Panama’s labor laws are governed by the Labor Code and provide detailed regulations on employment contracts, employee rights, working hours, and termination. This 2025 guide helps companies understand their legal obligations when hiring in Panama or if you want to register a company in Panama.

Key Takeaways

| What are the working hours mandated by labor laws in Panama? | Labor laws in Panama set a maximum work schedule of 8 hours per day and 48 hours per week, not including overtime. |

| What Is The Panamanian Minimum Wage? | The current minimum wage as of January 2025 varies widely according to sector, from USD$341 to USD$1,015 per month. Average is around USD$636. |

| Types of Employment Contracts in Panama | Fixed-term. Indefinite-term. Contracts for a set task. |

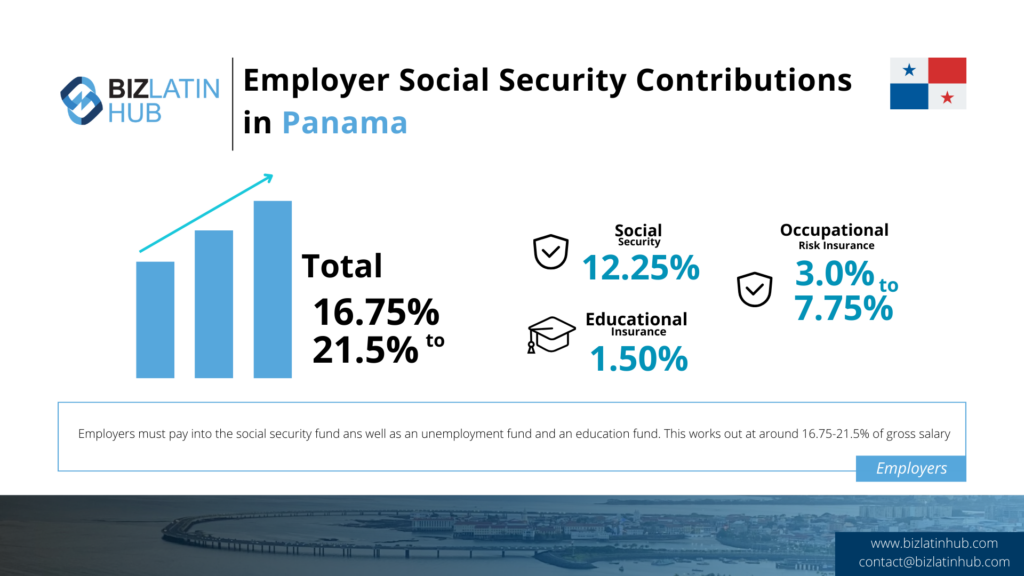

| What percentage of an employee’s salary is contributed to social security in Panama? | Employers must pay into the social security fund ans well as an unemployment fund and an education fund. This works out at around 16.75-21.5% of gross salary. |

Types of Employment Contracts in Panama

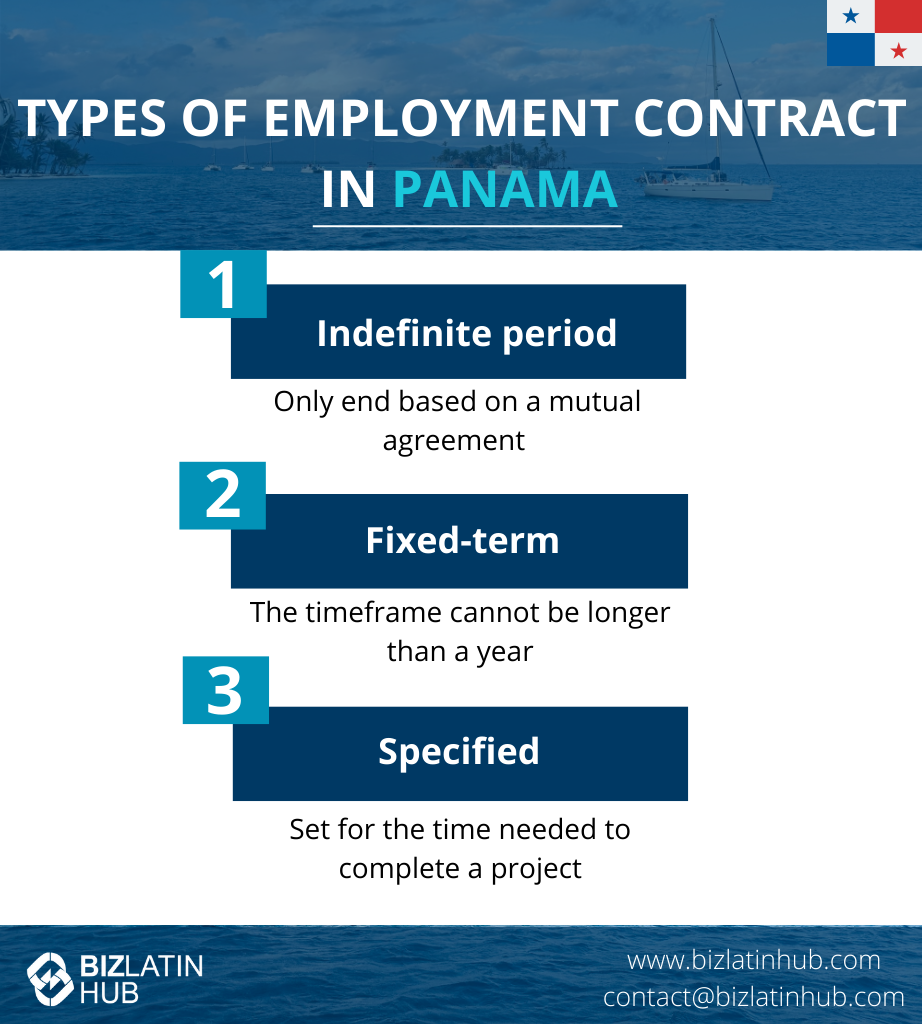

According to labor laws in Panama, periods for employment contracts can be indefinite, definite (fixed-term), and specified for the time the employee takes to complete a determined project.

The definite contract must always be in a written form. The timeframe cannot be longer than a year, unless the project requires specialized technical preparation. In this case, the contract can be signed for a period of 3 years.

Under labor laws in Panama, It is also possible to hire an employee for a probation period – this period has a maximum time limit of 3 months. If the employer isn’t satisfied with the employee’s performance or work during this time, there is no obligation to hire them. Similarly, employees have no obligation to the company if they choose not to continue working within the specified period.

Employing foreign workers

Under Panamanian labor law, only 10% of your business workforce can be filled by foreign workers. If foreign individuals are considered specialized, technicians or trusted individuals, the percentage increases to 15%.

Note that foreigners married to or dependent on a Panamanian national are not included in the above foreign workforce percentage.

Labor laws in Panama also define an employee’s benefit(s), which include the following:

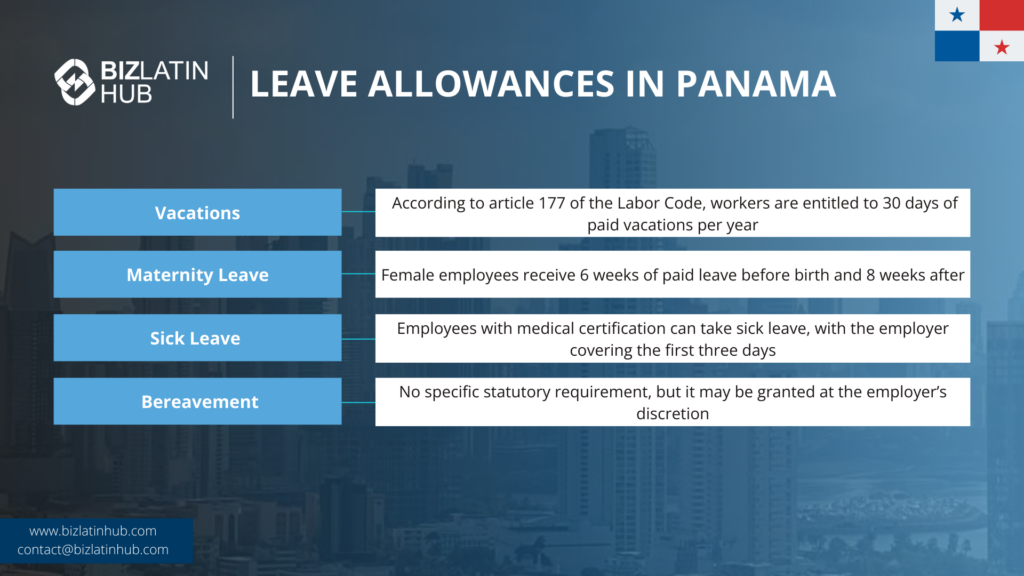

- Vacations: According to article 177 of the Labor Code, workers are entitled to 30 days of paid vacations per year.

- Bonus salary: Employees are entitled to a bonus equal to one month of salary each year. This bonus is split into 3 parts and is paid on April 15, August 15 and December 15.

- Social Security: Companies in Panama must comply with social security obligations. They must make contributions towards employee health insurance to the social security authority, Caja de Seguro Social, (Social Security Fund), as well as applicable pension and unemployment support.

- Maternity Leave: During pregnancy, female employees may receive a paid maternity leave of up to 6 weeks before birth, and a paid leave for up to 8 weeks afterwards.

| Category | Employer Obligations | Employee Rights |

|---|---|---|

| Minimum Wage | Pay minimum wage (varies by region/industry) | Right to legally mandated minimum pay |

| Working Hours | Max 48 hours/week; overtime rates apply | 1 rest day/week and overtime compensation |

| Social Security (CSS) | Enroll employee in Caja de Seguro Social (CSS) | Access to healthcare, pensions, and maternity leave |

| Annual Leave | Grant 30 calendar days after 11 months of service | Paid vacation and 13th-month bonus |

| Termination | Provide notice or payment in lieu, pay severance where applicable | Right to fair dismissal and legal compensation |

What is the minimum wage in Panama?

Opportunities for investment in Panama are scattered in a variety of industries, each with certain recruitment needs. To hire talent for your business, it’s important to know the different minimum wages applicable for each industry or economic zone.

There is no such thing as an equal minimum wage for all economic activities in this Central American country.

According to labor laws in Panama, the minimum wage depends on the type of activity and size of the business. There are 37 different classifications for minimum wages between regions.

The most common commercial activities and their respective wages include:

|

Commercial activity |

Minimum wage (US$ per hour) |

|

Agriculture and animal breeding |

US$1.91 |

|

Construction |

US$3.24 |

|

Wholesale and retail for small- to medium-sized enterprises(SME) |

US$2.27 |

|

Wholesale and retail for big companies |

US$2.81 |

|

Supermarkets with 5 or more branches |

US$2.88 |

|

Colon Free Trade Zone |

US$3.20 |

|

Small-sized Hotels |

US$2.28 |

|

Big-sized hotels |

US$2.75 |

|

Resort with franchises |

US$2.88 |

|

Small-sized restaurants |

US$2.22 |

|

Big-sized restaurants |

US$2.88 |

Termination and Severance Rules in Panama

To terminate an employee in Panama, the employer must either provide a written dismissal notice at least 30 days in advance or pay the employee at least 30 days’ salary plus an indemnification for unjust dismissal. This indemnification is equivalent to 4 weeks’ pay for every year of employment.

– The employer must give the employee a written dismissal notice at least 30 days prior to termination.

– If the employer fails to provide the required notice, they must pay the employee at least 30 days’ salary plus an indemnification for unjust dismissal.

– The indemnification for unjust dismissal is equivalent to 4 weeks’ pay for every year of employment.

When an employee decides to quit their job in Panama, they are required to provide their employer with a minimum of 15 days’ notice. Failure to do so will result in the employee having to compensate the employer with the amount equivalent to one week’s salary, which can be deducted from their seniority premium. Additionally, when an employee’s contract is terminated, they are entitled to receive severance pay, which includes the accumulated 13th salary and vacation pay.

Furthermore, employees who have worked for less than two years are also entitled to receive an advance notice payment equivalent to one month’s salary. Lastly, employers are obligated to pay any outstanding wages and compensation that the employee has earned but has not yet been paid. This payment must be made no later than the employee’s regular payday or within 7 days after they have resigned, whichever comes first.

Working Hours, Leave, and Holidays

The workday is divided into 2 periods:

- Daytime, from 6:00 until 18:00

- Nighttime, from 18:00 until 6:00

If an employee’s day shift includes more than 3 hours during the nighttime schedule, it is considered nighttime work. In addition, if the person’s working hours include both daytime and nighttime working hours, it is considered a mixed schedule (noting that more than 3 hours’ work during the night schedule classifies as a night shift).

The maximum daytime working hours is 8 hours and the working week cannot exceed 48 hours. The maximum night-time working hours is 7 hours, which corresponds to 42 weekly hours.

Panama’s regulation regarding labor unions

The Labor Code recognizes that employees have the right to organize in unions. Employees can choose from any union registered with the government. The employer is obligated to negotiate with the union that represents their staff. In addition, labor laws in Panama recognize workers’ right to strike and establishes prior negotiation procedures between the employer and the union before the employer suspends an employee.

In order to protect your business and comply with all relevant employment regulations, it’s strongly recommended you engage with a labor law expert in Panama for advice and guidance.

FAQs about labor laws in Panama

In our experience, these are the most common questions that our clients ask us.

Panama labor law states that there are specific working hours for day time and night time employees. Day time workers are employed between 6 a.m. to 6 p.m., while night employees work between 6 p.m. to 6 a.m. If an employee works for 3 or more hours during the night shift, they are considered a night time employee and will earn a higher wage.

The maximum hours for a day shift employee in Panama is 8 hours, while a night time worker is allowed to work for seven hours. The day time work week maximum is 48 hours, with most employees working a 44 hour week. On the other hand, the night shift workers are allowed to work a maximum of 42 hours per week. Overtime is charged for any hours worked beyond the maximum daily or weekly hours.

Employees may work up to 48 hours per week, with a standard workday of 8 hours. Night shifts and mixed shifts have different limits. Overtime must be compensated at increased rates.

The minimum wage refers to the lowest amount a worker can legally be paid for their work in Panama. It ranges from USD$341-USD$1,015 per month, depending on the region and sector. The average minimum wage across sectors and regions is around USD$636.

Overtime in Panama is calculated for hours worked beyond the maximum daily or weekly limit. Day workers receive an extra 25% of their hourly wage for overtime, while night workers receive 75% more. It is important to note that wages in Panama are subject to income tax, social security tax, and an education fund.

Terminations must follow lawful grounds. Severance pay or prior notice is required unless there is justified cause. Employers must also pay out unused leave and other benefits.

To terminate an employee in Panama, the employer must either provide a written dismissal notice at least 30 days in advance or pay the employee at least 30 days’ salary plus an indemnification for unjust dismissal. This indemnification is equivalent to 3.4 weeks’ pay for every year of employment.

– The employer must give the employee a written dismissal notice at least 30 days prior to termination.

– If the employer fails to provide the required notice, they must pay the employee at least 30 days’ salary plus an indemnification for unjust dismissal.

– The indemnification for unjust dismissal is equivalent to 3.4 weeks’ pay for every year of employment.

When an employee decides to quit their job in Panama, they are required to provide their employer with a minimum of 15 days’ notice. Failure to do so will result in the employee having to compensate the employer with the amount equivalent to one week’s salary, which can be deducted from their seniority premium. Additionally, when an employee’s contract is terminated, they are entitled to receive severance pay, which includes the accumulated 13th salary and vacation pay.

Furthermore, employees who have worked for less than two years are also entitled to receive an advance notice payment equivalent to one month’s salary. Lastly, employers are obligated to pay any outstanding wages and compensation that the employee has earned but has not yet been paid. This payment must be made no later than the employee’s regular payday or within 7 days after they have resigned, whichever comes first.

Yes. All employment relationships must be governed by written contracts, detailing compensation, working hours, and other conditions as per the Labor Code.

Employees are entitled to a 13th-month salary, paid in three equal parts (April, August, and December). This is a legal requirement for all employers.

Employers must register employees with Caja de Seguro Social (CSS) and contribute to pension, health insurance, and other social programs.

No. A company must establish a legal entity or work with an Employer of Record (EOR) to legally employ staff in Panama.

Biz Latin Hub can help you with labor laws in Panama

Panama is an attractive destination for investment. The country’s fiscal policies represent a great advantage for expanding companies of all sizes. Panama also offers significant ease of access to international markets.

Foreign businesses expanding to the country should hire employees in compliance with labor laws in Panama. Seek assistance from trusted, experienced employment law professionals so as to avoid any unnecessary penalties from local authorities.

At Biz Latin Hub, we specialize in supporting multinational companies from all around the world enter Panama. Our team of multilingual lawyers and accountants offers customized market entry and back-office solutions in areas such as company incorporation, recruitment and hiring, PEO services, commercial representation, and visa services.

Contact us now for more information and personalized advice. Learn more about our team and expert authors.