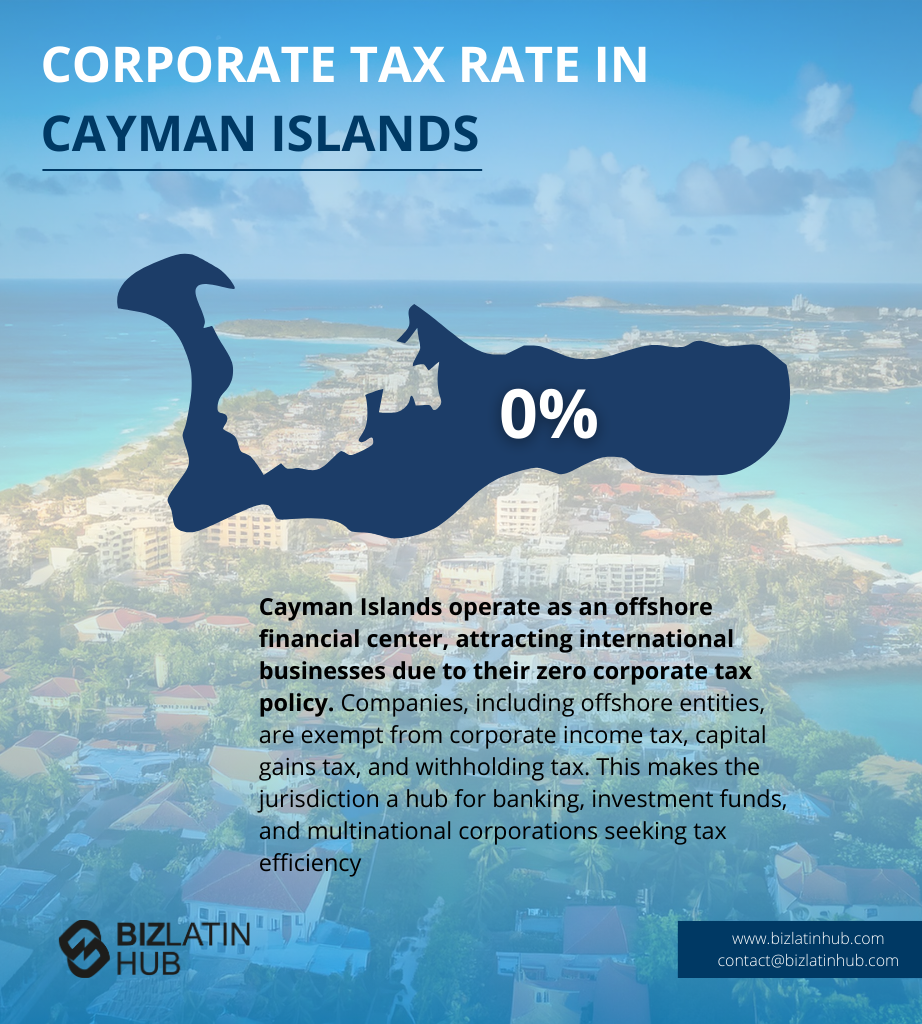

1. A Tax-Neutral Jurisdiction

The Cayman Islands has no corporate income tax, no capital gains tax, no withholding tax, and no sales tax. This tax-free environment allows businesses to operate with maximum financial efficiency.

Expert Tip: Understanding Tax Neutrality vs. “Tax Haven”

From our experience, it is important for investors to understand the distinction between “tax neutral” and the outdated term “tax haven.” The Cayman Islands is a tax-neutral jurisdiction, meaning it has chosen not to levy direct taxes like corporate income or capital gains tax.

However, it is not a secretive jurisdiction that facilitates tax evasion. The Cayman Islands complies with international tax transparency standards, including the OECD’s Common Reporting Standard (CRS), and exchanges tax information with other countries. This compliance makes it a well-respected financial center, not a place to hide assets illicitly.

2. Economic and Political Stability

As a British Overseas Territory, the jurisdiction benefits from a stable political system and a strong economy focused on financial services and tourism. The currency, the Cayman Islands Dollar (KYD), is pegged to the US Dollar.

3. Straightforward Company Formation

The process of incorporating a company, particularly an Exempted Company for international business, is modern, efficient, and can be completed quickly with the help of a local registered agent.

4. A Well-Regarded Financial Sector

The Cayman Islands is one of the world’s leading offshore financial centers, with a sophisticated banking system, a large presence of top-tier legal and accounting firms, and a robust regulatory framework overseen by the Cayman Islands Monetary Authority (CIMA).

Economic and Political Stability

The Cayman Islands furnish a stable economic and political setting. This stability supports a high living standard. It also contributes to a high Gross Domestic Product (GDP) per person, one of the leading figures in the Caribbean region. The economy is modern and well-managed, which helps businesses succeed.

By the end of 2024, official records showed over 122,500 companies registered there. This figure indicates the area’s welcoming approach to business. Political stability assists companies. It also simplifies global business expansion. The Cayman Islands is an important financial center, with many global investment funds operating from its shores.

Key reasons the Cayman Islands is a good place for business:

| Key Benefit | Description |

|---|---|

| Stable Economy | The economy is modern, developed, and strong. |

| Political Stability | This encourages growth and builds confidence. |

| Business-Friendly | An efficient legal system offers cost and operational benefits. |

| Global Financial Hub | Developed financial services attract investment. |

The legal system in the Cayman Islands is structured to support business efficiency. It is secure and cost-effective. This makes it a sound choice for companies entering international markets. The thriving investment funds and financial services sectors demonstrate the Cayman Islands’ economic strength and its investor-friendly approach.

The Exempted Company: The Vehicle for International Business

The most popular legal entity for foreign investors is the Exempted Company. This structure is designed specifically for business conducted outside of the Cayman Islands. It offers confidentiality, administrative simplicity, and a government guarantee against any future taxation for up to 20 years.

Tax Advantages

Businesses find significant tax advantages in the Cayman Islands. The region operates a tax-neutral system. Companies can function without local corporate or income taxes. This aspect attracts many foreign companies aiming to increase their profits. These advantages position the Cayman Islands as a top choice for businesses focused on growth.

No Direct Taxes

A significant benefit for businesses in the Cayman Islands is the absence of direct taxes. The government does not impose taxes such as corporation tax or capital gains tax. Individuals also do not pay these taxes.

Consequently, businesses can improve profitability by avoiding these common tax burdens. Furthermore, transferring shares in Cayman companies generally does not incur stamp duty, unless island property is involved in the transaction.

This tax-free policy makes many business activities financially appealing.

Tax Neutrality

Tax neutrality is a defining feature of the Cayman Islands’ system. Foreign owners or investors do not pay additional taxes there. Instead, investors comply with their home country’s tax laws.

This system offers benefits similar to those found in double tax treaties. For instance, citizens of countries like the United States and the United Kingdom must still meet tax obligations in their home countries. Nevertheless, the lack of direct taxes in the Cayman Islands continues to draw international business interest.

Flexible Business Environment

International businesses find the Cayman Islands to be an advantageous location. The business setting is flexible. This flexibility aids global investments and financial operations. Businesses discover good conditions for tax structures and wealth management. The Cayman Islands offer globally recognized company structures alongside a developed legal system. These elements allow businesses to register and operate with ease using various models. This environment accommodates holding companies, trusts, and diverse other business activities. Companies here do not pay corporate taxes, a factor that makes the Cayman Islands attractive to entrepreneurs. The structure also facilitates smooth mergers and Initial Public Offerings (IPOs), serving both local companies and approved foreign entities.

Simplified Registration Processes

The process for starting a business in the Cayman Islands is notably quick and efficient. Entrepreneurs can typically register a company in about three to five business days. For urgent requirements, a same-day service is available. The process is clear and not prohibitively expensive. The Cayman Islands feature low registration fees, and no minimum capital amount is needed. To begin, applicants submit the required documents and pay incorporation fees to the Cayman Islands Registrar of Companies. Following approval, the company receives a certificate of incorporation, which officially confirms its registration. Operating businesses must still obtain a Trade and Business License and adhere to local rules and economic substance standards.

A summary of the registration process:

| Feature | Detail |

|---|---|

| Standard Registration Time | 3-5 business days |

| Express Service | Same-day option available |

| Registration Fees | Low |

| Minimum Capital Requirement | None |

| Initial Steps | Submit documents, Pay incorporation fees |

| Issuing Authority | Cayman Islands Registrar of Companies |

| Outcome | Certificate of Incorporation |

| Post-Incorporation | Get Trade and Business License, Meet local rules |

No Minimum Capital Requirement

A notable feature for new enterprises is that businesses in the Cayman Islands do not need to meet a minimum capital requirement. New businesses find this aspect appealing. Entrepreneurs gain more freedom. Companies can issue shares with or without a set par value and can incorporate with no initial capital. This financial freedom acts as an incentive, attracting individuals and companies. The absence of minimum capital requirements simplifies business setup and encourages both new ventures and business expansions. This freedom permits Cayman Islands companies to concentrate on growth. Entrepreneurs often appreciate the straightforward process, finding it easier to launch their business in this jurisdiction.

Asset Protection

The Cayman Islands provide a secure setting for asset protection. Its legal structures are well-regarded for protecting personal and business assets. Offshore companies in the Cayman Islands benefit from strong legal systems that focus on privacy and security. Offshore banking is a common practice in Cayman, helping clients to protect their assets. Individuals and businesses involved in wealth management discover significant benefits here. Cayman trusts allow for the strategic sheltering of wealth, offering solutions that pair confidentiality with effective estate planning. Establishing a company in the Cayman Islands also grants access to comprehensive asset protection plans, which are important for reducing risks associated with legal or financial challenges.

Legal Framework

Businesses operating in the Cayman Islands adhere to a clear legal framework. This includes obtaining necessary licenses and following economic substance rules. Companies need a Trade and Business License to operate legally. The specific requirements for this license vary based on local ownership levels. Exempted companies possess flexibility regarding directors and shareholders and do not face the usual local licensing and reporting duties. Additionally, the Cayman Islands enforce strict Anti-Money Laundering (AML) and Know Your Client (KYC) policies. These policies align with international standards, ensuring businesses operate with transparency. To meet economic substance requirements, companies must demonstrate substantial business activity within the islands.

Confidentiality

Maintaining business confidentiality is a recognized strength of the Cayman Islands. This is a key benefit for both asset protection and offshore investments. Companies benefit from a stable economy that supports secure operations. The legal system, influenced by British common law, ensures strong privacy measures. This framework attracts international investors who value privacy. The registration process itself is structured to help protect company confidentiality. Such measures appeal to those involved in wealth management and tax structuring. The confidentiality available within Cayman corporate structures is appealing, giving businesses the assurance needed for efficient and secure operations.

Easy Regulatory Environment

The regulatory environment in the Cayman Islands makes starting a business simple and fast. The process commences with filing the memorandum and articles of association with the Cayman Islands Registrar of Companies. The entire procedure is efficient, with most registrations completed within three to five business days. A same-day service is available for those requiring a faster option.

The absence of direct taxes on income or capital gains, which also applies to corporate profits, contributes to a favorable setting. Companies here utilize efficient structures that aid international investments and financial dealings. Furthermore, regulatory measures ensure compliance with global tax standards, including the US Foreign Account Tax Compliance Act (FATCA) and the OECD Common Reporting Standard. Consequently, businesses tend to do well under these conditions.

Few Bureaucratic Hurdles

Company formation in the Cayman Islands involves few bureaucratic hurdles, making it direct and easy. Foreign individuals and companies find incorporating a business to be a simple undertaking. Most company types, such as Exempt Companies and Limited Liability Companies (LLCs), are typically incorporated within three to five days. An optional same-day service can expedite this process.

The framework for business compliance in the Cayman Islands is well-defined and clear. It encompasses local operating requirements and necessary licenses. Businesses also find it straightforward to adhere to economic substance standards. Simple registration processes permit the establishment of foreign branches. Entrepreneurs can also form partnerships and sole trader businesses with ease. This efficiency helps business people to succeed quickly and with confidence.

Strong Financial Services

The Cayman Islands stands as a major participant in the global financial sector. The region offers significant benefits to both foreign and local companies. Businesses in the Cayman Islands operate within a zero-tax system, meaning there are no direct taxes such as income or corporate taxes.

Moreover, it is a premier location for global investment funds; a large share of the world’s investment fund assets is registered here. Offshore banking, investment funds, and corporate services are characteristic of the local financial offerings. Legal and regulatory rules are stringent, ensuring adherence to international standards and the protection of assets.

Wealth Management Industry

Wealth management and effective tax planning draw many to the Cayman Islands. Companies here function in a tax-neutral area, free from corporate taxes, personal income taxes, or capital gains taxes. This setting allows high-net-worth individuals and businesses to optimize their tax planning strategies. Legal structures in the Cayman Islands afford privacy and asset protection. The jurisdiction’s firm laws facilitate offshore asset protection, attracting a considerable number of individuals and entities.

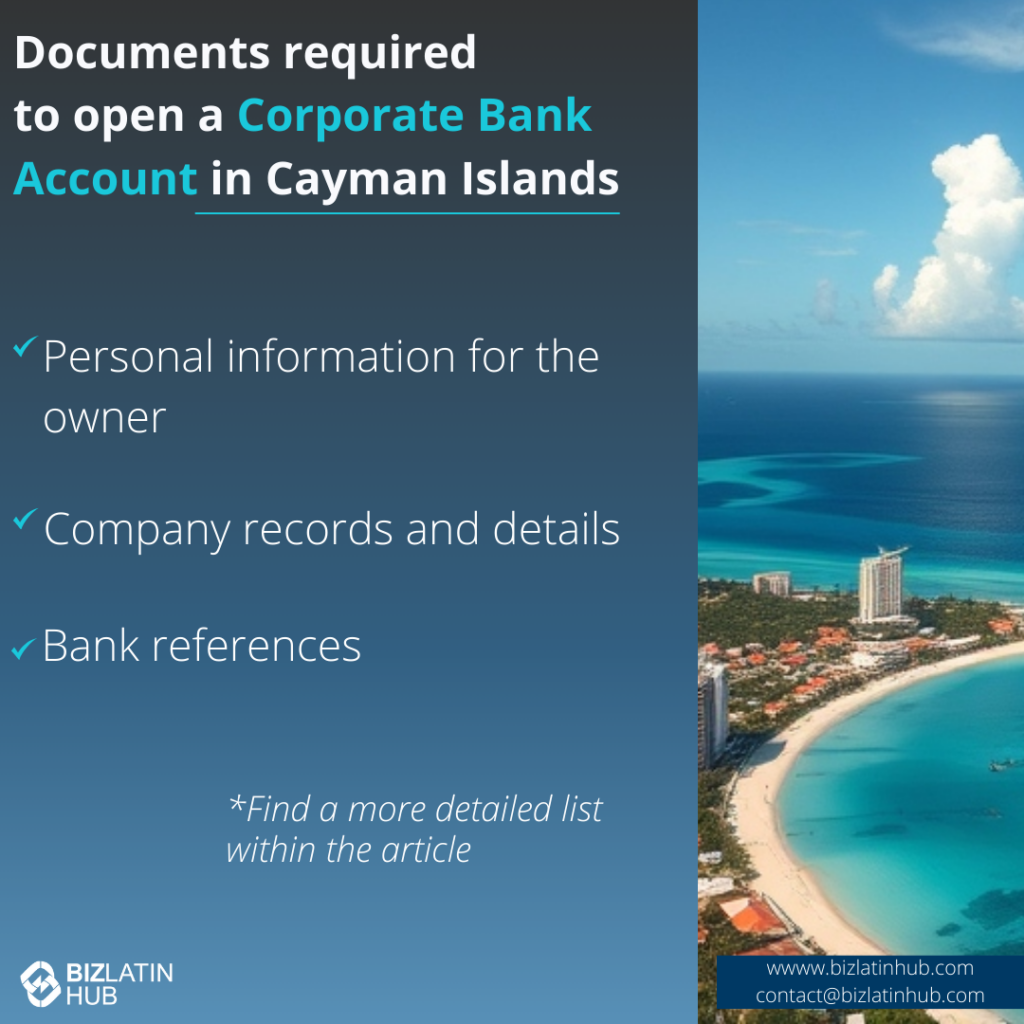

Banking Infrastructure

The banking sector in the Cayman Islands supports a wide array of business activities. Companies can access corporate banking services that range from basic account management to more complex financial solutions.

Opening a bank account necessitates the submission of several documents. This detailed documentation process ensures the safe handling of both personal and corporate assets. The banking infrastructure effectively meets the financial needs of businesses.

Key documents usually needed to open a corporate bank account include:

- Certificate of Incorporation

- Memorandum and Articles of Association

- Personal details for account signatories (such as identification documents and proof of address)

- Personal details for company directors (such as identification documents and proof of address)

- A business plan and a description of business activities

- Documents verifying the source of funds

(Note: Specific bank requirements can change.)

Supportive Business Infrastructure

An efficient and flexible infrastructure supports businesses in the Cayman Islands. Companies can register quickly, typically within three to five business days, with an express option available for same-day service. The islands accommodate various business structures, including sole trader, partnership, company, or a foreign branch. This flexibility permits full foreign ownership, making the Cayman Islands a prime location for international operations. The absence of direct taxes on income and capital gains is a strong attraction for investors. Additionally, the Cayman Islands Centre for Business Development assists entrepreneurs by improving their skills and encouraging business growth. This supportive infrastructure makes the region a good base for enterprise.

Telecommunications and Technology

Good infrastructure allows tech and telecom businesses to flourish in the Cayman Islands. The islands have respected IT service providers that support these sectors. Starting technology companies is straightforward, particularly with the Special Economic Zone Company (SEZCo) option. This setup simplifies processes, allowing businesses to concentrate on growth. The Cayman Islands’ political stability provides a secure setting for these sectors, ensuring a degree of predictability that comforts businesses seeking a solid foundation. The legal system, based on British common law, reduces bureaucratic steps, which aids tech innovation. With no exchange controls, companies can easily conduct international transactions. This global connectivity improves operations, making the Cayman Islands a tech-friendly location.

Transportation and Accessibility

Transportation and accessibility are strengths of the Cayman Islands. A well-planned transport system supports smooth movement around the islands. Modern infrastructure allows easy access, and reliable communication systems facilitate connectivity. Strong political connections to the United Kingdom support a stable and efficient transport network. Visitors and residents find it easy to move around, with car rentals readily available, offering convenience for exploring the islands. This reliable transportation system, combined with political and economic stability, makes accessing and navigating the Cayman Islands uncomplicated. Such accessibility enhances the islands’ attractiveness, aiding business activities and tourism.

High Standard of Living

A stable and secure environment in the Cayman Islands supports a high standard of living. As a British Overseas Territory, they possess a legal system based on British common law, which provides a safe setting for residents. The islands are strategically situated in the Western Caribbean, near Jamaica, Cuba, and Florida. This location improves access and connectivity, which can enhance life quality. The Cayman Enterprise City and the Special Economic Zone present business opportunities that can boost economic prosperity and community living standards. The islands also feature favorable business conditions, with no corporate taxes, benefiting economic well-being. Lastly, the developed legal and business infrastructure, along with easy company registration, makes the islands appealing for entrepreneurs. These factors together contribute to a high standard of living.

Quality of Life

A pleasant lifestyle is a hallmark of the Cayman Islands. They offer favorable weather, clean beaches, and tropical gardens. These features create a paradise-like feel. Located in the Caribbean, the islands allow a blend of work with a vacation atmosphere due to their natural beauty. Entrepreneurs can find a balance between work and leisure in this attractive setting. A lively community enhances the island’s lifestyle, welcoming both locals and expatriates. This welcoming attitude provides an enjoyable living experience. The quality of life in the Cayman Islands makes it a desirable place for business, where individuals can achieve professional success and personal satisfaction.

Safe and Welcoming Community

With approximately 88,000 residents, the Cayman Islands offers a safe and welcoming community. English is the official language, which makes communication straightforward for English-speaking visitors and residents. The business culture takes cues from European and US standards. Typical working hours are from 8:30 a.m. to 5:00 p.m., Monday to Friday, offering a structured and familiar work setting. The legal and regulatory system, including data protection laws similar to the EU’s General Data Protection Regulation (GDPR), creates a secure business environment. The islands offer family-friendly attractions, making them welcoming for families. Possessing a modern economy, the Cayman Islands maintain one of the highest living standards in the Caribbean, providing a high quality of life for both locals and expatriates.

Networking and Business Opportunities

A welcoming setting for business in the Cayman Islands creates networking and growth opportunities. This attracts many entrepreneurs and companies. Businesses can benefit from tax exemptions and legal protections. Starting a company here is a direct process. It involves choosing the appropriate company structure and following local rules. This stable setting is well-suited for long-term business success. Entrepreneurs find privacy and asset protection by using the Cayman Islands as a base. This makes the Cayman Islands a good place for those intending to grow globally or secure assets.

Local and International Markets

The Cayman Islands serve as an excellent base for international investments. They provide flexible company structures. Businesses can utilize exempted companies and limited liability companies, which are popular among foreign investors. Many companies establish holding companies here to help increase tax efficiencies in international markets. Local businesses must adhere to trade and business licensing laws, which depend on Caymanian ownership levels. Registering a new business entity is fast, usually taking three to five business days. Express options can make this process even quicker.

Entrepreneurial Community

The entrepreneurial community benefits from resources like the Cayman Islands Centre for Business Development (CICBD). It helps small business entrepreneurs by offering consulting, training, and coaching services. The Cayman Islands Government runs this support organization, which works to improve local entrepreneurship. The entrepreneurship setting in the Cayman Islands is flexible. Businesses can operate as sole traders, partnerships, or companies. The business registration process is efficient, typically completed within three to five days. This efficiency benefits entrepreneurs aiming for a quick start.

Frequently Asked Questions

Why is the Cayman Islands considered a good place to start a business?

The Cayman Islands offer political and economic stability, no direct taxes, a business-friendly legal system, and a strong financial sector. These features make it an attractive location for entrepreneurs seeking growth, asset protection, and global market access.

What does tax neutral mean?

Tax neutral means the jurisdiction does not impose direct taxes on income, profits, or capital gains. Companies and individuals are not subject to these taxes.

How long does it to form a company?

The company formation process is highly efficient. Once all required due diligence documents are provided, an Exempted Company can typically be incorporated in just a few business days.

Is the Cayman Islands a stable place to do business?

Yes. It is a British Overseas Territory with a stable, democratically elected government. Its legal system is based on English Common Law, providing a familiar and reliable framework for international business.

Can a foreigner own 100% of a company?

Yes, the laws of the Cayman Islands permit 100% foreign ownership of an Exempted Company. There are no requirements for local directors or shareholders.

How does the Cayman Islands support financial services and investment funds?

The Cayman Islands is a global financial hub, home to a significant number of investment funds and offshore banks. It offers zero-tax operations, regulatory compliance with global standards, and access to high-quality legal and banking infrastructure, making it ideal for financial services and global investment management.

What legal and compliance requirements must businesses follow in the Cayman Islands?

Businesses must obtain a Trade and Business License, comply with economic substance rules, and follow Anti-Money Laundering (AML) and Know Your Client (KYC) policies. The legal system ensures transparency and aligns with international financial standards.

Biz Latin Hub can help you with opportunities in the Cayman Islands

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.