Free trade zones in Uruguay provide companies with tax and customs benefits. Likewise, it is an effective tool for businesses to efficiently manage their business ventures, allowing them to avoid long delays, unnecessary bureaucratic administrative processes, and of course, providing attractive fiscal benefits.

Free trade zones in Uruguay allow 100% foreign ownership of local companies and companies can be formed with only one shareholder. This makes it relatively easy to start operations in the country, meaning that you can register a business in Uruguay quickly and efficiently.

Additionally, the government’s implementation of legislation relating to tax regimes and free trade zones in Uruguay has made it into a commercial paradise for companies looking to establish their operations abroad. Moreover, we cannot overlook Uruguay’s political, economic and social stability.

What are the Features of Free Trade Zones in Uruguay?

Free trade zones are areas in Uruguayan territory which can be both public or privately owned. These are highly secured locations with the following features:

- State monopolies do not govern.

- The business activities of companies operating in these zones have tax and customs exemptions.

- There is total freedom for the entry and exit of goods, fixed or capital assets, with exemptions in taxes and duties.

Companies can develop any business, industrial and service activity in these zones. Some examples are given below:

- Marketing, deposit, storage, conditioning, selection, fractioning, assemble, disassemble, handling or mixture or goods or raw materials with foreign or national origin.

- Installation and operation of manufacturing equipment.

- Financial, IT, repair and maintenance services, professional services and others required for the operation of the activities.

To date, Uruguay has eleven free trade zones with a variety of specializations. These areas are located near the metropolitan area. The eleven free trade zones are:

- Zona Franca Punta Pereira.

- WTC Free Zone.

- Zona Franca Colonia Suiza.

- Aguada Park.

- Zona Franca Nueva Palmira.

- Parque de las Ciencias.

- Zona Franca Florida.

- Zona Franca Libertad.

- UPM Fray Bentos.

- Zona Franca Colonia.

- Zonamérica.

What are the requirements for operation?

The sole stipulation for companies operating within an FTZ is that 75% of their workforce must consist of Uruguayan citizens. However, in the services sector, a company can seek approval to employ only 50% local labor.

- There is no requirement for company officers to be locals.

- To operate within an FTZ, a company must establish a Special Purpose Vehicle (SPV), and submit its user/lease agreement along with a business plan to the Finance Ministry.

How Are the Free Trade Zones Managed?

In Uruguay, both private owners and the state operate the free trade zones. The government duly authorizes companies to manage some the free zones and the government manages others. Additionally, the government is responsible for the supervision and monitoring of the whole system throughout the General Agency of Commerce – Free Zones Areas (Dirección General de Comercio – Área Zonas Francas).

How to Operate in Free Trade Zones?

Operating in free trade zones will grant companies various attractive tax advantages, granted by law. In order to be granted the status of a user of a free trade zone, the company will need to be registered at Dirección de Zonas Francas. It should be noted that there are two types of users of free trade zones:

- The Direct User: This user gets the right to operate in the free trade zone and the process occurs through signing a contract with the entity that manages the free trade zone.

- The Indirect User: This user acquires the right to operate in a free trade zone and has to sign a contract with the owner and then has the right to use or exploit the zone for commercial purposes.

According to national legislation, only legal persons (ie. companies and corporations) can operate in free trade zones. Most often, Uruguayan corporations are chosen as the vehicle to manage operations in these zones. However, a branch office of a foreign company can also be used to carry out commercial activities.

Companies operating in free trade zones should choose the most appropriate zone to develop their business. The choice of the free trade zone will depend on your companies planned business activity. Some specialize in production and manufacturing, while others focus on service provision.

Infrastructure and Services Offered

The Uruguayan state must have previously authorized Uruguayan free trade zones in order for them to legally operate. Moreover, the state must deliver the necessary infrastructure for them to function – warehouses, offices and a mínimum urbanization development.

Additionally, free trade zones must include basic services such as electricity, waste disposal, communication, security, and surveillance, etc.

Companies involved in construction can operate free of taxes and with limited paperwork, if they meet the requirements below:

- The constructions of buildings with the aim of developing industrial or service activities.

- The construction of shipping yards.

- The creation of office space.

- The development of green areas designed to improve the environment.

Tax Benefits Of Free Trade Zones in Uruguay

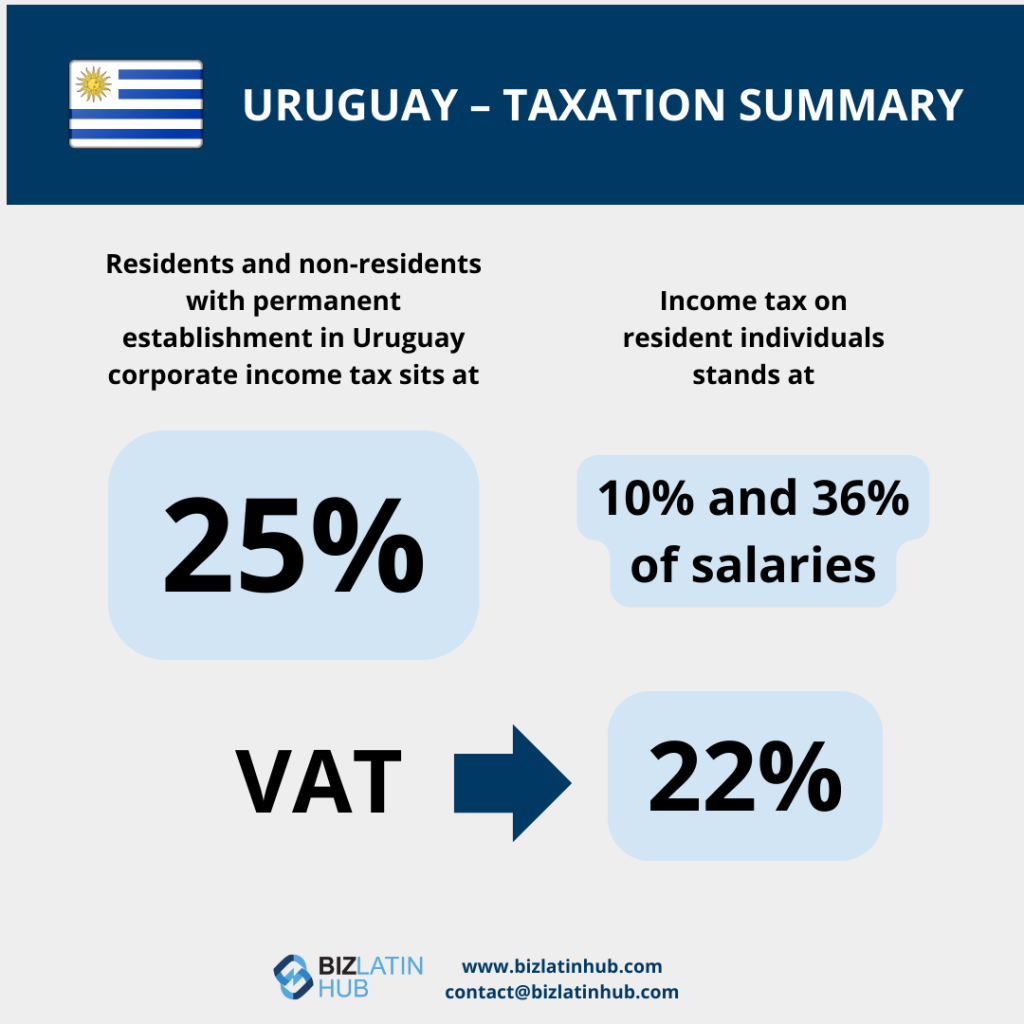

Free trade zone users are free from all existing and future national Uruguayan taxes. Additionally, fiscal benefits are found within the following taxes for companies operating in Uruguayan free trade zones:

- Corporate Income Tax (IRAE).

- Net worth taxes (IP).

- Value Added Tax (VAT).

- Internal Specific TAX (IMESI).

- Tax on Public Limited Companies (ICOSA).

FAQs on The Benefits Of Free Trade Zones in Uruguay

What are free trade zones in Uruguay?

Free Trade Zones (FTZs) are designated geographic regions granted special regulatory status, where companies conducting business within them are exempt from taxation.

What are the key advantages of free trade zones in Uruguay?

The main advantages of a free trade zone in Uruguay are:

- Companies setting up in FTZs are relieved of Uruguayan taxes, except social security contributions for local staff.

- Tax exemptions cover existing and forthcoming levies.

- Consequently, companies are spared from:

- Import tariffs.

- Corporate Income Tax (IRAE).

- Tax on dividend distribution.

- Capital Tax (IP).

- Value Added Tax (VAT) on goods or services.

What are the requirements to operate within a free trade zone in Uruguay?

The sole stipulation for companies operating within an FTZ is that 75% of their workforce must consist of Uruguayan citizens. However, in the services sector, a company can seek approval to employ only 50% local labor.

- There is no requirement for company officers to be locals.

- To operate within an FTZ, a company must establish a Special Purpose Vehicle (SPV), and submit its user/lease agreement along with a business plan to the Finance Ministry.

Can service providers operate in free trade zones in Uruguay?

Payroll outsourcing in Uruguay can indeed save costs for businesses. Here are some key points to consider:

- Labor Cost Reduction.

- Compliance and Efficiency.

- Affordability.

How many zones are there in the country?

To date, Uruguay has eleven free trade zones with a variety of specializations. These areas are located near the metropolitan area. The eleven free trade zones are:

- Zonamérica.

- Zona Franca Punta Pereira.

- WTC Free Zone.

- Zona Franca Colonia Suiza.

- Aguada Park.

- Zona Franca Nueva Palmira.

- Parque de las Ciencias.

- Zona Franca Florida.

- Zona Franca Libertad.

- UPM Fray Bentos.

- Zona Franca Colonia.

Biz Latin Hub can help you invest in free trade zones in Uruguay

Free trade zones in Uruguay play an important role in attracting investment and capital to the nation. Above all, the free trade zones highlight the governments drive to develop industrial, business, and service activities in Uruguay.

As the government shows its support for foreign business and foreign capital, the investment opportunities in the region grow. It comes as no surprise that businesses see Uruguay as one of the most appealing destinations in Latin America to expand their business too.

If you are interested in doing business in Uruguay and taking advantage of the benefits obtainable through the nations free trade zones, then get in contact with Biz Latin Hub.

Contact us now or visit our website at bizlatinhub.com to find out more about how we can support you.