Accounting and taxation in Panama must be considered in your market entry strategy, ensuring compliance with its detailed regulatory framework. This guide provides vital information to help you handle Panama’s fiscal requirements effectively. Biz Latin Hub offers professional support to navigate the country’s accounting standards after you incorporate a company in Panama. This will involve working with the relevant authorities. DGI (Dirección General de Ingresos) oversees tax reporting and corporate filings. Caja de Seguro Social manages payroll and social contributions.

Key Takeaways on Accounting and Taxation in Panama

| What Are The Accounting Standards in Panama? | In Panama, the accounting standard is based on the International Financial Reporting Standards (IFRS) for publicly traded companies. Private companies can opt to follow IFRS or use the Panamanian Generally Accepted Accounting Principles (GAAP). |

| What is the Corporate Tax Rate in Panama? | The current corporate tax rate in Panama is set at 25%. |

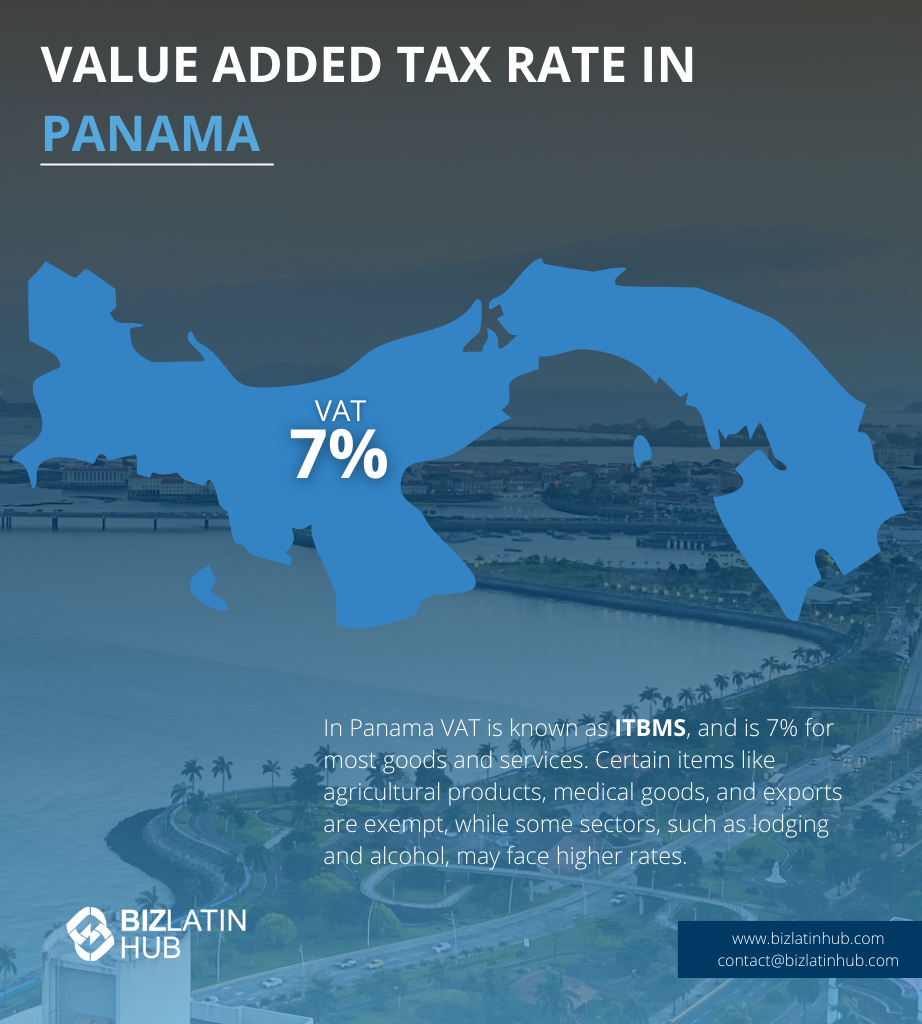

| What is the Panamanian Value Added Tax Rate? | The standard VAT (IVA) rate in Panama is set at 7%. |

| Dividend Tax Rate in Panama | A withholding tax of 10% is collected at the moment of their distribution. |

Overview of Panama’s Tax and Accounting Structure

The accounting and taxation requirements in Panama:

- Income Tax.

- Commercial and Import Tax.

Corporate Income Tax and ITBMS Obligations

By far the most important tax for prospective investors, income tax, is the percentage paid to the government on your earnings. Panama utilises a progressive tax system where the income tax is directly related to the amount you earn and utilises a band system to split the population into three:

- Earnings up to USD$11,000 are tax-free.

- Earnings from USD$11,000 to USD$50,000 are taxed at 15%.

- Earnings over USD$50,000 have a tax rate of 25%.

- By comparison, the USA has a maximum income tax of 37%.

- Onshore companies with annual revenue of less than USD$1.5million will pay corporate income tax at 25%. All other onshore companies will be taxed at 28%. Only income earned in the local territory will pay taxes.

- Branches will pay an additional dividend tax of 10% of their after-tax income.

Another significant advantage of the Panamanian tax system is the fact that it is territory-based. This means that only profits registered in Panama require payment of income tax, with any profitable business that takes place outside of the territory being untaxed. This is the ‘magic’ policy that has granted Panama the status of “tax haven” throughout the globe.

Furthermore, there are many further tax reductions that investors can enjoy:

- Small businesses and companies that work in the agricultural sector can apply for lower income tax rates.

- Married couples can receive a reduction of USD$800 on their joint tax return.

- All resident companies can forward up to 20% of their losses for a maximum period of 5 years.

With an incredibly strong import and export-based economy, boosted by a strategic geographic location (providing a natural bridge between the huge North and South America markets, and having access to two oceans), knowing the commercial and import taxes is useful for international investors.

Any company looking to conduct business or trade in Panama must be granted a ‘Panama Commercial Operation Permit’. Tax on this permit for most companies is set at 2% of net worth with a maximum of USD$60,000, whilst companies within certain free trade zones (FTZs) pay a reduced rate of 1% with a maximum payment of USD$50,000.

In terms of a VAT, known as the ITBMS (Impuesto de Transferencia de Bienes Muebles y Servicios) in Panama, the country offers some of the lowest rates in the world. For most goods, a meagre 7% is added to the retail price, whilst for alcoholic drinks and tobacco products, there are slightly higher rates (10% and 15% respectively).

These intensely competitive sales tax rates mean that there are large amounts of retail tourism, with thousands of tourists travelling to Panama to purchase electronics, clothes and more in the largest shopping centre in the Americas, Albrook Mall. All local onshore companies with annual turnover exceeding USD$36,000 must pay VAT at the standard rate of 7%. Companies will be required to file monthly VAT returns.

Note: VAT is an indirect tax and is often added on to invoices for clients.

Employing workers in Panama means that you will have a number of tax responsibilities on behalf of your employees as well as contributions to make to the social security system. Employer contributions come to 12.25% of the gross salary paid, with employee contributions of 9.75% of the same.

These must be filed monthly via the SIPE online system. Like many countries in Latin America, Panama mandates a compulsory Decimo Tercer Mes (13th-month bonus) payment to employees which is paid in December. This must be the equivalent of one month’s regular salary and paid pro-rata if incomplete.

UBO Declaration, Accounting Records, and Deadlines

All companies must register their UBOs (Ultimate Beneficial Owners) with the Superintendence of Non-Financial Subjects. Law firms must maintain records of beneficial ownership. Under Law 254, law firms must record UBOs and entities must provide UBO info annually or face penalties.

Entities must maintain accounting books and submit annual declarations. Bookkeeping can be held in Panama or abroad but must be accessible for inspection. Law 254 applies to all companies registered in Panama. ITBMS (VAT) must be filed by the 15th of each month and payroll is also monthly. UBO info is recorded annually and income tax must be paid by March 31st of the following year.

Recordkeeping penalties for non-compliance can reach USD$1,000/month.

Are there any more accounting and taxation requirements in Panama?

Despite all the very favourable tax rates in Panama, there are occasional doubts about the ethics of tax havens such as Panama. However, it is very important to remember that offshore companies are legal and are a great method to manage your wealth and protect your assets.

Additionally, Panama is a registered member of the IFRS (International Financial Reporting Standards) foundation. This is an organisation that helps to promote and enforce transparent, “globally accepted accounting standards”.

The organisation believes that given the growing number of transactions being done across borders, estimated to be ⅓ around the world, it is of increasing urgency to have a uniform standard that ensures a fair and equal application of accounting and banking standards.

Panama’s membership in this organisation can be seen as an effort to wipe out illicit money laundering and as a sign of commitment to a fair and trustworthy international business.

It must also be noted that having offshore accounts in Panama does not exonerate you from complying with any local tax obligations that exist in your country of origin.

FAQs About Tax and Accounting in Panama

Based on our extensive experience these are the common questions and doubts from our clients when looking to understand accounting and taxation in Panama.

1. What is the corporate tax rate in Panama?

The corporate tax rate in Panama is 25% over the net profit.

2. How are businesses taxed in Panama?

Businesses in Panama are taxed according to the Panamanian Financial Reporting Standards, which works on the basis of paying tax on the difference between revenue minus deductible expenses.

3. What is the IRS called in Panama?

DGI (Direccion General de Ingresos).

4. What is the accounting standard in Panama?

Panamanian accounting standards require companies to prepare their financial statements in Spanish. Accounting registries and books of account must be recorded in Spanish.

5. What is the CPA equivalent in Panama?

The equivalent to CPA is “Contador Publico Autorizado” The license is granted by the Colegio de Contadores Publicos Autorizados en Panamá.

6. Does Panama report in IFRS?

All listed companies must follow IFRS Standards.

7. What is ITBMS in Panama?

ITBMS is Panama’s VAT, charged at 7% on most goods and services. Monthly filings are required.

8. What are payroll tax obligations?

Employers contribute ~12.25% to Caja de Seguro Social (CSS), including health, pension, education, and occupational risk. Employees contribute 9.75%.

9. Is UBO declaration mandatory in Panama?

Yes. All companies must register Ultimate Beneficial Owners with the Superintendence of Non-Financial Subjects. Law firms must maintain records of beneficial ownership.

10. Are accounting records required even for offshore companies?

Yes. Law 254 of 2021 requires all legal entities to maintain accounting records and supporting documentation, even if not operating in Panama.

Why Invest in Panama?

Panama offers a strategic location as a global business hub, connecting North and South America. Its favorable tax regime, including a low corporate tax rate and incentives for specific industries, makes it an attractive destination for foreign investment.

The country also benefits from a stable economy, supported by the Panama Canal, which facilitates international trade and logistics. With a growing infrastructure sector, Panama presents opportunities in real estate, construction, and tourism.

In addition to its economic advantages, Panama boasts a well-developed legal and regulatory framework. The country follows International Financial Reporting Standards (IFRS) for publicly traded companies, while private companies may opt for either IFRS or Panamanian GAAP.

This flexibility, combined with a robust financial sector and ease of doing business, makes Panama a favorable environment for investors seeking stability and growth in Latin America.

Biz Latin Hub can help with accounting and taxation requirements in Panama

Understanding taxation and accounting requirements in Panama will make it easier for you to budget. Additionally, it will help you understand what you will have to deal with when it’s time to declare your taxes.

If you would like more information about accounting regulations or tax laws in Panama, Biz Latin Hub’s group of experts offer you legal and accounting assistance for your business in Bolivia. Take advantage of our large range of multilingual market entry and back-office business solutions to meet your company’s incorporation and compliance needs.

Contact us now for help in establishing a successful business in Panama.

Learn more about our team and expert authors.