Belize is a popular jurisdiction for offshore companies thanks to its favorable legal framework, confidentiality provisions, and tax advantages. Foreign investors can establish International Business Companies (IBCs), Limited Liability Companies (LLCs), or branches. You will need to know how to evaluate these options and how to incorporate in Belize. This guide clarifies the crucial distinction between entities designed for international trade (IBCs) and those permitted to operate within the local Belizean economy.

Key Takeaways

| What are the common legal entity types in Belize? | Business Company (BC): This is the most common entity type for general business activities. International Business Company (IBC): Designed for offshore operations. Limited Liability Company (LLC): Offers liability protection and benefits from a flexible structure. Public Limited Company (PLC): Suitable for larger ventures with more shareholders. |

| What is the most common Belizean business entity? | The most frequently incorporated legal entity in Belize is the Sociedad de Responsabilidad Limitada (SRL). |

| What are the primary considerations when choosing a business entity in Belize? | Ownership Structure. Tax Efficiency. Profit distribution. Transfer Pricing. Compliance. Flexibility. |

Main Legal Entity Types in Belize

Belize offers a variety of corporate entities to accommodate diverse business needs. These entities are popular among international investors for their flexibility, low-tax environment, and minimal regulatory requirements.

- Business Company (BC): This is the most common entity type for general business activities.

- International Business Company (IBC): Designed for offshore operations.

- Limited Liability Company (LLC): Offers liability protection and benefits from a flexible structure.

- Public Limited Company (PLC): Suitable for larger ventures with more shareholders.

Comparison Table: Key Legal Entity Types in Belize

| Entity Type | Best For | Members/Shareholders | Liability | Legal Personality | Tax Status |

|---|---|---|---|---|---|

| IBC | Offshore activities, holding companies | 1+ | Limited to capital | Yes | Tax-neutral (offshore) |

| LLC | Asset protection, flexible structuring | 1+ | Limited to capital | Yes | Tax-neutral (offshore) |

| Branch | Multinational operations | 1 (foreign HQ) | Parent company liable | Yes | Taxable on Belize income |

International Business Companies (IBCs)

International Business Companies (IBCs) are popular for international business in Belize. Governed by the International Business Companies Act, enacted in 1990, they offer a streamlined incorporation process. Typically, you can set up an IBC within two to three days. An IBC enjoys tax exemptions on activities conducted outside Belize, making them attractive for international investors. Also, under the Belize Companies Act 2022, IBCs now follow the same regulations as local companies. They provide opportunities for asset protection and facilitate opening bank accounts.

Expert Tip: Economic Substance is Real

From our experience, many investors still view Belize IBCs as “paper companies.” It is vital to understand that Belize now strictly enforces Economic Substance laws. If your IBC conducts “relevant activities” (like banking, insurance, shipping, or being a headquarters), you must demonstrate real presence (office, staff, expenditure) in Belize. Failing this test leads to heavy fines and strike-off. We advise verifying your activity classification immediately.

Limited Liability Companies (LLCs)

Limited Liability Companies (LLCs) in Belize offer a blend of benefits. They provide limited liability, protecting shareholders from personal obligations. LLCs also enjoy pass-through taxation, similar to a partnership, without needing a minimum authorized capital. Belize LLCs are exempt from income, capital gains, and dividend taxes if they operate outside the country. The setup process can be completed in two to three days. Additionally, the International Limited Liability Companies Amendment Act of 2023 provides fiscal transparency, classifying them as disregarded entities or partnerships for tax purposes.

Partnerships

Partnerships in Belize involve shared business. They have two main types: General Partnerships, where partners share unlimited liability, and Limited Partnerships, offering limited liability for at least one partner. General partnerships entail equal responsibility among partners. They suit businesses that thrive on collaborative decision-making and combined expertise. Creating a partnership requires a legal agreement detailing management, profit-sharing, and dispute resolution.

Trusts

Trusts in Belize serve purposes like asset protection and estate planning. A trust involves a trustee holding assets for beneficiaries. Belize’s Trusts Act governs these entities, ensuring proper regulation. Offshore trusts must register with the Financial Services Commission (FSC) for legal status. Trusts in Belize are recognized for strong asset protection, safeguarding against third-party claims. Legislation ensures trusts remain unchanged by foreign court rulings, enhancing their reliability in disputes involving marriage, divorce, or insolvency.

Branch of a Foreign Company

Installing a branch in Belize is an attractive alternative option for companies who have headquarters in a foreign country. In order to install the branch, proof of the existence of the office overseas must be provided to local authorities. It suits already well-established companies looking to build on existing brand awareness.

The branch will have to prove the following conditions:

- A representative in the country where the company is being established.

- Carry out business in line with partnership purposes.

- Have own accounting and submit annually its balance sheet to the controlling authority.

Who Should Choose Which Entity Type in Belize?

IBC – International Business Company

Who should choose this: Ideal for international trading, IP holding, and investment vehicles. Offers simplicity and zero taxation on foreign income.

LLC – Limited Liability Company

Who should choose this: Best for private asset protection, estate planning, or flexible profit-sharing between members.

Branch

Who should choose this: Large companies operating in Belize under their home office with direct control and central administration.

Choosing the Right Legal Structure in Belize

The key considerations when deciding on the best entity type in Belize are the following:

Ownership Structure

Make sure that you set up a corporate entity structure that allows you to have as much control as you need over your enterprise.

Tax Efficiency

Different corporate entity types in Belize have very different rates of taxation and you should choose the one that suits you best.

Profit Distribution

Make sure that you are aware of withholding tax rates and clear on the way that you must declare both revenue and profit.

Compliance

While an IBC may have few compliance demands compared to other structures in Belize or elsewhere, this does not mean zero. You still have some hoops to jump through.

Flexibility

Choose a business structure that provides flexibility for future needs. For example, the IBC is perfect for trading overseas, but will restrict you from trading in the home market.

Steps to Incorporate a Company in Belize

These are the 7 key steps to incorporate an offshore company in Belize.

- Step 1: Name Check

- Step 2: Complete a Memorandum and Articles of Association

- Step 3: Approval from Central Bank

- Step 4: Obtain a Certificate of Incorporation

- Step 5: Director Appointment

- Step 6: Officer Appointment

- Step 7: Issuance of Company Seal

Compliance Tip:

Since 2021, Belize IBCs must maintain accounting records and may be required to demonstrate economic substance depending on business activities. Non-compliance leads to fines and dissolution.

Common Pitfalls When Choosing a Legal Entity in Belize

- Assuming no compliance applies — even IBCs must retain accounting records

- Using a branch without understanding tax and audit exposure

- Failing to appoint a registered agent or keep a registered address

- Selecting an IBC for local trading (not permitted)

- Mismanaging annual renewals and registry filings

Partnering with Biz Latin Hub for Company Formation in Belize

At Biz Latin Hub, we provide integrated market entry and back office services throughout Latin America and the Caribbean, with offices in more than a dozen countries around the region and trusted partners in other markets where we don’t currently have a presence.

Our unrivaled reach around the region means that we are ideal partners to support multi-jurisdiction market entries and cross-border operations.

Our portfolio of services includes company formation, accounting & taxation, legal services, due diligence, and hiring & PEO, among others. So whatever your investment plans are, we can provide a package of services to suit your needs.

Contact us to find out more about how we can support you do business.

FAQs: Legal Entities in Belize

The IBC is the most popular vehicle, offering simplicity, privacy, and tax neutrality for offshore income.

Yes. Belize permits 100% foreign ownership of IBCs and LLCs with no residency requirements for shareholders.

Yes — IBCs are not taxed on foreign-sourced income. However, they must now maintain accounting records and comply with AML/CFT and substance laws.

LLCs allow more contractual flexibility and profit distribution among members. IBCs are simpler and better suited for holding assets or conducting offshore trading.

Not often. Most foreign businesses prefer IBCs or LLCs. Branches are more complex and expose the parent to local tax and legal risk.

Belize IBCs and LLCs can be incorporated in as little as 1–2 business days once documents are submitted and approved.

Not publicly, but they must maintain internal accounting records and may be audited under certain circumstances.

Generally, no. An IBC is restricted from owning local real estate or trading with locals. It must maintain its “non-resident” status to enjoy tax exemptions.

It is a “Domestic” or “Local” company formed under the Companies Act to do business with Belizean residents. It pays regular business tax and files annual returns.

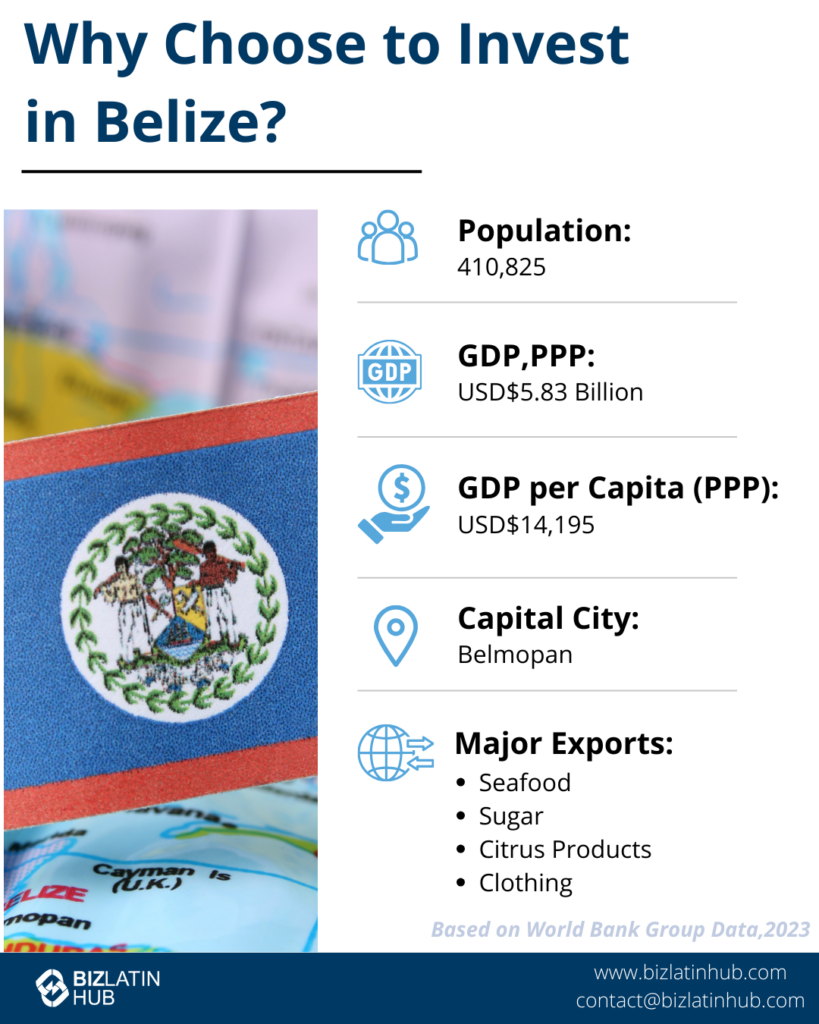

Overview of Belize’s Business Environment

Belize offers a business environment based on English common law. This framework attracts international investors.

The most common company type is the Business Company (BC). Other options include Limited Liability Companies (LLCs) and Public Limited Companies (PLCs).

Key Benefits of Belize’s Business Environment:

- Fast Incorporation: You can set up a company within 2-3 days.

- Minimal Reporting: Businesses are not required to prepare accounts, file annual returns, or maintain audited accounts.

- Flexibility: Belize allows redomiciliation of companies, allowing easy relocation.