Explore the key opportunities and challenges of doing business in Panama in 2025, including insights into strategic sectors, legal frameworks, and practical steps for foreign investors.

Doing business in Panama in 2025 offers strategic advantages for foreign investors, thanks to its robust economy, favorable tax environment, and pivotal role in global trade. Not only is it easy to register a company in Panama, but its GDP continues to grow at four times the rate of the Latin and Caribbean (LAC) region. This continued economic growth in an uncertain global market makes Panama an attractive location for business investment today and in the future. Companies doing business in Panama benefit from its dollarized economy, extensive free trade agreements, and a well-established logistics infrastructure centered around the Panama Canal.

Key takeaways on doing business in Panama

| Is foreign ownership allowed in Panama? | Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals). There are no major restrictions on foreign investment. For example, there are no registration requirements for capital and the transfer of funds to the country is not taxable. |

| Most important sectors in Panama | Banking and trade dominate traditionally, with energy, real estate and tourism all up and coming sectors. |

| Are there Free Trade Zones in Panama? | Yes, many. For example, the Panama Pacifico project offers exceptional tax, labor, and legal benefits to companies that base themselves within its boundaries, making it a desirable destination for multinational corporations to establish regional headquarters. |

| Are there incentives for Foreign Direct Investment in Panama? | Thanks to the government’s tax incentives, already over 140 multinational companies reside in Panama due to its policy of not imposing taxes on foreign-earned income that is brought into the country and deposited in its banks. |

| What international links does the country have? | Panama has signed a number of trade agreements with countries worldwide. Panama serves as a vital connection point between the Americas, linking the East and West as well as the North and South by sea, land, and air. |

What are the Panama business investment opportunities?

Panama’s government is very open to foreign business investment. They are focused on making it the primary destination in Latin America for foreign investors.

Key sectors for doing business in Panama include logistics, financial services, tourism, renewable energy, and real estate development, particularly within special economic zones like Panama Pacifico.

There are no major restrictions on foreign investment. For example, there are no registration requirements for capital and the transfer of funds to the country is not taxable.

Here are some key Panama business investment opportunities:

- Tourism – Panama’s tourism sector offers many investment opportunities ranging from building hostels, resorts, and hotels to establishing charter dive operations and guided tours.

- Real Estate – Panama offers several benefits for construction projects. Residential projects valued under USD$120,000 receive a 20-year exemption on property taxes for the improvements made. For construction projects ranging from USD$120,000 to USD$300,000, the exemption period is 10 years. And for those exceeding USD$300,000, the exemption is for five years.

- Special Economic Area Panama Pacifico – The government established this entity as an independent and accountable organization responsible for managing, promoting, developing, regulating, and ensuring proper use of the Panama Pacifico region. It offers exceptional tax, labor, and legal benefits to companies that base themselves within its boundaries, making it a desirable destination for multinational corporations to establish regional headquarters.

- Energy – In 2016, the National Energy Plan was passed by the government which proposed a goal of sourcing 70 percent of the country’s energy from renewable sources by 2050. To encourage the construction of natural gas, wind, and solar power facilities, the government created tax credits and incentives.

What challenges are there in Panama business investment?

Like any new business market, investing in Panama does come with its challenges.

Here are some important factors to consider when doing business in Panama.

- Inflation

- Corruption

- Language

- Tax system

Below we explore each of these points in more detail:

- Inflation – While Panama currently has a low inflation rate compared to other countries in the region, it is not exempt from external global factors affecting its inflation rate.

- Corruption – Panama was on the Financial Action Task Force ‘Grey List’. This list refers to countries identified with anti-money laundering and financial terrorism deficiencies. However, Panama was taken off the list in 2023, a major step forwards in tightening legislation.

- Language – To succeed in business in Panama, it is crucial to have a basic understanding of the Spanish language. Those who don’t speak Spanish may struggle to communicate effectively and establish new commercial relationships in the country. Partnering with a multilingual business associate can aid in entering the market, as well as growing connections with local suppliers, distributors, and partners.

- Tax system – Understanding the local tax system is key to success in any location. Panama’s territorial tax system only taxes income generated within its borders. Foreign income is only taxed in the other country, making it helpful for companies and investors based in Panama. Businesses should seek professional support from local accountants.

Local Insight for 2025:

Panama’s commitment to economic diversification and infrastructure development continues to create new opportunities for foreign investors, particularly in sectors aligned with sustainable growth and innovation.

Is Panama good for investment?

Yes, there are many compelling reasons why Panama is an enticing country to invest in. From its strategic location, improving infrastructure and talent pool to its economic growth.

Let’s focus on some of its leading investment benefits.

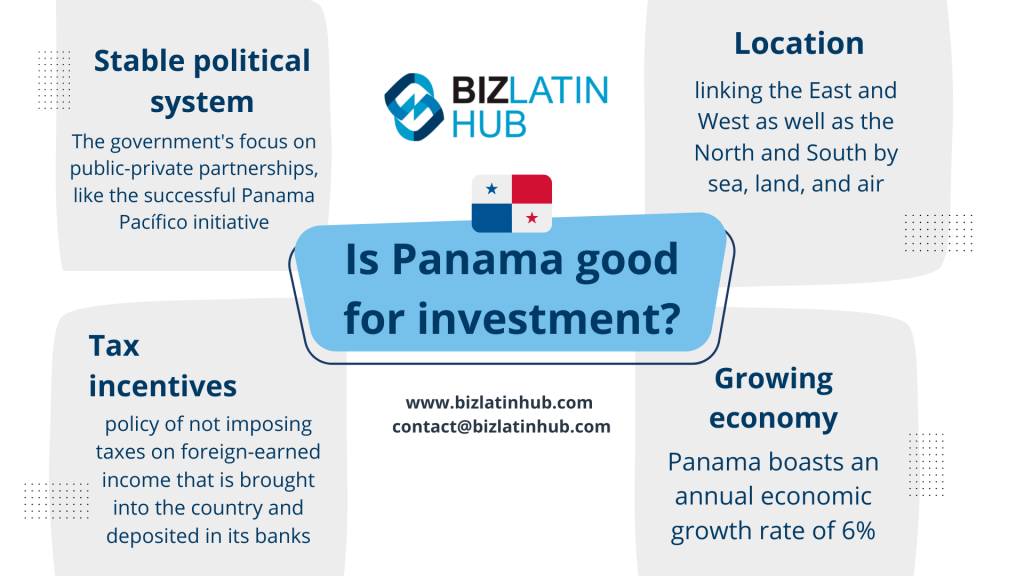

- Stable political system – Panama is well-known for its robust political system, earning consistent recognition from the World Bank as one of the most politically stable nations in Latin America. It boasts the title of the second safest country in Central America and ranks fifth in the entire American continent. The government’s focus on public-private partnerships, like the successful Panama Pacífico initiative, underscores its commitment to development and investment in the country.

- Location, location, location – Panama serves as a vital connection point between the Americas, linking the East and West as well as the North and South by sea, land, and air. With over 1,100 international flights per week, Tocumen International Airport boasts 83 direct destinations and accommodates 40 airlines.

- Tax incentives – Thanks to the government’s tax incentives, already over 140 multinational companies reside in Panama. As mentioned earlier, Panama is an appealing choice for multinational corporations due to its policy of not imposing taxes on foreign-earned income that is brought into the country and deposited in its banks.

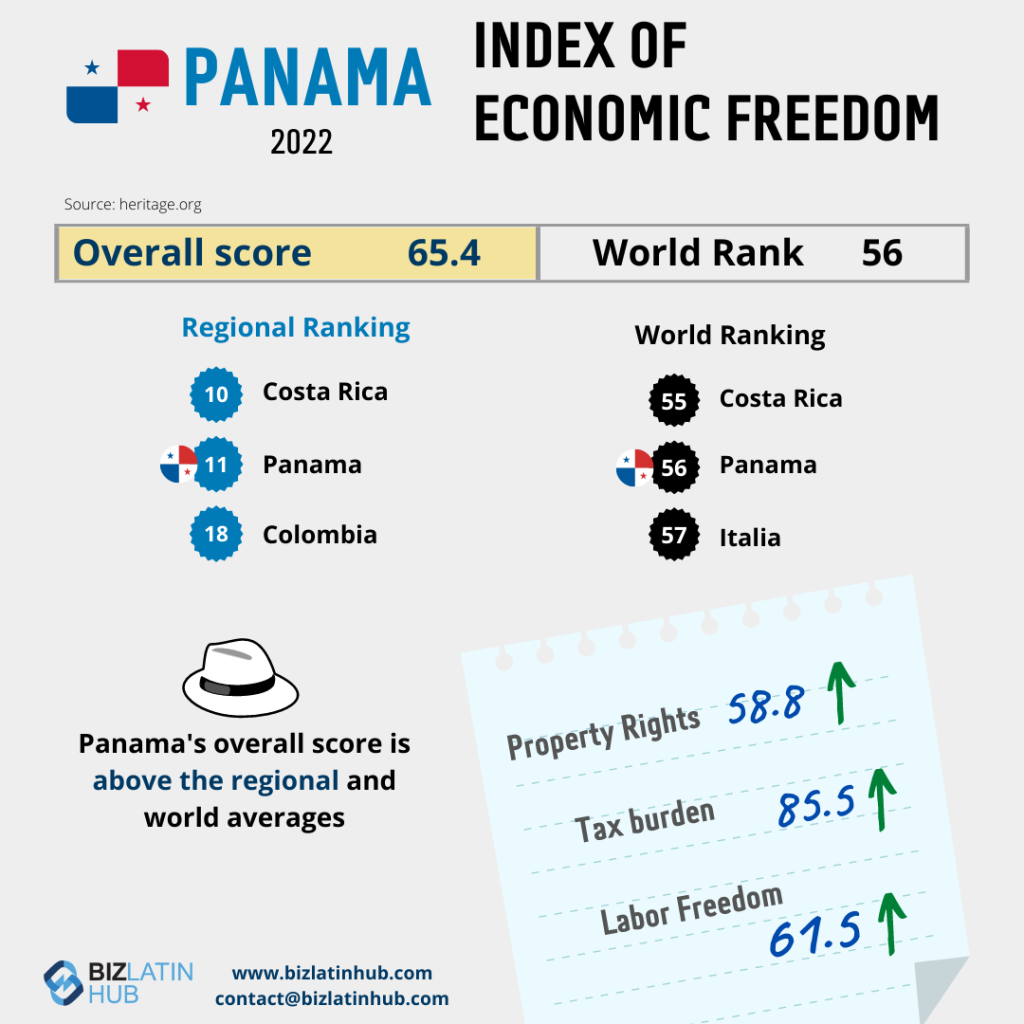

- Growing economy – Panama boasts an annual economic growth rate of 6%, which is among the highest in Latin America. Additionally, it has achieved the best credit rating in all of Central America, surpassing Costa Rica, Honduras, and El Salvador. The Panamanian government has been instrumental in creating laws that encourage investment and offer tax incentives. These laws also provide legal certainty, attracting foreign investors with promising returns.

Why Panama Remains a Prime Investment Destination in 2025

Panama continues to be a top choice for foreign investors in 2025, offering a stable political environment, strategic geographic location, and a pro-business government. The country’s commitment to infrastructure development and economic diversification further enhances its appeal.

Key reasons to invest in Panama:

- Strategic Location – Serving as a bridge between North and South America, Panama is a logistical hub with access to major markets.

- Favorable Tax Regime – Panama offers various tax incentives, including exemptions for certain sectors and operations within special economic zones.

- Robust Infrastructure – Ongoing investments in ports, airports, and the Panama Canal expansion support efficient trade and transportation.

- Skilled Workforce – A growing pool of bilingual professionals supports diverse business operations.

- Special Economic Zones – Areas like Panama Pacifico provide additional benefits, such as streamlined customs procedures and labor flexibility.

Local Tip:

When establishing a presence in Panama, consider leveraging the benefits of special economic zones to maximize operational efficiency and cost savings.

Company formation in Panama

To start a company in Panama, foreign investors must choose a legal structure (commonly a Sociedad Anónima), register with the Public Registry, obtain a Tax Identification Number (RUC) from the Directorate General of Revenue (DGI), and comply with local labor and social security regulations. The process typically takes 2–4 weeks with proper legal assistance.

Doing business in Panama requires compliance with local regulations, including company registration with the Public Registry, obtaining a Tax Identification Number (RUC), and adhering to labor and social security laws.

FAQs on a Panama business investment

Answers to some of the most common questions we get asked by our clients.

1. Can a foreigner own a business in Panama?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

2. Are there Free Trade Zones in Panama?

| Yes, many. For example, the Panama Pacifico project offers exceptional tax, labor, and legal benefits to companies that base themselves within its boundaries, making it a desirable destination for multinational corporations to establish regional headquarters. |

3. How long does it take to register a company in Panama?

It takes 8 weeks to register an operating company in Panama.

4. Which sectors are important in Panama?

Banking and trade dominate traditionally, with energy, real estate and tourism all up and coming sectors.

5. Does Panama have trade agreements with other countries?

Panama has signed a number of trade agreements with countries worldwide. Panama serves as a vital connection point between the Americas, linking the East and West as well as the North and South by sea, land, and air.

6. What entity types offer Limited Liability in Panama?

In Panamá, both S.A (Sociedad Anónima) and S.R.L (Sociedad de Responsabilidad Limitada) are limited liability entity types.

7. Is Panama a good country for doing business in 2025?

Yes. Panama offers a stable economy, strategic location, and investor-friendly policies, making it an attractive destination for foreign businesses.

8. How long does it take to start a company in Panama?

With legal support, incorporation and registration can take approximately 2 to 4 weeks, depending on the business structure and sector.

9. What types of businesses succeed in Panama?

Businesses in logistics, financial services, tourism, renewable energy, and real estate development thrive due to Panama’s strategic advantages and supportive regulatory environment.

Biz Latin Hub can help you with a Panama business investment

Biz Latin Hub offers a fully integrated, multilingual team of legal, accounting, and company formation services for your business plans in Latin America, and the Caribbean.

If you’re considering doing business in Panama in 2025, Biz Latin Hub offers comprehensive support for company formation, legal compliance, and strategic market entry.

With wholly-owned subsidiary offices located throughout the region, including Panama we have the expertise to answer your questions and help you achieve your business goals.

To learn more about how we can assist you in doing business in Panama and the rest of Latin America, talk to our experienced team today.