The crisis in Ukraine caused by Russia’s invasion in February has brought renewed focus on Caribbean citizenship by investment programs, as sanctions imposed on Russia and many of its wealthiest citizens have drawn attention to immigration and investment arrangements used by the Russian elite in order to provide them greater international mobility and manage funds around the world.

Controversy regarding citizenship by investment programs, like those available in many Caribbean nations, have been brewing for some years, amid concerns that they are exploited by organized criminals and contribute to the legitimization of corrupt individuals and corruptly acquired funds.

While the majority of the estimated 35,000 people who have been granted Caribbean citizenship under such schemes are legitimate investors simply accessing opportunities designed precisely for the reason of attracting foreign capital, the recent focus on Russia and its super-wealthy set has increased scrutiny of citizenship for investment programs and amplified calls for them to be curtailed.

SEE ALSO: Steps to Register a Company in the Dominican Republic

In both the European Union and the United States, moves are currently being made to implement legislation that will penalize nations offering such schemes, as part of broader actions to place as big a pinch as possible on the Russian government and its highest-profile collaborators.

Well-known Caribbean citizenship by investment programs are found among members of the Organisation of Eastern Caribbean States (OECS), with those countries now facing pressure to bring the effective sale of passports to an end, just as the United Kingdom did earlier this year when it scrapped its so-called ‘golden visa’ scheme little more than a week before Russian troops crossed the Ukrainian border.

In the United States, a ´No Travel for Traffickers Act’ was introduced to the US Congress in early March, which will prevent countries that offer citizenship by investment beyond 2025 from accessing the US Visa Waiver Scheme.

Less than a week later the European Parliament passed a resolution decrying Golden Visa schemes, in an effort to force member states to end them, with particular emphasis on preventing access for wealthy Russians. One of the measures proposed to force the hand of non-EU nations, similar to that in the US, is to deny access to Schengen Area visas.

Such measures are particularly potent precisely because one of the big draws of Caribbean citizenship by investment programs is the fact they provide the visa-free travel to the United States or EU that citizens of those countries enjoy.

Where are Caribbean citizenship by investment programs in place?

The OECS is made up of seven the member states of Antigua and Barbuda, Dominica, Grenada, Saint Kitts and Nevis, Saint Lucia, Monserrat, and Saint Vincent and the Grenadines, of which the latter two are the only nations that do not offer Caribbean citizenship by investment programs. Saint Kitts and Nevis was the first nation from the bloc to offer citizenship by investment, launching its programme in 1984. Applications generally take a matter of a few months to be completed.

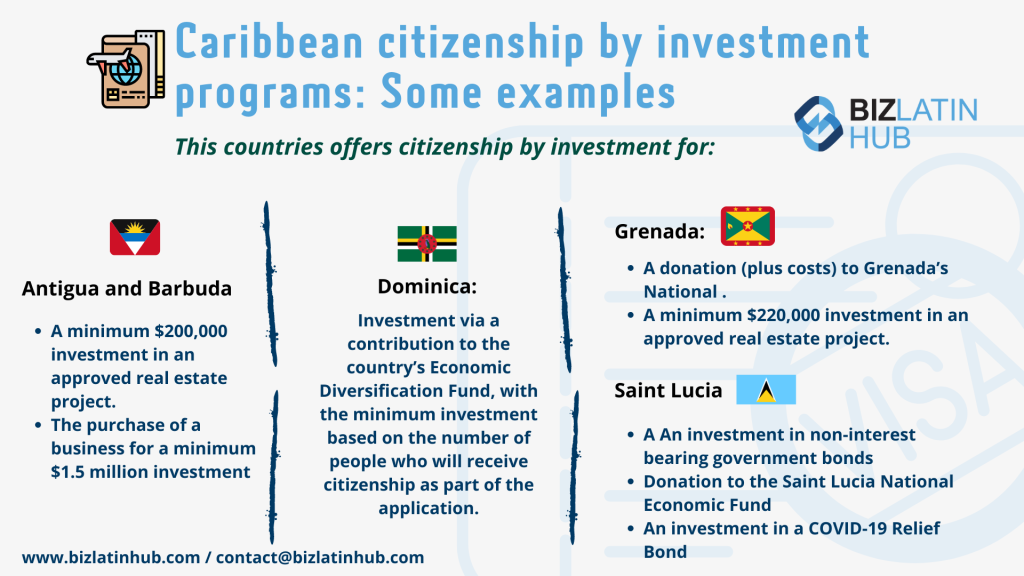

Each of the five OECS members that offer citizenship by investment do so under different terms (all figures are expressed in USD).

Antigua and Barbuda offers citizenship by investment for:

- A minimum $200,000 investment in an approved real estate project

- The purchase of a business for a minimum $1.5 million investment

- A join purchase totalling at least $5 million, in which each individual contributes at least $400,000

- A minimum contribution to the National Development Fund of $100,000

- A minimum contribution to the Universityof the West Indies of $100,000.

Dominica offers citizenship by investment via a contribution to the country’s Economic Diversification Fund, with the minimum investment based on the number of people who will receive citizenship as part of the application:

- $100,000 for a single applicant

- $150,000 for a main applicant and their spouse

- $175,000 contribution for a main applicant, spouse, and up to 2 children

- $25,000 each for additional dependents

- $50,000 each for eligible siblings aged 18 to 25 years old.

Grenada offers citizenship by investment for:

- A donation (plus costs) to Grenada’s National Transformation Fund totalling:

- $150,000 for an individual

- $200,000 for families of up to four people

- $225,000 for families of five people

- A minimum $220,000 investment in an approved real estate project.

Saint Kitts and Nevis offers citizenship by investment for:

- A donation to the Saint Kitts and Nevis Sustainable Development Fund totalling:

- $150,000 for an individual

- $175,000 for a married couple

- $195,000 for a family of four

- An additional $10,000 for any additional child or parent

- An additional $20,000 for any additional sibling

- A minimum $175,000 investment in an approved social or infrastructural real estate project

- A minimum $200,000 investment (plus $35,050 fee) in an approved real estate project, which must be held for a minimum of seven years (or minimum of five years for purchases in excess of $400,000)

- A minimum $400,000 investment (plus $35,050 fee) in a real estate project that does not appear on a government held list of approved projects.

Saint Lucia offers citizenship by investment for:

- A donation to the Saint Lucia National Economic Fund totalling:

- $100,000 for an individual

- $140,000 for an individual and their spouse

- $150,000 for an individual, their spouse, and up to two dependents

- An additional $15,000 for each additional qualifying dependent applying at the same time

- An additional $25,000 donation for each additional qualifying dependent who subsequently applies

- An investment in non-interest bearing government bonds (plus a $50,000 administrative fee) totalling:

- $500,000 for an individual

- $535,000 for an individual and their spouse

- $550,000 for an individual, their spouse, and up to two dependents

- An additional $25,000 for each additional qualifying dependent applying at the same time

- An investment in a COVID-19 Relief Bond (plus a $30,000 administrative fee) totalling:

- $250,000 for an individual (must be held for five years)

- $250,000 for an individual, their spouse, and one dependent (must be held for six years)

- $250,000 for an individual, their spouse, and up to four dependents (must be held for seven years)

- $300,000 for an individual, their spouse, and up to four dependents (must be held for five years)

- An additional $15,000 for each additional qualifying dependent applying at the same time

- A minimum $300,000 investment in an approved real estate project, which must then be held for a minimum of five years

- A minimum $3.5 million investment in an approved enterprise project that creates at least three permanent jobs

- A minimum $6 million joint investment, in which each individual invests at least $1 million, in an approved enterprise project that creates at least six permanent jobs.

Caribbean citizenship by investment programs lucrative for govts

Some Caribbean nations depend heavily on citizenship by investment programs, with Antigua and Barbuda reportedly generating 10% to 15% of total revenue from its program, while others reportedly generate up to 50% of revenues from them.

In response to the EU and US moves to tackle the schemes, Antigua and Barbuda’s Prime Minister Gaston Browne has sought to promote a sub-regional response, proposing a Caribbean regulatory body to oversee citizenship by investment schemes among OECS members in an attempt to address the concerns stoking legislation against them.

“It will be a response to the issues [the EU] have raised and it will be to demonstrate over and above anything else, our intent to be compliant and sympathetic to issues that may arise in terms of their own internal security,” Antigua and Barbuda’s cabinet spokesman Melford Nicholas reportedly told local press following government discussions on the issue.

For Browne’s part, while he has vocally voiced his opposition to the moves, he has also conceded that the EU and US hold the cards, given that removing visa-free access would “clearly undermine the value of these programs.”

In March, Browne was candid about Caribbean citizenship by investment programs, stating that it was the ability of applicants to rapidly gain citizenship without going through a period of residency, as is the case in many countries, that made them attractive and lucrative to the nations offering them.

“The reason why our citizenships are viable is because we go straight to citizenship. If countries had to compete exclusively by offering residency, then clearly we would not be able to compete with the US program or those in Europe,” he was quoted as saying in the local press.

However, with the conflict in Ukraine moving into a new phase as Russia mounted a major offensive in the eastern Donbas region in mid-April, pressure continued to mount in the United States and EU for more measures to be taken to undermine Russia and its elite – with bans on citizenship by investment programs a very visible target for US and European lawmakers.

Life after Caribbean citizenship by investment programs

Opposition to Caribbean citizenship by investment programs is not reserved to outside the OECS, with the longstanding government of St Vincent and the Grenadines critical of such schemes.

Years before the current moves to close them down, Vincentian Prime Minister Ralph Gonsalves had committed to never allow citizenship by investment under his leadership. More recently, the US and EU legislation to combat them saw Gonsalves brand them “ not sustainable.”

As highlighted in a recent analysis by David Jessop, a consultant at the Carribean Council trade and investment promotion body, the likely passage of legislation in both the United States and European Union, amid doubts about the viability and likelihood of a proposed sub-regional regulatory body preventing it happening pose a significant issue for many nations in terms of revenue.

According to Jessop, while it is not entirely clear how lucrative citizenship by investment programs are, an analysis from the East Caribbean Central Bank has suggested that OECS nations offering the schemes generated almost USD 185 million in 2019 alone – almost 5% of the combined GDPs of Dominica, Saint Kitts and Nevis, and Grenada, three nations that are reportedly particular beneficiaries of such schemes.

As Jessop states, the scrutiny that Caribbean citizenship by investment schemes are now under will also likely see offshore banking regimes come under the spotlight, representing another challenge to the economies that benefit from them.

“Faced with a world rapidly dividing and adapting to new norms, this would seem to be the moment when [citizenship by investment] nations agree to end the sale of passports and either update or design well-regulated internationally acceptable residency by investment programmes,” wrote Jessop, stating that such an approach might sit alongside enhanced longer-term schemes to encourage remote workers to relocate to the Caribbean.

According to Jessop, while such measures will not provide immediate compensation, the high-end long-stay market does offer the potential for creating fresh revenue streams and attract both high net-worth individuals and young skilled professionals that could make important contributions to economic growth.

Biz Latin Hub assists investors in the Caribbean

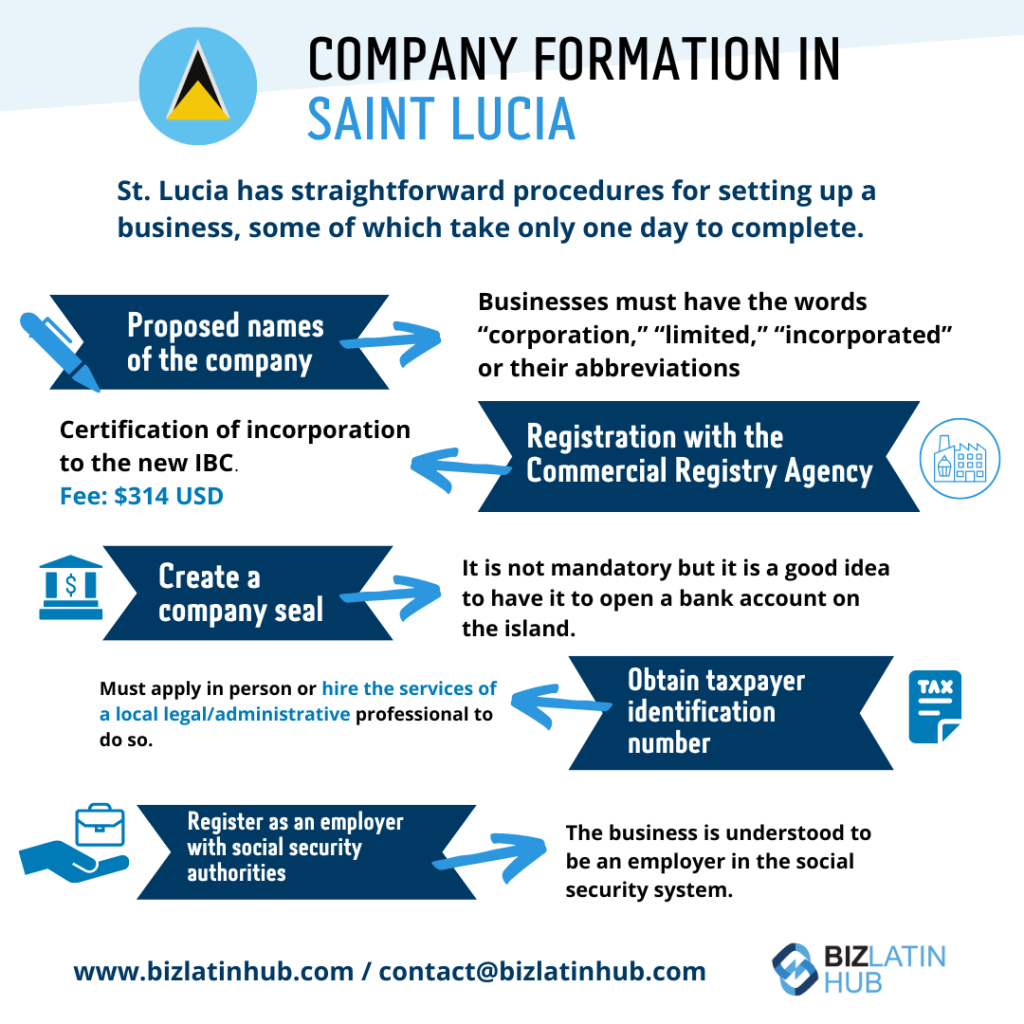

At Biz Latin Hub, we provide integrated market entry and back office services throughout Latin America and the Caribbean, with offices in 17 major cities around the region, including in the Domincan Republic and Puerto Rico. We also have trusted partners in other markets, meaning wherever you are looking to invest in the region, we can usually help.

Our porfolio of services includes accountign & taxation, company formation, due diligence, legal services, visa processeing, and hiring & PEO.

Contact us today to find out more about how we can assist you doing business in the region.

If you found this article on Caribbean citizenship by investment programs of interest, check out the rest of our news coverage.

Or read about our team and expert authors.