For anyone looking to make a commercial entry into Latin America, doing business in Honduras may not be the first place that springs to mind. However, decades of consistent growth, an improving security situation, good conditions for enterprise, and a host of commercial opportunities combine to make company formation in Honduras an increasingly attractive option. This guide details the primary opportunities and advantages of the Honduran market, and outlines the foundational steps for establishing a corporate presence.

Key takeaways on doing business in Honduras

| What is the most common type of company for foreign investors? | The S.A de C.V |

| What are the main economic advantages of doing business in Honduras? | The country has a strategic location with access to key sea ports and Honduras offers a cost-effective operational environment. |

| Are there Free Trade Zones in Honduras? | Yes, these are known within the country as Employment and Economic Development Zones (ZEDE). Their status has recently been questioned by the government. |

| Are there incentives for Foreign Direct Investment in Honduras? | Especially within the ZEDE there are tax exemptions, customs easing and labor flexibility in order to attract particularly US investors. |

| What are the key steps to starting a business? | The process involves drafting a public deed of incorporation, registering it with the Mercantile Registry, and obtaining a tax ID (RTN) from the tax authority. |

Why Do Business in Honduras? Key Advantages

There are a number of good reasons for doing business in Honduras. Here are some important ones to keep in mind:

1. Strategic Geographic Location

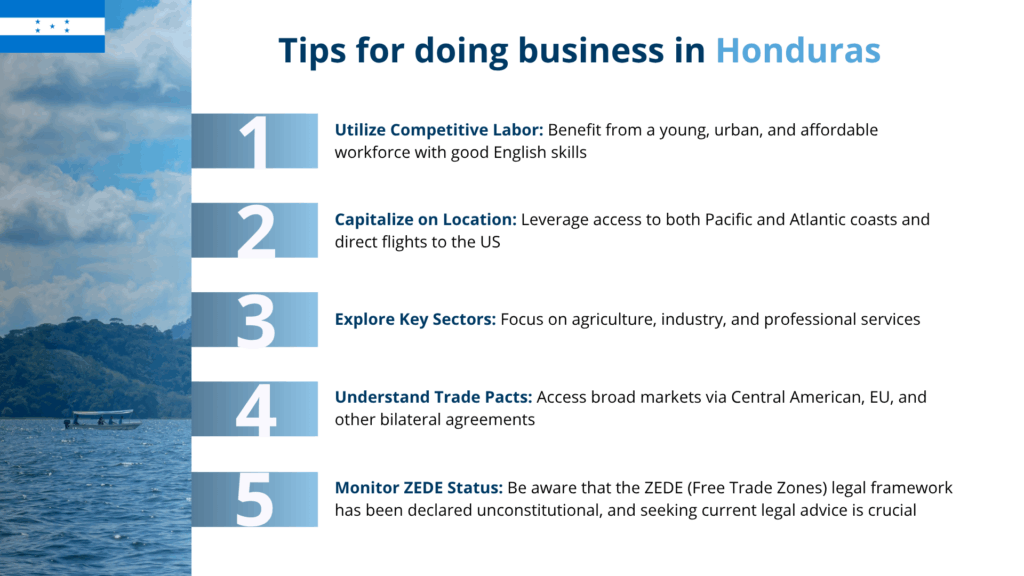

Honduras has coastlines on both the Pacific Ocean and the Caribbean Sea, with major ports like Puerto Cortés providing excellent shipping access to North America, South America, and Europe.

Located between Guatemala and Nicaragua, Honduras is the second-largest country by both area and population in Central America. The country has coasts providing trade access to both the Pacific and Atlantic oceans, with a 700km-long Caribbean coast home to four significant ports.

Meanwhile, the country has a growing highway network, with the Panamerican Highway passing through the south of the country, and major cities connected by thousands of kilometers of multi-lane roads. The country also benefits from having fast direct flights to the United States, with the capital Tegucigalpa just over three hours from Houston, and even closer to Miami.

2. A Cost-Competitive Environment

The country offers low operational costs, particularly in terms of labor and real estate, making it an attractive location for setting up manufacturing and service-based operations.

Honduras has an increasingly urbanized and young population, with an average age of 24 in 2024, providing a ready supply of workers to new businesses. With a national minimum wage ranging from between USD$236 and USD$365 depending on the type of work being undertaken, it also has highly competitive labor costs that are attractive to investors.

The country has a growing pool of skilled labor, as well as a relatively high level of English proficiency, notably higher than major Latin American investment destinations such as Brazil, Colombia, and Mexico.

3. Growing Key Sectors

The Honduran economy has strong and growing sectors that offer clear investment opportunities. These include textile and apparel manufacturing (maquilas), agribusiness (coffee, bananas, palm oil), and tourism.

Honduras has made efforts over recent years to open up more to international business and encourage greater investment, with the series of free-trade zones (FTZs) known as Employment and Economic Development Zones (ZEDE).

On top of the trade- and business-friendly regime, Honduras has one of the shortest company formation processes in Latin America, with foreign investors able to open a company in just two weeks.

Expert Tip: Opportunities in the Maquila (Free Trade Zone) Sector

From our experience, the most significant opportunity for many manufacturing and logistics companies lies within Honduras’s “maquila” or Free Trade Zone (FTZ) regime. Companies operating within an FTZ benefit from a complete exemption on import duties for machinery and raw materials, as well as an exemption from corporate income tax.

Honduras has a well-developed network of industrial parks, particularly around the city of San Pedro Sula, that cater to the textile and light assembly industries. For businesses involved in manufacturing for export, setting up within an FTZ provides a major competitive advantage.

4. Favorable Trade Agreements

As a member of CAFTA-DR, Honduras benefits from preferential trade access to the United States, its largest trading partner. This makes it an ideal platform for exporting goods to the US market.

That follows a decade in which the country has signed a number of free trade agreements, including agreements between Central American countries and the European Union, South Korea, Mexico, and the United Kingdom, as well as bilateral agreements with Canada and Peru.

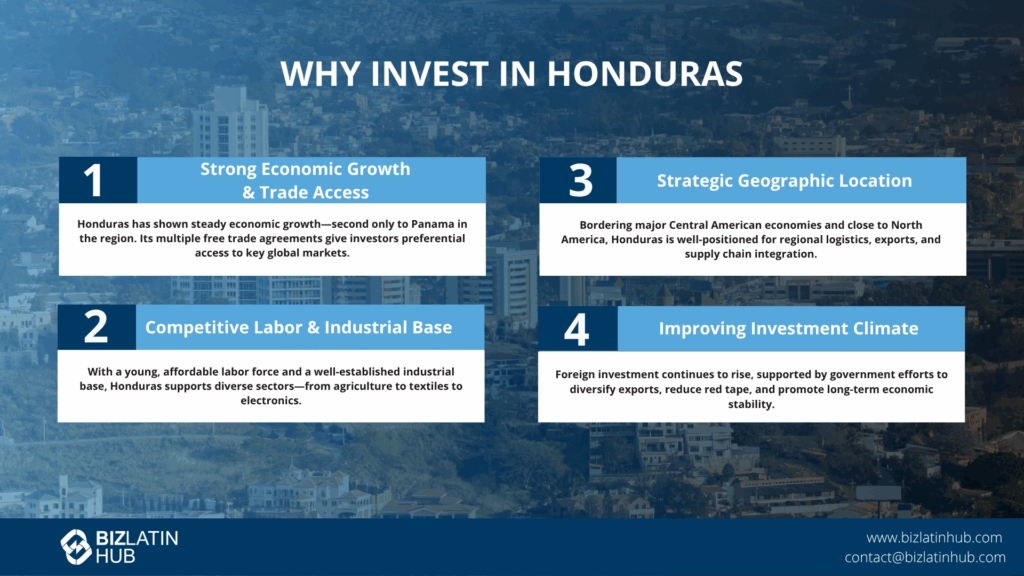

Why invest in Honduras? Economic overview

Situated between El Salvador, Guatemala and Nicaragua, Honduras has a well-established agricultural sector, a thriving industrial base and a rapidly evolving professional services industry. Its main export products include bananas, coffee, fish, clothing and household appliances.

During recent years, Honduras has witnessed the second-highest growth rate in Central America, behind only Panama. According to the International Monetary Fund, following 25 years of almost unbroken annual growth in gross domestic product (GDP), Honduras registered a GDP of USD$34.89 billion in 2023.

Among the attractive aspects the country has to offer investors is its growing and young workforce, with employees available at highly competitive rates. Beyond that, the country boasts a growing industrial base, a strategic location close to Mexico and the other major economies in North America, and ongoing government efforts to diversify exports.

Known as the original “banana republic” because of its dependence on the fruit crop and the political instability that gripped the country during the early 20th century, today bananas continue to be one the most important export commodities for Honduras. Other important products include garments, coffee, electrical goods, and fish.

While foreign direct investment (FDI) inflows have fluctuated over recent decades, they have followed an overall pattern of growth, with inflows reaching USD$1.07 billion in 2023, over ten times the FDI inflows seen in 1998 of USD$99 million.

Over recent years, the country has experienced the second-highest growth rate in Central America, exceeded only by Panama, and according to The World Bank, Honduras is expected to see growth accelerate in the coming years.

The country is party to a number of free trade agreements (FTAs), both via agreements struck by Central American countries collectively and through bilateral treaties.

The agreements provide businesses based in Honduras with preferential access to Canada, Mexico, Peru, South Korea, the United States, the United Kingdom, and the European Union.

Although Honduras has seen fluctuations in foreign direct investment (FDI) inflows in recent years, since 1998 they have followed a general upward trajectory, increasing 14-fold between 1998 and 2018. In the following year FDI inflows dropped, but more than $955 million entered the country in 2019.

How to Start a Business in Honduras

To begin operations, a foreign investor must typically form a local legal entity. The most common and flexible structure is the Variable Capital Corporation (S.A. de C.V.). The process involves drafting a public deed of incorporation, registering it with the Mercantile Registry, and obtaining a tax ID (RTN) from the tax authority.

FAQs on doing business in Honduras

Answers to some of the most common questions we get asked by our clients.

1. Can a foreigner own a business in Honduras?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

2. Are there Free Trade Zones in Honduras?

| Yes, these are known within the country as Employment and Economic Development Zones (ZEDE). |

3. How long does it take to register a company in Honduras?

About two weeks. The country is one of the fastest in the region for company incorporation.

4. Which sectors are important in Honduras?

Honduras has a well-established agricultural sector, a thriving industrial base and a rapidly evolving professional services industry. Its main export products include bananas, coffee, fish, clothing and household appliances.

5. Does Honduras have trade agreements with other countries?

Yes, Honduras is a key player in CAFTA, which links Central America and the United States of America. Yes, the country has excellent links to North America and elsewhere. The Panamerican Highway runs through the country and there are four major Caribbean ports. Major US cities are a short flight from the capital Tegucigalpa.

6. What entity types offer Limited Liability in Honduras?

In Honduras, both S.A (Sociedad Anónima) and S.R.L (Sociedad de Responsabilidad Limitada) are limited liability entity types.

7. What is the currency in Honduras?

The official currency is the Honduran Lempira (HNL).

8. What is the most common business entity?

The most common and recommended entity for foreign investors is the Variable Capital Corporation (Sociedad Anónima de Capital Variable – S.A. de C.V.).

9. Is the workforce cost-effective?

Yes, Honduras offers one of the most competitive labor costs in the Central American region, which is a significant advantage for labor-intensive operations like manufacturing and call centers.

10. What is CAFTA-DR?

Honduras is a member of the Dominican Republic-Central America Free Trade Agreement (CAFTA-DR) with the United States. This agreement provides duty-free access to the US market for most goods manufactured in Honduras.

Biz Latin can help you with doing business in Honduras

At Biz Latin Hub, our multilingual team of experienced company formation experts is ready to help you establish an entity in Honduras. With our full suite of back-office support options, including hiring & PEO, legal, and accounting services, we can be your single point of contact for entering the market and doing business in Honduras, or any of the other 17 countries around Latin America and the Caribbean where we are present.

Reach out now for a consultation or free quote.

Or learn more about our team of expert authors.