El Salvador has become one of the most important economies in Latin America, this means many foreign companies are increasingly more and more interested in the market. Recently implemented business-friendly policies, a higher emphasis on safety, and a generally favorable environment help make this country a top player. An auditor in El Salvador plays a role in this.

This explains why the search for things like company formation in El Salvador is at an all-time high. However, with an incremented interest in the country, these opportunities come with some inherent challenges related to financial management, corporate governance, and risk mitigation. An auditor in El Salvador can solve some of these issues.

In this article, we’ll delve into the role an auditor in El Salvador plays and why you must have someone who will ensure regulatory compliance and financial accuracy to uncover operational efficiencies and mitigate risks. Auditors play a vital role in providing valuable insights and ensuring the overall health of your company.

An Auditor in El Salvador Will Help Ensure Compliance

Complying with the ever-evolving regulations and laws is vital for businesses anywhere in the world.

This is especially true when your business is in a foreign country like El Salvador, where laws differ greatly, the language is unfamiliar to you and your team, and the legal requirements are very different from what you’re used to, even if you’re a seasoned professional.

An auditor possesses an in-depth understanding of the local legal framework and industry-specific regulations. They help your company navigate complex compliance requirements, ensuring adherence to accounting standards, tax regulations, and industry-specific guidelines.

Through regular audits, an auditor assists in reducing the risk of non-compliance, thus preventing potential legal consequences and financial fines.

Enhance Financial Accuracy

Accurate financial reporting is essential for informed decision-making, attracting investors, and maintaining stakeholder confidence. An auditor in El Salvador plays a significant role in reviewing and verifying financial statements, ensuring accuracy, transparency, and reliability.

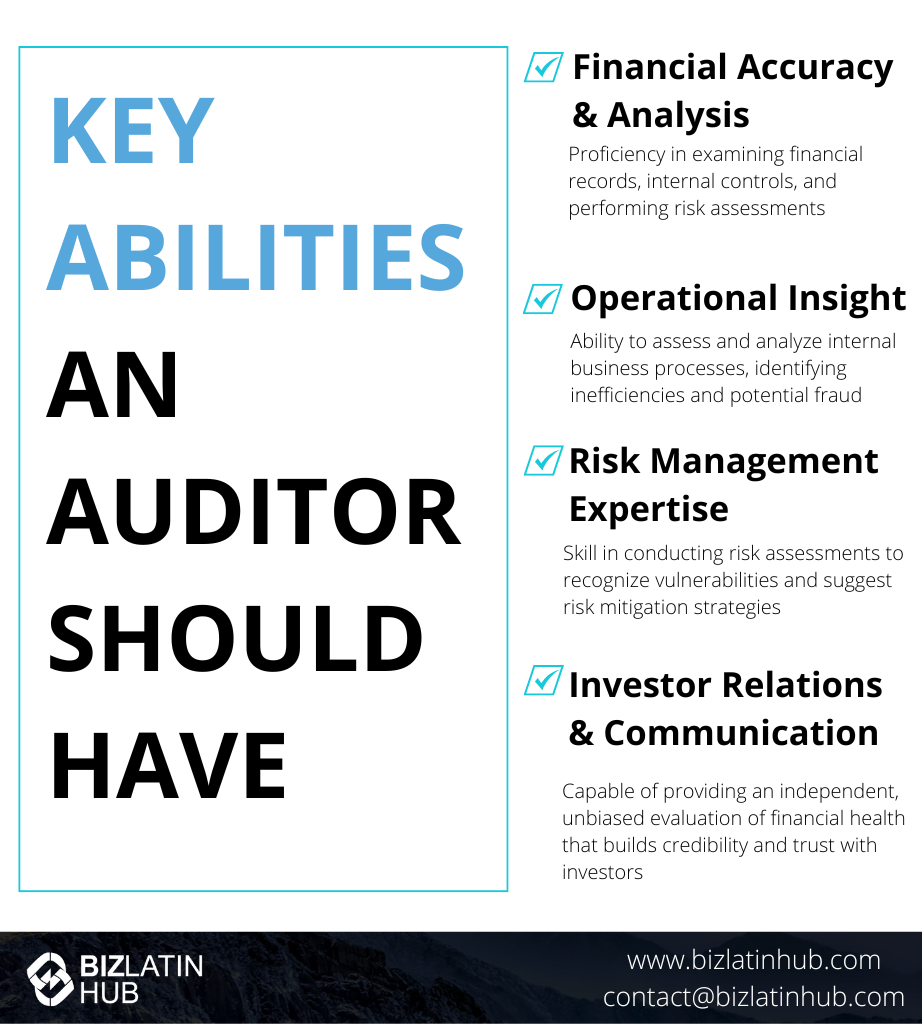

Some of the key abilities an auditor should have are examining financial records, internal controls, and risk assessments. Auditors provide an unbiased evaluation of your company’s financial health. This helps identify areas for improvement, reduce errors, and enhance overall financial accuracy.

Uncovering Operational Efficiency

Although financial reporting is one of the main tasks an auditor in El Salvador should have, it’s far from the only one. A good auditor goes beyond that and dives into the operational aspects of your business.

By thoroughly examining internal processes and controls, they identify operational inefficiencies, potential fraud, and weaknesses in risk management. Their valuable insights enable you to streamline operations, optimize resource allocation, and strengthen internal controls, resulting in improved efficiency, cost savings, and enhanced overall performance.

Mitigating Risks

In a rapidly changing business environment, identifying and managing risks is crucial. An auditor conducts risk assessments and recognizes potential vulnerabilities and threats to your company’s financial stability and reputation.

They help implement effective risk management strategies, providing recommendations to mitigate identified risks. This proactive approach safeguards your business from potential financial losses, fraud, and reputational damage.

Gaining Investor Confidence

Investors and stakeholders seek assurance that your company’s financial statements are accurate and reliable. Having an auditor in El Salvador instills confidence in the integrity of your financial reporting.

Their independent evaluation provides external validation, demonstrating transparency and adherence to best practices. This builds trust and credibility with investors, increasing the likelihood of attracting investment opportunities and fostering long-term partnerships.

Hiring an Auditor in El Salvador is Your Safest Option

In today’s complex business environment, an auditor is an invaluable asset for your company in any foreign country, more so in a country, you don’t know the particularities of, like El Salvador.

The role of an auditor is crucial to the success of a business, whether it’s ensuring compliance with regulations, improving financial accuracy, identifying operational efficiency, mitigating risks, or gaining investor confidence.

By engaging the services of a professional auditor, you not only meet regulatory requirements but also strengthen your company’s foundation, positioning it for sustainable growth and competitiveness in the marketplace.

FAQs on an auditor in El Salvador

It is important to have an experienced auditor in El Salvador to ensure that your company is compliant with the country’s financial rules.

Yes. All companies must appoint an external auditor by local law, and larger companies may have to do so under IFRS rules, depending on sector.

You may not need one by law, but you may find it beneficial to undergo an auditing process in order to demonstrate reliability, company health and transparency.

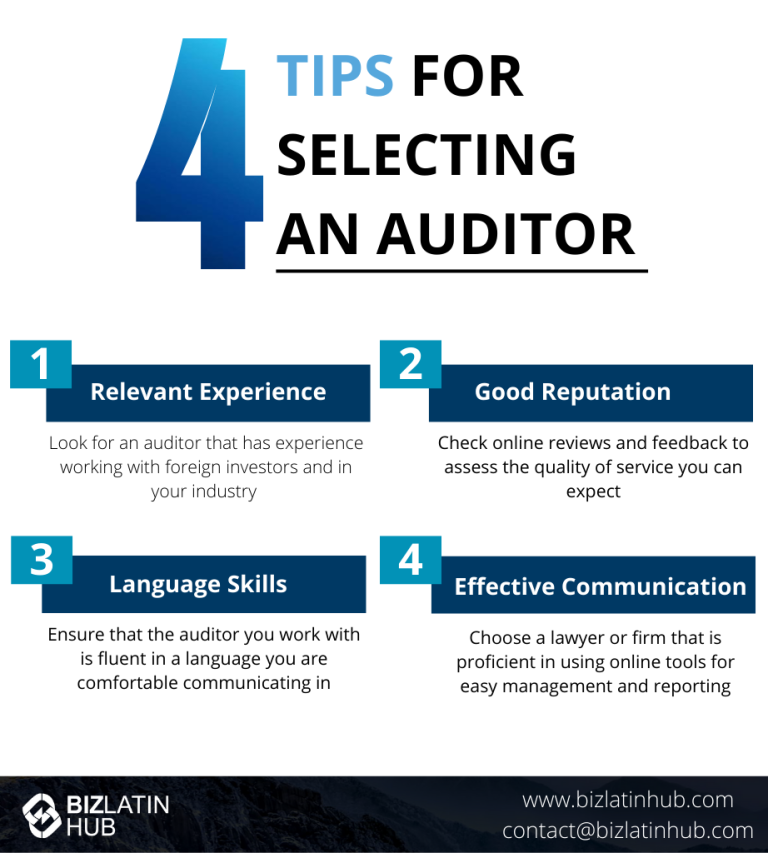

When looking for an auditor in El Salvador, there are certain factors to keep in mind, including:

Experience: Look for an auditor that has experience working with foreign investors and in your industry.

Reputation: Check online reviews and feedback to assess the quality of service you can expect.

Language: Ensure that the auditor you work with is fluent in a language you are comfortable communicating in.

Communication: If you will be spending extended periods outside of the country, choose a lawyer or firm that is proficient in using online tools for easy management and reporting.

It is important to note that accounting records must be kept in Spanish.

Biz Latin Hub can help you hire an auditor in El Salvador

With offices in El Salvador, as well as more than a dozen other major cities in the region, Biz Latin Hub offers integrated market entry and back-office services throughout Latin America and the Caribbean. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross-border operations.

As well as knowledge about how to hire an Auditor in El Salvador, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent or otherwise do business in Latin America and the Caribbean.

If this article on hiring an auditor in El Salvador was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.