Investors thinking of incorporating a company in Peru, should research the incorporation process and the regulations specific to the country.

According to the World Bank Group’s Doing Business Index, Peru ranks as the third-best country in Latin America for doing business. The government has a track record of improving the country’s commercial environment. They have passed legislation that facilitates foreign investment and ensures foreign and local companies are treated equally. Moreover, incorporating a company in Peru is a relatively straightforward process.

Table of Contents

If you are thinking of starting a business, Peru offers highly competitive conditions that are worth exploring.

The textile sector, which is known for its highly competitive prices, is experiencing an annual growth rate of 11%. In the decade between 2010 and 2019, it attracted USD$1 billion in foreign direct investment. By April of 2021, 37 IT projects had received funding from abroad, and the country had registered over 200 fintech companies collectively worth $15-20 billion.

If you are unfamiliar with the legal requirements, registering a company in Peru can become overwhelming. This article will help you do so successfully, by outlining how to incorporate a company in Peru and how to find a legal representative.

9 Steps to Successfully Incorporate Your Company in Peru

- Step 1 – Understand the types of legar entities available.

- Step 2 – Appoint a legal representative.

- Step 3 – Choose Your Company Name.

- Step 4 – Identify Your Shareholders.

- Step 5 – Establish a Fiscal Address.

- Step 6 – Prepare and Sign the Public Deed.

- Step 7 – Register for Your Tax ID.

- Step 8 – Open a Corporate Bank Account and Deposit Your Company Share Capital.

- Step 9 – Legalize Your Company’s Accounting Books.

1. Understand the types of legal entities available

When you start a business in Peru, you must choose the type of legal entity you wish to create. These include:

- Closely-Held or ‘Closed’ Corporation (Sociedad Anónima Cerrada or SAC)

- Open Stock Corporation (Sociedad Anónma Abierta or SAA)

- Limited Liability Company (Sociedad de Responsabilidad Limitada or SRL)

- Association

- Foundation

- Branch Office (Sucursal)

- Individual Company of Limited Responsibility (Empresa Individual de Responsabilidad Limitada, or EIRL).

Most experts recommend that new investors create a Closely-Held Corporation (SAC) when expanding into Peru. Because a formal “Board of Directors” structure is not mandatory, a SAC allows for easier decision-making and facilitates business activities.

When you incorporate a SAC in Peru, transferring shares is also faster because the final shareholders don’t need to be registered with the Public Registries. This means that there are less costs involved in the registration process. When you incorporate a company in Peru, choosing to create a SAC will facilitate the process.

All companies interested in doing business in Peru must be aware of the country’s company incorporation requirements, to ensure they remain in good standing with local governmental authorities.

Note: be aware of the regulations specific to your legal entity

Once you have decided on the legal entity that best suits your company, you must follow the steps outlined below. They provide information on how to finish incorporating a company in Peru in accordance with local corporate laws.

Depending on your company’s commercial activities, you may have to adhere to additional corporate compliance obligations. Therefore it is reccommended that you confirm with a local lawyer with experience registering companies in Peru.

2. Appoint a legal representative

In Peru, a legal representative acts as the legal face of the company before government authorities. The legal representative must make all the decisions on behalf of your company on legal matters. As such, the person appointed as legal representative holds certain legal liabilities.

The appointed individual must be either a local national or a foreign national with a valid Peruvian visa. All companies wanting to incorporate in Peru must have a legal representative.

3. Choose Your Company Name

Once you have appointed a legal representative, you can select and reserve your company name. The government authority in charge will confirm if your preferred name is available. In Peru, this is done by the National Superintendency of Public Registries, known locally as SUNARP.

To ensure you get your preferred company name and avoid any delays, it is best to provide three potential name options for SUNARP to review.

4. Identify Your Shareholders

Every legal entity in Peru must have at least 2 shareholders and a maximum of 20 shareholders. They can be foreign individuals or other legal entities.

5. Establish a Fiscal Address

Another important step when incorporating a company in Peru is establishing a fiscal address.

You must register your company with a fiscal address within Peru in order to receive correspondence from government authorities.

6. Prepare and Sign the Public Deed

To register your company with the Peruvian authorities you will need to create a public deed. This is done by creating a draft of the constitution act and having it reviewed and approved by a Public Notary. Once approved, the Public Notary and all company owners (if there are multiple) must sign and stamp the deed.

You must present the completed public deed before the SUNARP.

7. Register for Your Tax ID

Every legal entity must be registered with the national tax authority, and get its own tax identification number. This number is known as a Registro Único de Contribuyentes (RUC).

The agency responsible for this in Peru is the National Superintendency of Tax Administration (Superintendencia Nacional de Administración Tributaria, or SUNAT).

8. Open a Corporate Bank Account and Deposit Your Company Share Capital

Peruvian law doesn’t require a minimum share capital for new companies. However, to formalize your company, you need to deposit your desired share capital amount in a Peruvian bank.

This will also enable you to open and activate a corporate bank account, which is crucial before a company can start operations in Peru.

To open a bank account, you will need to provide your company’s information. To save yourself time, consult a local lawyer in Peru to find out what documentation you need and how to prepare it properly.

It is recommended you open a bank account with at least S/500.00 Peruvian soles, but exact rules depend on the bank you choose.

9. Legalize Your Company’s Accounting Books

The final stage when incorporating a company in Peru is legilizing the company’s accounting books.

If your company chooses to issue electronic accounting books, you can present them to the SUNAT via their online platform.

If you choose to work with physical accounting books, check with your Peru accounting consultant on how the legalization process works.

After completing this process, your new company will be successfully incorporated and ready to begin operations in Peru.

Common Questions when Forming a Company in Peru

According to our experience, these are the most common questions and doubts of our clients about company formation in Peru.

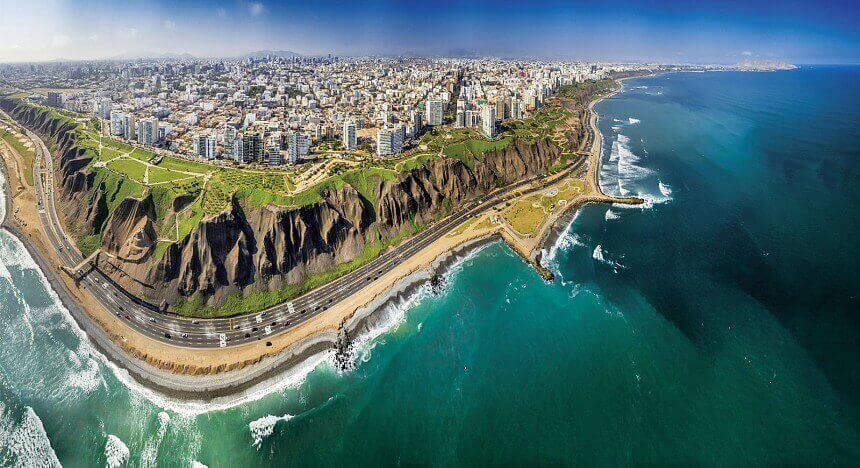

Peru is ideal for business with its rich natural resources, strategic location, and economic stability. Abundant minerals, agricultural diversity, and proximity to key markets foster investment. Stable economic policies, commitment to free trade, and a growing middle class make Peru a compelling destination for sustainable business opportunities across various industries.

Yes, foreigners can form a business in Peru.

It requires a minimum of two shareholders to form a company in Peru.

The equivalent of an LLC in Peru is the “Sociedad de Responsabilidad Limitada” (SRL).

It takes between 6 to 8 weeks to form a company in Peru after all required information and documentation has been provided.

We Can Help you Incorporate a Company in Peru

Peru has a promising year ahead in 2023, and the goverment is making an effort to bolster the economy and attract foreign investment. This sets the stage for continued economic growth and success for businesses in the country.

Take advantage of this period of growth by getting expert support for the incorporation of your company in Peru. At Biz Latin Hub, our Peru team is equipped with a depth of expert knowledge on how to incorporate a company in Peru. With our assistance ensure you have everything you need to enter this market.

We customize our suite of multilingual market entry and back-office services so your company can start off on the right foot and within the parameters of local law. For more information on how we can assist you with your company incorporation in Peru, reach out to us here at Biz Latin Hub today.

Learn more about our team and expert authors.