Before entering the territory, it’s crucial to have a good grasp of the annual entity compliance in Honduras and the broader regulatory framework. Investors should be aware of these financial regulations before company formation in Honduras, as non-compliance could lead to legal challenges and financial penalties. Financial regulatory compliance is a significant aspect of overall corporate compliance. This overview is designed to assist you in navigating the legal landscape.

Key Takeaways On Corporate Legal Compliance in Honduras

| Is a physical address in Honduras necessary for doing business? | Yes, a registered office address or local fiscal address is required for all Honduran entities to receive legal correspondence and governmental visits. |

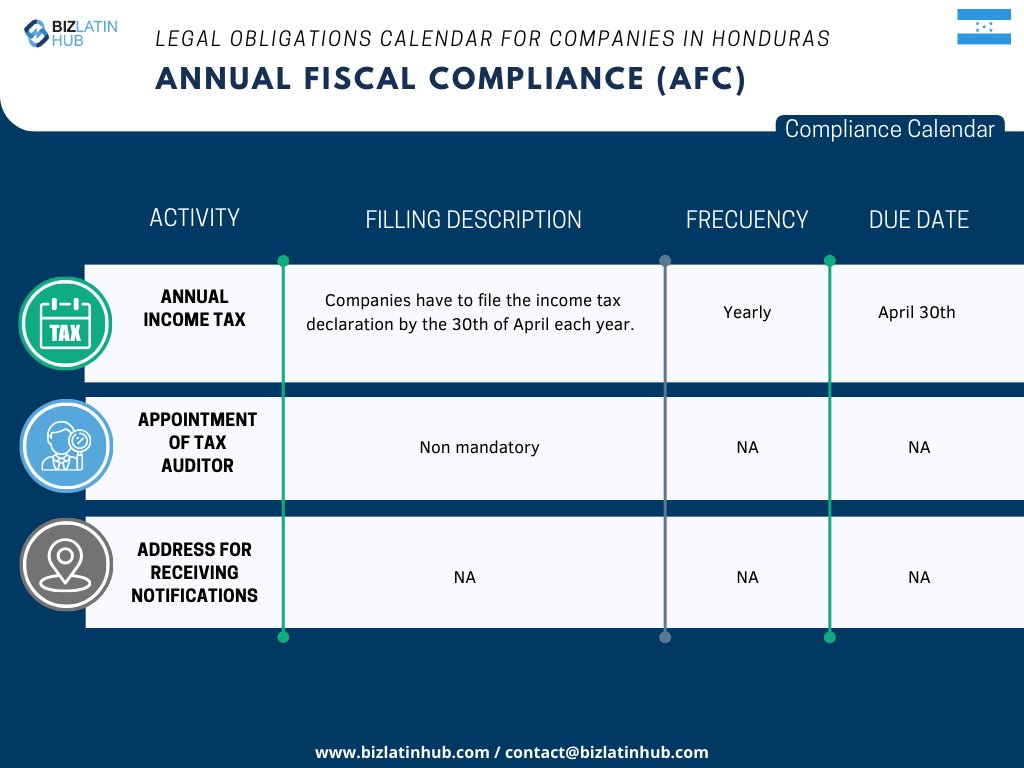

| What are the annual entity fiscal compliance requirements? | Companies in Honduras have to file their income tax declaration by the 30th April each year. |

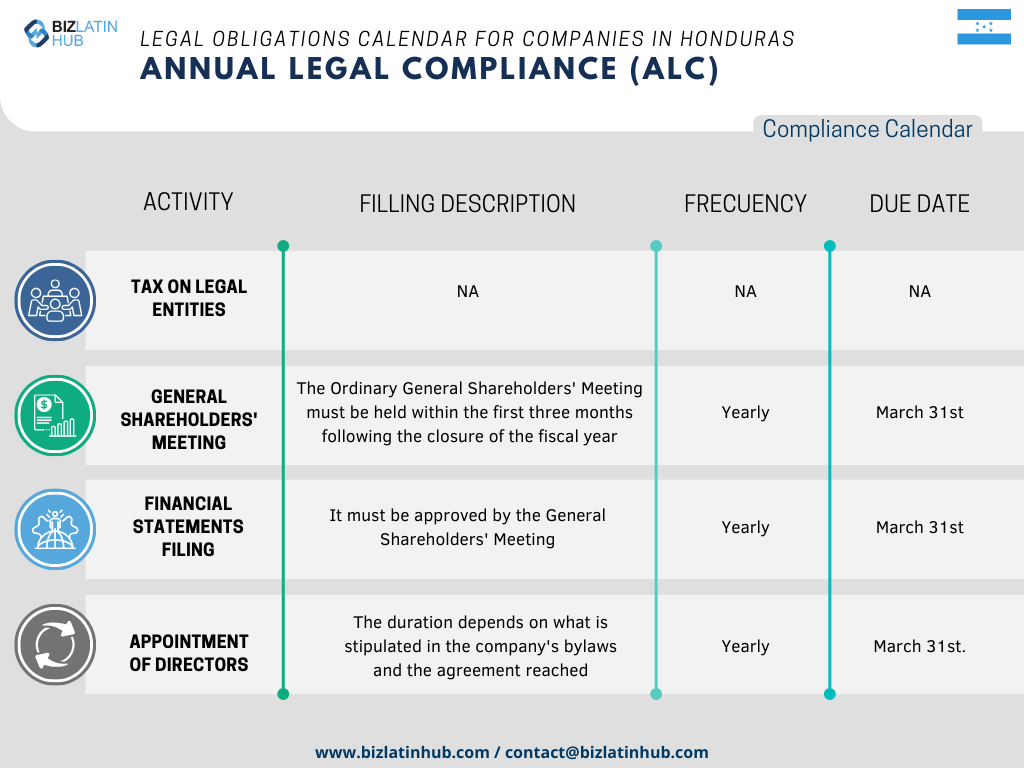

| What are the annual Entity Legal Compliance Requirements? | Yearly submission of financial statements and tax returns Meticulous upkeep of current corporate records Organization of regular shareholder meetings, usually conducted on an annual basis. Furthermore, board meetings and annual shareholder meetings that involve the following aspects must be disclosed to financial authorities as part of entity annual compliance |

| What common statutory appointments do companies make in Honduras? | An appointed legal representative who will be personally liable, both legally and financially, for the good operation and standing of the company. This should be a local national or a foreigner with the right to live/work in the country. |

| Why Choose to Invest in Honduras? | There is a wide array of opportunities for investors in industries like textiles, agricultural productions and call centers. |

Types of companies in Honduras

In Honduras there are a variety of company types, but the most commonly used are the following:

- Corporations – A corporation exists under a name and has capital divided into shares. The partners are responsible for the payment of what they have subscribed.

- Limited Liability Companies – A limited liability company exists under a corporate name. The partners are only required to pay their contributions, and are not responsible for the financial liabilities or the debt of the company as a whole.

- Branch of foreign company – The foreign parent company regulates the rules and assumes the responsibilities before third parties.

What corporate requirements are there for entity annual compliance in Honduras?

In Honduras, businesses are have a number of regulations pertaining to operations, aiming to guarantee both legal adherence. These requisites include:

- Yearly submission of financial statements and tax returns

- Meticulous upkeep of current corporate records

- Organization of regular shareholder meetings, usually conducted on an annual basis.

Additionally, companies must conform to the stipulations outlined in the Honduran commercial code concerning corporate governance. The stipulations mandate tasks such as appointing a legal representative, and, depending on the company’s scale and nature, constituting a board of directors.

Furthermore, board meetings and annual shareholder meetings that involve the following aspects must be disclosed to financial authorities as part of entity annual compliance:

- Presentations are given

- Job appointments are made

- The company’s financial status is reported

- Profits or losses are discussed

- Other similar activities

Requirements for corporation formation in Honduras

If you have not yet set up a corporation in Honduras, you must complete the following steps:

- Obtain a certificate of registration of the foreign company in its place of origin.

- Agree on the appointment of a permanent legal representative in Honduras.

- Ensure that the documents confirming the above are of recent date, duly notarized, and where appropriate, translated into Spanish.

What tax obligations are there in Honduras?

In Honduras, the fiscal year runs from January 1st to December 31st. To start commercial operations, companies must have a unique taxpayer registry, which is obtained via the ATV portal of the Ministry of Finance.

The main taxes that must be declared and paid are:

| TAX | DETAILS |

| Income Tax | This annual tax is levied on income from capital, labor or a combination of both |

| Sales Tax | Applied in a non-cumulative manner on imports and the sale of goods and services |

| Municipal Taxes | This local tax is levied on income from capital, labor, or a combination of both |

What labor regulations are there in Honduras?

Foreign companies doing business in Honduras must comply with labor regulations, which include:

- Providing employees with a trial or probationary period that cannot exceed 60 days and must be paid

- Payment to employees of at least USD$305 per month, which is Honduras’ national minimum wage

- Payment to employees of fourteen monthly salaries (12 regular monthly salaries, plus the June bonus payment and Christmas bonus paid in December)

- A standard workday of eight hours

- Entitlement of 10 days of paid vacation per year

To meet entity annual compliance in Honduras, companies must also provide their employees with social security. The employer/employee contributions are as follows:

- The employer covers 10.66 percent of the employee’s salary to monthly social security payments

- The employee must contribute 6.5 percent of their salary to monthly social security payments

FAQs on entity legal compliance in Honduras

Based on our extensive experience these are the common questions and doubts of our clients on entity legal compliance in Honduras:

The following are the most common statutory appointments for Honduran legal entities:

– An appointed legal representative who will be personally liable, both legally and financially, for the good operation and standing of the company. This should be a local national or a foreigner with the right to live/work in the country.

Yes, a registered office address or local fiscal address is required for all Honduras entities to receive legal correspondence and governmental visits.

Companies in Honduras have to file their income tax declaration by the 30th April each year.

The Ordinary General Shareholders Meeting must be held within the first three months following the closure of the fiscal year in Honduras and by the deadline of March 31st.

The main taxes that a company must declare and pay in Honduras are the following:

Income tax: This annual tax is levied on income from capital, labor, or a combination of both.

Sales tax: Applied in a non-cumulative manner on imports and the sale of goods and services.

Municipal taxes: This local tax is levied on income from capital, labor, or a combination of both.

Biz Latin Hub can help you with entity annual compliance in Honduras

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Bogota and Cartagena, as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge about entity annual compliance, our portfolio of services includes hiring & PEO accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent, or otherwise doing business in Latin America and the Caribbean.

If this article about entity annual compliance in Honduras was of interest to you, read about our team and expert authors.