Conducting an entity health check in Costa Rica when performing commercial operations — especially the likes of purchasing or merging with a local organization — is important for protecting your business from potential risks. By getting an entity health check, you will be able to identify compliance inconsistencies and even violations of the law, as well as holes in accounting records, all of which could give you cause to reconsider your venture, or may inform you of demands that need to be imposed on the person you are doing business with in order for a deal to be finalized.

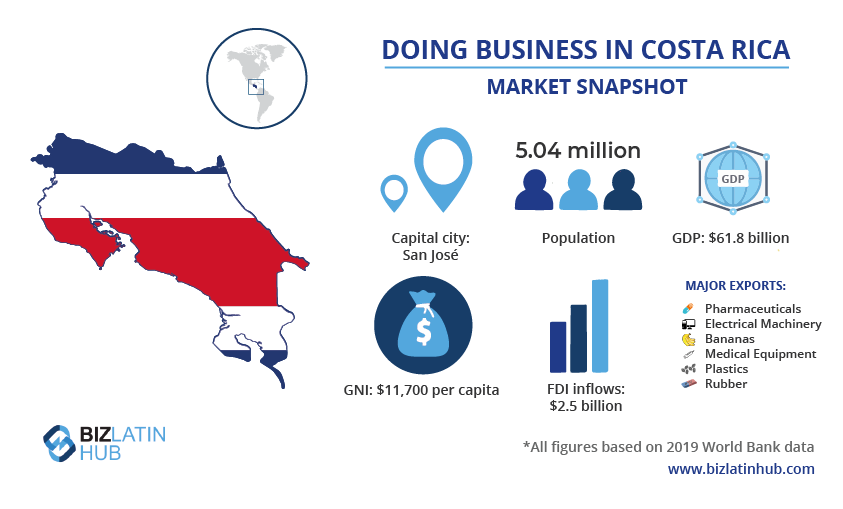

Costa Rica has experienced consistent gross domestic product (GDP) growth over the last half-century, reaching a GDP of $61.77 billion in 2019 (all figures in USD). The Central American nation has also seen a corresponding rise in gross national income (GNI) — considered a key indicator of general prosperity — which more than tripled in the last 20 years to reach $11,700 per capita in 2019. That figure places the country as an upper-middle income nation, based on standards set by the World Bank.

Costa Rica is known for being one of the most developed nations in Latin America, and is a major recipient of foreign direct investment (FDI) in the region, despite its relatively small size. The country is also a popular destination among ex-pats and tourists from the United States and Europe. Additionally, Costa Rica has some of the lowest crime statistics in Latin America.

The country has multiple free trade agreements (FTAs) currently in place providing locally-based businesses with preferential access to the likes of Chile, China, the Dominican Republic, Mexico, and the United States, as well as the rest of Central America and the Caribbean States Community (Caricom). Its major exports include pharmaceuticals and medical equipment, electrical machinery, bananas, and plastic products.

If you are considering starting a business in Costa Rica or have already established a commercial presence in the country, read on to understand the importance of an entity health check in the Central American country. Or go ahead and contact us now to discuss your business options.

What is an entity health check in Costa Rica?

An entity health check in Costa Rica includes an exhaustive legal and accounting review to determine if a company complies with all local norms and regulations, and verify that accounting records are accurate. An entity health check can include the examination of different corporate documents such as tax returns, corporate filings, or operating licenses.

By conducting an entity health check in Costa Rica when buying or doing business with a local organization, you will be able to identify — and ideally rectify — any inconsistencies to protect your business operations and avoid possible penalties imposed by local authorities.

In addition to undertaking such due diligence ahead of doing a deal in Costa Rica, you can also conduct a self-check. Such a measure is particularly useful if your company has witnessed a decrease in productivity or profits, but can simply be undertaken to verify that everything is running smoothly and identify and eliminate potential future risks that may come to affect your business operations.

Note that you can also carry out an entity health check on a subsidiary or branch operating in Costa Rica, to know if there is any type of non-compliance or bad business practice that could have repercussions for your headquarters or broader operations.

Types of corporate health check

The following types of corporate health check may be particularly useful, depending on your goals:

High-level corporate health check: This type of entity health check closely examines a company’s registration submissions, legal records, and meeting minutes to identify issues that may turn into potential violations of the law.

In-depth gap analysis: This type of entity health check analyzes the finances, accounting practices, and financial statements of a company, to identify gaps in the management of accounting records that may cause future legal sanctions.

What does an entity health check involve?

An entity health check in Costa Rica can be comprised of several elements, and an individual process may involve all or just some of them, depending on your aims and needs. These include:

Corporate compliance: An entity health check process verifies that all corporate practices comply with local regulations. This includes a review of the minutes of annual meetings to verify if such meetings have been held and logged according to rules established in the Costa Rican commercial code.

Tax compliance: An entity health check in Costa Rica can involve the study and verification of tax returns made before the General Directorate of Taxation of Costa Rica, as well as the municipality where the entity is based. Such a process will verify compliance with the likes of valued added tax (VAT) and income tax regulations, among any other business- or sector-specific levies.

Labor compliance: Where an entity health check in Costa Rica looks at labor compliance, a study will be done of the likes of social security payments made to the Costa Rican Social Security Fund, as well as a review of workers’ compensation insurance policies held with the National Insurance Institute. In addition, employee hiring and firing processes and relevant legal documentation related to the workforce will also be evaluated. Note that failing to comply with labor regulations in Costa Rica can lead to serious penalties, or even result in the closure of your business.

Biz Latin Hub can conduct an entity health check in Costa Rica

At Biz Latin Hub, our team of multilingual legal services specialists has deep knowledge of Costa Rica’s regulatory framework and broad experience conducting entity health checks for companies and executives doing business in the country. With our extensive portfolio of accounting, commercial representation, and back-office services, we are equipped to deliver service with excellence and can be your single point of contact to support your commercial operations in Costa Rica or in any other of the 15 countries in Latin America and the Caribbean where we are present.

Reach out to us now for personalized assistance or a free quote.

Learn more about our team and expert authors.