Corporate compliance in Panama requires regular monitoring and verification. An entity health check in Panama ensures your business meets all local legal requirements and maintains good standing with government authorities. Foreign companies operating in Panama must conduct regular due diligence Panama assessments to protect against penalties and operational risks.

Key Takeaways on Entity Health Check Panama

| Topic | Key Information |

|---|---|

| Main compliance areas | Corporate structure, tax obligations, employment law, social security, licenses and permits |

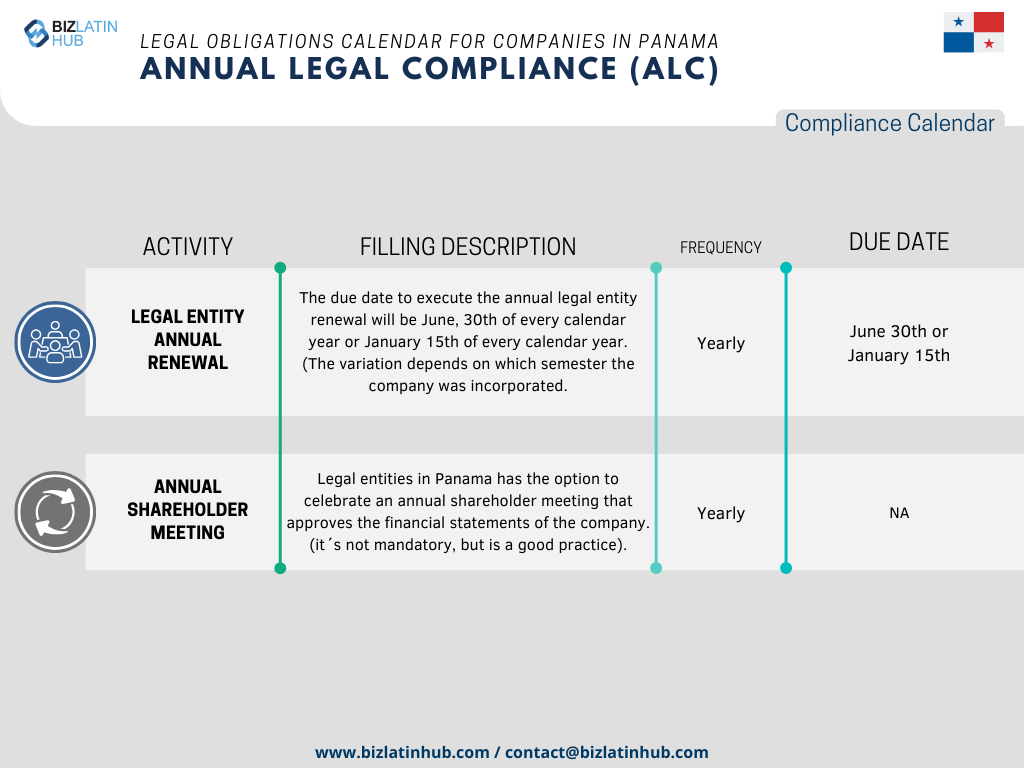

| Critical deadlines | Monthly social security contributions, annual tax declarations, quarterly fiscal reports |

| Who needs health checks | All companies in Panama, especially foreign subsidiaries, SEM regime companies, M&A participants |

| Frequency recommended | Annual reviews for most companies, quarterly for special economic zones and multinational headquarters |

| Common violations | Missed social security payments, outdated corporate books, incomplete tax filings, expired permits |

| Cost-saving tip | Combine health checks with annual compliance tasks to reduce legal fees by up to 25% |

| Local expertise requirement | Must use Panama-qualified auditors familiar with DGI regulations and local corporate law |

What is an Entity Health Check Panama?

An entity health check Panama is a comprehensive audit conducted by independent experts to examine legal due diligence Panama requirements and fiscal compliance. This corporate due diligence Panama process reviews whether companies operating in the country comply with tax declarations, labor regulations, monthly reports, and accounting registries. The main objective of conducting a Panama compliance check is to identify discrepancies that might affect business operations or create legal liabilities.

The verification process examines both legal and fiscal elements of corporate operations. Legal compliance focuses on corporate structure integrity, contract validity, and regulatory adherence. Fiscal compliance ensures proper tax filings, social security payments, and financial reporting accuracy. Companies subject to special regimes like SEM (Sede de Empresa Multinacional) face additional scrutiny regarding their multinational headquarters status and associated tax benefits.

Why Conduct Due Diligence Panama?

Regular Panama entity verification protects businesses from severe financial and legal consequences. Social security violations in Panama carry criminal penalties, making CSS (Caja de Seguro Social) compliance critical for foreign executives. The Dirección General de Ingresos (DGI) actively monitors corporate tax compliance and imposes substantial penalties for late filings or incomplete documentation.

Transaction-related benefits include smoother M&A processes, enhanced investment attraction, and improved banking relationships. Panama’s financial sector requires updated compliance certificates for various transactions, making regular health checks essential for maintaining operational flexibility. Companies planning expansion, seeking financing, or entering partnerships benefit significantly from current compliance verification.

Legal Due Diligence Panama Components

Legal compliance verification examines corporate structure integrity and regulatory adherence. Corporate books must reflect current shareholding structures, board compositions, and decision-making authority. Minutes from shareholder meetings and board resolutions require proper documentation and filing with the Public Registry. Contract analysis evaluates third-party agreements for compliance with Panamanian law and identifies potential liability exposures.

Regulatory compliance extends beyond basic corporate requirements and includes:

- Business licenses requiring regular renewal

- Industry-specific authorizations that must remain current

- Environmental compliance certificates for applicable sectors

- Import/export documentation accuracy for international trade

- Employment contracts conforming to Panama’s Labor Code

- Proper social security registrations for all employees

Pro Tip for Panama Operations: Municipal taxes vary significantly across Panama’s jurisdictions. Companies operating in multiple locations need location-specific compliance strategies, as Panama City, Colón, and David each maintain different tax rates and filing requirements.

Corporate Due Diligence Panama: Fiscal Requirements

Fiscal compliance encompasses all tax-related obligations managed by multiple government agencies. Monthly obligations include:

- Social security contributions through CSS (non-negotiable, with criminal penalties for delays)

- Income tax withholdings

- VAT declarations (ITBMS)

- Municipal tax submissions (deadlines vary by jurisdiction)

Annual requirements include corporate income tax returns filed with DGI, audited financial statements for companies exceeding specific revenue thresholds, and special regime reporting for SEM entities. Free zone companies follow distinct tax protocols with unique exemption maintenance requirements. International services companies enjoy specific exemptions but must demonstrate ongoing qualification through detailed documentation.

SEM Regime Expertise: Companies in the SEM regime enjoy significant tax benefits but face strict compliance monitoring. Annual health checks are essential for maintaining this privileged status, as any compliance failure can result in immediate regime disqualification and retroactive tax assessments.

Panama Entity Verification Process

The verification process begins with comprehensive information collection from corporate operations, legal, accounting, and administrative departments. Many companies create dedicated compliance departments to centralize important documentation, significantly streamlining this initial phase. Independent auditors then validate all gathered information through cross-referencing with primary sources and government databases.

Compliance assessment involves evaluating current standing with key government agencies including DGI for tax matters, CSS for social security compliance, the Ministry of Commerce and Industries for business licenses, and relevant municipal authorities. Risk analysis identifies potential compliance gaps and quantifies their severity levels, including financial exposure calculations and operational impact assessments.

Remediation planning develops specific action items to address identified deficiencies. This includes timeline establishment, cost estimation, and priority ranking based on risk severity. Documentation of the entire process creates valuable records for future audits and potential government inspections, while also fulfilling legal obligations related to anti-money laundering requirements.

Local Expertise and Compliance Strategies

Banking Integration Insight: Panama’s banking sector requires updated compliance certificates for significant transactions. Regular health checks ensure banking relationships remain uninterrupted, particularly important for companies requiring frequent international transfers or credit facilities.

Free zone companies must demonstrate ongoing compliance to maintain valuable tax exemptions. These entities face unique challenges as they operate under different regulatory frameworks while still maintaining obligations to various government agencies. Annual verification prevents loss of beneficial status that could result in substantial tax liabilities.

Critical Social Security Warning: CSS violations represent the highest risk area for foreign companies in Panama. Late payments or incomplete registrations can result in criminal charges against company executives, making this compliance area non-negotiable for successful operations.

Professional Requirements and Independence

Panama entity verification requires qualified professionals with specific local expertise. Licensed auditors must possess deep knowledge of Panamanian corporate law, experience with DGI procedures, and understanding of industry-specific regulations. Independence requirements mandate that auditors have no financial interest in companies being examined and maintain clear conflict of interest policies.

The audit team should include specialists with expertise in:

- Tax matters (DGI requirements and municipal variations)

- Corporate law (legal compliance verification)

- Labor law (employment contracts and social security compliance)

Common Violations and Risk Areas

The most critical compliance violations include:

- Social security payment delays (potential criminal charges for executives)

- Corporate book maintenance failures (problems during government inspections)

- Missing annual tax filings with DGI (automatic compounding penalties)

- Expired business licenses (immediate operational halt)

Foreign companies face additional challenges with proper resident agent appointments, comprehensive shareholder meeting documentation, adequate transfer pricing documentation for international transactions, and beneficial ownership reporting compliance. These requirements often catch foreign executives unprepared, emphasizing the importance of regular professional guidance.

FAQs on Entity Health Check Panama

How often should companies conduct due diligence Panama assessments?

An annual assessment is sufficient for most businesses. Entities in high-risk sectors or under special regimes benefit from quarterly reviews, and any company planning a major transaction or expansion should perform a fresh assessment beforehand.

What is the typical cost range for corporate due diligence Panama?

Basic health checks for a simple corporate structure start at roughly US $2,500. Full-scope reviews of complex groups can exceed US $15,000. Companies operating under the SEM regime usually fall toward the higher end because of extra reporting and compliance obligations.

Can violations discovered during Panama entity verification be resolved?

Most shortcomings can be cured through corrective filings and the payment of penalties. Social-security breaches are the exception: they may trigger criminal proceedings and usually demand legal representation, making proactive compliance the safest approach.

Do different industries face varying compliance requirements?

Yes. Banking, insurance, telecommunications, and mining are subject to extra regulatory oversight beyond standard corporate rules. Free-zone operations and international-services companies also follow distinct compliance frameworks dictated by their respective regimes.

Professional Guidance for Panama Compliance

Regular entity health checks protect Panama operations from compliance risks while maintaining good standing with government authorities. The combination of legal due diligence Panama and fiscal verification ensures comprehensive corporate protection against regulatory penalties and operational disruptions.

Professional guidance ensures thorough assessment and proper remediation of discovered issues. Expert auditors familiar with Panama’s regulatory environment provide the most effective compliance verification, particularly important given the severe consequences of certain violations.

At Biz Latin Hub, our multilingual team of legal experts has extensive experience conducting entity health checks for companies in Panama and Latin America. With our complete suite of market entry and legal advisory services, we offer support and advice to improve your company’s corporate compliance, increase its value, and manage risks.

Contact us today for personalized assistance on how to successfully run your operations in Panama.

Learn more about our team and expert authors.