Accounting in Mexico should be an integral part of your market entry strategy to successfully register a company in Mexico and ensure compliance in a complex regulatory environment. This guide offers essential information to help you navigate Mexico’s fiscal requirements effectively. The local tax overseer is SAT (Servicio de Administración Tributaria), which manages all federal taxes. IMSS handles social security and employer registrations. INFONAVIT manages housing fund contributions. It is now mandatory to do everything on digital platforms.

Key Takeaways on Accounting in Mexico

| What Are The Accounting Standards in Mexico? | All resident companies must keep records of the company’s shareholders’ contact information, the amount of time in each shareholder meeting, and any changes in the share capital. A local registered address is required for all Mexican resident companies. All companies listed publicly must file financial reports with the Mexican Securities and National Banking Commission. Up to 10% of the annual income must be shared with the company’s employees. |

| What Is The Corporate Tax Rate in Mexico? | The corporate income tax rate is 30%. No surtax or alternative minimum tax applies. |

| What Is The Mexican Value Added Tax Rate? | The current VAT rate (IVA) is set at 13% in Mexico. |

| Dividend Tax Rate in Mexico | There is a 10% witholding tax on dividends. |

Overview of the Mexican Tax and Accounting System

The Mexican General Law of Corporations outlines the general legalities that all companies must follow. The country’s local system is known as the NIF (Normas de Información Financiera) and is based on IFRS reporting standards. Companies may choose between NIF or full IFRS. A few of its rules are:

- All resident companies must keep records of the company’s shareholders’ contact information, the amount of time in each shareholder meeting, and any changes in the share capital.

- A local registered address is required for all Mexican resident companies.

- All companies listed publicly must file financial reports with the Mexican Securities and National Banking Commission.

- Up to 10% of the annual income must be shared with the company’s employees.

All companies must maintain a number of running books, known as Diario, Mayor, Balanza de Comprobación in digital form. Electronic accounting (Contabilidad Electrónica) is mandatory for almost all taxpayers and certainly all large contributors to the system.

Payroll Taxes and IMSS Contributions in Mexico

Employers should be aware of the general regulations for workers in Mexico and the payments that they are entitled to. A few considerations include that employers must make a number of contributions across IMSS, INFONAVIT and retirement savings, coming to about 30% of gross salary. Payroll reports must be submitted digitally using the SUA platform and done monthly.

Corporate Tax, VAT, and ISR Obligations

ISR (employee income tax) must be withheld by the employer and submitted monthly.

All processes must be done online, which will involve registering with the tax authority for full access.

This means getting a CIEC key and complying with e-signature (e.firma) obligations for SAT portal access.

Corporations are subject to different tax rates than other business models, families, or individuals. They are listed by percentage here:

- Corporate Income Tax- 30%

- Capital gains considered as corporate income- 30%

- Value Added Tax- 16%

Withholding taxes are as follows:

- Dividends paid to residents and non-residents- 10%

- 5% royalties from railway rentals

- 25% royalties for technical assistance

- 30% royalties for patent rental

- Interests paid to non-residents- between 4.9 and 40%

Are there any tax incentives in Mexico?

- Dividends received from a resident company do not have to pay withholding tax.

- Due to Mexico’s lack of exchange controls, businesses can freely send funds back to their country.

- Companies registered in Export Processing Zones are exempt from corporate income tax.

SAT Compliance, CFDI, and Digital Bookkeeping

The Tax Administration (SAT) is similar to the IRS in the USA and has its regulations and timelines. It is required for all companies to file annual tax returns in Mexico with the Tax Administration within 3 months of the end of the upcoming fiscal year (i.e March 31st). No later than the 17th of each month, the Value Added Tax must be filed electronically and both CFDI and payroll are also required monthly.

Digital invoices are required for every transaction that a trading company in Mexico makes. All companies must issue CFDI using PACs (SAT-authorized providers). Every invoice must include SAT approval, digital seal, and XML file. Monthly accounting reports must be submitted via Contabilidad Electrónica, using SAT’s Buzón Tributario.

This includes the RNIE reports which are filed every quarter, and a year consolidated report. It is necessary to comply with filling the notice before the RNIE (National Foreign Investment Registry) if in any of the quarter’s investment has exceeded MXN$20 million of foreign investment in the following accounts:

- Capital stock and/or shareholding structure that implies a change in the participation in the capital stock of foreign individuals or legal entities.

- Assets. Accounts receivable from Subsidiaries resident abroad, Partners or Shareholders resident abroad, and/or Companies resident abroad that are part of the corporate group and do not participate as partners or shareholders.

- Liabilities. Accounts payable to Subsidiaries resident abroad, Partners or Shareholders resident abroad, and/or Companies resident abroad that are part of the corporate group and do not participate as partners or shareholders.

- Stockholders’ equity. Contributions for future capital stock increases.

- Stockholders’ equity. Capital stock reserves or results of previous years.

Additional Tax and Accounting Considerations

- Employers must pay 15-25% of each employee’s monthly salary to the Mexican Social Security Institute (IMSS).

- Mexico has signed double tax treaties (avoids or mitigates double taxation) with 61 countries, including the U.S., Canada, and many European countries.

- Mexico is a member of the NAFTA and EFTA free trade agreements and nearly 20 others.

FAQs About Accounting and Tax in Mexico

Corporate Tax rate in Mexico is 30%.

In Mexico, taxes are generally paid on profits, not revenue, with the exceptions of Value Added Tax (IVA) and the payroll tax.

In Mexico, the Internal Revenue Service (IRS) is called the Servicio de Administración Tributaria (SAT).

Mexico adheres to the Normas de Información Financiera (NIF), the country’s established financial reporting standards. The Mexican Financial Reporting Standards Board (CINIF) is responsible for issuing these guidelines.

The equivalent of a Certified Public Accountant (CPA) in Mexico is the Contador Público Certificado (CPC), which translates to Certified Public Accountant

Private companies can choose between IFRS and the Mexican Financial Reporting Standards (NIFs), which are aligned with IFRS but include specific adjustments for local needs.

The VAT (IVA) rate is 16%, with reduced rates or exemptions in border zones and specific industries. Monthly VAT returns are required.

Employers contribute ~30% of salary to IMSS (social security), INFONAVIT, and retirement funds. Monthly filings are required.

Yes. CFDI (Comprobante Fiscal Digital por Internet) is required for all invoicing. It must be issued via SAT-authorized providers.

Companies must follow Mexican Financial Reporting Standards (NIFs). Larger entities may also follow IFRS depending on their industry.

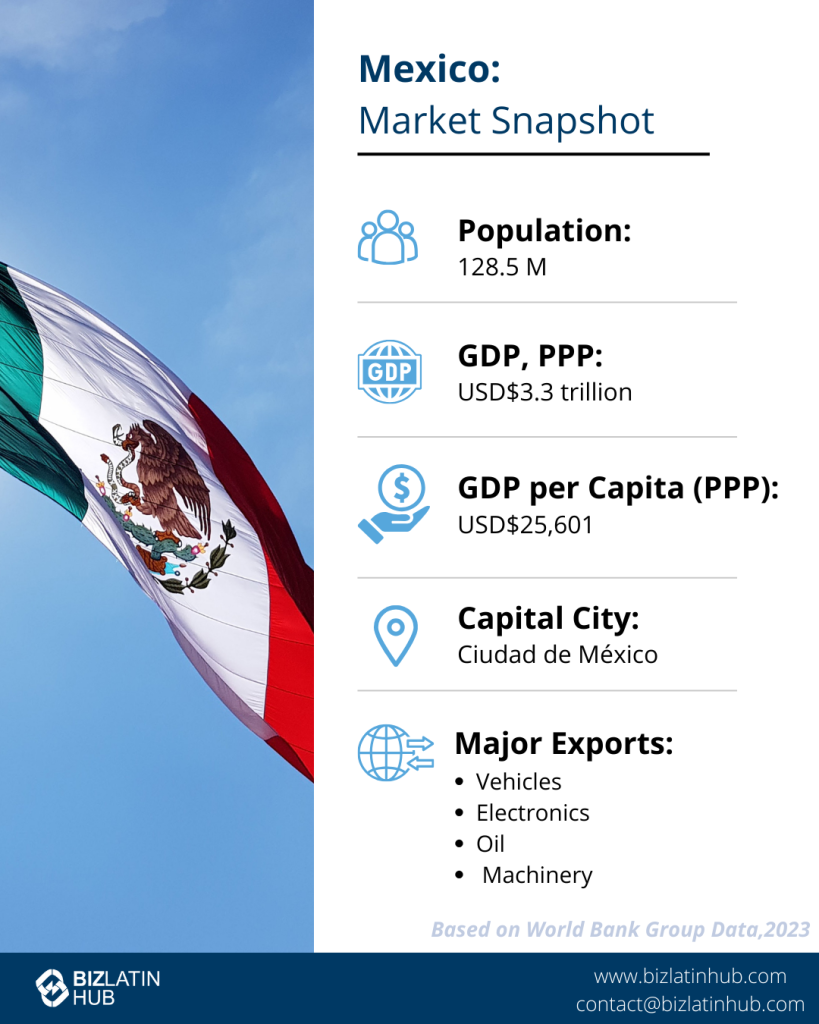

Why Invest in Mexico?

Accounting in Mexico involves compliance with various tax regulations, including corporate tax rates, value added tax (VAT) and social security contributions. Companies must adhere to Mexican Financial Reporting Standards (NIF), which are aligned with International Financial Reporting Standards (IFRS) but have specific local requirements.

Mexico continues to offer a prime investment opportunity due to its economic diversity, strategic location, and strong manufacturing base. As a leader in automotive production, electronics, and agriculture, it also benefits from extensive trade agreements like the USMCA, enhancing access to global markets.

Pro-business policies, competitive labor costs, and a skilled workforce strengthen Mexico’s appeal to investors. Growing sectors like renewable energy, technology, and infrastructure add further potential, making it a key destination for business expansion and international trade.

Biz Latin Hub can support you with accounting in Mexico

Mexico is a country of opportunity and is very open to the prospect of foreign business and trade. Understanding the legalities before designing your business plan will create the foundation for a smoother market entry.

If you would like more information on accounting in Mexico, Biz Latin Hub has a group of experts who can provide guidance for your business in Mexico. We offer professional accounting, legal, and financial services tailored to you and your company’s needs.

Contact us today to learn more about how we can support you in doing business.

Or read about our team and expert authors.